September 2014 Month in Review: Money

Please sign up for EPF’s new newsletter at the top of the right sidebar. I’ll email you about once per month about behind-the-scenes stuff. The purpose is to better connect with you! 🙂

This is going to be my last spending report in this format because we have revamped our money management system starting in October. So look out for some changes in my next spending update!

Even though our budget for this month was funded with Kyle’s higher postdoc paycheck and my last grad student paycheck, it seemed like things were still a bit tight – like before Kyle’s raise. That can be at least partially explained because Kyle had double insurance premiums taken out in August.

We also had an unusually high level of spending from our targeted savings accounts – particularly from our Cars account plus we paid for my FinCon14 hotel out of our personal accounts (for now).

One other bit of news is that my advisor/department came through in paying my fall tuition and fees. This has no impact on our money, but obviously would have been a sizeable blow if something had gone wrong and we had needed to pay them. (Fortunately, upper-year grad students have the pay only a fraction of the tuition that undergrads/early grad students do.) I had been checking with them about every 10 days for a couple months so it gives me a lot of peace of mind that this has been taken care of!

The Everyday Budget

Top-line items

INCOME: I’m going to change this income section up a bit. The money that we receive in September goes to fund our October budget, so I’m going to shift talking about our September income to the October report.

AUTOMATED GIVING:

- 10% of our paychecks to our church

- $50 to the missionary we support

RETIREMENT SAVINGS: We have a new arrangement for our retirement contributions starting last month. Kyle is contributing 15% of his pay and I am contributing $172 per month (through December). We are also contributing 15% of our irregular income, which this month was just Kyle’s church paycheck.

Non-discretionary spending

Rent: $870.

Internet: $34.99.

Cell phones: Kyle’s usual $70.14. I’m out of account credits from people using my referral link to sign up for Republic Wireless so I paid $26.37 for my cell this month. What a deal for unlimited everything! 🙂

Variable spending

Groceries: It seems that once again once-a-week shopping has caused us to spend more. We were quite over budget here. We did have some atypical spending because we had to buy a bunch of junk food for the 36-hour campout we participated in to get seasons tickets to our university’s men’s basketball games..

Gas: Fairly normal month with two fill-ups. However, I think we are driving a lot more and will end up spending more on gas because many mornings I will drop Kyle off at work, run an errand or two during the day, and pick him up at the end of the day. That’s a double commute instead of a single commute at least a few days per week.

Restaurants: We went out to lunch after church one afternoon and had a few other convenience meals related to my FinCon14 travel and the weekend I spent camping out for basketball tickets.

Electricity and Gas: Well under budget, woohoo!

Water: Just a bit over budget.

Miscellaneous Transactions

Every month we have some random transactions that are not accounted for in our normal budget.

- We received some gifts during a defense party my parents threw for us. We put the checks into our general savings account and reimbursed that account for gift cards we used this month. Next month, we won’t reimburse for gift card usage.

- I transferred $26.75 to my Bursar account to cover an activity fee that my department usually covers and ultimately did. I expect to get $20.75 of this back once I graduate (I had a $6 fee rolled over from last semester).

Spending Out of Targeted Savings

We had a fairly high-spending month, with $1,251.62 coming out of our targeted savings accounts and $515.88 going in over our normal savings rates.

Travel and Personal Gifts

We spent $59.90 on gas to visit my parents for the party they threw for us.

We redeemed some BarclayCard miles against my FinCon14 flight and put the $50 we received into this account.

Nest Egg

We transferred in the gifts we received during our defense party.

I used money from this account to pay for my hotel at FinCon14. I plan to reimburse this once our EPF account has enough money to cover the cost (next month?).

Cars

We spent $183 on my half of our university parking permit and $382 on repairs. We also used this account for a $167 payment for our renter’s insurance (we draw it from this account since it’s the same company as our car insurance).

Entertainment

I spent $12 on a ghost tour while I was in New Orleans.

Appearance

We spent $96.71 on new sneakers for each of us and $29.83 on dry cleaning.

Electronics

no spending this month – However, Kyle is itching to buy a raspberry pi after a friend of ours talked up the cool projects he’s done with his (affiliate link – thanks for using!).

Medical

We spent another $22.93 on birth control and received a reimbursement from our FSA for what we spent last month ($27.22 for bcp and band-aids). We finally figured out why we have a co-pay on our generic prescription by calling our university’s HR: our health insurance plan was grandfathered into the ACA. I wish I had known this when I was weighing my health insurance options, but it really isn’t costing us any more out of pocket because the university gives us each $200 into our FSA.

Charitable Giving

We gave $50 to a second missionary we support.

CSA

no spending this month

Taxes

no transfers this month

Camera

no transfers this month

Budget Adjustments

We are not adjusting our budget for next month – we threw out the system entirely! But one change is that we are going to month-to-month on our rent so that is increasing to $910. (It was going up to $890 anyway. That going month-to-month was only a $20/month increase was a wonderful surprise to us! We thought it would be more on the order of $100/month.)

Bottom Line

We came in with an excess of $15.49 this month, which we transferred to our general savings account.

Did you had any big expenses in September related to school starting? Have you ever gone month-to-month on a lease? Have you ever felt like your income was too low even when you knew it was higher?

Filed under: month in review · Tags: budget, spending report

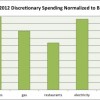

September 2012 Month in Review: Money

September 2012 Month in Review: Money September 2013 Month in Review: Money

September 2013 Month in Review: Money August 2014 Month in Review: Money

August 2014 Month in Review: Money May 2014 Month in Review: Money

May 2014 Month in Review: Money

University parking is HOW MUCH?! That’s criminal!

Myles Money recently posted..Peeing In The Shower

Our permit is $366/year. 🙂 Not having a second parking permit is actually the major contributor to how we’re spending less money by having one car instead of two. I’m not sure why the price is so high (given that parking in Durham is generally free) except that the university is really trying to discourage singe-car commuters. It’s worse for the employees, actually, which is why we were pleased to sneak in a whole year of parking as two grad students even though we were both post-defense. I actually talked with a student at Georgia Tech who pays almost $1,000/year for a parking permit, if you can believe it. I highly recommend not having a car in college, once you go.

Haha yea that would be me. Except I actually managed to find a place to park for free that’s close enough for me to get my car if I actually need my car instead of my bike, but just far away enough that I’m not tempted to use my car for short trips. But yes, Georgia Tech parking permits are $939/year! Now granted, Atlanta is a big city…but still.

Did we cover parking permits when we spoke? I was actually referring to a different conversation with a student at GT – I have many friends there! 😉 That seems like a good solution!

Heh whoops I just assumed. I think we did, but I can’t quite remember. And yea it works out quite well

FinCon is a once in a year thing. I’m sure October will feel less tight for you guys 🙂 My income has been pretty stable for the last few years so I usually feel it’s what I expect to make. Once in awhile I would earn 3 paychecks in a month from my part time job, which is always nice. I like putting the extra income towards savings.

Liquid recently posted..Don’t be Fooled by Labor Market Data

Well, my FinCon expenses came from savings, so they don’t explain the tight cash flow feeling. Does your third paycheck usually go to long-, mid-, or short-term savings?

I see. That’s cool. My extra income goes into long term savings 🙂

Yeah, it stinks paying employee parking prices…and to top it off, I’m still waiting to see if they will waive my $10 ticket for forgetting to hang my tag (even though I was in the correct garage, and they were kind enough to print my permit number on the ticket indicating as much…) It’s a racket!

That would really seem to warrant a warning rather than a ticket. Why are they taking so long to get back to you?

Before moving back into grad student housing we were considering extending our lease. They were trying to raise the rent $800/month to go month-to-month!! Luckily student housing worked with us and got us into an apartment sooner than we had expected…

Julia recently posted..Rafting the Mae Taeng River, Thailand

WHAT?! What % of the previous rent was that increase?

Almost 45%! This was when we were living with a roommate, so the apartment was originally decently priced for each of us. Yay, southern California housing market?

Oh my goodness, I’m sorry your campus parking pass is so expensive! That stinks. Also, the “$12 on a ghost tour” made me smile–and, congrats on having such a low entertainment budget.

Mrs. Frugalwoods recently posted..Weekly Woot & Grumble: 6 Months & A Healthy Hound

It was a great tour! New Orleans has a lot of fodder for ghost, vampire, and murder stories. In truth, I wrote check for $250 for entertainment in September for a basketball season ticket but it hasn’t been cashed yet. 🙂 Yet another reason I prefer plastic.

What’s the ideal time between grocery shops for you guys? We try to go no more than 1x per week, but never seem to make it much longer than that.

Genevieve @pftwins recently posted..Weekly Updates and Sunday Links

Probably about five days, but that’s difficult to pull off scheduling-wise. If I tell myself I can ONLY shop once per week though, I tend to over-buy and spend too much money. It’s kind of counter to the conventional advice! I think our best situation is for me to do a big (Costco + Kroger) shopping trip sometime Saturday through Monday but know that I can go to Kroger in between if needed.

I always think that my income is most of the time lower so that I could spend less and save something more. It also gives me encouragement to find extra job like working at our municipal hall every weekend. It seems to be working for me.

Jayson @ Monster Piggy Bank recently posted..Red Bull Might Not Give You Wiiings, But They Will Give You $10

I’ve kind of done that with our cost-of-living raises – I’ve anchored my pay at what it was back when I started grad school, even though it is a little higher now.

[…] month is the first one in over a year that we’ve set up a line item budget for ourselves. Our last budget before this was my last month as a graduate assistant at the end of summer 2014. That was the month […]