Evolving Personal Finance » Archive

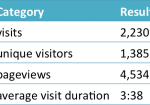

Blog Statistics Update April – May 2012

I’ve decided to start giving regular updates as to how the blog is growing. Because I’m doing monthly spending reviews on or just after the first of the month, these blog updates will be just after the 15th of each month for the second half of the previous month and the first half of the current month. Statistics are for over the last month or on May 15, 2012. I don’t have any goals for the … Read entire article »

Filed under: blogging, month in review

Taxes You Should Be Paying

I had a really strange thought a couple weeks ago – hear me out and tell me what you think! Have you ever considered paying yourself what you think you should be paying in taxes? Do You Think Taxes Will Increase in the Future? I’m not sure if there is much debate over this issue, actually. The US national debt is 100% of GDP and we have among the lowest tax rates of our peer nations. Something … Read entire article »

Filed under: taxes

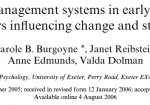

Joint and Separate Money Series: Individualized Marriage and Money Management

This is the second installment of a series probing the issue of joint vs. separate money in marital and cohabiting relationships, inspired by the great discussion in the comments of my slippery slope of separate money post. In each post in this series, I review the methodology and major findings of a paper in the field and then discuss how my husband and I fit into the results. I encourage you to share your reactions … Read entire article »

Filed under: marriage, the literature

Weekly Update 15

Last Sunday and Monday I went to a departmental retreat near-ish to the NC coast. While it’s never been an awesome time, I had the most fun this year of any of the four I have attended. We got a very nice carpool group together for the 7 hours of driving we did over two days and had great conversations. The talks were all really interesting and I had a nice conversation with two late-stage PhD candidates about “alternate” career options. The other fun event we had this week was hanging out with another couple on Friday evening. We played Pandemic; I usually don’t like games of strategy but this was a cooperative one so I enjoyed it a lot. We were having such a good time we stayed until after … Read entire article »

Filed under: weekly update

April 2012 Month in Review: Money

I’ve decided to start a series in which I look back on the previous month’s spending and saving and report how we matched up with our goals (i.e. budget) and what we spent out of our targeted savings accounts. The point is to give you a deeper look into how we spend our money (to provoke discussion) and to provide us some accountability. In April we had three weekends on which we were traveling, so I’ll … Read entire article »

Filed under: month in review

How Do You Decide How Much to Spend on Groceries?

It seems like a simple question, right? So far, how much we budget for groceries has been determined by how much we do/can spend on groceries. Last year we tried to cut back to $300/month on groceries but realized that was too low, so we reworked the rest of our budget to allow us up to $360/month. I’ve identified four factors that influence what food we buy: health cost sustainability convenience Right now those four factors have found an equilibrium and … Read entire article »

Filed under: food

Joint and Separate Money Series: Changes During the First Year of Marriage

This is the first installment of a series probing the issue of joint vs. separate money in marital and cohabiting relationships, inspired by the great discussion in the comments of my slippery slope of separate money post. In each post in this series, I review the methodology and major findings of a paper in the field and then discuss how my husband and I fit into the results. I encourage you to share your reactions … Read entire article »

Filed under: marriage, the literature

Financial Simplicity Carnival #10

I kicked around a few ideas for the theme of this carnival – the Kentucky Derby was yesterday, for example, and Mother’s Day is next week (have you sent your mom a present yet?) but in the end I couldn’t pass up playing around with the coincidence that this is the tenth edition of the Financial Simplicity Carnival. That means there’s an order of magnitude more Financial Simplicity Carnival posts than there were when Nick launched it! And if any of you haven’t seen the Scale of the Universe video yet (it’s been around quite a while) you really must take 5 minutes to watch it now! It shows the structure of the world, solar system, galaxy, and universe from 1 meter to 1026 meters. Going smaller from 1 m … Read entire article »

Filed under: carnival

Weekly Update 14

As I mentioned last weekend, we returned from our 5-year college reunion on Monday morning. The rest of this week has been a real struggle between being exhausted from the weekend and re-adjusting to EST. We got back to Kyle’s parents’ house after midnight Thursday – Saturday (PDT of course, 3 AM for our time) so the exhaustion compounded. Anyway, we had a WONDERFUL time seeing our friends, former teachers, and the campus. Nothing too exciting … Read entire article »

Filed under: weekly update

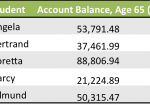

Can a Net Income Boost Compensate for Not Having Earned Income?

Two weeks ago I got a great comment on my Roth IRAs for Graduate Students post from Joe. He asked “Why would you want fellowship income to be reported as earned income? The payroll tax (6.2%+1.45%) that must be withheld from wages … in my opinion, makes the unearned income classification better.” The payroll tax exception for 1099-MISC income wasn’t something I addressed in the Roth IRA post (although I mentioned it as a perk for some … Read entire article »

Filed under: budgeting, retirement, taxes