Evolving Personal Finance » retirement

We Maxed Out All Our Retirement Accounts for the First Time!

It’s Tax Day for 2021 and our final transfer to Vanguard has gone through, so I can officially announce that Kyle and I maxed out ALL of the tax-advantaged retirement accounts available to us for the first time EVER! We filled up: Kyle’s traditional 401(k)The employee side of my traditional 401(k)The employer side of my traditional 401(k)My Roth IRAKyle’s Roth IRA In recent years, we capped our retirement contributions at 20% of our gross income because we were simultaneously saving for our house down payment. With our house purchase complete, we had no reason to limit our retirement contributions (except, you know, cash flow). We set our goal of maxing out all the traditional accounts available to us in part to keep our AGI low enough to qualify, as best we were able to, … Read entire article »

Filed under: retirement

Where’s the Tipping Point Between a Roth and Traditional IRA?

I love my Roth IRA (and my Roth 401(k)). Throughout my twenties, I didn’t have access to a workplace-based retirement account, so the IRA was a retirement-life-saver. I also was not making much money as a grad student, so using a Roth made total sense. When I speak to current grad students, I advocate using a Roth IRA for retirement savings. But at some point, doesn’t a traditional IRA or 401(k) start to make more … Read entire article »

Filed under: retirement, taxes

Avoiding an Expensive 401(k) Plan through Self-Employment

Kyle finally received the 401(k) plan information from his new employer about 6 weeks after starting work. When he told me the plan offered American funds, my heart sank! The stereotype I have about American funds is that they have loads and high expense ratios. When we looked at the plan documentation, we didn’t find any load disclosures (thankfully), but the expense ratios were approximately an order of magnitude higher than what we have in … Read entire article »

Filed under: retirement, self-employment

Consider the Source

I think most of us like to think of ourselves as skeptical, or at least not gullible. It probably goes doubly so for me because I call myself a scientist. But I realized just in the last couple weeks that I was taking some financial advice at face value without considering the potential bias and motivation of the advisor! And I lost out on giving some advice to someone who likely has a more conflicted … Read entire article »

Filed under: choices, housing, retirement

Surprise! You Get a 401(k) Match!

This post is by my (Emily’s) younger sister, Michelle, who is making awesome financial decisions under my and Ramit Sethi’s tutelage (I gave her I Will Teach You to Be Rich for Christmas a few years ago). In spring 2013, she started working full-time as an hourly employee in a doctor’s office. This post is on how she found out that her employer offered 401(k) to employees who had been working there for more than … Read entire article »

Filed under: retirement

Dollar-Cost Averaging vs. Percentage-Based Budgeting

Kyle and I had the most ridiculous fight about our budget two weeks ago. Our positions were only slightly different, yet we were so entrenched we couldn’t come to a resolution and had to drop the argument for the night! Both of us are very opinionated and stubborn and I am definitely not the only PF nerd in the family. I’ve been preaching percentage-based budgeting on EPF basically since the start of the blog. What I … Read entire article »

Filed under: budgeting, retirement

Why We Aren’t Contributing to Our New 401(k)

Kyle’s new postdoc position comes with a benefit neither of us have ever had before – access to a 401(k). (Okay, it’s a 403(b) because it’s through our university, but I’m going to call it 401(k) in this post.) However, we have (mostly) decided not to set up contributions to it. I’ll tell you our reasoning and then you can let me know if we’re missing anything and should change our decision. Accounts Prioritization Up to this … Read entire article »

Filed under: career, retirement, savings

When to Pass Up a Company Retirement Match

I know this is practically heresy around the personal finance community, but I don’t think everyone should contribute to his 401(k) or equivalent, even when a company retirement match is available. I didn’t think that I held that opinion until I advised a coaching client to pass up his unlimited 100% company 401(k) match. I am supposed to advise my coaching clients according to the Dave Ramsey Baby Steps, perhaps with some reasonable modifications. Starting Baby … Read entire article »

Filed under: budgeting, choices, investing, retirement, savings

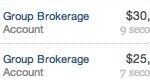

Reaching Our First Retirement Savings Milestone

Kyle and I are both celebrating our 28th birthdays this July. We’ve been flirting with having one year’s income in our Roth IRAs and after the big upswing in the stock market last week I decided to take a closer look to determine if we had finally passed that one year mark. Wouldn’t that be a wonderful birthday present to ourselves? The one-year’s-income-in-retirement-accounts milestone isn’t some objectively big accomplishment. If you poke around the web for … Read entire article »

Filed under: retirement

Will You Ever Reduce Your Retirement Contribution Rate?

November 4th, 2013 | 23 Comments

When I think about the retirement savings trajectory of a typical American, I imagine that his rate of saving for retirement increases basically monotonically throughout his life. In his 20s and 30s he doesn’t save anything; in his 40s he wises up and starts putting money away; in his 50s he panics and saves as much as he can given the lifestyle he’s become accustomed to; by the time he’s about to retire he’s putting … Read entire article »

Filed under: choices, retirement, savings