Why We’re Not Getting the Chase Sapphire Preferred Card Even Though It’s a Great Deal

I’ve heard such great things about the Chase Sapphire Preferred card over the last few months – especially the signup bonus! Plenty of bloggers who track this sort of thing have highly recommended it.

The signup bonus for the Chase Freedom card definitely influenced us to get it, but we also knew that we would continue using it for its highlighted rewards categories and it has actually become our primary card. The difference now is that we are happy with our current credit card rewards structure, so we would be getting the Sapphire card primarily for the signup bonus and would plan to cancel the card without ever paying the annual fee. Kyle and I had a bit of an argument about whether or not this is ethical but it seems he’s okay with it overall.

I’ve been concerned recently about how we’re going to pay for what we need to out of our Travel and Personal Gifts account through Christmas, so using the signup bonus would help out amazingly! The bonus is 40,000 points, which can be redeemed through the rewards site for up to $625 in airfare, so that would cover nearly the entire expense of our Christmas flights. Plus we’re going to Canada in September so the double points on travel and not having foreign transaction fees would be lovely.

I was so excited about the prospect of this signup bonus that all day after we talked about it I was bugging Kyle showing him the above articles and saying how great it would be to get a relief from spending so much money on flights.

The only question left was whether or not we would be able to get the signup bonus, since that is the whole reason we would apply for the card. To qualify for the bonus, we need to charge $3,000 in the first three months. We can switch our recurring expenses over for that period and use it for every one-off charge except for gas (we get 5% back on gas in the third quarter so we’re going to keep using our Chase Freedom card for those expenses).

I looked back (using Mint! love it!) at all the charges we’ve put on our credit cards in the last year, subtracted out the gas, and found that on average we charge $3.7k in a three-month period. So far so good!

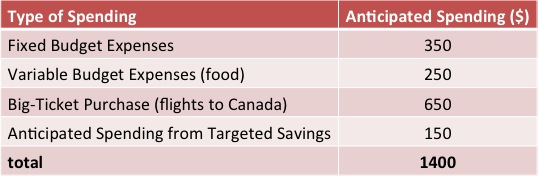

However, when I actually tried to project how much money we’d charge in the next three months, I really couldn’t come up with much. I looked back over more recent months to figure out how much food we would charge, because since we’ve been going to ALDI we’ve been putting a lot less groceries on our credit cards. We are expecting to spend quite a bit out of our targeted savings accounts in the next few months as the school year starts up, but our university only accepts checks. The only savings account I can reasonably expect to spend out of on a credit card is our Appearance account (because that always seems empty) but we don’t put much money into that account.

All of that only amounts to $1,400! Of course some other random spending will come up, particularly out of our targeted savings accounts, but I can’t see how it would total more than a few hundred dollars. It seems we are not going to spend anywhere near the $3,000 needed to get the bonus in the next 3 months.

The card is really attractive to us still and we’ll probably re-evaluate in a few months to see if we will spend enough to get the signup bonus, if it’s still available. We pay our 6-month car insurance policy in November and of course will be buying flights and Christmas presents in Oct/Nov/Dec, so maybe the end of 2012/beginning of 2013 will be a better time.

Have you ever signed up for a credit card for the bonus and would you do it again? If you keep a traditional monthly budget, do you ever go through the spending-projection exercise? How much do you typically put on a credit card per month?

Filed under: credit cards, travel

Putting Rent on a Credit Card: An Opportunity to Churn

Putting Rent on a Credit Card: An Opportunity to Churn Choosing an Amex Card

Choosing an Amex Card “I Want a Credit Card, But I’m Scared”

“I Want a Credit Card, But I’m Scared” Current Credit Cards Rewards Strategy

Current Credit Cards Rewards Strategy

Have you considered paying utilities with the card? That’s the only way I think I could come up with to coming close to spending $3000 in three months.

Edward Antrobus recently posted..How I Spent Less Than $200 on My Wedding

The utilities are already in the calculation (under the fixed expenses). The only ones eligible to put on a credit card are Kyle’s cell phone and our internet – everything else has to come directly from checking.

Ouch. I’m pretty sure I could pay all of our utilities with credit if I so desired.

Edward Antrobus recently posted..How to Spend Gift Cards

Wait, you only anticipate spending $250 on groceries over three months? And does that include anything like gas? That and maybe the “fixed” and “targeted” ones seem like maybe one month numbers, not three, unless Aldi is almost free and you are going to have a very light three months on targeted spending. (If those are real costs for three months then please, teach me!)

(Ok, just read the bit about university only taking checks, that makes sense. But nothing medical? Car-related? Do you pay for a lot of groceries in cash/have a prepaid CSA for the full growing season that covers most of your bill? That would explain a lot. Sorry.)

We have nothing medical or car-related that we’re confident we’re going to pay in the next 3 months. Certainly something could come up and that’s why we have the targeted savings (although we just got our car repaired last month so the likelihood of taking it in again is low), but I’d rather find a 3-month period when I know that we’re going to have things like that come up than this next three months, even though now is when the rewards would be most helpful. We might have an optometrist expense, though, now that you mentioned it – Kyle might want to use a voucher before our insurance turns over – I’ll ask him if that’s the case and how much he would spend. I doubt it will get us up to $3k but sometimes that stuff is expensive!

No, we anticipate spending $1000 on groceries – just not on a credit card. We do most of our shopping now at Costco, ALDI, and the farmer’s market and we have to use debit or cash (or Amex, but that doesn’t help either). Sorry that wasn’t clear!

The gas is going on our Chase Freedom card because we get 5% back right now. Even if we put it on the Sapphire card though, that’s only about $400 or so including our road trip later in the summer.

Ah, I see. I think I originally thought “spending eligible for this credit card” meant ALL spending and I was amazed! Sounds like the new card wouldn’t be too useful right now, yeah.

(I’ve never started a new card for rewards, just out of laziness and liking to keep things simple…is there one you’d recommend most for doing that, or not worth it in general?)

We started slowly into the rewards game 5 years ago and I think it’s smart to make slow changes, like you said, to keep things simple. It’s been useful to have 2 rewards cards as they have different benefits and so far it’s not been difficult to keep straight which card is best for a certain purchase. We (and I’m sure you) don’t spend enough to make really big money from the rewards, so that’s why we stick with cashback instead of miles or other benefits since we can redeem them in little dribbles without losing value. The signup bonuses are really motivating as we might only get a couple hundred dollars in rewards over the course of a year, so the signup bonus is just as valuable.

We really like the Chase Freedom card, and I’d say any card from a retailer that you spend a lot of money at would be worth checking out. Our BP card was great for several years as the most convenient stations to where we live and work are BPs and they are very common in NC. We have also considered getting the Costco Amex card, but didn’t follow through because so much of our grocery spending shifted to ALDI, which doesn’t accept any credit cards. So yeah, just look at the retailers you already use or the really good general rewards cards (like you can see in some of the links at the beginning of the post). For you guys maybe miles would hold sway over cash back?

Good job doing the math and analysis to see if this card was worthwhile for you. To get those extra bonuses you usually do have to try to put a lot of your expenses on that card, that is unless you just happen to spend a lot in general.

By the way, I recommend you sign up for one of the many credit card affiliate networks for posts like this. You might as well give yourself the chance to get some commission while providing advertising for Chase. E-mail me if you need recommendations there.

Thanks for the suggestion! You’re right that this is basically free advertising for Chase. I’ll ask my business manager (aka Kyle) to chat with you about how to get started with that.

Sounds like a good call. I was amazed that you only spend $1400 in three months! Then I realized you aren’t counting like the essentials, a place to sleep and a place to eat. That makes much more sense, though it is still impressive!

Kathleen @ Frugal Portland recently posted..Jumping in

Well, that’s how much we expect to put on a credit card. There is plenty of other spending that we have to use debit or checks for, and there’s a lot else that we can’t anticipate. I don’t want to get into a situation where I feel pressured to spend to get up to the $3k minimum as the period is drawing to a close.

I signed up for the Chase Slate recently and feel it is a great card. I received $250 after I made my first purchase and I’m receiving 0% interest on balance transfers for 18 months.

JW @ AllThingsFinance recently posted..The State of Social Security – Midweek Infographic

Hm, good tip! I’ll check it out.

I’m having trouble finding recent reviews of the card or a mention of the magnitude of signup bonus you referenced. Do you have some links?

With the way we budget I could figure out how much we would spend over the next few months fairly easily. I’ve been extremely enticed with the Sapphire card’s offer but I’ve held out. It would fit really well with some of the expenses associated with my business but I’m not convinced I’d use it for our every-day lives.

Jason recently posted..Being Cheap or Frugal – 12 Signs You’ve Gone Too Far

Will you not be suckered in with sign-up bonuses? I don’t think we’ll use it in everyday life, either. You don’t have any ccs now right?

Very wise to do some homework on this! I have 100% signed up for many credit cards just to take advantage of their offer or big promotion. The credit cards are no dummies and they protect themselves with these $3000 barriers knowing that you might not get there. Even though $625 sounds like a great bargain, you’re probably better off sticking to the lower entry cards with the revolving rewards.

My Money Design recently posted..Overcoming Envy – Why Do We Hate Other People’s Success?

Do you space out your credit card applications at all – are you concerned about the hits to your credit score?

We got a Chase Sapphire Preferred for the sign-up bonus because we were getting ready to plan and pay for our vacation in February. Otherwise, we wouldn’t have hit the $3000 spending…not even close!!!

[email protected] recently posted..Household Luxuries I Can’t Live Without

I’m glad to know the strategy worked for someone! Have you used the card at all after the first 3 months?

Well, we just got it about a month ago. We put our vacation on it which was $2700 then we bought the rest of our groceries on it for the month. Once we reached the $3000, we haven’t used it since but that was only a few weeks ago.

The other reason that we got it was because it has no foreign transaction fees and our February vacation is out of the country. We also plan to cancel it before we have to pay the annual fee in June of 2013.

(We don’t usually take vacations this expensive. This is definitely a splurge!)

[email protected] recently posted..Household Luxuries I Can’t Live Without

Oh, I thought you meant last February. We don’t plan vacations that far in advance! Putting $2700 on that card is perfect!

Our trip in September is also out of the country so we wanted that benefit as well. I’ll have to check our other cards to see if any of them offer the no foreign transaction fee perk.

No, I meant this upcoming February. I always plan way in advance. I don’t know why. So, yes. Using the card was perfect for us!

There are other no fee credit cards that don’t have foreign transaction fees. I can’t think of which ones they are right now but I know there were several when I was looking!!!

[…] presents Why We’re Not Getting the Chase Sapphire Preferred Card Even Though It’s a Great Deal posted at Evolving Personal […]

[…] Why We’re Not Getting the Chase Sapphire Card Even Though It’s a Great Deal was featured in the Festival of Frugality. […]

[…] Why We’re Not Getting the Chase Sapphire Card Even Though It’s a Great Deal was featured in the Yakezie Carnival. […]

[…] Why We’re Not Getting the Chase Sapphire Preferred Card Even Though It’s a Great Deal […]

[…] perk hole in our current set of cards in advance of our trip to Canada in a couple weeks. After my analysis of whether or not we should get the Chase Sapphire Preferred card, we ultimately decided to get a no-fee cash rewards card with a low minimum to get the (small) […]

[…] few months Kyle and I consider adding a credit card to our collection to further optimize our rewards. Most of the time we decide not […]