How Often Do You Adjust Your Budget?

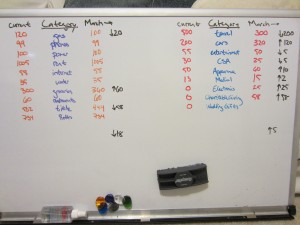

Kyle and I have to do a massive budget overhaul for next month. We need major edits in groceries, tithe, cars, and travel and minor edits in several other categories. Of course there are always more needs/wants than take-home pay so we have to make some tough decisions.

I realized this is the first big edit we’ve done in quite some time though. Every few months we’ll adjust a category or two by a small amount, like less than 15%. I try not to change the budget every month but rather arrange it so we have extra money left at the end of the period even with seasonal drift of certain expenses.

It got me wondering how often other people tweak their budgets. Our situation is fairly static, but we do a big edit about once per year and some small adjustments every few months. What about you? Leave an answer in the poll and/or explain in the comments.

Filed under: budgeting, participation · Tags: budget, editing, frequency, overhaul, tweaking

Consistent Grocery Budget Fail

Consistent Grocery Budget Fail Poll: Budgets Are a Tool, After All – How Do You Use Yours?

Poll: Budgets Are a Tool, After All – How Do You Use Yours? Emergency Budget Exercise

Emergency Budget Exercise How Do You Decide What to Spend on a Wedding Gift?

How Do You Decide What to Spend on a Wedding Gift?

Overall, we never adjust our daily living budget – BUT we do have the occasional month where we go way over budget due to an exceptional circumstance (i.e. a big purchase or vacation). We make sure to get right back on track though the following month.

How do you handle going way over? Pull from savings, EF, checking account balance…? And then how do you repay where you pull it from without changing your budget?

I voted “few times per year” but in reality, we don’t have a budget. Not in the traditional sense. Insted, we project our cash flow out about six months at a time. As expenses are paid, we delete them off the spreadsheet, and adjust balances for unexpected payments or to compensate for a different sized paycheck.

Ah I see. I guess it’s a budget but stretched out longer than most. Why do you use the six-month period and are they overlapping or non-overlapping (i.e. Jan-June/July-Dec or always the next six)?

Since this will be our 1st year with a written budget, I’m going to try not to adjust it for the year, I’m hoping to come pretty close to even for the entire budget (so if groceries are over I’ll pull from dining-out, etc)

Good idea. It’s difficult to write a budget without tracking spending for a while but you learn as you go.

Emily, I just saw that we posted on the same topic! Great minds think alike. 🙂

I set our annual budget in January and recently reviewed it as some items came up related to education, retirement, and travel. I think I will check in on our budget every quarter, and calculate our net worth every six months.

For me, it’s finding that balance between being accountable and being obsessive. And, of course, working toward our financial goals!

Good idea to be proactive/scheduled in your reviews. We tend to wait until the budget shows itself to be misaligned with our needs.

Emily – we haven’t made too many changes to our budget in the last couple of years. It seems our biggest changes occur around major life events (moves, new jobs, etc). Also, we aren’t nearly as tight on our budget these days because we’ve done a good job of keeping our spending in check after we got out of debt.

It’s nice that you don’t need to keep such a tight budget now. Re-evaluating with life events definitely makes sense and it’s great that you can go for stretches between them. I’m rather afraid that tight budgeting is an ingrained part of my personality and I’ll be doing it long after we have need to.

I look at it every month but mainly because I find it fun, not because many things change. Little things will change month to month but not enough for me to actually sit down and try to see where the extra $5 I saved should go. If I have extra money in my bank account after paying all my bills, however much I think I can comfortably save goes straight into savings.

I like taking whatever we have left over in checking at the end of the month and putting it into (secondary) savings too. Generally we make it a fun savings account like for Travel or Electronics. Unfortunately that hasn’t occurred the last few months – hence the overhaul!

I’d put myself in the multiple times per year category. If I had the time and inclination, I would micromanage expenses and budgeting quite a bit. Alas, I just don’t have the time to do so. A few times a year it is, which is probably for the best for me:)

I’m a micromanager too. I should probably fill my time up with some other things because I’m spending too much on cash flow management!