Evolving Personal Finance » taxes

How to Enter 1099-MISC Fellowship Income into TaxACT

This post is the second in this series on how to convince tax software to accept grad student fellowship income – last week was TurboTax, this week is TaxACT. I’ll refer you to sections of that post so I don’t have to repeat the information but you also don’t miss it. Please read two words of caution regarding my qualifications (none) and the wisdom of using tax software to begin with. Also, please again ignore the … Read entire article »

Filed under: grad school, taxes

How to Enter 1099-MISC Fellowship Income into TurboTax

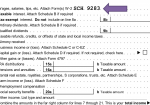

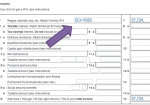

Update February 2017: I have updated and expanded this post into an entire section of Grad Student Finances. Read the entire 2016 grad student tax guide, jump to the step-by-step instructions for entering grad student income of various types into TurboTax, or go directly to the equivalent of this post on entering 1099-MISC fellowship income into TurboTax. This post is a step-by-step guide to show you how you can enter 1099-MISC box 3 income and withholdings that … Read entire article »

Filed under: grad school, taxes

Why Don’t More People Do Their Own Taxes?

First, I need to get this out of the way: I don’t consider using tax software to be “doing your own taxes.” I hear that kind of language all the time, but I disagree with it. When you use tax software, you are not using your brain and you don’t gain any understanding of how income taxes are calculated or why. I have observed that very few people I know prepare their own tax returns, despite … Read entire article »

Filed under: grad school, taxes

Financial Tweaks for Our New Year

Kyle and I have been so busy with work in the past few months that we have really left our money management on autopilot. I haven’t even played with spending scenarios recently, as I love to do! But even without me looking for issues to tweak, three areas of our budget have popped up with some needed updates. Take-Home Pay Increase We noticed that the take-home pay we received at the end of in January was slightly … Read entire article »

Filed under: budgeting, food, savings, spending, targeted savings, taxes

Oops, We Need to File an Estimated Tax Payment This Month

When I wrote about how to have a financially successful first month of graduate school back in August, I added to my editorial calendar for this January a post on how to file estimated tax payments. I thought that would be perfect timing for those first-year grad students to consider filing estimated taxes on the fellowship money they’d received in their first semester, if they didn’t set up withholding. I never considered at that time that … Read entire article »

Filed under: taxes

How to Calculate and File Estimated Tax Payments

If you are being paid but aren’t having any money withheld for income taxes, you may need to pay estimated tax quarterly. If you don’t know what those are or how to do them, read on! Grad students, please pay special attention. You have to pay income tax on your stipend if it doesn’t go toward qualified educational expenses (your rent does not count). If you do not have withholding set up, you will likely … Read entire article »

Filed under: grad school, taxes

Financially Surviving Your First Month as a PhD Student

First month’s rent up front plus a security deposit. A parking permit. Textbooks. Furnishing your new place. In the first few weeks of grad school you’re hit by one expense after another. On top of that, your department expects you to start orientation (followed by classes and research) five to six weeks before getting your first paycheck! How are you supposed to swing this? The best position to be in at the time you enter grad … Read entire article »

Filed under: budgeting, credit cards, food, frugality, grad school, housing, income, spending, taxes

Would Someone Date You After Seeing Your Taxes?

The inspiration for today’s post came from a very random place. I recently added a new podcast that answers listener questions, usually about relationships. One question was whether it is appropriate to ask someone out on a date in her place of work (like your waitress at a restaurant, for example). The hosts tried to think of various service relationships that come up in everyday life and how the customer might go about asking out … Read entire article »

Our Experiences Using Tax Software

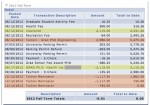

A week ago I filled you in on why Kyle and I haven’t yet filed our taxes – we aren’t sure what our gross income truly is! Now that we’re getting down to the wire on the deadline for filing our taxes we need to make a decision and get through the math of figuring out how much tax we owe for 2012. Like other years, we will likely use free online tax software and … Read entire article »

Filed under: taxes

Disagreement Over Grad Student Health Insurance Taxes

If you want to read an updated version of this post, see Grad Student Tax Lie #6: You don’t have to pay tax on the scholarship that pays your health insurance premium on Personal Finance for PhDs. Kyle and I haven’t filed our taxes yet this year – perhaps because of laziness/procrastination but chiefly because we haven’t yet agreed on our reportable income! The “income” under question is the money used for our health insurance. One … Read entire article »

Filed under: grad school, taxes