The Benefits of Targeted Savings Accounts – and Their Uncertain Future

Boy, am I grateful for our targeted savings accounts this month! We have spent a crazy amount of money this month, some of it unexpectedly.

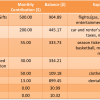

This month we have used our targeted savings accounts to purchase our Christmas flights ($625.20), six months of car insurance ($405.47), and other miscellaneous items ($149.85). All of that was planned and budgeted for so even though it was a lot of money it wasn’t stressful at all. Actually, we have also been expecting to spend even more as Kyle may buy a smartphone at any point (as soon as he picks one!), which will be a few hundred dollars out of pocket.

Then, last Saturday, our car – our only driveable car – failed its yearly safety inspection. Two of our tires needed to be replaced within the next 60 days.

Then, last Saturday, our car – our only driveable car – failed its yearly safety inspection. Two of our tires needed to be replaced within the next 60 days.

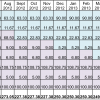

Thankfully, we did have a bit of notice on this. Before we drove to Chicago last July we got the car looked at and were told that two of the tires would need to be replaced within the next year. Kyle said he was tired of buying only two tires at a time, though, and we decided that we would replace all four by June 2013. We increased our savings rate to our Cars savings account to prepare for that eventuality. So even though we now have to replace the tires earlier than we wanted to, we were forewarned and were able to save up part of the money needed.

With the tires, alignment, and inspection fees costing $552.75, we are up to $1,733.27 coming out of our targeted savings accounts in just three weeks – over 40% of our net monthly income! There is no way we could have cash flowed all the auto work, insurance, and our Christmas flights in the same month, let alone consider purchasing a smartphone, if we weren’t putting away some money aside every month for irregular expenses. In that sense, I’m still completely in love with our targeted savings accounts.

However, it is becoming more and more difficult to employ the short-term targeted savings account strategy because of the impending uncertainty in our lives. Once we crossed the one-year-until-expected-graduation mark for Kyle, the expenses that we would have one year out started fuzzing out. For instance, for the last several years we’ve bought season tickets to the Broadway musical series at our local theater, but with Kyle probably leaving town it’s doubtful that we would be able to commit to such a series. However, that doesn’t necessarily mean our Entertainment costs will go to zero in place of that series.

I think this looming uncertainty make divvying up our savings into all these various pots a little silly. I think that Cars, Appearance, Medical, and Charitable Giving will be stable, and the volatility I see could be fairly easily adjusted for on the fly. But I can’t really say how Travel, Entertainment, CSA, and Electronics will change or even trade off with one another, and Travel and Entertainment often require large purchases that take months to save for, so being myopic is not an option. It’s worth it to consider getting rid of these individual silos since we can’t predict expenses in them well anyway, and just keep saving at the same rate to our general/nest egg savings account.

My conclusion is that short-term targeted savings has worked very well for us while our lives have been stable and expenses were regular and predictable, and I often recommend this type of strategy. But now that our future expenses are more difficult to predict, the artificial barriers we’ve put around various pots of money may start to work against us as large, harder-to-predict expenses start cropping up. I have also gained confidence in our ability to save our budget leftovers instead of blowing them on treating ourselves, so we may not need the motivation of many empty, named pots now to motivate us to save like we used to when we were less disciplined.

The possibility of dismantling some of these accounts is definitely something we’ll discuss in our budget meeting this month!

Have you changed budgeting strategies during your life (aside from none to something)? How do you save through times of transition? How far out do you try to predict your irregular expenses?

photo from Free Digital Photos

Filed under: targeted savings · Tags: car repairs, general savings, irregular expenses, large expenses, targeted savings

Targeted Savings Accounts and Funemployment for the One-Car Win!

Targeted Savings Accounts and Funemployment for the One-Car Win! Our Short-Term Savings Accounts

Our Short-Term Savings Accounts Hard and Soft Earmarks in Targeted Savings

Hard and Soft Earmarks in Targeted Savings Targeted Savings Account Calculation: Cars through Aug2013

Targeted Savings Account Calculation: Cars through Aug2013

Have you considered saving the same amount of money each month into ONE account and then tracking in a spreadsheet instead? That would make the funds a bit more fluid between goals.

My budgeting strategy back in college was keep $200 in checking (for ATMs) and everything else in savings, put everything on the credit card, pay off the credit card before the due date, and we’re good! Yup, that was my entire budget. I had more than enough in savings to cover all my expenses at all times, so that worked great. I eventually kept a small amount of savings locally and the rest at ING.

In the last few years, I’ve adjusted savings strategies quite a bit. I’ve realized that I can cash flow quite a bit as my income grew, to the point that it’s more valuable to pay down the mortgage aggressively than to set aside $250/month for eight years to replace my two year old car. I could easily save the money to pay cash for a car or a wedding within 6-12 months, so I’m not longer worried about big purchases. I still do budget for more “normal” cash flow though and it works fine. So I do predict my next laptop or iPod or cell phone, but I’m not saving for my next car or a wedding. Not sure how that makes sense, but it seems to work for me, for now at least.

Leigh recently posted..Winter Commute Options

That’s the alternative strategy we might switch to – a smaller number of targeted accounts and a much higher savings rate to our general savings account.

Having that high savings rate so that you can be nimble and accomplish goals quickly is very nice. You don’t need to see terribly far in advance like you said, so for the time being the mortgage can be the primary recipient of savings.

I’ve only ever used one targeted savings account. That was an account we opened to save for a down payment on our home. Now that we have something, the money we put in there is being set aside for home repairs and improvement.

Aside from that, we’ve always just lumped our extra money together in a general savings account. Then as expenses come up, the money comes out.

Edward Antrobus recently posted..The Pros and Cons of No-Contract Cell Phone Plans

Do you try to predict those irregular expenses? How do you decide how much to save?

I don’t make saving a specific goal. My wife’s paycheck pays for all of our regular expenses these days. I have $100 each week that comes out of my paycheck to pay my debts, and the rest goes into savings.

Edward Antrobus recently posted..The Pros and Cons of No-Contract Cell Phone Plans

We do things a lot differently than we used to. For instance, we used to have a lot of seperate budget categories. Over the last few years, I have lumped most of our spending into our grocery category. This is mostly because I dont have the time like I used to to go through and seperate things out. Now things like toilet paper, medicine, etc. are all grocery. It makes things easier for us and it’s a lot less work. Plus, now that we are more disciplined we do pretty good at staying on track without a lot of help.

Holly@ClubThrifty recently posted..This Is What I’m Thankful For…

So you have observed the same pattern – lots of buckets and restrictions help when you are less disciplined, but with experience they become less useful. I don’t separate our personal care from our grocery spending either, any longer.

[…] @ Evolving Personal Finance writes The Benefits of Targeted Savings Accounts – and Their Uncertain Future – Our targeted savings accounts have saved our necks this month with lots of planned and […]

I used to know where every penny went and when every bill would be due. We had a lot fewer expenses and a lot less money in those days. Now we just have one big slush fund for emergencies and one-time annual expenses and I don’t pay attention to anything. I did set the dates of those one-time expenses to hit at reasonable times (half of them hit in the summer and half in the winter) and we have two reckonings, one after taxes in April and one in October when we get our first paycheck of the academic year. These are both shortly after those annual expenses hit. Excess money gets directed at those points.

This coming year our income will be reduced so I’m bulking up that emergency fund. But I still probably won’t pay much attention.

nicoleandmaggie recently posted..Fred: Ghost or gremlin? And an origin story.

Yep, that’s where we are – few expenses and not a lot of money! But it sounds like we may move toward your current system.

[…] The Benefits of Targeted Savings Accounts – and Their Uncertain Future was featured in the Carnival of Money Pros. […]

I am definitely in the opposite category — I have savings, period. Not much, since I’d really like to decrease the number of debts I’m paying, but enough to handle some irregular expenses.

Kathleen @ Frugal Portland recently posted..Awesome Portland thing: Willamette Week’s Give Guide!

I think that makes sense because you are trying to aggressively pay down debt – if necessary, you could pay less in a given month if money was needed elsewhere.

[…] The Benefits of Targeted Savings Accounts – And Their Uncertain Future was featured in the Carnival of MoneyPros. […]

[…] We had so many expenses for our car this month! We paid six months of car insurance for $405.47. We spent $30 on our yearly registration and $29.75 to get our car inspected – it failed, so we paid $523.00 for new tires and an alignment. […]

[…] 1/3 of the month. Sticking to our discretionary budget was nearly a lost cause and not even our targeted savings accounts could save us completely! Zeroing-out-wise, it turns out that you can’t spend $460.34 on cell […]

[…] Get rid of most of our short-term targeted savings accounts (since our spending will no longer be predictable) in favor of 1) a line item for “whatever” in our monthly budget and 2) two savings accounts, […]

[…] us to defer spending. More recently, I’ve realized that as our next year is so uncertain, the role of our targeted savings accounts may become diminished. As I’ve thought through what money we might be willing to shift around, it has occurred to me […]

[…] Check out our budget! It is a reflection of our values and goals. I’m also completely enamored with our targeted savings accounts (well, not so much any more). […]

[…] we are considering eliminating most of our targeted savings accounts in favor of having one more general savings account. The targeted savings accounts have been […]

[…] for the last few years, which we laid the basis for shortly after we were married. I have trumpeted its benefits in many blog posts over the years and think it worked very well for us for those years, though it […]

[…] away quite a bit of our income. Before we sort of obscured our actual spending by using our targeted savings accounts to smooth irregular […]

[…] The Benefits of Targeted Savings Accounts – and Their Uncertain Future […]