Should You Count Your Employer’s Contribution into Your Retirement Savings Percentage?

The question of whether or not to count an employer’s match or contribution into your own savings percentage is a perennial PF debate – but I swear I have a new twist! (At least, it’s new to me. I have never read this advice anywhere, but it’s so simple that I’m sure I can’t be the first to suggest it.) I had this brain wave while reading a Money Under 30 post on how to split savings between retirement and other goals.

The question of whether or not to count an employer’s match or contribution into your own savings percentage is a perennial PF debate – but I swear I have a new twist! (At least, it’s new to me. I have never read this advice anywhere, but it’s so simple that I’m sure I can’t be the first to suggest it.) I had this brain wave while reading a Money Under 30 post on how to split savings between retirement and other goals.

With the downfall of the pension system in the US and the rise of 401(k)s, virtually everyone needs guidance as to how much to save for the future. A quick rule of thumb that’s been proffered by PF gurus is somewhere between 10 and 15%, depending on age and assets. But many employees enjoy the benefit of 401(k) matches or contributions directly from their employers, which clouds the answer to the question of how much the individual should save.

On the conservative side, some argue that an individual should still contribute what he would without the employer contribution and just consider any money from the employer as gravy. After all, you can’t control your employer and it may decide to stop the contribution, as many have during the past few years, and then you would have to scramble to increase your contribution back to the target percentage. The unaccounted employer contribution could even able you to retire earlier than you planned without you even having to sweat it.

But perhaps it’s not realistic for everyone to just ignore that match – it is inaccurate, after all, to pretend it’s not there for your long-term planning. Maybe a person wants to save 10%, is saving 8%, and doesn’t want to squeeze his budget for the extra 2% when his employer is contributing 4%. I think that’s a reasonable position.

As I don’t have access to a 401(k) and have never been offered a retirement contribution from my employer, I’m not entirely sure what I would do. I’d like to think I would take the conservative position of saving at my target percentage no matter what my employer does, However, I can envision life stages when we will want to devote as much money as we can to some mid-term savings goals and will cut back our retirement contributions to the minimum we consider necessary.

Taking this into consideration, I have a recommendation for those who decide to include the employer contribution in her own personal savings rate: Increase what you consider your gross income to include the match!

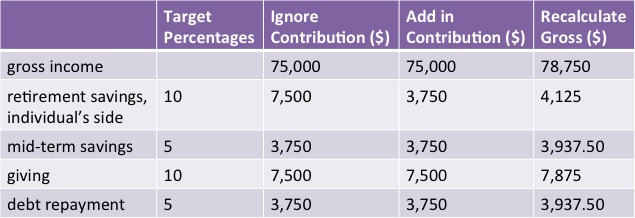

I think this is a good compromise position, especially if you follow a percentage-based budget plan like the Balanced Money Formula or just your own personal equation. If your employer contributes 5% to your 401(k), reset the gross income you use to calculate the percentages to 105% of what it was (or less, if your household has multiple income sources). After all, you are receiving straight up money (though it’s not flexible) from your employer so it is part of your overall compensation package. If you changed employers to one that you didn’t offer a retirement contribution, wouldn’t you negotiate for a higher salary to offset that benefit?

Following this strategy means that the other budget categories you use percentages to guide will shift, even though your taxes won’t for a traditional 401(k). If you give a certain percentage of your income, you will need to increase your giving slightly, and same for percentage-based savings goals, if you have them. On the plus side, your expense percentages will decrease a bit.

Here is an example of a person being paid $75,000/year who has a 5% employer match available and follows some other percentage-based budgeting guidelines and what dollar amounts would go in each category depending on how she treats the employer retirement contribution.

The downside to implementing this strategy is that if your employer cuts its side of the retirement contribution, it is a pay cut in your percentage-based reality and not just on paper. If you are determined to stick to your retirement savings target percentages you will have to cut the rest of your budget. But I think this is the most true-to-life way to handle a employer contribution (though the conservative position is still attractive).

The next logical step is whether to incorporate other employer benefits into what you consider your gross income – ones that you would have to pay for if your employer chose to cut the benefit or you lost your job. Health insurance would be the next major one to consider, given the cost of COBRA and health insurance from the private market, but perhaps there are others like free food, an on-campus gym, or housing. I won’t go so far as to suggest that everyone who receives benefits do this, but it is something to think about. It’s considerably more difficult to calculate the monetary value of those kinds of benefits than to add in an employer retirement contribution.

Do you count your employer’s contribution into your retirement savings percentage or do you ignore it? Does anyone include benefits into their gross income for their personal budgeting? What do you think of this suggestion and how do you think it would play out when the benefits or employer changes?

photo from Free Digital Photos

Filed under: retirement · Tags: employer match, percentage-based budgeting, retirement contribution

Reaching Our First Retirement Savings Milestone

Reaching Our First Retirement Savings Milestone Why You Should Save for Retirement While In Graduate School Part 2

Why You Should Save for Retirement While In Graduate School Part 2 Why You Should Save for Retirement While In Graduate School Part 1

Why You Should Save for Retirement While In Graduate School Part 1 Can a Net Income Boost Compensate for Not Having Earned Income?

Can a Net Income Boost Compensate for Not Having Earned Income?

We ignore it in terms of our savings rate, only recognizing it as part of our ROI.

Mrs. Pop @ Planting Our Pennies recently posted..He Said She Said: What We Love

Hm, that is a good way to put it. We don’t calculate our ROI as of now, though I suppose Vanguard gives it to us automatically.

In Australia employers take 10% of your money and throw it into a retirement fund for you. It is a bit annoying to those of us that know how to manage their finances, but with so many people who have no idea what they are doing I can see why they implemented such a system.

Glen @ Monster Piggy Bank recently posted..January 2013 Goal Review

Would you save at that rate for retirement if it was optional? Or would the financially responsible thing, for you, be to save at different rates depending on your other goals? I think I would save 10% no matter what the circumstances so I wouldn’t mind.

Great idea. We ignore our matches which is uber conservative. One of us even gets a large match which makes it tempting to count it. However it is unlikely that this match of 12% would follow to another job so right now we just save a lot- which is a good thing!

NoTrustFund recently posted..Interview: Reader Laurie

If I were getting a match now I think I would just ignore it and save a lot like you are. But in later life stages when we have other mid-term goals I would probably want to count it in some fashion. 12% is awesome!

My employer requires me to invest 10% towards my retirement in order to receive a 7% match.

I am fully vested so once the money is in my account, it’s mine. it goes into my net worth calculations.

SavvyFinancialLatina recently posted..I Went on A Shopping Spree Last Week

That is a sweet match and a high overall savings rate! Are you satisfied with saving 10% or would you save more without the match?

I would just ignore it, it is money on top but you can change company and have a different, lower match, that will make is harder for you to compensate, had you accounted for it as part of your plan.

Pauline recently posted..Little house in Guatemala, week 14-15

But in that case I would negotiate for an even higher salary since that is an effective pay cut so why switch jobs? Unless you are open to the pay cut, in which case the budget has to change anyway.

Well, we don’t even look at our gross for budgeting purposes. We look strictly at the net. After all, we are never going to see the gross amount.

The options in my wife’s 401(k) are so horrible that the company match probably has about the same affect of not having a match but better investments. Seriously, 2011 was the first year since the start of the recession where it actually gained value above the contributions.

Edward Antrobus recently posted..Meet the 2013 $3K Challengers

My point wasn’t to differentiate regarding taxes – if it’s a traditional 401(k) contribution it’s a boost to gross or net. If you use percentage-based budgeting off your net, you can still make the adjustments I talked about. Personally we do percentages off our gross.

Those sounds like terrible investments! Is it the funds they have available or the fees that take such a terrible bite? At least they do have the match available since their returns are so terrible. I hope you guys are maxing out your IRAs before contributing above the match (or even before it!).

I brought up gross vs. net because not all deductions are going to be percentages. If my wife got a 2% raise, our health insurance premiums would not rise by 2%. Actually, that’s why I wouldn’t use percentage-based budgeting. The majority of our expenses, both pre- and post-tax are fixed.

The funds available are just worthless. For a while, the best performing option in it was cash. We currently aren’t maxing out my IRA nor are we contributing to the full match as dept repayment is a higher priority for us at this point.

Edward Antrobus recently posted..Scrambled Egg Melt: Recipe Sunday

Sure, that’s why we only use percentage-based budgeting for certain categories that are pretty flexible, whereas it would be a guide in other areas (like housing) only as a cap.

Well at least you have some guaranteed returns from your debt payment so you don’t have to feel too bad about the funds in the 401(k).

I just ignore the match. It is not a guarantee, so I don’t think about it.

Grayson @ Debt Roundup recently posted..The Best No Annual Fee Credit Cards of 2013

Very conservative but I’m sure that attitude will serve you well in retirement!

This may be a perennial debate but it’s the first I’ve heard of it. I personally don’t think in terms of percentage as much as I think in terms of actual dollars. My goal is to be able to retire in the next 10-15 years, and that means having a certain amount of money saved up.

That said, my point is in our position we’re focused on saving a certain dollar amount rather than a specific percentage, so while aware of the percentage numbers we don’t really consider where exactly they are coming from. Your point about just considering the match as an addition to your gross pay is a great one and is more the way I tend to look at it. If the match weren’t 100% vested right away though I would just consider it a bonus.

Regarding health insurance, the amount provided by my company is in excess of what we would buy otherwise, so I don’t consider it part of my total compensation. If I were no longer employed I wouldn’t be spending as much as the company does on my health insurance. So for budgeting/early retirement purposes I consider what I would actually spend on health insurance as the income I would need to replace, not what the company is spending.

David W recently posted..A Closer Look at Cash Value vs Term Life Insurance

I suppose you are a step or two more advanced in retirement planning than the audience I wrote this post for. I was thinking of someone who wants to follow some kind of plan but isn’t close enough yet to retirement to have a dollar figure in mind. Did you dollar figure involve calculations based on a percentage of your current income at any stage?

Definitely I agree that not being vested should mean that the match/contribution is ignored. I honestly didn’t think about that point!

Good point that some benefits might not be ones that you would pay for on your own, or not at that price.

The dollar figure we have in mind isn’t specifically based on a percentage, rather it’s the amount that we’ll need to produce our same level of income through returns/dividends and be self-sustaining.

Since we are living on about 50% of our income, we can figure that we’ll need to generate a minimum of that amount from investments in order to be able to retire. That said, it’s more complicated since our income needs will go up once we have kids or move, etc, but that’s the basic idea.

David W recently posted..A Closer Look at Cash Value vs Term Life Insurance

I’ve tended to ignore it in the past, but not all the time. I think another thing to consider is how often the employer is putting their match in. If it’s with each paycheck then you can count on it (to a certain extent) and it’s there. However, some companies are moving to where they only put in the match every year/quarter. That makes it much more likely that it’ll fluctuate and thus making it more important to not include it.

John S @ Frugal Rules recently posted..Reader Question: How Do I Prepare My Son Financially For Law School?

Good point about the frequency, but I suppose it depends on when you choose to contribute for each year as well. If you like to contribute as early as possible you may want to ignore what your employer plans to do, and same if you contribute with each paycheck but they don’t. But if you are saving at the end of the year (or in the next year until April) you should already know what your employer has done.

I don’t have an employer’s match program but I sure wish I did. Would making saving for retirement a bit easier.

So if you had a match you would count it toward your target savings rate?

I don’t think there is a magic number for retirement savings. It isn’t like if you save 15% with or without the match you get into a special club at retirement. The answer is really save as much as you can. People who have more at retirement have a lot more choices and can take greater risks, thereby getting bigger returns and having better lives. If you have only $1M at retirement, you would be stuck accepting the lousy 1% CD rates ($10,000 per year) because you could not afford the risk of investing in stocks. If you had $10M, you could, and therefore you would have gotten over $1M returns in 2009, 2010, and 2012 (about $200,000 in 2011). People also tend to spend up to the amount of their free cash, so it is very difficult to increase personal savings when an employer stops contributing, so ignoring the match is probably best.

SmallIvy recently posted..If the National Debt Were the Obama’s Debt, and the Obamas Were Fiscal Adults

I’m afraid that for the average person what you say is probably true, but based on the comments on this post so far it seems that many readers are far from average! I don’t want to tell myself to save as much as I can because I would sacrifice too much “now” in favor of later and we would never buy a house.

Interesting point about how having a different amount of assets might cause you to invest differently… I tend to think it would be the opposite though, that people with lower amount of assets would be riskier to try for that higher return, while those with higher assets wouldn’t need to generate more so they can invest conservatively.

By “as much as you can” I’m not saying 20% of your pay or something into retirement, but if you can contribute 15% and you boss is contributing 5%, I wouldn’t cut back to 10%. Unfortunately we’re all putting away 13% already into Social Security which we’ll probably never see and we’d live in great poverty at current returns even if it did last another 50 years.

I would take far more risks if I only had $10,000 when I was twenty than I would if I had $100,000. That’s because I’d have a salary to fall back on if things went south with the $10,000. When you’re 70, though, and you no longer have a job (and it would be difficult to find someone to hire you after being out of the job market for a few years), it’s a different matter. You can only risk what you can afford to lose and still be able to eat for the next 20 years. The less you have, the more certain your returns would need to be, and therefore the less return you could get.

SmallIvy recently posted..Being the 1%

I don’t have an employer match anymore, but when I did I didn’t count it in my savings projections. I treat it as a bonus to my savings rate in the name of keeping my projections on the conservative side.

The First Million is the Hardest recently posted..Investing Experts and the Herd Mentality

Did you stay with the same company and they dropped the match or did you switch companies? If you switched, did you ask for a higher salary because you knew you were losing the matching benefit?

As Glen mentioned above, in Australia our “super” (superannuation) gets set aside prior to our getting paid. (I work for the government so super is calculated as additional to my salary, which makes no real difference but does makes it much easier to accept – I know for a lot of people working for private industry, they get told “we’re offering you $100,000k!” and it’s not until they start in the role that they realise that it includes super, meaning they actually only get paid $90,000. Not that that’s to be sniffed at, just that I wanted to use nice big numbers to make it easy with the maths!).

Personally, because official retirement savings (super) can’t be accessed until a certain age, I don’t count it in my savings rate. When I save for my future, I want that money to be accessible whenever I need/want it, whether that’s at 40 if I retire young or 70 if I keep working until then.

Sophie recently posted..What’s for dinner? Broccoli!

Yes, good point about tying up money for the long term vs. having it more liquid. Are you pushing for early retirement?

At this stage, I love my job and I can’t see wanting to quit while crazy-young (i.e. under 40). But I don’t think I want to work until 65 either.

I guess my philosophy is that if you save and invest, you’re set for the future no matter what you decide to do – financial independence gives you options, of which retirement is one good option, but only one. You can decide what you want at 40 when you get to about 39, but whatever it is, it’ll be made possible by the way you save at 25. Or at least that’s my theory 🙂

Sophie recently posted..What’s for dinner? Broccoli!

I like your theory! Personally I think I would rather have some sabbatical periods rather than leaving the work force forever, but that will take serious saving outside of our retirement accounts, which we aren’t doing now.

I always thought the recommended % included employer match (at least the financial planners we have talked to included them in the recommendation). I don’t have an employer to match, when I did I didn’t consider that as part of our contribution. I always thought of it as a bonus. A nice one at that (I miss the contribution now, even though it was something I never thought about while I worked). My husband’s company now has a 2.5% match, but their investment choices are horrible. I figured we will take the match for one year and do the math to see if it is worth continuing to put some money in 401k or just forget about it entirely and go with IRA.

Suba recently posted..Is Costco membership worth it? A field trip report on buying in bulk

So you went against your financial planner’s advice to save even more?

Sorry to hear about the bad options in your husband’s 401(k). Is there any way to petition for better ones – especially now that the fees have to be disclosed?

Yeah we did save a lot more than he recommended. He also could get around the fact that we didn’t have any debt. He kept insisting that the best approach for personal finance is to pay off high interest debt first and then save for retirement. I think he didn’t really believe us. Oh well. We have asked for better ones but the company is too cheap to actually give us any real benefits. The insurance is another hell hole.

Suba recently posted..Companies, Cupid and Cost of being average

He didn’t believe you when you said you didn’t have debt? Do people really outright lie to their financial advisors?? I would think it a waste of time/money if an advisor kept talking about debt we didn’t have!

I actually work all the numbers off my total gross compensation, which includes 401(k) matching, employer health insurance costs, and so forth. Thus, 401(k) matching is part of income, but goes directly into savings, and health insurance paid by my employer counts as income, but also counts as a health insurance expense. I make sure that I have awareness of smaller expenses like company paid life insurance, but I don’t actually put those into the budget just to save work.

There’s certainly no one best way to do this, and so I understand why most people start with net income. It’s certainly a lot simpler. Also, my current employer is the first one I’ve ever had that was transparent about the health care costs, so not everyone is even in a position to track this accurately.

The bottom line is that I wanted to be aware of exactly what my employer is currently providing because if I stopped working or got a different job, this is what I would be losing and would have to come up with through other means.

S. B. recently posted..Year-End Note

Glad to hear from someone who actually implements this idea! It does make it much easier that your employer is transparent about the health care costs – I certainly don’t know what kind of premiums my employer is paying on my behalf.

I count the contributions but only in the total sum of my portfolio, not in the amount I’m contributing.

I, like SB, also have line items for these auto-debits in my monthly budget–I account for health benefits, etc. as an “expense.”

The Happy Homeowner recently posted..I Quit the 9-5…Forever

How did you get your employer to let you know what they were paying for your benefits?

I take advantage of it, but genuinely try to pretend it doesn’t exist when considering retirement savings percentages. A big reason is that this match might not be sustainable, in that it could be taken away. Best to save independent of it, but still take advantage of it.

TTMK recently posted..What to Do If You Don’t Like Your Engagement Ring

I’m sure that position will serve you well!

[…] from Save Invest Give actually implements my idea of including employer benefits (like retirement matches) into gross compensation for budgeting purposes. I’m including the whole comment here because it’s so […]

[…] having your family’s world turned upside down. 5. Emily @ Evolving Personal Finance writes Should You Count Your Employer’s Contribution into Your Retirement Savings Percentage? – If you get an employer match to your 401(k), do you count it toward your target savings […]

[…] @ Evolving Personal Finance writes Should You Count Your Employer’s Contribution into Your Retirement Savings Percentage? – If you get an employer match to your 401(k), do you count it toward your target savings […]

[…] Should You Count Your Employer’s Contribution into Your Retirement Savings Percentage? […]

[…] Should You Count Your Employer’s Contribution into Your Retirement Savings Percentage? was featured in the Carnival of Retirement (Editor’s Pick) and the Carnival of MoneyPros. […]

My conservative side is to treat it as “gravy.” You cannot go wrong with thinking about it in this way.

STEVEN J. FROMM, ATTORNEY, LL.M. (TAXATION) recently posted..Estate Planning 2013: Now What? A Must Read For Everyone

Well, I guess the wrong would be that you’re not enjoying spending money that you might… but I’m more concerned about undersaving than oversaving!

[…] Fresh Perspective on Employer Retirement Matches Emily presents Should You Count Your Employer’s Contribution into Your Retirement Savings Percentage? posted at Evolving Personal Finance. “If you get an employer match to your 401(k), do you count […]

[…] Fresh Perspective on Employer Retirement MatchesEmily presents Should You Count Your Employer’s Contribution into Your Retirement Savings Percentage? posted atEvolving Personal Finance.“If you get an employer match to your 401(k), do you count it […]

[…] Should You Count Your Employer’s Contribution into Your Retirement Savings Percentage? was featured in the Wealth Management Carnival #12. […]

[…] that might be reason to reduce the amount you’re contributing. It’s part of your gross compensation package, after […]

[…] Should You Count Your Employer’s Contribution into Your … – 53 Responses to "Should You Count Your Employer’s Contribution into Your Retirement Savings Percentage?" […]