Blog Statistics Update June-July 2013

I have a shame-face this month! In the last few weeks I’ve totally squandered the 2-3 weeks of posts I had written up in advance. I’m still not quite writing the day before posting, but I’m definitely working a bit closer to my deadlines. I’m also feeling more “dry” in terms of topic ideas – well, I still have a lot of ideas but not the will or interest to pursue many of them. I want to get back to having at least a week of posts queued up in advance.

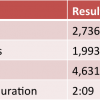

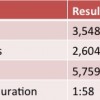

Analytics Data from June 16 to July 15, 2013

People who listen to us, as of July 15, 2013:

RSS subscribers: 179 (+14)

Twitter followers: 472 (+41)

Facebook fans: 35 (no change)

Rankings:

Alexa: 138,948 (+3,7,17)

Google PR: 3 (no change)

MozRanks: 5.10 and 4.94 (-0.01 and -0.03)

Some Google Analytics statistics:

We’ve finally hit a little rebound from our months of falling stats – a very little one! But otherwise we’re sort of treading water.

Popular Posts

Most viewed posts:

1) What Do You Consider a Good Salary?

2) How to Move Out on a Shoestring Budget

3) How Emerging Is Your Adulthood?

4) My Sister’s Awesome Financial Decisions

5) Is ‘Live Like a College Student’ Good Advice?

Most Commented Posts:

How Emerging Is Your Adulthood?

Rethinking Our Student Loan Repayment

Reaching Our First Retirement Savings Milestone

Is “Live Like a College Student” Good Advice?

My Sister’s Awesome Financial Decisions

Earnings

Our Adsense earning still hasn’t reached $100 so we have no payout yet. 🙂 Republic Wireless credits are still coming in fast!

Search Terms from Real People

Q: “can i give less money at a wedding if i am from out of town”

A: IMO, no. While I do think that your presence at a wedding is a gift, I think what you spend on the physical present is independent of how much money you spent to attend the wedding.

“leighs financial journey” – I think you were a little misplaced! You were looking for this blog. 🙂

Q: “is it normal to lose money the first few months of purchasing an ira”

A: When you open your IRA doesn’t have anything to do with which way the markets are going (unless you were trying to time things and got it wrong). It’s not normal and it’s not abnormal – they are unrelated.

And check out all these responsible grad students:

- graduate student ira

- savings while in gradschool

- saving money as a graduate student

- retirement planning for graduate student

- contribute to roth ira graduate school

- fellowship income and roth ira contributions

What do you do for inspiration when you lack ideas or motivation to write? Do you keep a regular posting schedule like we do?

Filed under: blogging, month in review · Tags: inspiration, motivation

Blog Statistics Update June – July 2012

Blog Statistics Update June – July 2012 Blog Statistics Update May – June 2013

Blog Statistics Update May – June 2013 Blog Statistics Update July-August 2013

Blog Statistics Update July-August 2013 Blog Statistics Update July – August 2012

Blog Statistics Update July – August 2012

I like that you are keeping the stats of the site. I need to add analytics to my site in a few. Usually I just use my cpanel stats. Over 3k visitors is good as well. For me I am on a post schedule as I don’t want to get burned out. The plan is eventually get posts up daily after all the site is Your Daily Finance. I am not at the point where I am running out of motivation or topics though I only have about 12-13 posts up so far.

Daily is a big challenge if you don’t have staff writers! I think everyone sort of has a natural limit to the number of words they can write a week on average, and I suppose that could become several posts if they are short, or one or two longer posts.

Well it’s always good to see a little rebound in the stats. I sometimes get searches for other related blogs as well. It’s so funny sometimes.

On another note, I’ve been having trouble accessing your blog on my smartphone for the past 2 or 3 weeks. It used to work, but now it just all greys out. Not a huge deal, but I thought mentioning it might motivate Kyle to figure it out.

CashRebel recently posted..Should I get a car loan to build my credit score?

Yes, thank you for telling us! I will set him on the case!

Looks like you guys are doing great! Your goal for staying ahead is definitely ambitious. It’s something I’d love to do but haven’t gotten there yet. I’d like to write a few posts that could really be put up at any time and just leave them there, so I have them when I need them. Put it on the neverending list.

Matt Becker recently posted..The Dual Benefit of Increasing Your Savings Rate

I have written some backup posts like that and I usually end up running through them pretty fast! Or I get bored with the subject and forget about them, because if I don’t want to post it right away it means I’m not that excited about it! I need to stop being so deadline-driven…

I’m crazy – I post 5-6 times a week (without staff writers)! But it helps I’m not in a niche even broadly like personal finance. Two days/posts are always themed (Tuesday is book or film reviews, Wednesday is about my attempts to go zero waste). The other four posts, I loosely have a guide to what I’d like to post about but it’s fluid. Naturally not all posts drive high numbers of readers. Keep up the great content – you’re always writing things I’m interested in and feel like commenting on so you’re doing something right!

SarahN recently posted..Friday – fun or not?

That is quite frequent, but having posts that are always the same theme/format each week definitely cut down on the mental workload. Even my two regular posts per month help a lot!

Thanks so much for that wonderful compliment! 🙂 I appreciate the encouragement.

I know what it is like to squander a stockpile of posts. Not only did I do that with three weeks worth of posts two years ago, but by Sunday night, I had 2 posts done and another started. I didn’t finish that third one until 7 hours before it was scheduled to go live!

Edward Antrobus recently posted..Fly Smaller Airports to Save Hundreds

I guess we’re both living in a boom and bust or feast and famine situation regarding posts! I’m not sure I’m even going to get one up tomorrow morning.

LOL! I can’t believe people got to your site searching for mine! That’s so crazy.

I kept a regular posting schedule for about six months last year and then I gave up. I just didn’t have enough ideas to post that often. Now I write when I have something to write about and the time to do so and don’t write if I don’t. Most months, I’ve been posting once a week.

Leigh recently posted..Independence Day Long Weekend Mini-Vacation Budget

I guess I write out your site name a lot in my weekly posts…?

Posts are definitely more uniformly interesting and high-quality when the motivation is inspiration only. But I also think there’s something to be said for volume and predictability. 🙂

I keep a regular posting schedule, but if I don’t have a post done, then I don’t worry about it. It is just a blog.

Grayson @ Debt Roundup recently posted..The Weekly Personal Finance Digest – One Busy Weekend

I have trouble remembering that it’s just a blog, at least when it comes to posting regularity.

I have a hard time sticking to a regular posting schedule. I know that’s actually horrible.

Marissa @ Thirty Six Months recently posted..Guess who’s going to BlogHer?

Well, it’s only horrible if you want the regular posting schedule to begin with.

[…] @ Evolving Personal Finance writes Blog Statistics Update June-July 2013 – This month I squandered a three-week frontlog of posts, but at least our pageviews are no […]

[…] Blog Statistics Update June-July 2013 was featured in the Yakezie Carnival. […]