Evolving Personal Finance » savings

Six Years of Internet Banking

I can’t believe it’s been six years since I opened my first account with an internet-only bank! There have been so many changes during that time and I think internet-only banks have really come into their own. I believe they can go toe-to-toe with brick-and-mortar banks and even beat them in many ways. I opened an account with ING Direct (now Capital One 360) after I graduated from college when I realized that Bank of America … Read entire article »

Attend Weddings But Don’t Go into Debt

Wedding season is upon us! I love marriage and I love attending weddings to spend time with and support our friends and family. That’s why I initially felt sympathy for Christopher Sledzik, the face that CNN put on its recent article on the rising cost of wedding attendance and the pressure friends and family feel to attend. Like Sledzik, we are also 27 and in the last three years have devoted all our vacation time … Read entire article »

Filed under: choices, credit cards, debt, marriage, savings, targeted savings, travel

Evolution of Our Relationship with Bank of America

Let’s get one thing straight from the start: I think Bank of America is terrible. You will hear that repeatedly through this post. Kyle thinks Bank of America is okay. They haven’t done anything major to annoy him – or perhaps I should say he has not let the things about their service that drive me crazy get to him. This post details the stages of our use of BoA and concludes with why the heck … Read entire article »

Giving Should Exceed Saving?

My church put on a financial boot camp this past weekend, the content of which largely followed Dave Ramsey’s baby steps, along with additional Biblical support for a debt-free generous lifestyle and some fun mathematical examples of the power of compound interest. But one of the volunteers mentioned a principle that he and his wife live by: his savings rate does not exceed his giving rate. I admit that I was surprised to hear this come … Read entire article »

Filed under: giving, retirement, savings

What’s the Point of Calculating Net Worth?

I enjoy reading other PF bloggers’ monthly reports on their net worth progress, whether they use real numbers or percentage increases. I haven’t so far written a net worth post or series for us and as of now I don’t plan to. I just don’t see how it would be interesting or informative in our situation. So I’ll bore you with one post instead of with a series. Here are the components that contribute to our … Read entire article »

Filed under: net worth, savings, stock market

Why You Should Save for Retirement While In Graduate School Part 2

aka Why You Should Save For Retirement Even with a Low Income This is the second half of a two-part post intended to inspire graduate students and others with low incomes who are currently not saving for retirement to start. Check out the first post for my assumptions and an argument concerning compound interest. Please remember that I am not a financial planner or CPA and you should not consider my opinions financial advice targeted for … Read entire article »

Filed under: choices, retirement, savings

Living a Step Behind

This week I’m thinking about a great illustration that our pastor used a few years ago in a sermon on putting others before ourselves. He was helping our church accept that if we chose to live by the Biblical principles of money management, we should expect to see obvious differences in our lifestyles in comparison with our peers at work. By tithing 10% of our income and giving generously above that, we would be one step … Read entire article »

Childhood Games Indicating Financial Personality

Kyle has been lobbying for us to get a chess set for several months now so we can play together, and last Friday I finally agreed and we picked one up. We played four games over the next two days and he beat me soundly in every one. I am a bad loser so I was kind of sulking after, and I asked him if he would let our (future) kids win in chess. Then … Read entire article »

Filed under: emergency fund, personal, savings

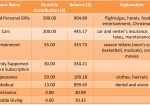

Our Short-Term Savings Accounts

The aspect of our financial situation of which I’m most proud is our short-term targeted savings accounts. I’m proud of them because they are a solution to a recurring monthly-budgeting problem – regular but infrequent expenses – that I came up with all on my own. (Not that I’m the only one, of course – I just did it independent of those others.) And I actually think they’re really fun. Targeted savings accounts: 1) Take the stress … Read entire article »

Filed under: budgeting, savings, targeted savings

Psyching Out My IRA

For the last six months or so I’ve wanted to max out my IRA. Like, I’m dying to. I’ve looked at our budget numerous times, attempting theoretical cuts here and there that could get me to the limit. I took my contribution from just under 10% of my gross income to about 16% but going the rest of the way is just not happening. Why do I want to max out my IRA? Two psychological precepts … Read entire article »

Filed under: budgeting, goals, retirement, savings, stock market