My Biggest Financial Mistake and Why I’m Glad I Made It

March 14th, 2012 | 35 Comments

You’re going to think I’m really dumb when you read this. You might even want to take away my PF blogger card. My mistake was a doozy. I’ll just say that I made it several years ago when I was just figuring out my finances and I was a lot less involved than I am now. And Kyle wasn’t around to catch the mistake.

Summer 2007. I had just graduated from college and started my first full-time job. I read Get a Financial Life by Beth Kobliner and some other personal finance books and decided that I need to start a Roth IRA and contribute $200/month (10% of my income) to it. Because I had no money to invest up front, I had to find a company that would let me open an account with no minimum balance and a low monthly contribution. I settled on Fidelity and opened my account. (Note: I do not blame Fidelity at all for what happened. This was my own error entirely.)

I set up an auto-withdrawal for my contributions and kind of stopped thinking about it. Every few months I would grab the month-end balances from my account. During the next year I was busy applying to grad school, converting to Christianity, working on my relationship with Kyle, moving out of my parents’ house… I thought I had the retirement stuff on set-and-forget.

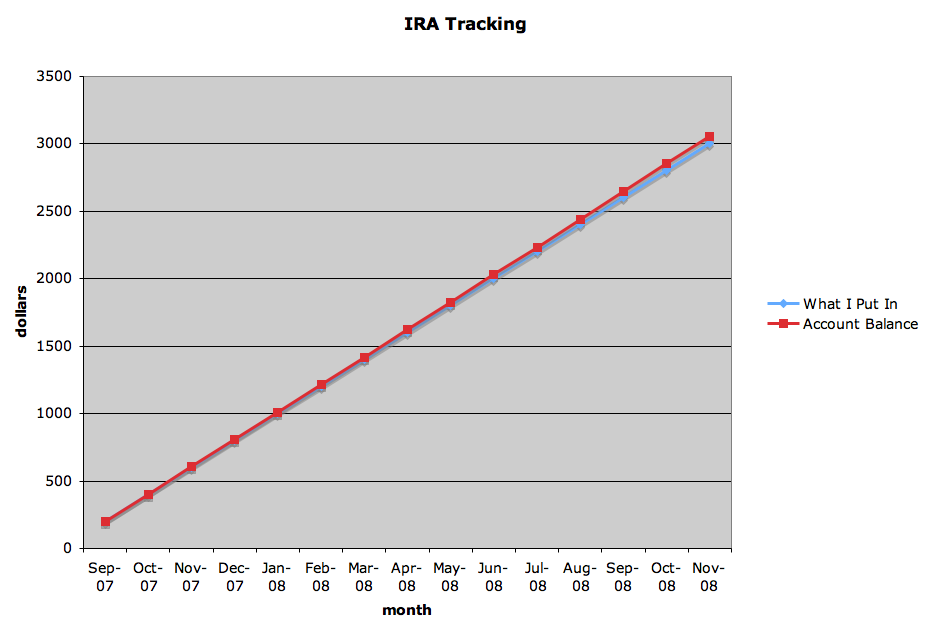

Fast-forward to my first semester in grad school in the fall of 2008. I had been hearing a lot about the stock market and economy tanking and yet my little Excel spreadsheet showed that my IRA account balance had stayed on a linear increase, just barely ahead of what I had invested. I wondered on my personal blog why I hadn’t lost money with everyone else.

Anyone catch my mistake? Anyone? I HAD “INVESTED” MY IRA IN CASH. The only thing I’ll say to my credit in this whole situation was that I did figure out myself what I had done – no one pointed it out to me.

Because I discovered this mistake over a year after I made it, I really can’t say what I was thinking when I set up the account. Apparently I didn’t realize that I hadn’t actually indicated a mutual fund to buy shares of. Because I was unfamiliar with the fluctuations of the market and I was only looking at my balances every few months (upon PF book advice) it took me quite a while to realize something was wrong. If the economic downturn hadn’t been so extreme and penetrated my grad school bubble, who knows how long this could have gone on for.

I finally corrected my mistake in January 2009. You can see in my chart above that I had just crossed a $3000 balance, which meant that I had enough money to meet the Vanguard IRA minimums. I was so embarrassed by my lack of knowledge/common sense/observation skills at Fidelity that I wanted to get away from the company entirely! In January 2009 I put my $3000 in a Roth IRA at Vanguard that invested in the 2050 Target Date Retirement Fund and set up my auto-withdrawals to go there. That’s where my IRA has been ever since.

Why am I glad I made this heinous error of keeping my IRA in cash for over a year? Because of the year that it happened. When I finally got into the market it was very near its absolute trough for this period. I lost money in my first two months with Vanguard and have had mostly gaining-months since then (except last summer, of course!). My quick estimate how much money I didn’t lose by staying out during September 2007 – December 2008 is in the neighborhood of a quarter of my the ending balance.

Moral of the story: Pay attention to what funds you’re in and (non-obsessively) keep an eye on the balances in comparison with how the market generally is doing, assuming you’re largely in stocks. If you wonder about anything, investigate!

Have you made any really huge financial errors when you probably should have know better? Have you found any silver linings?

Filed under: featured, investing, mistakes, retirement, stock market · Tags: cash, embarrassment, errors, ignorance, IRAs

35 Responses to "My Biggest Financial Mistake and Why I’m Glad I Made It"

Leave a Reply Cancel reply

Recent Comments

- Adam on Home Equity Is Funny Money

"Hi Emily - I just stumbled upon your blog. Great post! Up in Canada this is a…" - Emily on Home Equity Is Funny Money

"I agree that an appraisal is the best number to work with. I can't think of why …" - JL on Home Equity Is Funny Money

"I only note it as round numbers, in $50k or $100k estimates. I also usually upda…" - We Maxed Out All Our Retirement Accounts for the First Time! - Evolving Personal Finance | Evolving Personal Finance on Avoiding an Expensive 401(k) Plan through Self-Employment

"[…] was the first year that we contributed to Kyle’s expensive 401(k…" - Business Goal Tracking for Week 8 of 2022 - Evolving Personal Finance | Evolving Personal Finance on Business Goal Tracking for Week 6 of 2022

"[…] Done as of two weeks ago! […]…"

Archives

Categories

Popular

- How to Price a Room for Rent 130.4k views

- Who Has Seen You Financially Nude? 62k views

- Earned Income: The Bane of the Graduate Student’s Roth IRA 54.3k views

- Why I Took Out a Car Loan for More Than the Purchase Price of the Car 42.5k views

- Average Clothes Spending and Pattern 35k views

My Sister’s Awesome Financial Decisions

My Sister’s Awesome Financial Decisions Trying Hard to Not Time the Market

Trying Hard to Not Time the Market Reader Question: Where to Open an IRA?

Reader Question: Where to Open an IRA? Reaching Our First Retirement Savings Milestone

Reaching Our First Retirement Savings Milestone

LOL. As soon as I looked at the graph I knew you were invested in a CD or cash.

Rookie mistake but a lot of people make it. At least you’re not in a CD/cash because you’re scared of the market.

It ended up working out well for you though (being able to accidentally time it in get in when the market was at its bottom).

2050 Target Fund, huh? Only 40 more years to retirement! Cheers! 🙂

Really, a lot of people do this? Really??

That’s true, this was a mistake, not an investing philosophy. I cringe when I hear about people cashing out because of the downturn – just in time to miss the upturn.

Well, 40 years until we’ll access this money. I rather hope I won’t be working full-time that entire time. We’ll see.

Thanks for sharing that Emily, that’s a real good story. But stop being so humble, you knew the market was about to crash in 2008 and recover in 2009 so that’s the real reason you put your money in cash, didn’t you? 😉

Emily – I wish we had made the same mistake! When we graduated in 2007, we did the same thing – maxed out 2 Roth IRAs in aggressive target date funds (Vanguard) and we all know how that worked out for us! At the time, I was so proud of our financial independence and initiative! Good thing our retirement dates are WAY off!

I still think you should be proud of that step even though the timing was poor (but out of your control). Did you max out in 2007 or DCA your way in through 2007 and 2008? Definitely DCAing on the way down lessens the pain.

Hmm. That’s not even that big of a mistake! At least it didn’t cost you your principal, right? But I guess it cost you a lot of potential interest. I think mistakes are important.

That’s not bad since you didn’t really lose any money! I’m just starting to contribute to my Roth IRA and I still am not really sure what all this means in terms of investing. I need like a roth-ira-for-dummies book.

Hahahaha… that “mistake” turned out to be a good one for you! To be honest, I purposely use an approach like that with my IRA. My contributions go to a cash account within the IRA and then once a year or so I take the lump fund and allocate it to some investment based on my financial adviser’s advice.

I think the important part here is that you put the money into the Roth IRA before you didn’t have access to that contribution room anymore. Plus, this way, you got the money over to Vanguard 🙂

Vanguard was my ultimate goal and I had planned to transfer the IRA anyway when I got to $3k, but I just had even more motivation because I failed so hard at Fidelity.

Well at least it worked out to be a mistake that saved you a lot of money!

One good thing of sharing your mistake is everyone else becomes cognizant and tries to not make that mistake, thanks for sharing. A mistake always makes you wiser.

Our biggest mistake was talking ourselves into getting the 12 months same as cash for our kitchen remodel. Why did we think we’d have MORE money after having a baby? We were stupid and it ended up costing us about $3500 in fees, plus we’re still in debt…so who knows how much it’s actually costing us.

Wow, that is a big one. Keep on your plan and you’ll be out in good time!

Sounds like it was probably a “lucky” mistake. I’d guess it’s a mistake that happens far more then people admit to, so don’t feel silly. At least you caught the mistake and fixed it. And you were just trying to make sound financial decisions for your future, I bet a lot of people retiring in 2050 haven’t even started saving yet!

I agree – better to do something kinda wrong than not do anything at all! I’d feel that way even if I had lost money.

[…] My Biggest Financial Mistake and Why I’m Glad I Made It at Evolving Personal Finance […]

I think we call that a “blessing in disguise.” 🙂

At least you corrected it in time for the market gains. I moved my account to cash when things started to fall, but then didn’t put it back in until after 2009, when things had started to climb. That was my mistake.

Yeah, that’s why I don’t bother trying to time the market. I think I read somewhere that, in most years, if you miss the top 10 single gaining days, you’ve missed out on nearly all of the year’s gains. Would you take your money out again?

[…] Evolving PF – My Biggest Financial Mistake and Why I am Glad I Made It […]

[…] from Work Save Live assured me that my biggest financial mistake was a “Rookie mistake but a lot of people make it. At least you’re not in a CD/cash because […]

[…] […]

Best Mistake Ever!!! I have made many mistakes with my investments. My most common mistake is letting my emotions take over when trading. Thats how we learn. I wish my mistake helped save me like yours did :-/

Paul @ Make Money Make Cents recently posted..I Just Won The Foreign Lottery!

I wouldn’t trust myself to trade, only partially because of emotions. But if you have the skills and have learned to control your emotions, more power to you.

[…] with $0 at the end of grad school I’ll be happy for the lessons we’re learning. For instance, I made an enormous mistake with my retirement accounts right when I started out, and you can bet your britches I’ll never be […]

[…] Personal Finance writes My Biggest Financial Mistake and Why I’m Glad I Made It – I thought I had the retirement stuff on set-and-forget, so why was my IRA balance increasing […]

No need to be embarassed, I did the same thing at the same time. After everything dropped I moved from the money market account into mutual funds and avoided losing a bunch of money.

Glad to know I’m not alone!

[…] Evolving Personal Finance wrote My Biggest Financial Mistake and Why I’m Glad I Made It […]

[…] You don’t have to make the absolute best decision about which institution to invest through or which fund to choose from the get-go, so please don’t let paralysis of analysis (if that affects you – it does us!) keep you from opening an IRA and starting to save into it. Starting is more important than being perfect from the beginning! […]

fool, everyone knows the stock market always goes up and up and never corrects itself !!!!

Haha, for a long-term investor those fluctuations should be weather-able if you are properly diversified! If the future looks like the past, more or less.

[…] didn’t do everything correctly from the get-go. I invested in cash, I didn’t have an emergency fund, and I took out a car loan. But I was started, you know? My […]

[…] Further Reading: My Biggest Financial Mistake and Why I’m Glad I Made It […]

[…] had an inauspicious start with investing when I first opened and funded my Roth IRA. I didn’t actually purchase the investment I intended […]