Evolving Personal Finance » Archive

October 2013 Month in Review: Money

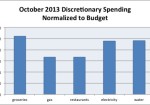

Our finances are almost settled after our move – we’re just waiting on a refund from TWC (isn’t it always TWC that screws you up?). We spent a loooooot of money though – I’ll post about it once everything gets shaken out – so we’re going to devote our budget leftovers toward repaying ourselves until that’s done. This has been a pretty quiet month for us in the regular budget but a big one in targeted … Read entire article »

Filed under: month in review

Talking to People Who Are Different from You about PF

Last week, I promoted one of my blog posts on my personal Facebook profile. (I know that’s crazy to anonymous PF bloggers, but I’m completely open about my blog IRL!) It was the review of the Barclaycard Arrival World MasterCard, and you can see I was pushing it a bit. (We just signed up for our second one last night! Woohoo!) I knew that some of my FB friends would see that and consider signing … Read entire article »

Filed under: credit cards, debt, family

Important But Uninteresting PF Topics

I have read broadly on personal finance so I have a passing familiarity with a bunch of subjects, yet here on EPF I stick to writing in the areas of budgeting, finances in marriage, frugality, grad student finances, etc. I don’t often write about debt because we’re not (really) in debt and don’t plan on getting into it again except for a mortgage. I don’t often write about insurance because, after reading the recommendations, I … Read entire article »

Filed under: investing

Favorite Posts, Mentions, and Top Comments Week of 20October2013

The big news this week was my guest post over at Get Rich Slowly last Sunday. I enjoyed the comments so much! Kyle and I even each got an internet coincidence out of it – GRS is really popular! 😉 Other than that, just tons of work this week. Kyle is writing feverishly and I’m putting in lots of hours in the lab preparing for an experiment with my collaborators. The only break in our routine was a dentist appointment, which went smoothly and our wallet is only $252 lighter. 🙂 Posts I Liked Jacob from iHeartBudgets impresses again with another plan for traveling for free – this one over four cities! Michelle from Making Sense of Cents and Diversified Finances is now officially self-employed and reflects on her first week. Gillian from Money After … Read entire article »

Filed under: weekly update

Carnival of Financial Camaraderie

This carnival is hosted every second week by My University Money and you can submit articles at Blogger Carnivals. BUDGETING Daniel @ Make Money Make Cents writes The Boom in Posh Pawnbrokers – If you watch any TV at all you have probably at least glanced at some of the myriad Pawn reality shows that have become so popular as of late. Cash poor but asset rich Americans are turning to pawn brokers for short-term loans, something that has been dubbed ‘high-class pawn brokering.’ Oscar @ Money is the Root writes The facts about Socially Responsible Investing – Socially responsible investors care more about the impact of their investments then the actual money that their investment will make. Jay @ Daily Fuel Economy Tip writes Your Fuel Economy Cheat Sheet – One of the … Read entire article »

Filed under: carnival

Stretch Goal: FinCon 2014!

I have absolutely devoured all the FinCon13 recap posts in my RSS reader this week! I know some of the writers think they are boring/tedious for their readers, but since I “know” so many of the participants it’s interesting to me to hear about them hanging out together. I am considering buying the Virtual Pass so I can at least learn from the presentations, although I know that the in-person networking is the more important … Read entire article »

Don’t Buy into the Pro- or Anti-Credit Card Hype

Last week’s FPU lesson was “Dumping Debt,” which was rather different from what I expected. Dave spent a lot of time talking about the disadvantages of various kinds of debt and not as much as I thought he would on the mechanics of the debt snowball. Of course, credit cards were pointed out as a particular evil, not just in the video but also reinforced by the class exercises. One exercise was to stand up … Read entire article »

Filed under: credit cards, debt

Welcome Get Rich Slowly Readers!

Today I have a guest post up on Get Rich Slowly. EPF readers, please check it out – this is the post in which I reveal our net worth! Get Rich Slowly readers, thanks so much for surfing over to check us out. If you want to hear more you can subscribe through RSS, follow us on Twitter, or fan us on Facebook. We have new content up every Monday, Wednesday, and Friday. It feels so strange to tell our whole story on another blog where I can’t link back to all the posts I’ve done on the individual components of it! I hope you came over to this post because you were interested in learning more about some aspect or another of our story, so I’ll use this post to … Read entire article »

Filed under: blogging

Favorite Posts, Mentions, and Top Comments Week of 13October2013

Another uneventful week for us – I’m still doing my normal activities and Kyle is still thesis-writing like a madman. I’m trying to get some work out to my collaborators but it hasn’t been going terribly well. The timing of this retreat that I’m on (I’m in Wilmington, NC!) wasn’t the greatest for that reason, but isn’t that always how it goes? I’m happy for the break in routine! I have a guest post up at Get Rich Slowly this morning – please check it out and leave me comments! Posts I Liked My Money Design shows graphically how to prepare for early retirement with savings, investments, and passive income. Robert from The College Investor retells in detail how he set up his will and trust. Michelle from Making Sense of Cents is considering long-term … Read entire article »

Filed under: weekly update

Eliminate Eating Out for Convenience with Batch Cooking

October 23rd, 2013 | 46 Comments

One of the main strategies I identify as a key to living well on less is eliminating eating out for convenience and limiting our food spending to groceries and restaurant spending for dates and group social events (and the occasional reward). Kyle and I both used to occasionally buy fast food at work, while driving from work to an evening activity, or when we were too hungry to take the time to cook. We also … Read entire article »

Filed under: food