Evolving Personal Finance » choices

Five Money-Saving Moves from Our Wedding

As wedding season 2012 has been heating up, I’ve seen more and more PF-blogger-brides (yet to see a groom) discuss their wedding budgets or various aspects of planning. It’s caused me to reflect on our wedding from 2010, which was not at all an inexpensive undertaking. To this day I don’t know how much money was spent on our wedding because some costs have not been disclosed to us by our parents and some small … Read entire article »

Filed under: budgeting, choices, featured, luxuries, marriage, spending, values

Why You Should Save for Retirement While In Graduate School Part 2

aka Why You Should Save For Retirement Even with a Low Income This is the second half of a two-part post intended to inspire graduate students and others with low incomes who are currently not saving for retirement to start. Check out the first post for my assumptions and an argument concerning compound interest. Please remember that I am not a financial planner or CPA and you should not consider my opinions financial advice targeted for … Read entire article »

Filed under: choices, retirement, savings

Why You Should Save for Retirement While In Graduate School Part 1

aka Why You Should Save For Retirement Even with a Low Income This two-part post is intended to inspire graduate students who are currently not saving for retirement to start. The graduate students I refer to in this post are those who are being paid a living wage while in school – that is, they are not taking out loans for tuition or living expenses and can keep their must-have living expenses (rent, utilities, food, etc.) … Read entire article »

Filed under: choices, featured, grad school, retirement

Why Do We Make Rules If We’re Just Going to Break Them?

Kyle and I have a rule: We don’t watch important basketball games (i.e. any game involving our team, or the final rounds of the NCAA tournament) with people who don’t care about basketball (apathy is bad enough – rival fans would be inconceivable!). You can imagine the situation that inspired this rule! So I was surprised when Kyle told me yesterday that he is planning to watch our team’s big rivalry game this weekend with people … Read entire article »

Filed under: budgeting, choices, credit cards, debt, giving, retirement, values

Private School Angst

Kyle and I received an excellent undergraduate education a private college – a very, very expensive private college (it’s on this list). Our college was an absolutely perfect choice for me. There are only around three institutions in the country that offer a similar educational setting and none are in nearly as desirable a location. For my personality, my academic interests, and my career aspirations – and my love of warm weather – it was very … Read entire article »

Do You Ever Just Give In and Spend?

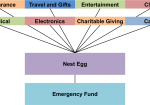

I’ve written several times about our targeted short-term savings accounts. For the most part these work very well for us in saving for our anticipated expenses. But sometimes, the system backfires – specifically, when we need (?) something that we haven’t saved for, or haven’t saved enough for. Dividing up our cash among all these accounts means we have to do some psychological tricks to get the money from elsewhere. We’ve had two instances of this … Read entire article »

Filed under: budgeting, choices, spending, targeted savings

Living a Step Behind

This week I’m thinking about a great illustration that our pastor used a few years ago in a sermon on putting others before ourselves. He was helping our church accept that if we chose to live by the Biblical principles of money management, we should expect to see obvious differences in our lifestyles in comparison with our peers at work. By tithing 10% of our income and giving generously above that, we would be one step … Read entire article »

Spend $1600 or Become a One-Car Family?

Irony: My car breaking down the day after writing about our disagreement over carpooling to work! When I published that post on Monday becoming a one-car family seemed a remote possibility, but as of this writing on Tuesday evening we are giving it serious consideration. So much can change in 36 hours! For the last few months, my car has been shaking considerably when its speed exceeds 65 mph. I knew I would eventually need to get … Read entire article »

Filed under: budgeting, cars, choices, emergency fund, targeted savings