June 2013 Month in Review: Money

We did an excellent job sticking to our budget this month! We came in under budget in every single category! Plus we had a big-spending month from our targeted savings, so months like these really validate why we have those accounts in place. We paid for much of our July 4 trip to Madison, WI as well as a quick drive up to northern Virginia.

The Everyday Budget

Top-line items

INCOME: Our paychecks from our university plus

- $172.40 from Kyle’s side hustle, divided as usual

- our state tax refund of $218.12, which went into our Taxes savings account

GIVING: Our usual 10%+ to our church plus $50 to the missionary we support plus 10% of Kyle’s side hustle income.

SAVINGS: What we always put to our Roth IRAs, 17%-ish, plus 15% of Kyle’s side hustle income.

Non-discretionary spending

Rent: $895.

Internet: $39.24

Cell phones: $70.03 for Kyle’s phone; due to credits to my Republic Wireless account, we didn’t pay anything for my cell this month!

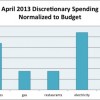

Discretionary spending

Look at us – under in every category! I can’t remember the last time that happened.

Groceries: Woohoo, we met our budget this month – even though we had an extra trip to CVS and we filled up the propane tank for our new grill. It’s so rare that we accomplish this. I can’t say what we did differently, though, aside from not having any guests over!

Gas: Two fillups this month as usual with plenty left over for next month. 🙂

Restaurants: We had a lot of random meals this month – not of high value. We ate on the drive up and drive back on our trip to northern Virginia at the beginning of the month. Kyle also went out for dinner with some coworkers. Since we had so much of this budget left over at the end of the month, we went out to dinner all by ourselves last Saturday night – an unusual treat!

Electricity and Gas: We’re under! We are keeping the house at 79°F all the time.

Water: Safely under here.

Every month we have a few transactions that do not fall under either our budget or our targeted savings.

- We bought a shower curtain liner and an area rug for the house. We used a gift card to offset part of the cost so we paid $7.88 out of pocket.

- Our student loan CD matured this month, giving $65.40 in interest. We are keeping that in the CD to roll into the next period.

Spending Out of Targeted Savings

This was a big spending month for our targeted savings accounts! We spend $1346.69 out of these accounts and added $384.23 to them above our normal savings rates.

Travel and Personal Gifts

We reimbursed ourselves $60.04 from this account for gas for our drive to northern Virginia. We also booked our flight and hotel for our trip to Madison in early July for $842.76. We added $76.46 from the discretionary part of Kyle’s side hustle paycheck.

CSA

We made four $12 transfers into this account, one for each week we picked up our box.

Cars

We paid our renter’s insurance for the year at $139.00.

Entertainment

no spending this month

Appearance

We spent $107.47 on shoes (one pair for each of us) and $49.42 on clothes for Kyle.

Medical

no spending this month

Electronics

We moved $50 to our Nest Egg account to repay ourselves for our smartphones. We also moved in the $50 Kyle received as a gift from his PI for publishing a review paper.

Charitable Giving

We gave $100 to one of our local homeless shelters.

Nest Egg

This account received $50 from our Electronics account to repay ourselves for our smartphones.

Taxes

We added $218.12 from our state tax refund and $39.65 from Kyle’s side hustle paycheck.

Budget Adjustments

We started a new savings account this month for a nice camera! All our budget leftovers are now directed to this account as well as the discretionary portions of our extra income.

Bottom line: We came out $153.78 ahead this month! Look what happens when we actually stick to our budget! That money is going into our camera savings account. 🙂

At what temperature are you keeping your home for the summer (while you’re at home) and how is your energy spending going? When is the last time you met your budget in every category and how successful did you feel?

Filed under: month in review · Tags: budget, camera, travel

May 2013 Month in Review: Money

May 2013 Month in Review: Money July 2013 Month in Review: Money

July 2013 Month in Review: Money February 2013 Month in Review: Money

February 2013 Month in Review: Money April 2013 Month in Review: Money

April 2013 Month in Review: Money

Great month! We try to keep our AC off most of the time during the day even when it’s hot and humid, so the goal is just to use it from 9pm-5am (it’s on a timer) at 75. It makes a big difference for how well we sleep.

Mrs. Pop @ Planting Our Pennies recently posted..Why We’re Hoping For a Net-Worth Drop (And You Probably Should Be Too!)

If it’s too hot in our house I don’t have much trouble getting to sleep but I have a lot of trouble waking up!

Great job this month Emily! You are right when you stick to the budget some times you actually come out better than you initially planned. Groceries hurt us last month do to the extra mouths to feed. I think going forward we will have this under better control for the month I just have to stay on top of it until it becomes apart of habit. Need to find more meals that are larger and cost effective for 4 adults at this point.

Thomas | Your Daily Finance recently posted..Paying For College with Federal Student Loans

Did you have some friends or family move in with you? I’m sure you will be able to cut down on the cost of food per person if you change a few things up, but there’s no way to get around it costing more overall.

Under in every category! I don’t think we’ve ever accomplished that. Nice work.

We have some targeted savings accounts for travel, home improvements, etc. and I never know how to classify them on a monthly basis. Is it savings, since it goes into a savings account, or spending because I know it’s going to be spent later?

Done by Forty recently posted..Being Frugal with Time

It’s somewhat easier right now for us to get under in every category because it seems we have a few categories that we never exceed (gas, water)! We are considering re-adjusting our budget so that these limits better reflect what we actually spend.

My house temperature fluctuates depending on the time of day, but it is on a program. We raise it at night because we use our window A/C unit to just keep our room cold. We have a hard time sleeping when it is hot.

Grayson @ Debt Roundup recently posted..Why is Prepaid Such a Dirty Word?

We own a programmable thermostat but we have actually never installed it!

Good job! We keep our house around 73 degrees when we are home and 75 when we are not home. We have a French Bulldog with a bad nose, so if it gets stuffy or too hot then he can’t breathe (he has actually had seizures before).

Luckily, it has been a VERY cool summer here so far, and our electric bill is much lower than usual.

Michelle recently posted..Make Extra Money – Offline Side Hustles

Man, pets expenses can crop up where you never expect! The heat has been tempered recently by a lot of rain so I don’t think our A/C is having to work too hard to keep the house at 78F.

We keep the thermostat at 80 most of the time, but I’ve been known to knock it down to 75 for a couple hours when I get home from work. But a programmable thermostat wouldn’t help us, because there is somebody home and probably awake here pretty much 24/7. Maybe 3-5am everyone is usually asleep.

Edward Antrobus recently posted..My Day in Small Claims Court

Having different schedules would definitely make reducing energy expenditures difficult.

We usually only have to use the AC in July and August for about 4-5 hours in the afternoons, and it’s usually around 78. It’s always good to come in under budget!

Kim@Eyesonthedollar recently posted..Eyes on the Dollar 20/20 Roundup #42- Home and Gone Again

I’m not sure how often our A/C actually kicks in… Not often while we’re actually at home but at least it’s not crazy hot when we get home.

I don’t have A/C, so my electric bill is usually way cheaper in the summer months than the winter. I can’t wait for the one at the end of this month to see how cheap I got it! 🙂 I keep the place at around 67-70 F while I’m home in the winter and with no A/C in the summer it can be anywhere between 75 to 90 F inside. Hence the ceiling fan that I had installed back in May 🙂

I’m not sure when I last hit my budget in all categories. I’d just started to get the hang of it while my ex and I were dating and now my social spending is all over the place again. I haven’t managed to send ANY money to the mortgage from zeroing out my checking account in a few months now 🙁 Maybe July will be the magic month?

Leigh recently posted..June 2013 net worth update (+1.4%)

Ceiling fans are clutch – Kyle can’t live without them. He grew up without A/C as well. But they don’t get rid of humidity!

Yeah, it can take some time to re-adjust the budget after life changes. Does your variable spending mean you’re going out more and having fun though? Sounds like you might want to cut some other areas to free up more for that?

Definitely having more fun and I’m not spending more than $100/month more than before, so not really all that bad overall.

Leigh recently posted..Ting from Sprint: 5 Months In

[…] @ Evolving Personal Finance writes June 2013 Month in Review: Money – When you meet your budget, good things […]

[…] June 2013 Month in Review: Money was featured in the Yakezie Carnival. […]

[…] I haven’t thought much yet about how we’ll use the bonus. I doubt we’ll take an extra trip – we’re way overdue for a summer vacation already. I’m sure we’ll do some traveling between now and next September to celebrate Kyle’s graduation. So we’ll be able to free up the $450 or so to add to a fun targeted savings account – the frontrunner right now being our DSLR fund! […]