When to Start Saving for a Mid-Term Goal

Mid-term goals – what the heck do we do with them? Kyle and I currently have no mid-term goals, but I’ve put some thought into them this week because of some interactions I’ve had with friends and financial clients. Some of our peers in NC are looking forward to buying homes!

Mid-term goals take a bit of different thinking than short-term and long-term goals. For example, the long-term goal of retirement is something we expect to save for year-in and year-out, even if the rate changes a bit. Short-term goals are easy to create, especially if they recur yearly like our season tickets or our CSA – it’s a fairly static price and time-frame.

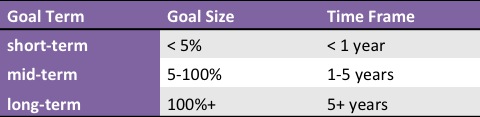

This is how I break down these goal categories in terms of yearly income (more or less):

Saving for a car is an example of a mid-term goal, but I wouldn’t set it up in the same way I would with a short-term goal. With a short-term goal, I would immediately start saving for the next period’s expense when I pay for the current period’s expense – for instance, as soon as we pay our car insurance, we start saving up for the next installment. But it would be silly to save for your next car over the entire lifetime of your current car – on the order of 10 years, hopefully. A car can be paid for in a few years – typically 3-6 years if you financed the car, and if you save up in advance you have interest rates working for you instead of against you.

We have three reasonable mid-term goals that we would like to accomplish in the next several years – replacing each of our cars and saving for a down payment on a home. Like I said before, we’re not currently working toward any of these goals – I suppose because our current budget feels tight and we hope to maintain our standard of living while experiencing income increases over the next few years that will enable us to save more aggressively. (That’s what I’m telling myself, anyway… You can dispute the likelihood of that happening!) I think we’ll start working toward these goals nonspecifically when Kyle gets a real job and more specifically once we are living in a city in which we’re interested in ‘putting down roots.’ And then it will just take as long as it takes to save up.

When have you started to save up for mid-term goals in the past (or currently) or when do you plan to start? Here are the various points I find reasonable:

- now/yesterday

- when some money frees up in your budget

- when you can make the goal specific and detailed (e.g. price range of home and target month/year to buy)

- as found money/bonuses/side hustles comes in

- a few month in advance

- 1-3 years

- 3-5 years

In some ways taking on debt is easier than making all these squishy decisions. You get what you want and someone else determines the term and you make room in your budget for the payments – isn’t that always easier to do retrospectively when you have all the details? But I think it’s worth it to attempt to premeditate and prepare for these large purchases.

How do you decide to start saving for a mid-term goal? Have you created any mid-term goals other than a car or house down payment?

Filed under: goals · Tags: car, house down payment, mid-term goals

Short-Term Challenges to Speed Debt Repayment

Short-Term Challenges to Speed Debt Repayment Setting a Reward for a Big Goal

Setting a Reward for a Big Goal Stretch Goal: FinCon 2014!

Stretch Goal: FinCon 2014! Business Goal Tracking for Week 1 of January 2022

Business Goal Tracking for Week 1 of January 2022

I think your savings plan makes sense to me. I suck at setting goals though. I generally just try to save money all the time without much real purpose. It’s something I definitely need to get better at. Now that I have enough saved up for an apartment downpayment, I want to start getting more aggressive with investing. Beyond that I just don’t have any goals that I need to save up for.

Modest Money recently posted..End of July 2012 Blog Update

Are you actively looking for an apartment to buy now? That’s exciting to have enough saved for a down payment! You’ll probably need savings for maintenance once you own your own place, too.

I wouldn’t consider financing a car and I am the sort of person who would start saving for their next car immediately after buying one. I did, in fact, do that with my last car. After buying the condo though, I decided that since I plan on paying off the mortgage in under 5 years and my car will be only 7 years old at that point, I’m not going to set aside any money towards buying my next car in the meantime.

When I was in college, I kept a cash buffer to cover me until my next income spurt and then I realized that I didn’t need all of my savings for that, so I started setting money aside for things like a car and a down payment. I think that was silly to start targeting goals like that when I had no idea where I was going to live or if I would even want a car.

I ended up buying property way sooner than I had really envisioned for myself because like you said “And then it will just take as long as it takes to save up.” Well, it took a lot less time to save up than I had expected it would, so I bought sooner.

I guess my only mid-term goal right now is paying off the mortgage. I really like having one goal at a time – it makes it easier to keep the motivation.

Leigh recently posted..Levels of Financial Freedom

Since you have the ability to save up for a new car so quickly, I definitely think it makes more sense to work on other goals until the need for another car becomes imminent. I agree about having only one mid-term goal, though I’m definitely comfortable with multiple short-term goals. It seems like we’re in a similar place now to where you were in college, though without the non-designated savings – why put names on savings before we know what our life will look like when we want to buy?

For me, saving isn’t targeted. But that’s because I don’t have my goals finished just yet. Once I do, though, then I’ll set new goals, which I’ll save for. A six-month emergency fund is first!

Kathleen @ Frugal Portland recently posted..Why I Don’t (Usually) Use Cash

Ugh, you’re so right, we need to get our EF up to snuff before we start thinking about other mid-term goals!

I’m curious- why do you pay your car insurance in large chunks, instead of monthly? I’ve never thought much about it, but it seems like it would be so much easier to factor in a small monthly bill than a huge semi-annual bill.

But to answer your question, I recently opened an ING savings account to save for a trip to Europe. Neither my husband nor I has ever been, and I wanted to feel zero guilt about spending money this way. I knew the guilt would come if I co-mingled our emergency fund with a fun savings goal like this one! Oh, and at our current rate of savings, ING predicts that we’ll be ready to take that vacation in 9 years! 🙂

Jessica recently posted.."Ever notice that most of our suffering comes from rehashing the past, worrying about the future, or…"

I’m not sure about Emily, but for me, there’s a discount to paying car insurance for a full 6 month term rather than monthly.

Yes, we receive a discount for paying for 6 months at a time. Paying monthly would make monthly budgeting easier, but since we have all of our targeted savings accounts it’s no trouble to just account for the cost in there, saving monthly for it and pulling it out every six months.

Haha, 9 years, wow! I hope you can increase the savings rate somewhat to get there sooner! We haven’t been to Europe either and only one of us wants to go, so we aren’t saving for that right now.

I completely agree that mid term goals at this point are very difficult. I know that I want to buy a house someday, but I’m not actively setting money aside for that yet. One of my biggest problems is setting goals for my savings because so many things can change. I try to just keep on saving with the understanding that my savings will allow for more flexibility in my decisions when the time comes.

Julia recently posted..You will give me $200? Yes please!

I think that’s exactly why it’s okay to save generally even if you can’t put a name on it (if you can find room in your budget) – it frees up your options later.

We just revisited our savings approach a couple of months ago now that the wedding is over and the E-fund is full. I don’t put irregular expenses in to our monthly budget (like car ins, basic car maintenance, parking permit, renter’s ins, real clothing needs (but my shopping for fun comes out of our set monthly “fun money”)) because we always have the cash flow to cover those things. So what we do is take a set % of what’s left over at the end of the month (= income – taxes – retirement – set monthly budget – irregular expenses that happen that month) and have it ear marked for student loans (only me, so therefore in deferment), house down payment, car replacement, travel (we do a lot of this), and extra (it’s a small percentage and will be used for things like a new TV, kayaks, or replacement computers whenever the balance gets that high, ie we don’t have a real plan for this, but we also don’t really do short term savings goals). We won’t be buying a house before I graduate (still a few years) and we don’t necessarily need to be a two car family, but having money ear marked for these savings will allow us the option to buy a house when we move or replace a car in (mostly) cash; if we don’t want to do either of these things the savings can all then be thrown at the student loans once I graduate. Another thing that makes this plan work for us is that our checking acct is getting 2.5% interest.

That’s a sweet interest rate! Are you keeping a high minimum balance or something?

Your savings plan sounds good to me. I end up putting our “budget leftovers” (my name for what you’re describing) toward one savings account or another but I like that you have set percentages for the different funds. I’ll think about implementing that in our accounting.

Sounds like you guys are right on the ball following your wedding!

We have a Coastal Federal “Go Green Checking” account that gives 2.5% when 30 check card purchases are made in the month. 12-30 debit card purchases/month earn like 1.5% and less than 12 is a low rate similar to what you’d get in a non-rewards checking account.

Actually, money for a “new” car is something we plan on starting to save for in the next couple weeks. Just 10 months left to pay off my wife’s car and then we can sell it to a junkyard!

Edward Antrobus recently posted..The Dave Ramsey $1000 Starter Emergency Fund

Are you going to save up for your next car in full or do you plan to finance again? Between the two of us Kyle and I have only bought one car and it was financed (though paid off now).

I feel like most of our savings is for “mid-term goals” (by your income-percentage categories, rather than for time), apart from relatively small retirement contributions – saving for decreased income during the summer, research expenses not covered by external grants, and eventual Pacific Northwest and Europe trips, hopefully. The first two wind up taking up so much income, despite being relatively short-term, that it’s difficult to save up for things that are more medium-term in time. So what we do save for is more on psychological grounds.

Travel is pretty motivating as a savings goal, so that’s something to put money toward if a substantial amount is left over in the budget or found money comes in, but that hasn’t happened for about six months, mainly due to the seasonal crunch. I’m hoping there will be some left over in the “summer living” savings account come my next paycheck at the end of the September to throw into the travel fund, though, and that is a good reason to keeping spending in line. I don’t think we’re in a position to buy a car that we can’t cover out of our savings, and the idea of buying a house just seems so laughably far in the future that we don’t see a point in trying to save for one.

You are in the difficult position of needing “mid-term”-sized money over “short-term” time frames. You just need to make it through grad school! I guess this is a ‘character-building’ experience?

Yeah, we just have to make it through grad school, but we both actually struggled more before we got here, so it’s also a gratitude heightening experience. Wishing we could save a lot more of our income for real mid- and long-term goals is at the level of wanting “more” when we have “enough” – we don’t have to worry that we won’t be able to pay rent or buy food if something goes wrong next month, and that’s a pretty big deal too.

[…] My Part Time Job Became My Passion via Making Sense of Cents When to Start Saving for a Mid-Term Goal via Evolving Personal Finance What Would You Do?: I Won One Million Dollars!!! via Money Life […]

[…] the Big Stuff featured When to Start Saving for a Mid-Term Goal in his best of the […]

[…] mid-term savings […]

[…] like the idea of finally having a mid-term goal to save for! It’s been only retirement and irregular expenses/planned purchases for so long! […]