Evolving Personal Finance » Archive

November 2013 Month in Review: Money

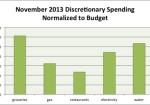

Y’all, I screwed up this month. It’s only like half my fault, though. My paycheck is no longer being direct deposited since I switched payroll systems a few months ago. (How patient am I supposed to be with this? I submitted the paperwork for the new direct deposit in August.) So now I grab my paycheck on the last workday of the month and use my smartphone to deposit it to our Ally checking account. … Read entire article »

Filed under: month in review

The Thinking Person’s Guide to Dave Ramsey: Underlying Principles

As I stated in the overview for this series, in this first post I will share what I have observed are the key foundational views of money on which Dave Ramsey’s entire program is based, the underlying principles. If you disagree with any one of these views, DR’s program is either not for you or you will want to make some modifications to follow it successfully. You Want to Plug in to a Simple, Universal Program DR’s … Read entire article »

Filed under: debt, psychology, savings, values

The Thinking Person’s Guide to Dave Ramsey: Overview

There is no question that Dave Ramsey’s (DR’s) financial coaching has helped millions of people improve their finances through paying off debt and saving for emergencies and their futures. However, DR’s program is quite unconventional and it can be difficult to reconcile his advice with that of financial advisors, coaches, and authors. Now that I have been through Financial Peace University, read The Total Money Makeover, and listened to The Dave Ramsey Show for a couple … Read entire article »

I Don’t Work for the Money

I often read in the PF blogosphere about the importance of achieving financial independence through the generation of passive income streams. Some bloggers will go on to explain that until we achieve FI, we are trading time for money, and time should be recognized as a more precious resource than money because it is non-renewable. I turned over the phrases “trading time for money” or “working for money” while Kyle and I traveled for Thanksgiving. (Aren’t … Read entire article »

Filed under: income

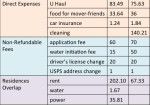

The Cost of an In-Town Move Part 2

Yesterday we finally received our refund from Time Warner, so our all expenses have been settled from our move in mid-September! (6-8 weeks to issue the refund and 3 weeks to have it mailed. Seriously??) I can finally report what our in-town move cost and compare it to what we spent last year. The two townhouse rentals are very similar – both about 1200 square feet, both 2 bedroom/2 bath, and about a mile apart off … Read entire article »

Filed under: housing

Our Two-Year Anniversary: How Blogging Has Enriched My Life

Last week we passed the two-year anniversary of Evolving Personal Finance; our first post went up on November 21, 2011. (It was so interesting for me to re-read that post and see how much and how little has changed in terms of my vision for this blog!) I let the one-year anniversary pass without comment because it didn’t feel like that much of an accomplishment for me, but this year for whatever reason I am … Read entire article »

Filed under: blogging

Favorite Posts, Mentions, and Top Comments Week of 17November2013

I am happy to report that my intense work period is over (probably)! I both worked through my problems and found that my deadline had been pushed back! Kyle has slowed down but is still writing his dissertation. Last night, Kyle and I saw Ender’s Game and went out for dinner. As Ender’s Game is my all-time favorite book and I have read it numerous times, we spent the entire dinner discussing the differences between the book and the movie (i.e. virtually everything). I was pretty disappointed, but Kyle had to explain to me why some of the adaptations made sense for turning a book into a film. Posts I Liked Johnny Moneyseed discusses the areas his family sacrifices in to save 75% of their income and how difficult they perceive those sacrifices … Read entire article »

Filed under: weekly update

Blog Statistics Update October – November 2013

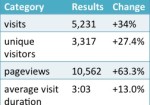

What do you know, we had a sneakily higher month for pageviews! I have been so discouraged by the analytics lately that I haven’t been paying much attention, so it was a nice surprise when I finally looked at the numbers. I’m sure it was due to my GRS guest post and the post I put up to direct new visitors to previous posts. It was our highest month for pagviews, though not quite the … Read entire article »

Filed under: blogging, month in review

“I Want a Credit Card, But I’m Scared”

I got this question from a coaching client recently. He is a recent college graduate who has never had a credit card but has been told that he should get one for his credit score. He said he was afraid because he knows how damaging misusing credit cards can be. I told him that I closely identified with this conundrum because I felt exactly the same way after I graduated from college. I read that I … Read entire article »

Filed under: credit cards

Carnival of Money #6

Welcome to this week’s edition of the Carnival of Money! Thank you to those of you who participated. General Financial Advice Jack presents Tips for a Great Financial Year posted at Money Saving Ethics, saying, “Improving your financial situation is not as difficult as it might sound, but it does require dedication and thought. It is really just a matter of starting and maintaining healthy financial habits.” Danielle presents Financial Tips That Sound Bad but Work Well posted at Saving Without a Budget, saying, “If you ask most certified financial planners you will find that one of the things they are constantly warning their clients against is making bad money choices based on popular financial advice, which is often wrong.” Matt presents The High Cost of Using Cash posted at Budget Snob, saying, “It has been calculated that … Read entire article »

Filed under: carnival