Evolving Personal Finance » Archive

What Are You Gazelle Intense About?

This post was inspired by the recent Get Rich Slowly article on pushing vs. relaxing in personal finances. A “pushing” phase is when you are super intense about your finances and making sacrifices in other areas of your life, like relationships and health. Circumstances that should bring about pushing are living beyond your means, feeling a lot of stress about your finances, or when you are nearing default on a loan. Similarly, Dave Ramsey would … Read entire article »

Filed under: budgeting, debt, psychology, spending

You Should Spend More and Save Less (Especially Grad Students)

The same episode of Freakonomics that I wrote about last week contained another segment that I thought worthy of comment here (and actually there is one more!). Levitt told Dubner some advice that he received from an older faculty member when he was just starting out as a professor of economics: “You should spend more and save less. You’re never going to be poorer than you are today… Your salary would only go up and your … Read entire article »

Filed under: career, grad school, savings, spending

Favorite Posts, Mentions, and Top Comments Week of 6October2013

Nothing out of the ordinary to report this week. Just lots of work for me and lots of thesis-writing for Kyle. Oh, and I decided at the last second to attend a retreat with my church next weekend so that’s $110. I’ve said a zillion times recently that I need a vacation so this is a good holdover until Thanksgiving/Christmas/Kyle’s defense. Posts I Liked Congratulations to Eric on his engagement and Cat on her pregnancy! Cat from My Personal Finance Journey plans on renting for another decade. Pauline from Reach Financial Independence has a budget for people who hate budgets. Tonya from Budget and the Beach jumped on a great deal on a trip to Iceland. Mentions Jacob from iHeartBudgets listed The 3 to 6 Month Emergency Fund in his good reads. Carnivals Losing Half Our Buffer was featured in the Carnival … Read entire article »

Filed under: weekly update

Would You Live in Company Housing?

I saw an article this week that piqued my interest – Facebook is building an apartment complex close to its Menlo Park campus for its employees. The article and comments are highly critical of the idea, recalling the company towns of the nineteenth century. The author sarcastically asks, “Who isn’t sick of their healthy work/life balance?” Many of the commenters voiced that by living in a Facebook apartment, Facebook employees will be constantly monitored by … Read entire article »

Filed under: housing

What is the Purpose of an Emergency Fund?

In my last post on emergency funds, I looked at Dave Ramsey’s (and many others’) suggestion of an emergency fund size of three to six months of expenses and calculated what that would be for our current budget ($7,500 to $15,000). But at the end of the post I questioned whether a three to six month emergency fund is really appropriate for us. I am an overthinker, so I have trouble just accepting that we … Read entire article »

Filed under: emergency fund

Perfect Articulation of Plastic as Real Money for Young People

In episode of Freakonomics from 10/3/2013, Steve Levitt and Steve Dubner discussed a listener question that I thought was a perfect articulation of my opinion concerning the studies that show that people tend to spend more when using credit cards in comparison with cash. Steve Reta wrote: “This morning I was reading an article on how credit card spending is making us ‘irresponsible’ because it removes the ‘pain’ of paying with cold hard cash. I found … Read entire article »

Filed under: credit cards, psychology, spending

Favorite Posts, Mentions, and Top Comments Week of 29September2013

We are keeping our nose to the grindstones this week so there wasn’t much time for extracurriculars. A certain someone has started writing his dissertation and has a tight deadline so I’m being supportive/expressing solidarity by working at most of the same times he is (well, when those times are before midnight – that is my bedtime!). We have switched from attending church at 11:00 AM on Sundays to 4:00 PM on Saturdays – well, we’re trying to commit to the switch. It’s a little weird to change our weekend routine, but I’m happy to have the Sunday mornings free. Anyone else attend church on Saturdays? Oh! We spent $180 this week! On tickets to my 10-year high school reunion! I’m so excited! I got to see a bunch of my … Read entire article »

Filed under: weekly update

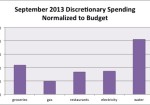

September 2013 Month in Review: Money

Our spending is completely out of whack this month with our move! We started our new lease on 9/17/2013 and ended the old one on 9/22/2013. I tried to pay all the direct moving expenses out of our nest egg and reimburse to that account as they come in. But we left off a few recurring maintenance things like changing light bulbs and air filters to the last minute, so we had higher non-budgeted spending … Read entire article »

Filed under: month in review

The 3 to 6 Month Emergency Fund

I can see why people find Dave Ramsey’s baby steps attractive, I really do. As someone who is prone to paralysis of analysis (and whose husband is even more prone), executing an instruction is so much easier than making an informed decision and then carrying it out. While watching week 1 of the FPU videos last week on “super saving,” my thoughts were on that 3-6 month emergency fund. We’ve had $1,000 set aside (baby step … Read entire article »

Filed under: emergency fund

Blog Statistics Update September – October 2013

October 18th, 2013 | 24 Comments

This was kind of a weird month. Traffic was way down, but comments were quite a bit higher than usual. I find the comments more personally fulfilling, but for general blog growth (and getting more commenters) I want traffic to increase. Alexa also dropped a lot (that’s the desired direction) but MozRank decreased a little (not the desired direction). Analytics Data from September 16 to October 15, 2013 People who listen to us, as of October 15, … Read entire article »

Filed under: blogging, month in review