Financial Tweaks for Our New Year

Kyle and I have been so busy with work in the past few months that we have really left our money management on autopilot. I haven’t even played with spending scenarios recently, as I love to do! But even without me looking for issues to tweak, three areas of our budget have popped up with some needed updates.

Take-Home Pay Increase

We noticed that the take-home pay we received at the end of in January was slightly higher than what it was in December – our state withholdings were reduced by $25 for each of us. For months we’ve been receiving emails about North Carolina’s tax system overhaul, but we weren’t sure how exactly it would affect us. North Carolina moved from having a tiered income tax system starting at 6% to a flax income tax rate of 5.8% – but they also monkeyed with the personal exemption and standard deduction amounts.

We weren’t sure if we could trust the automatic withholdings calculators, but after reading about the tax changes a bit we decided that they are probably in the ballpark. We have received a refund from our state taxes in each of the last several years, so we have some wiggle room there, probably. I found an estimate that a married couple making close to our income will pay $1,200 less in state income tax this year in comparison with last year. Since that would be a downward adjustment of $100/month instead of our $50/month, we’re probably being conservative and having more withheld than necessary. We’re likely okay to adjust our budget for the $50/month that was freed up without having to put it into our Tax savings account as we did when my withholdings went down when I switched payroll systems.

Budget Adjustments

With approximately $50 extra per month to play with from the lower state income tax, we are allocating it to three budget line items.

1) We’ll increase our Roth IRA contributions by $20 per month ($5 more per contribution).

2) We’ll increase our grocery budget by $20/month, since we exceed our $400/month grocery budget almost every month.

3) We’ll increase our charitable giving savings rate by $10/month (to $50/month).

Roth IRA Contributions

We dedicated a few months of Roth IRA contributions in 2013 to maxing out our 2012 Roth IRAs, hoping that we could roll the contribution room forward to subsequent years until we could finally use up all of our contribution room each year. Well, we weren’t able to finish maxing 2013 out in 2013 so we’re going to do it before April 15 of this year. We have $1,931.38 in contribution room left in 2013 ($1,431.30 in my IRA and $500.08 in Kyle’s) as of February 13, 2014.

We should have planned for this starting at the beginning of January, but as I said we have been kind of preoccupied and it wasn’t until the snow days last week that I took the time to consider what to do with the Roth IRAs. We decided to switch the next couple months of our normal contributions to apply to 2013 (they have been applying to 2014) and top up the extra $218.04 from extra paychecks or savings (we have too much cash lying around, anyway!), going in evenly with the 8 scheduled payments. We’ll use savings from our general savings account/nest egg.

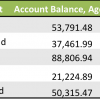

Here is a table of our old savings rate (until January 2014), our new savings rate (as of February 2014), and the rate at which we’re maxing out each of our Roth IRAs. The difference between the total top-up savings rate and our desired savings rate is $109.02 per month. If we don’t have enough of Kyle’s side hustle income coming in to cover the difference, we’ll pull the rest from savings. (Example: We have $54.51 in top-up contributions in February, but from Kyle’s paycheck we’ll contribute $30.63, so we only have to pull $23.88 from savings that month.)

Once we’re done with 2013 contribution we’ll switch back to 2014 at our “new” savings rate until we go through our job transitions – and we hope this is the year we can max out within the calendar year!

What budget adjustments have you made recently? Did you or will you max out your 2013 IRA contributions? Do you trust automatic withholdings calculators?

Filed under: budgeting, food, savings, spending, targeted savings, taxes · Tags: budget, charitable giving, groceries, Roth IRAs, tax

Contributing to Last Year’s Roth IRA

Contributing to Last Year’s Roth IRA The Great Debate: 15-Year vs. 30-Year Mortgages

The Great Debate: 15-Year vs. 30-Year Mortgages Can a Net Income Boost Compensate for Not Having Earned Income?

Can a Net Income Boost Compensate for Not Having Earned Income? Small Steps to Speed Financial Accomplishment

Small Steps to Speed Financial Accomplishment

That is something I don’t get – we have something very similar to Roths here, but the contribution room rolls over. It’s a bit of a double-edged sword because it means you can build up years of contribution room (I’m currently at $1k out of $31k used) if you truly cannot save your yearly $5,000/$5,500. But it also means that it doesn’t force you to save today. That’s why as soon as my debt is gone I am hitting this, and my RRSPs hard, trying to make up for lost time.

My graduate stipend wasn’t considered income, so I lost out of roughly $23,000 in contribution room for my RRSP. I think I’m happy about that, and not happy about it at the same time… it makes for a daunting amount of catch-up. 🙂

Alicia @ Financial Diffraction recently posted..Loans I Hate Giving.

It’s funny that in both of our cases the available contribution room affects our desired savings rate. Maybe it does less for you because you know you can catch up eventually (even though your money won’t grow as much) whereas we lose it so I don’t have to worry about the years I didn’t max out.

Technically I’m not eligible to contribute to a Roth IRA in 2014 (so far) because I’m being paid by a fellowship, so mine is a spousal contribution from Kyle’s earned income. One of the few advantages to being legally married we’ve availed ourselves of so far!

Roth IRAs are such a great tool for young professions. Glad to hear that you’re maxing them out!

Michael Solari recently posted..Technology is Changing the Game

We’re trying. We can wait to get to a year when we max out with ongoing savings instead of catching up. 2014 might be our last shot at it before the Roth stops making sense for us!

I don’t trust automatic withholding calculators – I have my own spreadsheets to do those calculations. My first paycheck of the year was under withheld by about $1,000, so I submitted an updated W-4 to have $100 less withheld each month for the rest of the year.

I maxed out my 2013 IRA in November and 2014 in January. I’m not sure what I’ll do for 2015 yet.

I was too lazy to do the calcs for myself but now you’re making me think I should! We have to know our federal AGI to pull over to the state form but it wouldn’t be too hard to just do it for our primary income. Even if we found out that our withhholdings were wrong, though, I probably wouldn’t mess with my W-2, just expect a small refund or save extra into our Taxes savings account.

Good for you for already being done with your 2014 contribution!

I’m glad you guys are able to max out your Roths for 2013, and are getting an extra $1200 back from a tax change, too! That’s real money, and might help out quite a bit in your investment goals.

Done by Forty recently posted..Anchoring My Expectations

Well, we’re not getting $1200 back because this is for 2014 so it hasn’t been withheld yet (and won’t, half of it it looks like). I think an extra $20/month to our Roth IRAs is nothing to sneeze at – every dollar counts (and counts more inside a mostly-stocks Roth).

Also doing some budget tweaks for my new year! It’s important to do, after all.

What are your changes?

We maxed out 2013 Roth IRAs but it will be early 2015 before we can max out 2014 Roth IRAs. Right now, no major budget tweaks and with all the traveling and tuition payments, the checking account is looking thin. Waiting for my relocation package to come in so I can start putting a little something away for the Roth again.

Well Heeled Blog recently posted..Planning a Big European Adventure

Your budget tweaks could be to fatten your checking account, if possible at this point! Do you know exactly when your employer will send you your relocation package? And how much of it do you actually need for relocation?

I made many changes in my budget and I can’t site it all here. But I appreciate and commend you for your effort to maintain your budget for the past year. Good job!

Are you making changes frequently? For us it seems to be 2-3 times per year.

[…] @ Evolving Personal Finance writes Financial Tweaks for Our New Year – With the new year come new taxes, a new budget, and maxing out our 2013 Roth […]

[…] Financial Tweaks for Our New Year was featured in the Financial Carnival for Young Adults. […]

[…] income from the previous month to our church (plus some additional amounts to other recipients) and 18% to our Roth IRAs. The minimum we want to save each month into our Roth IRAs is 15%, though we’ve edged the […]