Evolving Personal Finance » Archive

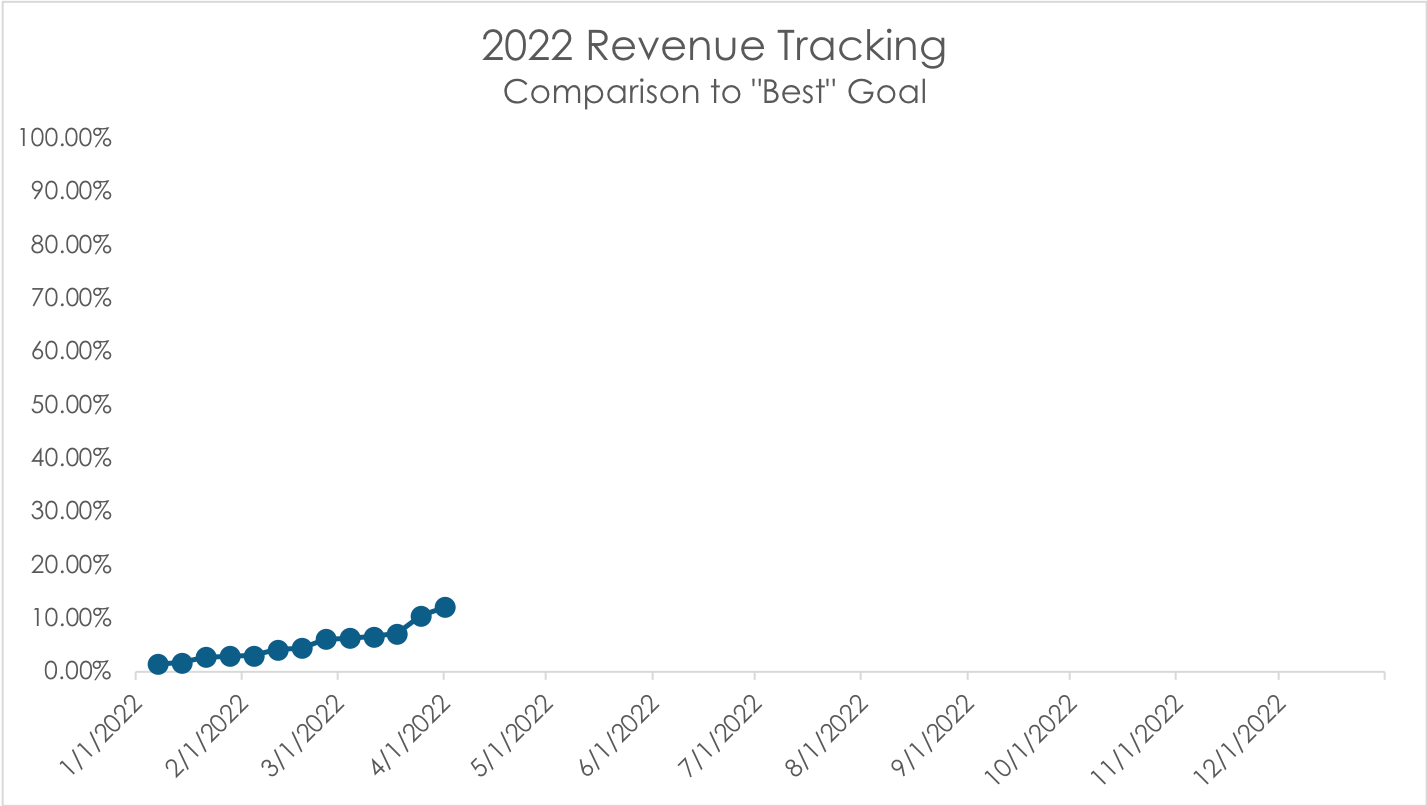

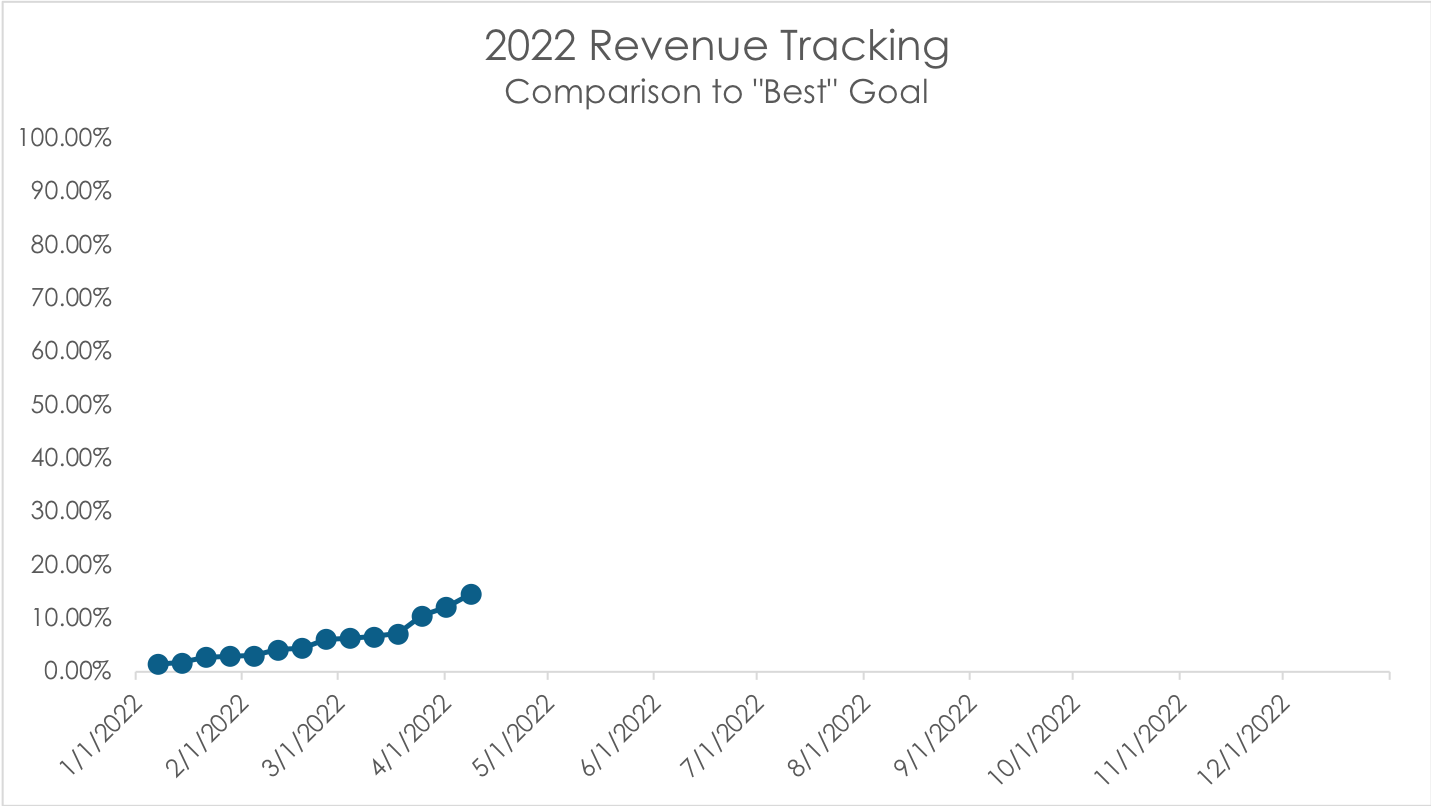

Business Goal Tracking for Week 20 of 2022

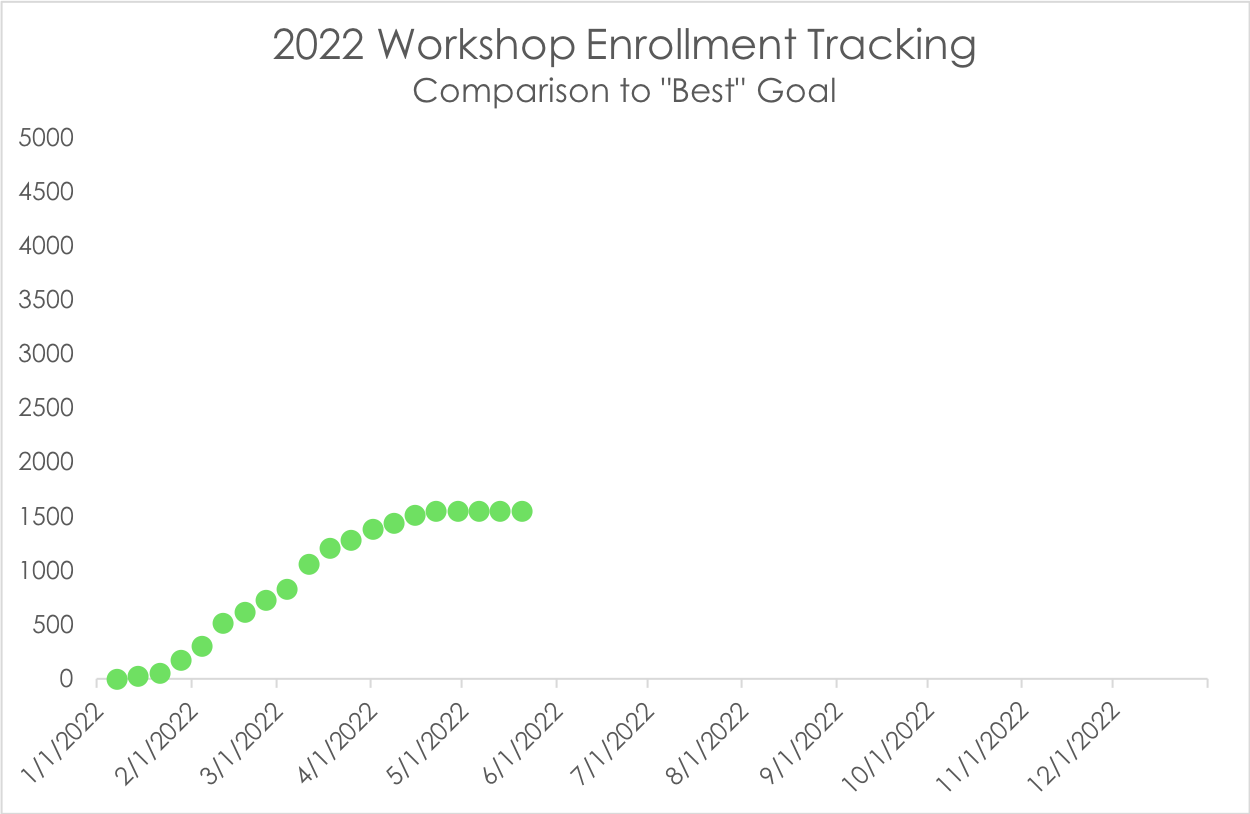

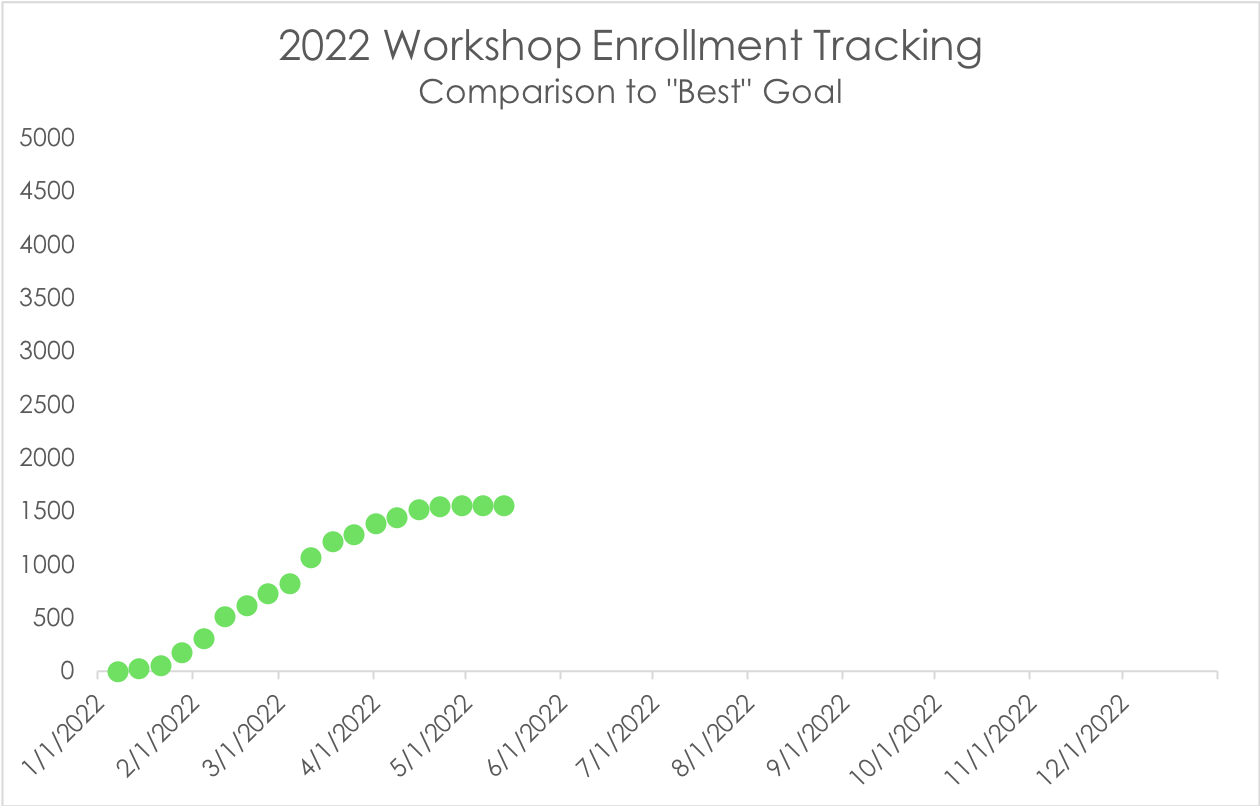

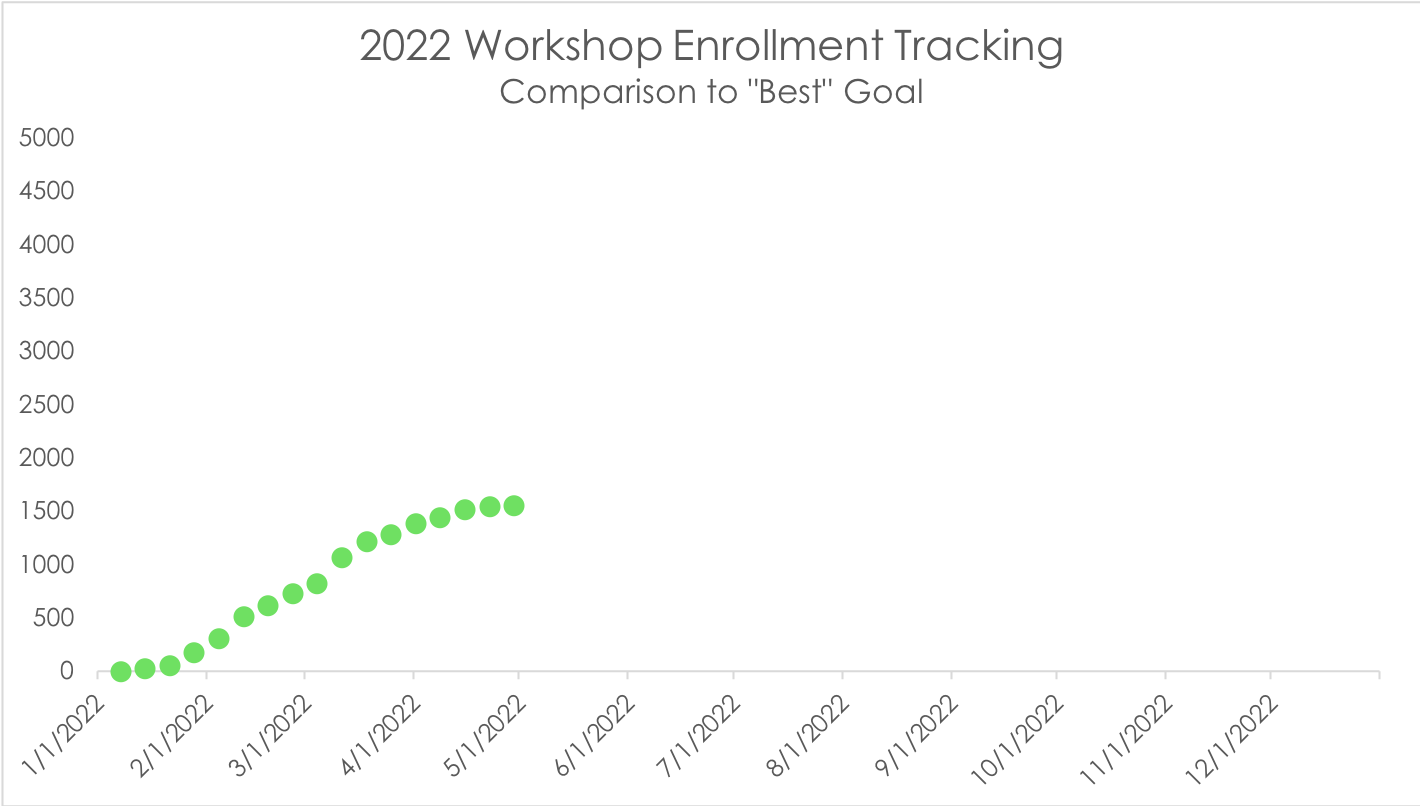

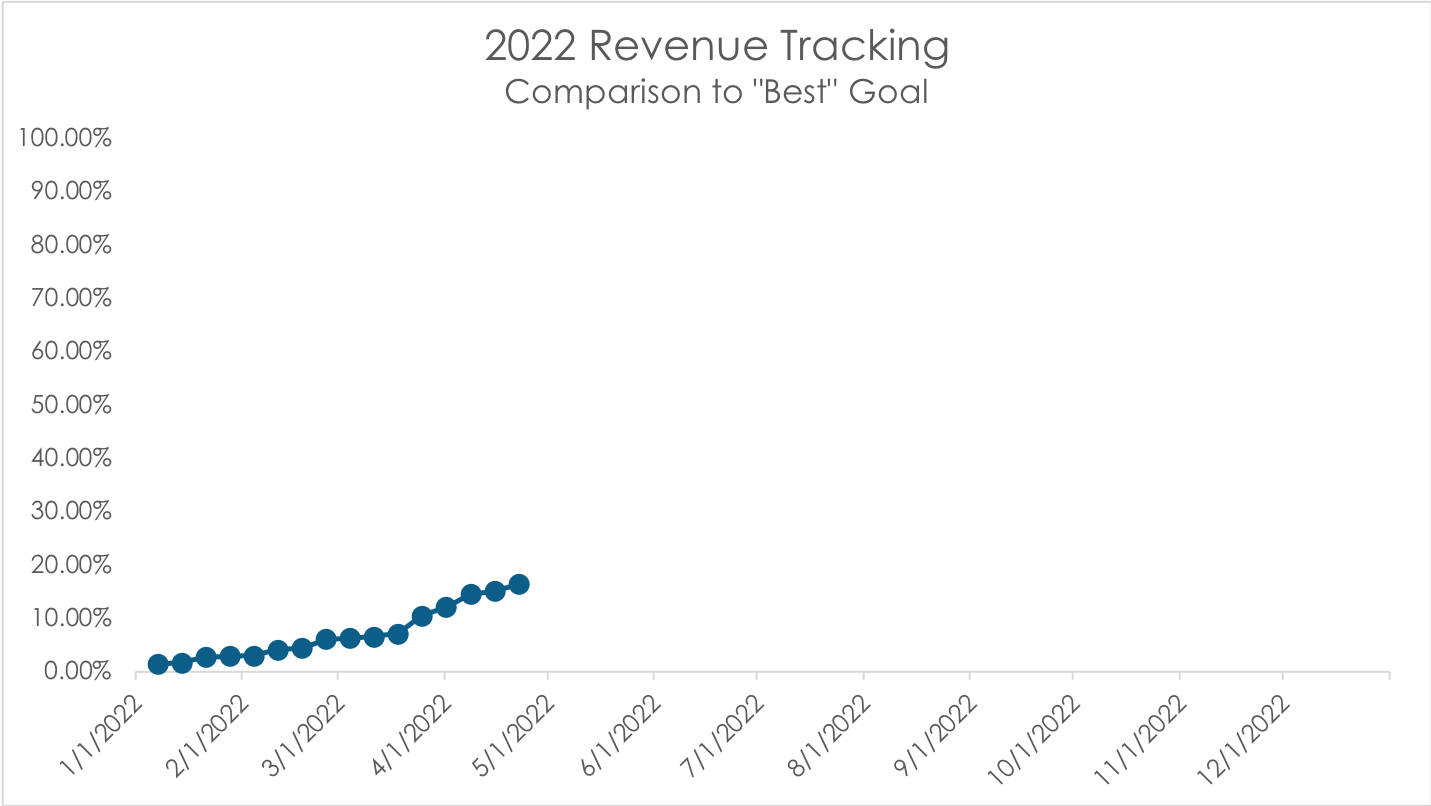

In May 2022, I set four overall monthly goals and four weekly habits to help me meet my revenue and workshop enrollment goals for 2022. This is my accountability report for how I did against these goals between 5/14/2022 and 5/20/2022. Monthly and Weekly Goals May Monthly Goals Ask for QE tax promotion on my behalfUpdate PF workshop series for 2022Promote Set Yourself Up for Financial Success in Grad School and enroll clientsCreate June through August content for … Read entire article »

Filed under: goals

Business Goal Tracking for Weeks 18 and 19 of 2022

In May 2022, I set four overall monthly goals and four weekly habits to help me meet my revenue and workshop enrollment goals for 2022. This is my accountability report for how I did against these goals between 4/30/2022 and 5/13/2022. Monthly and Weekly Goals May Monthly Goals Ask for QE tax promotion on my behalfUpdate PF workshop series for 2022Promote Set Yourself Up for Financial Success in Grad School and enroll clientsCreate June through August content for … Read entire article »

Filed under: goals

Business Goal Tracking for Week 17 of 2022

In April 2022, I set three overall monthly goals and four weekly habits to help me meet my revenue and workshop enrollment goals for 2022. This is my accountability report for how I did against these goals between 4/16/2022 and 4/22/2022. Monthly and Weekly Goals April Monthly Goals Create sales page and bonus for rising graduate students webinarCreate and deliver rising graduate students webinar (3x)Plan for 2022 April Weekly Goals Stay on top of all communications with university clients, including … Read entire article »

Filed under: goals

Home Equity Is Funny Money

We closed on our house just about exactly a year ago for $700k, and Redfin now has our home value pegged at over $900k. Redfin’s estimate is not necessarily reliable, but it’s a data point. Before buying our home, I saw PF bloggers and other interested parties discuss their net worth calculations online, and they often accounted for their home equity/the value of their home in odd ways. These other people sometimes left their home’s value out entirely or omitted any equity above the mortgage amount or used a lower value for their home. This was totally puzzling to me. I thought I would have just grabbed a value from Redfin/Zillow and plugged in that number on a monthly basis. That seemed to be the most accurate/up-to-date. I still think it’s important … Read entire article »

Filed under: housing

Business Goal Tracking for Week 16 of 2022

In April 2022, I set three overall monthly goals and four weekly habits to help me meet my revenue and workshop enrollment goals for 2022. This is my accountability report for how I did against these goals between 4/16/2022 and 4/22/2022. Monthly and Weekly Goals April Monthly Goals Create sales page and bonus for rising graduate students webinarCreate and deliver rising graduate students webinar (3x)Plan for 2022 April Weekly Goals Stay on top of all communications with university clients, including … Read entire article »

Filed under: goals

We Maxed Out All Our Retirement Accounts for the First Time!

It’s Tax Day for 2021 and our final transfer to Vanguard has gone through, so I can officially announce that Kyle and I maxed out ALL of the tax-advantaged retirement accounts available to us for the first time EVER! We filled up: Kyle’s traditional 401(k)The employee side of my traditional 401(k)The employer side of my traditional 401(k)My Roth IRAKyle’s Roth IRA In recent years, we capped our retirement contributions at 20% of our gross income because we were simultaneously saving for our house down payment. With our house purchase complete, we had no reason to limit our retirement contributions (except, you know, cash flow). We set our goal of maxing out all the traditional accounts available to us in part to keep our AGI low enough to qualify, as best we were able to, … Read entire article »

Filed under: retirement

Business Goal Tracking for Week 15 of 2022

In April 2022, I set three overall monthly goals and four weekly habits to help me meet my revenue and workshop enrollment goals for 2022. This is my accountability report for how I did against these goals between 4/9/2022 and 4/15/2022. Monthly and Weekly Goals April Monthly Goals Create sales page and bonus for rising graduate students webinarCreate and deliver rising graduate students webinar (3x)Plan for 2022 April Weekly Goals Stay on top of all communications with university clients, including … Read entire article »

Filed under: goals

Business Goal Tracking for Week 14 of 2022

In April 2022, I set three overall monthly goals and four weekly habits to help me meet my revenue and workshop enrollment goals for 2022. This is my accountability report for how I did against these goals between 4/2/2022 and 4/8/2022. Monthly and Weekly Goals April Monthly Goals Create sales page and bonus for rising graduate students webinarCreate and deliver rising graduate students webinar (3x)Plan for 2022 April Weekly Goals Stay on top of all communications with university clients, including … Read entire article »

Filed under: goals

Business Goal Tracking for Week 13 of 2022

In March 2022, I set three overall monthly goals and four weekly habits to help me meet my revenue and workshop enrollment goals for 2022. This is my accountability report for how I did against these goals between 3/26/2022 and 4/1/2022. Monthly and Weekly Goals March Monthly Goals Publish the 2022 version of my estimated tax workshopCreate sales page and bonus for rising graduate students webinarAdd general and CA state tax info to annual tax return workshop March Weekly … Read entire article »

Filed under: goals

Business Goal Tracking for Week 12 of 2022

In March 2022, I set three overall monthly goals and four weekly habits to help me meet my revenue and workshop enrollment goals for 2022. This is my accountability report for how I did against these goals between 3/19/2022 and 3/25/2022. Monthly and Weekly Goals March Monthly Goals Publish the 2022 version of my estimated tax workshopCreate sales page and bonus for rising graduate students webinarAdd general and CA state tax info to annual tax return workshop March Weekly … Read entire article »

Filed under: goals