Evolving Personal Finance » targeted savings

Do I Want a Camera or Subjects?

I’m “that person” in my group of friends – the one who always has a camera out, taking awkward candid photos. I estimate that I have tens of thousands of photos that I’ve taken with my two Canon point-and-shoots over the past 7 or 8 years. (But for all the flak my friends give me about annoyingly documenting everything, they frequently tell me how much they appreciate my efforts and several times have asked for … Read entire article »

Filed under: choices, spending, targeted savings

Pulling Back the Veil on Our Daily Money Management

I thought it would be helpful for some to get really into the nitty-gritty of how we manage our money on a daily (or at least monthly) basis. It’s simple to say “we have joint accounts” or “we use Mint” but what does that really mean? (You can reference a copy of our current budget if you like.) Start with a Clean Slate On the first of the month the only money in our checking accounts is … Read entire article »

Filed under: budgeting, credit cards, found money, side income, spending, targeted savings

Attend Weddings But Don’t Go into Debt

Wedding season is upon us! I love marriage and I love attending weddings to spend time with and support our friends and family. That’s why I initially felt sympathy for Christopher Sledzik, the face that CNN put on its recent article on the rising cost of wedding attendance and the pressure friends and family feel to attend. Like Sledzik, we are also 27 and in the last three years have devoted all our vacation time … Read entire article »

Filed under: choices, credit cards, debt, marriage, savings, targeted savings, travel

When Did We Acquire All This Cash?

When Kyle and I arrived home from our honeymoon in June 2010, our non-property net worth consisted of: our Roth IRAs around $16,500 in savings accounts/CDs a bit in checking the money we received as wedding gifts $16,000 in student loans We had just spent between $10,000 and $20,000 on our rings, our honeymoon, and our portion of the wedding expenses. We felt like we were starting from zero, in cash anyway. That summer we put in CDs the amount of … Read entire article »

Filed under: personal, targeted savings

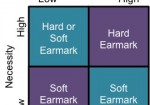

Hard and Soft Earmarks in Targeted Savings

I have come to another stage of reflection regarding our targeted savings accounts. When we first set them up right after we got married, they were a great way to plan for irregular expenses and to motivate us to defer spending. More recently, I’ve realized that as our next year is so uncertain, the role of our targeted savings accounts may become diminished. As I’ve thought through what money we might be willing to shift … Read entire article »

Filed under: targeted savings

Irregular Income: Gravy Edition

Kyle has been working at an extra position around 10 hours per month for a few months now, so we have had some time to adjust to having this additional income stream. He wasn’t looking for more income, but rather volunteered for a position (that we later found out was paid) so that he could learn a new skill. While I still stand by the method of handling irregular income I outlined earlier, that strategy … Read entire article »

Filed under: income, targeted savings

The Benefits of Targeted Savings Accounts – and Their Uncertain Future

Boy, am I grateful for our targeted savings accounts this month! We have spent a crazy amount of money this month, some of it unexpectedly. This month we have used our targeted savings accounts to purchase our Christmas flights ($625.20), six months of car insurance ($405.47), and other miscellaneous items ($149.85). All of that was planned and budgeted for so even though it was a lot of money it wasn’t stressful at all. Actually, we have … Read entire article »

Filed under: targeted savings

Winter 2012 Travel Plans

Last night Kyle and I booked our Christmas flights! Against my wishes, we have fallen into an every-other-year visitation pattern with our parents regarding Christmas, and this is a California year. I’ve been checking prices for about six weeks and the prices were far higher than I expected. I always strive to buy cross-country flights for around $400 but they were around $550-600. Finally last night we were able to score flights for under $400 by … Read entire article »

Filed under: targeted savings, travel

Toeing into the E in EPF

I thought I’d take this Friday post to update you all on the random money goings-on around the EPF household. We are gearing up for our first financial transition, moving from the apartment Kyle’s lived in for 5 years (and I for 2 years) to a townhouse that’s both cheaper and closer to school and church. In addition we’ve had some other small bumps in the road and changes and are looking forward to some … Read entire article »

Filed under: budgeting, credit cards, targeted savings, transitions, travel

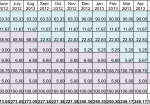

Targeted Savings Account Calculation: Cars through Aug2013

This weekend I re-projected the amount of money we need to save monthly into our Cars targeted savings account. I’d like to share my method with you so that you can see as an example how we decide how much to save into each savings account. The Cars account is a good one for this exercise because the payments we make out of it are very well-defined (unlike Travel or Appearance) but they’re shifting a … Read entire article »

Filed under: budgeting, cars, targeted savings