How to Calculate Estimated Tax When You Don’t Know Your Income

If you will owe more than $1,000 next April 15 (that is, if your total tax liability exceeds your withholdings by more than $1,000), you are supposed to make estimated tax payments quarterly. The next payment is due on April 15, 2015 If you basically know your 2015 income, you can easily and straightforwardly calculate and file your estimated tax payment.

You have two choices of how to calculate the amount you should pay and you can use the calculation that allows you to pay less in estimated taxes: You can pay 100% of your previous year’s tax liability (a known quantity) or 90% of your current year’s tax liability (you have to estimate). (If your AGI was over $150,000 in 2014, the first option increases to 110% of your 2014 liability.) The 2015 Estimated Tax Worksheet (p. 8) walks you through the comparison and helps you choose the approach that minimizes your estimated tax payments. (Also, it’s okay if your goal is not to minimize your estimated tax payments, but that is what the IRS assumes you want to do. If you are the type of person who likes to get a big refund, feel free to pay more than you have to!)

In the case of irregular income (e.g., from self-employment) or unknown income (e.g., an anticipated period of un/underemployment of undetermined length or a new job) it is not so easy to project 2015’s tax liability to know whether you will owe more than $1,000 or make the decision of which calculation method to use. (This also might be the case to a lesser extent if you have possible life changes on the horizon such as marriage, children, the purchase or sale of a home, or health spending. Your income may stay steady, but your tax liability could change in those cases.) I’m facing this personally and I know many other who are as well.

In the case of irregular income (e.g., from self-employment) or unknown income (e.g., an anticipated period of un/underemployment of undetermined length or a new job) it is not so easy to project 2015’s tax liability to know whether you will owe more than $1,000 or make the decision of which calculation method to use. (This also might be the case to a lesser extent if you have possible life changes on the horizon such as marriage, children, the purchase or sale of a home, or health spending. Your income may stay steady, but your tax liability could change in those cases.) I’m facing this personally and I know many other who are as well.

Our Uncertain 2015 Income

Projecting our 2015 income is actually very difficult for us at this time. Kyle has had steady income with an appropriate amount of withholding to this point in the year. Even though we expect him to go through a job transition later this year, his salary probably won’t change too much and he won’t take a significant break from employment. I, on the other hand, belong to two communities who frequently have to pay estimated tax: fellowship recipients without the option of withholding and self-employed individuals. I just finished a 12-week fellowship for which I received a fixed amount of pay in January. I freelanced a bit while I was doing the fellowship and plan to ramp that up now that I’m done. I also am trying to grow my speaking business and hope to have significant income from that source later in the year (also self-employment). Those two income sources are very uncertain at this point, plus there is always the possibility that I will start a full-time job before the year is out.

All that is to say that projecting our tax liability for 2015 was very difficult because our income could reasonably range from a bit less than what we earned last year to a bit more. If all my dreams came true, of course we could earn quite a bit more, but it’s not fruitful to calculate our Q1 estimated tax on those kind of dreams. I know that many other people who are going through job transitions that involve fellowships or who are self-employed, especially with new businesses, will have the same difficulty that I have in projecting 2015’s tax liability only a few months into the year.

The rest of the post will assume that you will owe more than $1,000 in additional tax next April 15 and will discuss different ways to calculate how much you should pay in estimated tax this quarter. I am not a tax professional and this discussion is not tax advice, so you should research your options yourself and the final decision is up to you.

Pay 100% of Last Year’s Tax Liability

If you have finished your 2014 tax return, you know your total tax liability for that year. To calculate your estimated tax payments for 2015, you simply subtract your projected 2015 withholdings from your 2014 tax liability. If that figure is more than $1,000, divide it by four and pay that amount each quarter. You should adjust as necessary if your withholdings change through the course of the year. This approach is the one that will minimize your estimated tax payments throughout the year if you think that your tax liability in 2015 will be at least 10% higher than your tax liability in 2014.

Pay 90% of Your Projection of This Year’s Tax Liability

The problem with the Estimated Tax Worksheet is that the very first line is “Adjusted gross income you expect in 2015.” That can be a very difficult question if you are going through job transitions, are or expect to be unemployed, or are self-employed with irregular income. However, you can minimize your estimated tax payments with this approach if you expect your tax liability to be about the same or less than it was in 2014, so if that is the case it is worth your time to make a good projection. Here are three ways to go about doing so:

Assume the Rest of the Year Looks like Q1

Just paying the tax you reasonably will owe for your Q1 income (that is, assuming the rest of the year will look exactly the same) is a good approach if you aren’t sure that there will be big changes. For example, if you are newly self-employed, you won’t have a lot of data on what your income will be, so you have to go with what you do know. If you apply this approach to each quarter, you will end up paying different amounts of estimated tax through the year, but it will likely turn out to be fairly accurate in the end.

Generate a High Reasonable Projection

If you use your best case scenario for your estimated tax liability (that is, high taxes), you may end up overpaying a bit, which will reduce your cash on hand. The upside is that you are likely to avoid penalties and minimize your year-end tax bill or possibly get a refund. Just make sure that your high projection does not reach your 2014 liability level, in which case it would be better to switch calculation methods.

Generate a Low Reasonable Projection

If you use your worst case scenario for your estimated tax liability (that is, low taxes), you may end up underpaying a bit and risking having a big tax bill at the end of the year and possibly penalties. The upside is that you are maximizing cash flow at a time when you might really need it, such as unemployment.

How to Make a Final Decision

You need to decide what you prefer (or what you want to avoid). To maximize cash flow throughout the year, which may be vital if your income doesn’t meet your expectations, you will take the chance that you will have a large tax bill next April 15 and possibly some penalties. This would apply for a low projection of 2015’s tax liability. To minimize the chance of a big tax bill at year end and avoid penalties, you take the chance of overpaying early in the year and having less cash on hand. This would apply if you choose to pay 100% of 2014’s tax liability or generate a high projection for 2015. A middle-of-the-road suggestion if your tax liability in 2015 will be similar to that in 2014 is to just assume that each quarter is representative of the year. It’s a pick your poison situation when your tax liability is truly unpredictable. You can always adjust your estimates for subsequent quarters in 2015 (though the least you will pay is $0 – you can’t get money back that you paid in previous estimated quarters until your year-end return is in).

Our Final Decision

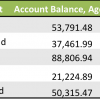

The poison we’ve chosen this time around is to possibly overpay now but minimize our year-end bill and be sure that we won’t be penalized for underpaying: We are going to pay 100% of our 2014 tax liability throughout the year. After taking into account Kyle’s withholdings, we would owe slightly more than $1,000 at year end, which means we do need to pay estimated tax of just over $250 each quarter. We save for estimated tax with every paycheck we get that doesn’t have withholding, so we have the cash on hand to make the payment with no issues. I do think we could get away with not paying estimated tax because a reasonable projection of my irregular income would put us below the $1,000 threshold for making payments, but we don’t want to take that bet this year. I’d rather plan for the best – a lot of irregular income!

How did/do/would you calculate estimated tax when you really don’t know what your income will be? In what situations have you had to pay estimated tax in the past or present? Would you prefer to maximize cash flow or minimize the end-of-year tax bill?

photo by Reuben Stanton

Filed under: taxes · Tags: estimated tax

How to Calculate and File Estimated Tax Payments

How to Calculate and File Estimated Tax Payments Oops, We Need to File an Estimated Tax Payment This Month

Oops, We Need to File an Estimated Tax Payment This Month How to Budget from a Lump Sum of Income

How to Budget from a Lump Sum of Income Can a Net Income Boost Compensate for Not Having Earned Income?

Can a Net Income Boost Compensate for Not Having Earned Income?

I would probably go for minimizing estimated tax payments and then keeping a buffer for paying taxes if I expect to go over.

Have you considered increasing Kyle’s withholdings so that he just pays an extra ~$125/month out of his paychecks? That would be easier (to me) than making estimated tax payments. You can also adjust his withholding even on his November/December paychecks to take more taxes out since withholdings are treated as being evenly withheld throuhought the year, contrary to estimated tax payments being quarterly.

That’s a good suggestion about changing withholding late in the year. Since we have decided to go the route of paying last year’s liability it should be 4 equal payments so we could increase Kyle’s withholding to compensate. We’ll talk it over. If I were just going to kind of pay as I go I think I would prefer to stick with estimated tax so we could vary the amount.

[…] How to Calculate Estimated Tax When You Don’t Know Your Income – Evolving PF – This a great post if you are still trying to navigate the world of paying taxes on self-employment income. […]