The 3 to 6 Month Emergency Fund

I can see why people find Dave Ramsey’s baby steps attractive, I really do. As someone who is prone to paralysis of analysis (and whose husband is even more prone), executing an instruction is so much easier than making an informed decision and then carrying it out.

While watching week 1 of the FPU videos last week on “super saving,” my thoughts were on that 3-6 month emergency fund. We’ve had $1,000 set aside (baby step 1) since before we were married, and within 3 months after our marriage we had put aside the money to pay off my student loan debt (effectively completing baby step 2). At that point we implemented our targeted savings account system and neglected to think about beefing up our EF.

The video this week made me realize that I’ve never even calculated what 3 or 6 months of expenses is for us! Obviously, I know our incomes for that amount of time and I’ve even calculated what an emergency budget would be for us if we lost one of our stipends. But I don’t actually know what we spend in an average month because the targeted savings accounts obfuscate our spending somewhat and Mint gets confused by all our transfers. If the TS accounts were perfectly set up and the net flow averaged to zero it would be easy to calculate our spending, but we have been over-saving into those accounts recently and built up quite a bit of cash.

I came up with a roundabout method of calculating our average monthly spending.

I came up with a roundabout method of calculating our average monthly spending.

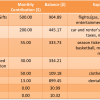

1) Our net income: I used our 2012 gross income from our tax return, since our monthly stipend income doesn’t take into account our other income sources (Kyle’s tiny weekend job, investment returns), and subtracted out the federal and state tax we owed last year.

2) Our giving: For this figure I used our current monthly giving to our church and the missionary we support, the amount we set aside in our charitable giving targeted savings account, and $13 to approximate the 10% we give from Kyle’s side income.

3) Our long-term saving: We dollar-cost-average into our Roth IRAs with our stipend money so that figure is easy to get, plus we save 15% of Kyle’s side income, which is about $20 per month.

4) The increase in our short-term savings: We’ve been piling money into our targeted savings accounts this year at a much greater rate than we’ve been spending out of them, so I wanted to account for this non-spending. I subtracted the balance of all of our targeted savings accounts on 8/31/2012 from the balance on 8/31/2013 to get an idea of how much money we save into these categories over a year (nearly $6k! I never looked at that figure before).

I estimated our monthly spending from the sum left over after subtracting our giving, long-term saving, and increase in short-term savings from our net income. This actually did seem easier to me than trying to figure out our yearly spending directly and delving into each one of our targeted savings accounts to figure out our real spending! I could have taken a few shortcuts like using our take-home pay instead of gross minus taxes but I just chose to go a little deeper.

When all is said and done, it looks like we’ve been spending on average $2,558.33 per month, or 55.5% of our gross income. A 3 to 6 month emergency fund would contain between $7,675 and $15,350. I was thinking that $10,000 would be a reasonable EF in the past so that is right in line with this range. Of course, we don’t have that kind of money set aside for that purpose alone!

But as I’m a bit of a contrarian, especially when it comes to Dave Ramsey’s teaching, I have to ask if the 3 to 6 months of expenses is really appropriate for our emergency fund. More on various methods for calculating emergency fund size next week!

Can you calculate your monthly spending in a straightforward manner or do you have a convoluted method like mine? Do you have a 3 to 6 month emergency fund?

photo from Free Digital Photos

Filed under: emergency fund · Tags: Dave Ramsey, emergency fund, FPU

Emergency Budget Exercise

Emergency Budget Exercise Our Short-Term Savings Accounts

Our Short-Term Savings Accounts July 2013 Month in Review: Money

July 2013 Month in Review: Money March 2013 Month in Review: Money

March 2013 Month in Review: Money

For my emergency fund number, I added up the following monthly costs

1. Mortgage payments

2. Super generous food allowance for me ($225)

3. Bill savings (money I put aside every week)

4. Phone ($30)

5. Transport ($30) <- I don't own a car

I then compared this to the total of my savings account/s, and worked out how many months I could live off the money in the accounts and the above total. I also factored in my additional mortgage payments this year, which I'd call on if I lost my income. I did this a while ago, since then I have a mortgage AND rent, but tenants, so the what ifs would be different… So I should sit and do it again! I was pleased to see I could survive 6 months, more than enough time to rent out my property and move home OR sell my place.

SarahN recently posted..Zero Waste & deli stickers?

It makes sense to me to add up “must” expenses to estimate the EF size rather than normal spending, which is what the DR method uses. Obviously in an emergency you could adjust your spending. I guess having a rental property means that the EF should be a lot larger in case you have to go without collecting for a while or they break things.

The way I’ve calculated the bare-bones Emergency Fund is I added up the following: rent, food, car insurance, tenant insurance, gas, cable, cell phones, life insurance, and minimum payments for any debt. I then multiplied that number by six and I ended up with close to $10000 (actually $11300, but 10K is just such a round number), so that is my Emergency Fund goal. It falls into the 3 – 6 month category, and assuming I don’t lose my job in the next three months I will have access to that amount of money in the bank and my debt will be much lower making my minimum payments lower.

Alicia @ Financial Diffraction recently posted..October – it’s raining money!

Our emergency budget (one stipend) total is actually very close to this expenses-only budget total. The fat we have in our expenses roughly equals the amount we would save and give off of one income.

That must feel great to be making progress on your debt and winnowing down your monthly nut!

Been tracking my spending for some time so I have a rough figure of what my monthly expenses would look like. No need for convulted process, just pick the average monthly expenditure, add a few miscellaneous amounts and multiply that by the number of months I plan on saving for.

Do I have that cash in the EF? No, am still in the process of building it up.

Simon @ Modest Money recently posted..EverBank Review – Exclusive Review of EverBank Online Banking

Yeah, it would be much easier to do it the way you said if we knew our expenditures. But we reimburse ourselves from our targeted savings accounts so often that it gets complex. I keep more detailed/understandable records in Excel while everything (while perhaps inscrutable) is in Mint.

Are you working hard at building up that EF or is it a back-burner goal?

I’m struggling with how much to have in an efund. After not having much of one and using credit for so long, I think I probably have too much in cash right now. The end of the year will be tricky if my business sale finally happens, so I’m saving everything in case of a huge tax bill. After that, we’ll need to decide what to do with the excess. It’s a much better problem than not having one at all!

Kim@Eyesonthedollar recently posted..Pros and Cons of Living in a Ski Resort Town

Yeah, that is a better problem. Seems like waiting and seeing is the best course for now. And it gives you time to plan for what you want to have where after the tax bill is paid without having the temptation of the excess money (if there is any) in front of you.

I think your method makes sense. You’re taking the net & then subtracting out certain categories, as what’s left is, by deduction, spending.

Our spreadsheet calculates our monthly spending figures so calculating our average monthly spend figure is pretty straightforward. We do keep a $10k emergency fund in cash but I get the feeling it’s overkill at this point. The main financial emergency I am worried about is a job loss, but that would mean we would get at least some unemployment dollars in the interim. Those funds (potentially $1,000 – $1,200 a month in Arizona) would stretch our emergency fund way further than 6 months, especially as we’d also cut out a lot of luxury items (restaurants, date nights out, travel) in such an emergency.

I think Dave’s recommendation is certainly a prudent one, but I’m okay with the idea of tinkering with the figures a bit to suit your particular situation.

Done by Forty recently posted..The Appalachian Trail & an Interview with Haley Miller

That’s why I liked using Excel when I did – it was so straightforward to track stuff! Our system doesn’t mesh well with Mint but at least it’s automatic.

If unemployment is your biggest concern it makes sense to factor in EF. Unemployment is way down my probability list of reasons I might use emergency money!

My method was just an easy averaging of all of our monthly costs over the past year then multiplying by 6. I even added some percentage variance on top to make sure we would be good. I haven’t hit that number yet, but I am working on it.

Grayson @ Debt Roundup recently posted..Priceline Rewards™ Visa® Credit Card Review

Do you have another pool of money because of self-employment or having an irregular income? Or just the 6 months EF?

It also helps to calculate what unemployement would be in your state (if you’re eligible). Also factoring your likelihood of getting a job in case of job loss really matters. I could always get a temp data-entry job immediately if I were unemployed where I currently live (although the pay may not be that great) but when I move to a more suburban area, it may be more difficult to find any kind of interim job so I’d be more focused on a larger emergency fund.

Also, things like student loans that can be temporarily deferred while unemployed is something to keep in mind. I would ask to stop paying loans while I was unemployed just to ensure the emergency money lasted longer.

Tara @ Streets Ahead Living recently posted..What to do when you’re overwhelmed

Thanks for pointing out the Employment Insurance benefits. I should in theory get $500 per week in EI which would stretch the Emergency Fund much longer even if it takes a few weeks to receive the funds.

Alicia @ Ffinncial Diffraction recently posted..October – it’s raining money!

I’ve had writing an EI post for students on my list for over a year… I should really get to it! I’m not CERTAIN we wouldn’t qualify. But it is something to factor in if your EF is for unemployment (also like having 1 working spouse and 1 not-working!).

Although I guess it’s the reasoning behind the calculation (not that DR reveals his reasoning), our EF is not primarily for the case of job loss. It’s more about random stuff like our bodies breaking. I’ve never looked into it but I doubt we would qualify for unemployment. If I did lose a job I’d try to make money in various “side” ways until I found another full-time job. Your thoughts are great for those they apply to, though.

Hello – I am a recent follower of your blog and we share the same first name 🙂 Our family’s emergency fund is bare-bones; it’s the sum of our mortgage, car insurance and fuel, groceries and necessary bills (phone, internet, utilities). We only have three months worth in our EF.

In the case that both my husband and I are out of work, we’ll be collecting unemployment insurance for a year. And, need be, we’d find temporary jobs until something in our field comes along.

Sounds like you’ve worked out a plan, which is the half of the battle I’m struggling with! Great job!

I am surprised that you did not calculate hat before. But to be honest having a lot of experience in corporate finance, I realized the necessity of emergency fund only from my relationship.

I just wrote an email about my book “Home Finances for Couples Workbook”, please have a look.

Leo

Leo Ostapiv recently posted..Wouldn’t it be great if Money is the One Thing You Never Argue about?

Yeah, we never felt like we had the option of saving for the short-term until we realized we were doing it. We have fat stashes in a few areas not labeled for emergencies but I’m considering re-naming them.

My emergency fund is at about 6 months’ of normal expenses, not barebones expenses and then I rounded it up slightly to get $20,000. It was lower, but I eventually decided that was the magic number where I felt comfortable with the size of my savings account.

Leigh recently posted..August 2013 net worth update (+0.6%)

You are so right – at the end of the day, what matters is being comfortable with the EF size. And this is definitely an area to round UP in, no matter how tempted I am to round down!

Wow, this is scary to think about! I saved up a year’s emergency fund before getting married (about $18,000), but since our married monthly spending is about 2/3 higher than my single person’s was, that is only seven months’ worth now. Sad. If we were on a stricter budget we could stretch it to at least 9, but our current lifestyle is fairly budget conscious already, and we’re saving at least 20% of our barely-living-wage stipends, so we’re not really willing to make the lifestyle sacrifices of living on the absolute minimum budget yet.

Having a full year’s worth of emergency savings is probably overkill though, just a symptom of my fears about the job market. Our more pressing savings priorities are the “before kids” trip we’ve been planning for two years, my spouse’s student loans, and increasing our retirement contributions (not necessarily in that order, decisions will be made toward the end of the year).

At least your spending didn’t double with the 2nd person!

Having a year’s EF does sound like a lot, but not when you factor in that you will eventually have to switch jobs (not necessarily when you are prepared to!) and that the savings could easily be reallocated after the job is secured for your other priorities. Good luck deciding what to put first! They’re all great purposes and I wish there was more money to go around. Soon, I hope, we will all emerge from this prison of grad school…

In the past we’ve kept as much as $25K in our buffer at all times, which was enough to cover all insurance premiums, as well as all expenses on an ongoing basis for about 4-5 months assuming that not a dime was coming in. (Which wouldn’t necessarily be the case since if our insurance on the rental includes rental insurance if the place is uninhabitable…)

But since paying back Mr PoP’s parents for their loans, we’ve settled on a $10K figure for the buffer that feels slightly riskier, but we have tons of credit available to us and will be building a taxable investment account that could be tapped should we really need it.

Mrs. Pop @ Planting Our Pennies recently posted..PoP Income Statement – September 2013

The previous approach was very conservative. I think having a smaller cash EF and then a taxable investment account (and then credit) – a tiered approach – is optimal.

Not even 12 months of income saved would make me truly relaxed, but 3-6 is a good starting point. Many people are currently with NO emergency funds and this is not OK at all. So we need to do some calculations and start saving, since you never know what might happen.

dojo recently posted..Personal Finance: There is no such thing as ‘good’ debt

What would it take for you to feel safe? 1 year seems like a ton to me!

Well, it’s not actually that much. Think about it: your car breaks so bad you need to get another one. It surely costs a lot of money, unless you want to go into debt. You break something and the health insurance doesn’t cover it. Your have a great investment opportunity and you need to cover some start-up costs and so on.

We are already saving each month and this helped us with many unexpected ‘pays’. I am pregnant, so a lot of our budget goes now towards all the needed stuff for our daughter. Not to mention health costs, since the insurance doesn’t cover it all.

My car needs the insurance renewed and it would probably be a good idea to change the oil/tires. More expenses that will come off our pocket.

My husband needs more things invested in our common business (he checks the heating installations for people – it’s mandatory in my country for them to have them checked every 2 years) and for this he uses an expensive gas analyzer and other tools. Which need to be checked themselves yearly and the prices keep on increasing. Not to mention more taxes we have to pay and a lot of other stuff.

My dog has a heart condition and his medication is putting a strain on the budget too. The ‘slow’ months in our business (we don’t work at a regular job, so we don’t have monthly paychecks) also meant we had to cover the regular expenses, plus the ‘surprises’, from our savings. And they can easily get depleted if we have 2-3 bad months.

It does sound like I’m exaggerating, but we had so much ‘crap’ thrown our way in the past year, that I’m getting crazy 😀

So probably 12 months would be the start for me to not obsess too much about money and know we’re covered better. Not to mention we need to also save money for retirement, since in my country there’s no such thing as a ‘decent’ plan (and the stat retirement plan is kinda bankrupt even now). So in 30 years time, we’ll mainly eat what we saved 😉

dojo recently posted..Saving & Frugality: How we saved more than 1/3 of our travel budget

It sounds like some of those items are emergencies and some aren’t, although if you just have a bunch of savings to cover both categories I guess it doesn’t matter! I agree you should be piling up money while you’re pregnant because the future is uncertain. Definitely self-employment adds another dimension of savings, although I would put that as more for smoothing rather than for emergencies… But I’m splitting hairs. I agree with you that saving 12 months of expenses in your case may be reasonable!

Like others, I looked at our monthly necessary expenses (house, utilities, food) and came up with a cost. I added a bit to that for some breathing space, and then my wife and I save 12 month’s worth of that into 12 5-year CDs that have only a 60 day interest penalty for early withdrawal. The CDs are all paying roughly 2% interest. We wanted to have 12 month’s of expenses because we both work for the same company. It is a large company, but if we were both laid off, we would want to have enough emergency money to cover our expenses while we find comparable employment.

Bryce @ Save and Conquer recently posted..Carnival of Financial Camaraderie – October 5, 2013

That is smart to have a larger EF because of your related incomes. Are you in closely related functions as well? Would you be competing for the same positions if you were let go?

That’s an interesting strategy regarding the CD laddering – slightly different from what I’ve seen in the past.

[…] Side Income – Time for Self-Employment (<–Srsly ballin’!) Evolving PF – The 3 to 6 Month Emergency Fund Frugal Rules – Frugal Birthday Parties for Kids Debt Roundup – Dear Government…..GROW […]

[…] weighed in with her comments on the 3 to 6 month emergency fund: “Not even 12 months of income saved would make me truly relaxed, but 3-6 is a good starting […]

An emergency fund doesn’t make sense for my wife and myself. My wife earns nearly double what I do. But even if she lost her job and didn’t get unemployment, my income is more than enough to pay our monthly bills. So why in the world would we want to tie up $10k or more in an emergency fund? It just doesn’t make sense.

Rory recently posted..The Middle Class Guide to Beating Wall-Street – Part 2

But an emergency fund can also be for stuff breaking, not only unemployment. But congrats on living on just your lower income! Great job!

Nice article. We have a simple formula for our emergency account: 6 x gross business profit. This works pretty well for two self employed people. Recently when we had a major plumbing repair ($1600) it just came out of the emergency account. No stress. No worries. Next I want to start a “travel” fund so that we can go on trips that are pre-paid.

Suzanne recently posted..9 Ways to Be a Better Financial Planning Leader

[…] my last post on emergency funds, I looked at Dave Ramsey’s (and many others’) suggestion of an emergency fund size of three to six months of expenses and calculated what that would be for our current budget ($7,500 to $15,000). But at the end of […]

[…] from iHeartBudgets listed The 3 to 6 Month Emergency Fund in his good […]

I’ve been tracking our spending for over a year now so I have a good idea of our monthly expenses. Also this year I started adding our income to it, which really has helped. I do not have a 3-6 month emergency fund, but it’s definitely a goal of mine.

DC @ Young Adult Money recently posted..Giveaway: $200 in Discover Gift Cards

How did you settle on the 3 to 6 month emergency fund?

[…] The 3 to 6 Month Emergency Fund – Evolving Personal Finance Not all emergency funds will look the same! Evolving Personal Finance shares how the numbers don’t always match up with your expectations. A great place to get started if you’re just starting out! […]

[…] 3) The 3 to 6 Month Emergency Fund […]

[…] for Zero included both The 3 to 6 Month Emergency Fund and What Is The Purpose of An Emergency Fund? in the topics we’re talking […]

[…] derail your budget by not having any savings. This savings could be in the form of a small emergency fund or perhaps some money you just have set aside for targeted […]