Blog Statistics Update December 2013 – January 2014

I had hoped that this month would be the one I got ahead in my posts, and I did a little bit but now I’m right back to writing 0-3 days in advance! I have plenty of ideas for posts still but keep putting off the ones that require more research.

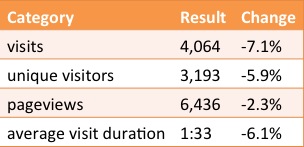

It’s disappointing that EPF’s traffic is lower than it was a year ago. Mostly I think that is from lost search engine traffic. I need to do some more guest posting and comment on some new blogs.

Analytics Data from December 16, 2013 to January 15, 2014

People who listen to us, as of January 15, 2014:

RSS subscribers: 159 (too many false fluctuations to bother recording change)

Twitter followers: 738 (+42)

Facebook fans: 50 (+4)

Rankings:

Alexa: 77,951 (+2,888)

Google PR: 3 (no change)

MozRanks: 5.05 (-0.04)

Some Google Analytics statistics:

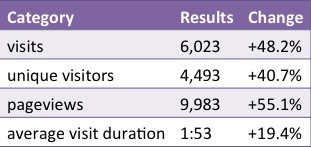

We got a big spike this month when The Simple Dollar linked to one of my posts. Thanks, Trent!

Popular Posts

This month, three of our top five most viewed posts are from this past month, which is pretty unusual! My post on reproduction got a lot of views and comments, as posts on that subject tend to do.

Most viewed posts:

2) What Do You Consider a Good Salary?

3) The Thinking Person’s Guide to Dave Ramsey: Realistic Wealth Building

4) Money and the Timing of Children

5) Earned Income: The Bane of the Graduate Student’s Roth IRA

Most Commented Posts:

Money and the Timing of Children (43)

Budgeting Is a Waste of Time (41)

Anchored in this Anomalous Economy (40)

When to Pass Up a Company Retirement Match (34)

How Do You Decide If You Can Afford a Purchase? (32)

Blog Balance Sheet

Income:

We got a weird unexpected payout in December that we weren’t expecting until January, which kind of bummed me out. I want to pay for FinCon14 with my 2014 income only, I decided, so we’re a bit further away with the earlier payment.

Adsense: $0

affiliate income: $125

Expenses:

Kyle wanted to try out some alternate hosting services, so we switched to paying Dreamhost monthly.

hosting: $8.65

Search Terms from Real People

“do grad stipend 401k” – No, they do not, at least not that I’ve ever heard. Grad students are either not employees or not real employees so they are not offered the same kinds of benefits as employees. I did hear that my university recently reinstated their 401(k) match for postdocs after suspending it during the recession, so you can look forward to that!

“how much savings going from 2 car to 1 car” – Not much, in our experience. Approximately $1,000 per year.

“courtesy letter instead of 1099” – At least at my university, a courtesy letter is sent to fellowship recipients who have not had any taxes withheld.

“my wife want me to spend less money from her personal account” – Wow, I’m not sure what’s going on with that statement. Why do you have separate accounts if you are able to spend from either? And why are you and your wife not in agreement about how your money should be spent?

“how can phd students wait 7 years to start saving for retirement” – You don’t have to. Even if you don’t have earned income, you can save in a taxable account and transfer the money into a 401(k) when you get a job with benefits. But even if you wait until after grad school to start saving, honestly you will still be ahead of most people.

We got a decent amount of searches for Republic Wireless this month, which is awesome. I received my new Moto X last week – y’all, it is a dream. I mean, I’m sure it’s comparable with the other smartphones released this year but it’s a big step up from the Defy XT. Kyle is so jealous of me. 🙂

- “republic wireless phone reviews 2013”

- “republic wireless reviews march 2013”

- “republic wireless phone reviews”

- “review republic wireless 2013”

- “republic wireless reviews 2013”

- “republic wireless reviews 2014”

How many blogs do you follow and regularly comment on (I have 81 in my reader and I regularly comment on about half)? What has worked for you to increase traffic?

Filed under: blogging, month in review · Tags: search traffic, traffic

Blog Statistics Update December 2012 – January 2013

Blog Statistics Update December 2012 – January 2013 Blog Statistics Update November – December 2013

Blog Statistics Update November – December 2013 Blog Update January – February 2014

Blog Update January – February 2014 Blog Statistics Update January – February 2013

Blog Statistics Update January – February 2013

I think I follow 50-60 blogs, most I get emails of the posts (like yours) and then comment on maybe 80% of them. The ones I don’t comment on, there’s a variety of reasons. Some content doesn’t warrant a response, some bloggers never reply, some have deleted my comments (if I disagree with them). I regularly cull the list if a blog no longer holds my interest.

I don’t (generally) comment with the view to more readers. I read more widely than the topics I write about. I don’t personally find much PF to write about – I have no debt, and I don’t live super frugally. So I think saying I saved more money each week would be boring! I am blogging more as a journal to myself, and accountability. I’m thankful for a suite of interested commenters, but am less worried about growing my readership than others. I also don’t monetise my blog, so that’s why growth is less of a concern.

If I was to be philosophical, I find growth (for growth’s sake) both unsustainable and distortive. I can’t endlessly become a bigger better blog, there’s limits, and I don’t want to be disappointed by a drop in readership. But I also don’t want to be a slave to my readers, only writing things I know will rank well in google, or get many comments. I want to write about what I want to – this isn’t my job, this is an outlet. Anyhow, just my thoughts!

SarahN recently posted..Things I achieved in 2013

I does irk me when bloggers don’t respond to (any) comments! But I still comment on some of those blogs.

I’m not very good about cultivating my feeds. I rarely add new ones and only delete defunct/uninteresting ones after many months.

I like PF as a niche because it can relate to anything, but we don’t fit with any of the major strains of PF blogger (get out of debt, retire early, lifestyle). I think that’s OK – I like it for the accountability and record, as you said.

I don’t care to tailor my writing to what Google wants, but I do want to serve my audience. I don’t think I would care about what the growth rate was as long as it is positive. Essentially, I want a larger community of commenters! I’ve seen more first-time commenters this week than I have in a while and that pleases me. Perhaps they came over from TSD, though that hasn’t happened following the previous links.

The monetization part is fun but we’re obviously not doing it in a serious way. It’s more to just see what we earn with ease through products we use and recommend.

Sorry to hear about the traffic drop Emily. I follow too many blogs, but only comment on a handful of them because I just don’t have the time anymore. I wish I did, but that was one thing I had to cut when I started getting more freelance work. I wish you luck with increasing income to pay for FinCon!

Grayson @ Debt Roundup recently posted..Manilla.com Review- Keeping Your Financial World Organized

I find commenting doesn’t take much more time than it does to read the posts in the first place. I think I’d rather be skimming more blogs, reading fewer posts in full, and commenting on more.

[…] Personal Finance writes Blog Statistics Update December 2013 – January 2014 – Traffic and earnings reports for the last […]

[…] insurance.) Our total income is slightly higher from Kyle’s tiny weekend almost-volunteer job, blog income, the occasional clinical study, and interest/dividend income – but not much. So there you have […]

[…] Blog Statistics Update December 2013 – January 2014 was featured in the Yakezie Carnival. […]

[…] this week and I do want to buy one (the base ticket) but I haven’t yet. We have had enough blog income so far in 2014 to pay the $200 conference fee, but I have to trust that there will be more to pay […]

Hey! I’ve just recently discovered your blog – I’m always on the lookout for other PF blogs to stalk! Question – I’m far away from ever generating income with my blog, but how do you track RSS followers (I use feedly personally, but I don’t know how another blogger can tell if I’m following him/her on Feedly rather than just clicking “follow this blog”)? I would love to make some side income with my blog eventually (but that wasn’t the point of starting it, of course), but I’ve heard people say you have to have a huge readership to make any money from Google AdSense or even affiliates (and I haven’t yet researched how using affiliates works).

Any advice you can give on those topics would be great! Happy blogging and PF’ing! 🙂 Also, I’m sure I could find this out by doing more research on your blog, but it looks like either you don’t already have student loans OR they are in deferment right now?

Mintly @ MintlyBlog recently posted..Personal Finance Spreadsheet Bliss

1) I use Feedburner, but the daily number shown fluctuates as it only reflects the number of your subscribers who have loaded their feed that day. I report these statistics on the same date of the month so it’s not always the same day of the week and there is a lot of fluctuation (50%, sometimes).

2) Yes, my understanding is that it takes lots of pageviews to make any money from Google Adsense (we’ve made $100 ever), but many bloggers are wary of depending on Google Adsense alone because your page rankings can be easily taken away by algorithm updates. We choose to make our income (small as it is) mostly from affiliate sales because they do not run awry of Google’s linking policies the way that other strategies do.

3) I switch my language on the debt issue so it’s a bit hard to tell! We have $16,000 of student loans, which are currently subsidized and deferred. We have the money to pay the debt off set aside in investment accounts. So technically we do have debt, but balance sheet-wise it’s neutralized. We’re waiting to pay it off just before graduation/it comes out of deferment to earn more money on the investments and as a mini insurance policy.

I think your system (of holding that debt while you have the funds to pay it off to make the money work for you) is a good one! I also know that it can be frustrating to know that the debt is still there even if you’re making a wiser financial decision (though I don’t know that you necessarily feel that way… it’s just something we’re going through right now, though in a different way).

Thanks for responding about the feed/subscriber issue & affiliate stuff. I’m enjoying your blog!

Mintly @ MintlyBlog recently posted..Debt Eradication (or: What We Did with Our Tax Refund!)

Nah, it doesn’t bother us. We like being leveraged, actually – well, who wouldn’t, with how the market did last year? And it is nice to know that if I die my husband will have the money we’ve saved for the payoff free and clear.

[…] Personal Finance writes Blog Statistics Update December 2013 – January 2014 – Traffic and earnings reports for the last […]