Evolving Personal Finance » Archive

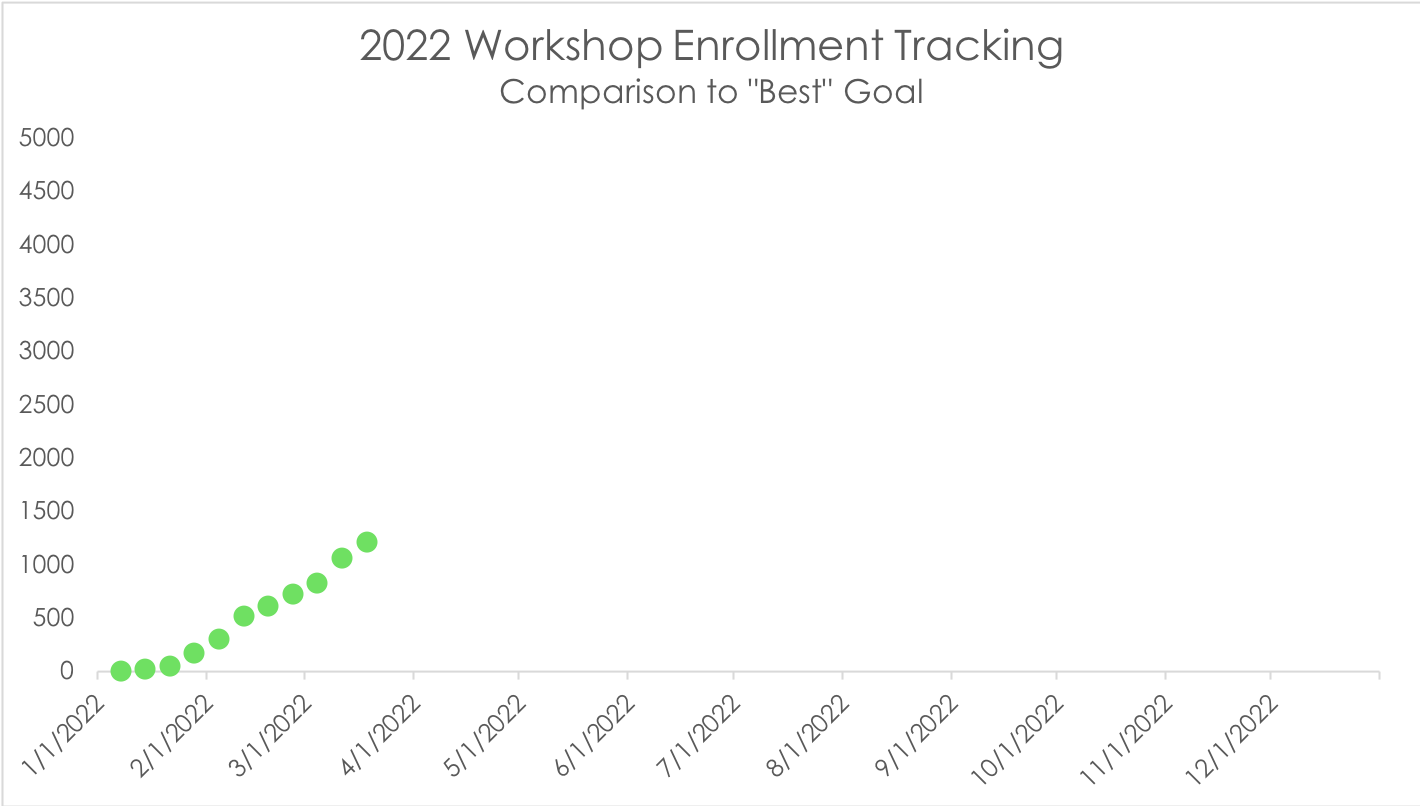

Business Goal Tracking for Week 11 of 2022

In March 2022, I set three overall monthly goals and four weekly habits to help me meet my revenue and workshop enrollment goals for 2022. This is my accountability report for how I did against these goals between 3/12/2022 and 3/18/2022. Monthly and Weekly Goals March Monthly Goals Publish the 2022 version of my estimated tax workshopCreate sales page and bonus for rising graduate students webinarAdd general and CA state tax info to annual tax return workshop March Weekly … Read entire article »

Filed under: goals

Business Goal Tracking for Week 10 of 2022

In March 2022, I set three overall monthly goals and four weekly habits to help me meet my revenue and workshop enrollment goals for 2022. This is my accountability report for how I did against these goals between 3/5/2022 and 3/11/2022. Monthly and Weekly Goals March Monthly Goals Publish the 2022 version of my estimated tax workshopCreate sales page and bonus for rising graduate students webinarAdd general and CA state tax info to annual tax return workshop March Weekly … Read entire article »

Filed under: goals

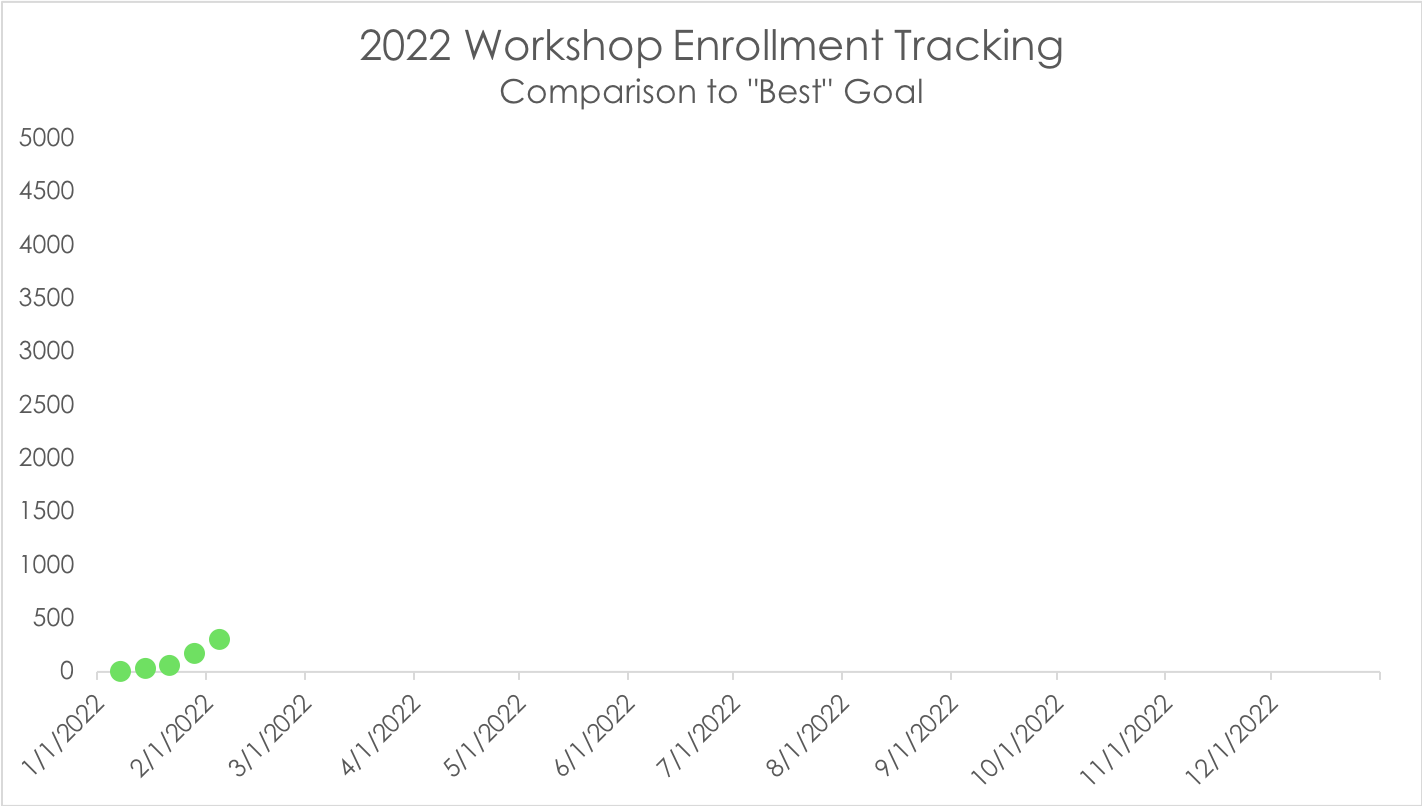

Business Goal Tracking for Week 8 of 2022

In February 2022, I set three overall monthly goals and three weekly habits to help me meet my revenue and workshop enrollment goals for 2022. This is my accountability report for how I did against these goals between 2/19/2022 and 2/25/2022. Monthly and Weekly Goals February Monthly Goals Publish the postdoc version of my annual tax return workshopCreate lead magnet and sales page for prospective grad student webinarConsider how to expand tax products this tax season February Weekly Goals Stay … Read entire article »

Filed under: goals

Business Goal Tracking for Week 7 of 2022

In February 2022, I set three overall monthly goals and three weekly habits to help me meet my revenue and workshop enrollment goals for 2022. This is my accountability report for how I did against these goals between 2/12/2022 and 2/18/2022. Monthly and Weekly Goals February Monthly Goals Publish the postdoc version of my annual tax return workshopCreate lead magnet and sales page for prospective grad student webinarConsider how to expand tax products this tax season February Weekly Goals Stay … Read entire article »

Filed under: goals

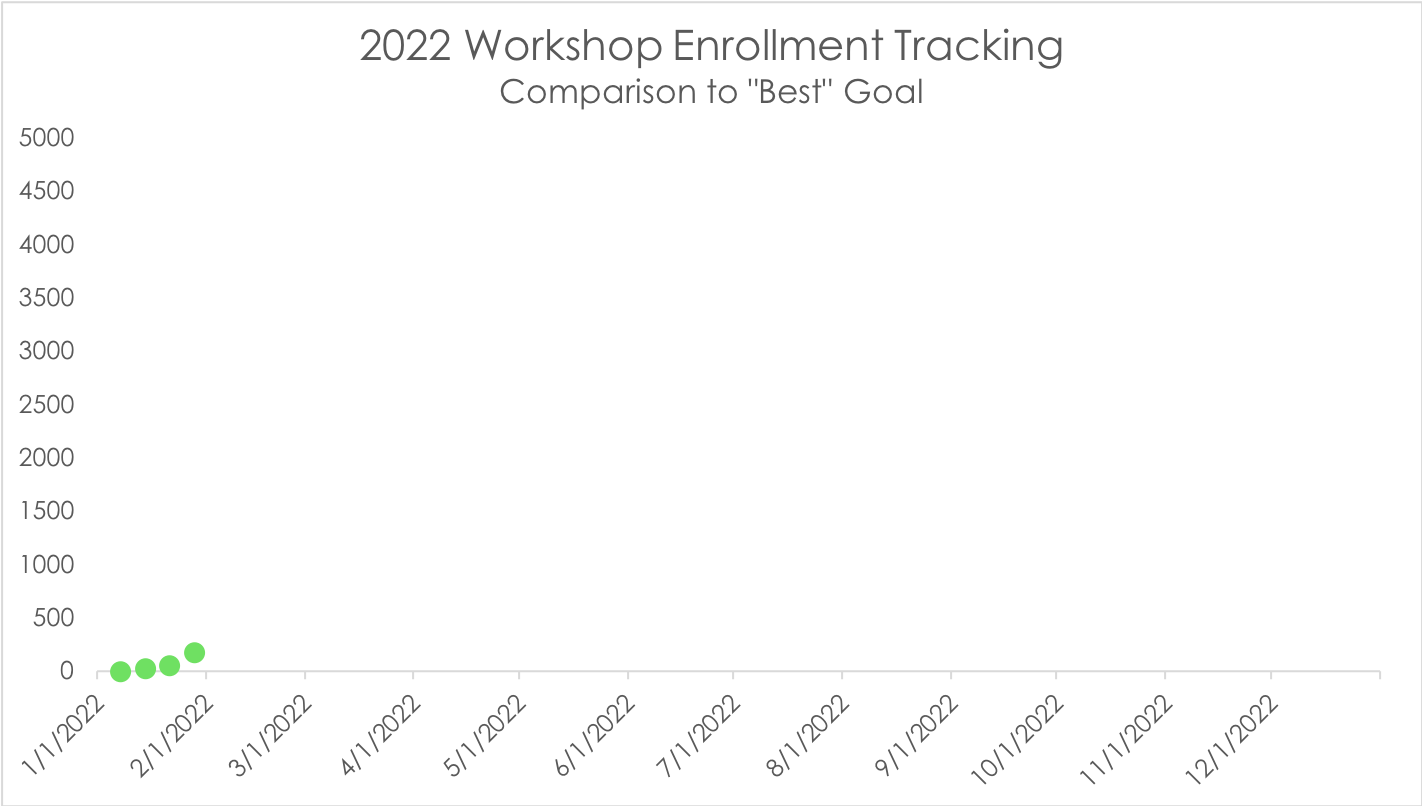

Business Goal Tracking for Week 6 of 2022

In February 2022, I set three overall monthly goals and three weekly habits to help me meet my revenue and workshop enrollment goals for 2022. This is my accountability report for how I did against these goals between 2/5/2022 and 2/11/2022. Monthly and Weekly Goals February Monthly Goals Publish the postdoc version of my annual tax return workshopCreate lead magnet and sales page for prospective grad student webinarConsider how to expand tax products this tax season February Weekly Goals Stay … Read entire article »

Filed under: goals

Business Goal Tracking for Week 5 of 2022

In January 2022, I set three overall monthly goals and three weekly habits to help me meet my revenue and workshop enrollment goals for 2022. This is my accountability report for how I did against these goals between 1/29/2022 and 2/4/2022. In February 2022, I have set three overall monthly goals and three weekly habits. Monthly and Weekly Goals January Monthly Goals: Pitch all potential university clients my speaking services and/or tax workshopsPublish my annual tax return workshopUpdate … Read entire article »

Filed under: goals

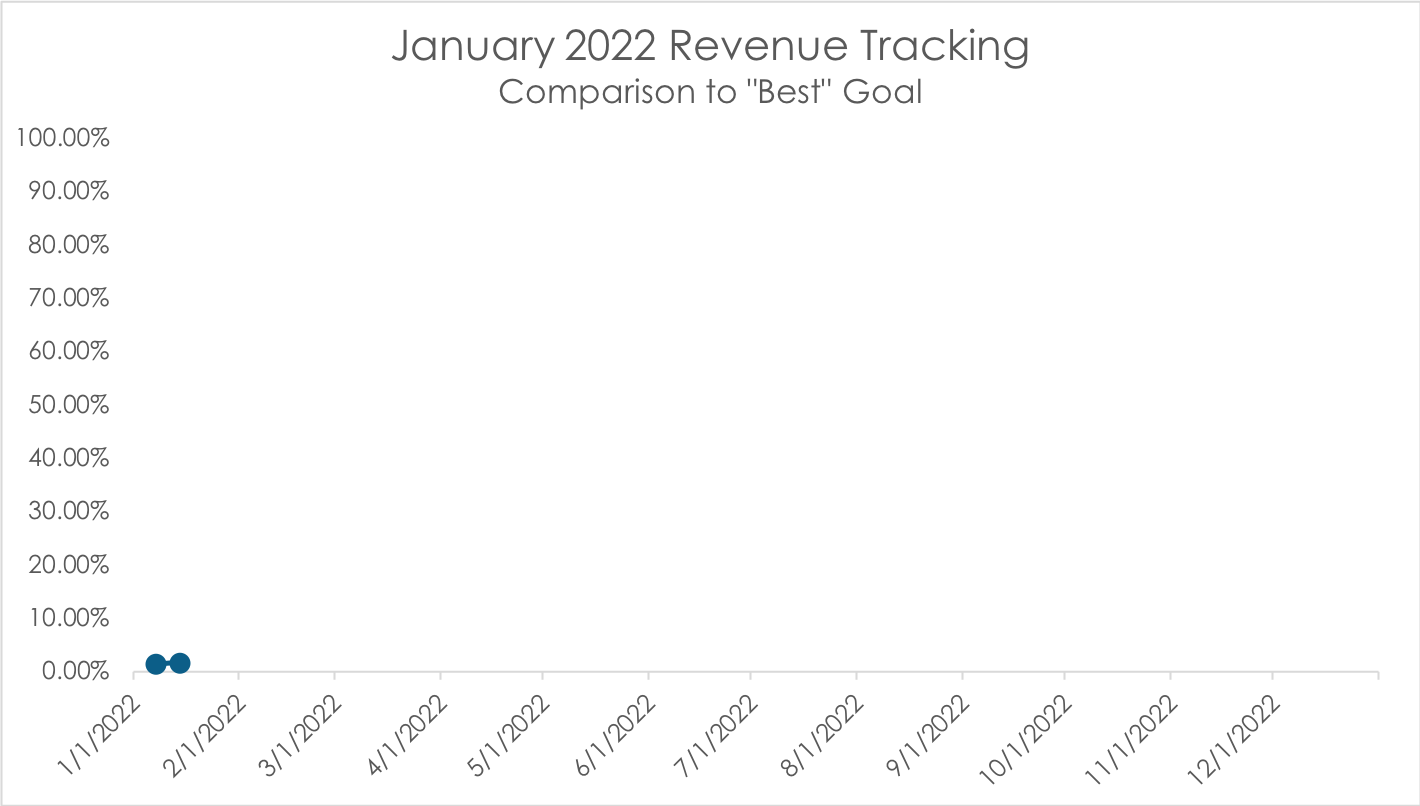

Business Goal Tracking for Week 4 of 2022

In January 2022, I’ve set three overall monthly goals and three weekly habits to help me meet my revenue and workshop enrollment goals for 2022. This is my accountability report for how I did against these goals between 1/22/2022 and 1/28/2022. Monthly Goals: Pitch all potential university clients my speaking services and/or tax workshopsPublish my annual tax return workshopUpdate all my read magnets and lead magnets for tax season 2021 Weekly Habits: Review all communications with university clients and … Read entire article »

Filed under: goals

Business Goal Tracking for Week 3 of 2022

In January 2022, I’ve set three overall monthly goals and three weekly habits to help me meet my revenue and workshop enrollment goals for 2022. This is my accountability report for how I did against these goals between 1/15/2022 and 1/21/2022. Monthly Goals: Pitch all potential university clients my speaking services and/or tax workshopsPublish my annual tax return workshopUpdate all my read magnets and lead magnets for tax season 2021 Weekly Habits: Review all communications with university clients and … Read entire article »

Filed under: goals

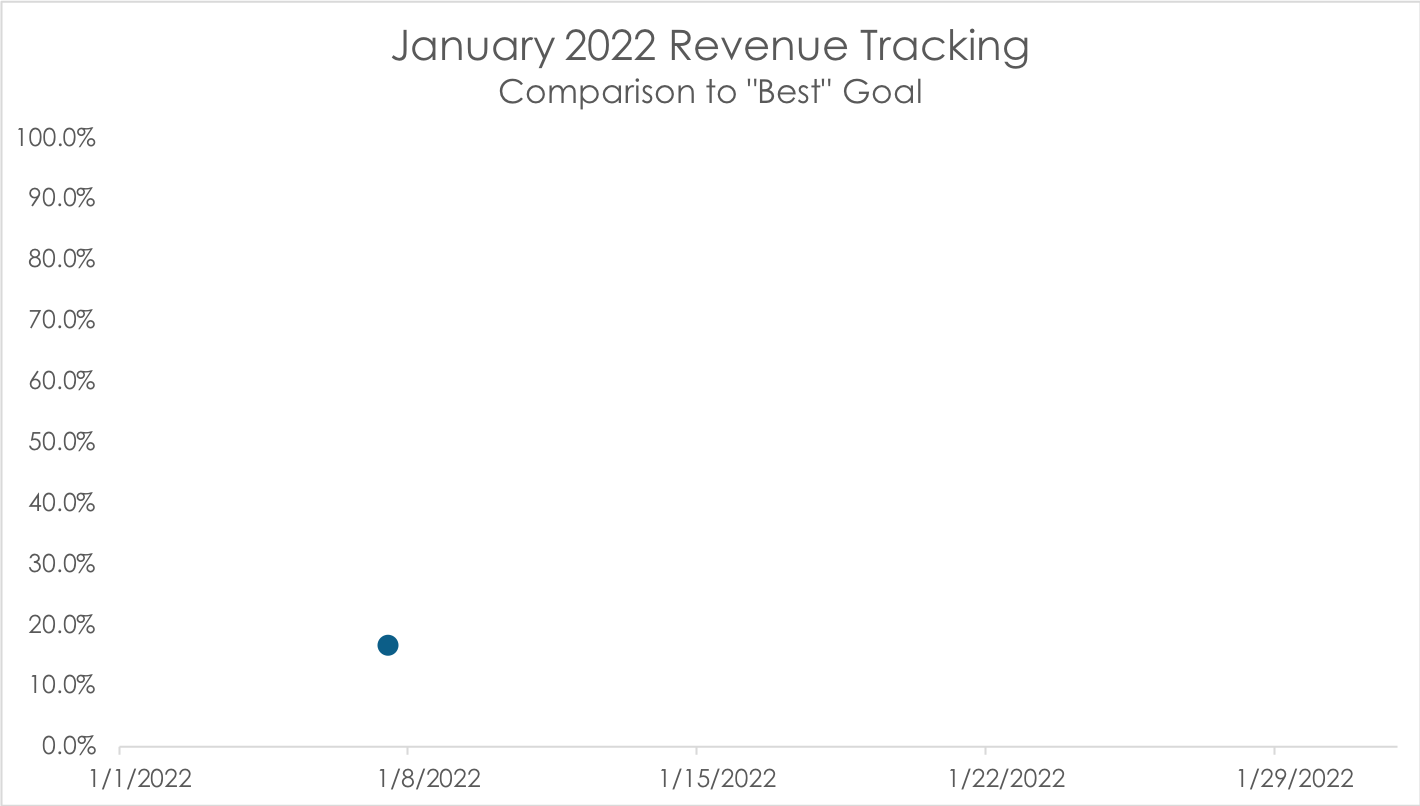

Business Goal Tracking for Week 2 of 2022

In January 2022, I’ve set three overall monthly goals and three weekly habits to help me meet my revenue and workshop enrollment goals for 2022. This is my accountability report for how I did against these goals between 1/8/2022 and 1/14/2022. Monthly Goals: Pitch all potential university clients my speaking services and/or tax workshopsPublish my annual tax return workshopUpdate all my read magnets and lead magnets for tax season 2021 Weekly Habits: Review all communications with university clients and … Read entire article »

Filed under: goals

Business Goal Tracking for Week 1 of January 2022

In January 2022, I’ve set three overall monthly goals and three weekly habits to help me meet my revenue goal for 2022. This is my accountability report for how I did against these goals between 1/1/2022 and 1/7/2022. Monthly Goals: Pitch all potential university clients my speaking services and/or tax workshopsPublish my annual tax return workshopUpdate all my read magnets and lead magnets for tax season 2021 Weekly Habits: Review all communications with university clients and respond as necessarySend … Read entire article »

Filed under: goals