Evolving Personal Finance » Archive

Favorite Posts, Mentions, and Top Comments Week of 10Mar2013

This week was spring break – of course that doesn’t mean anything changed schedule-wise for me and Kyle, but campus was just a bit empty. I found a really exciting paper and I want to implement the method in our lab, so I decided to give it to my undergrad to work on – Kyle said “Look at you, delegating like a PI!” I’m still trying to get comfortable in the whole mentor role thing. Our weekend plans were pretty well ruined by our team getting knocked out of our conference tournament early! We’re really bummed about that but hope it’s a wake-up call so they get it together for the big dance. Posts I Liked My Money Design lays out several wealth creation strategies. Kraig from Young Cheap Living details how to use … Read entire article »

Filed under: weekly update

When Did We Acquire All This Cash?

When Kyle and I arrived home from our honeymoon in June 2010, our non-property net worth consisted of: our Roth IRAs around $16,500 in savings accounts/CDs a bit in checking the money we received as wedding gifts $16,000 in student loans We had just spent between $10,000 and $20,000 on our rings, our honeymoon, and our portion of the wedding expenses. We felt like we were starting from zero, in cash anyway. That summer we put in CDs the amount of … Read entire article »

Filed under: personal, targeted savings

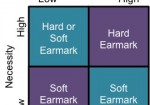

Hard and Soft Earmarks in Targeted Savings

I have come to another stage of reflection regarding our targeted savings accounts. When we first set them up right after we got married, they were a great way to plan for irregular expenses and to motivate us to defer spending. More recently, I’ve realized that as our next year is so uncertain, the role of our targeted savings accounts may become diminished. As I’ve thought through what money we might be willing to shift … Read entire article »

Filed under: targeted savings

Why We Don’t Have Life Insurance and When We’ll Buy It

Kyle and I don’t have life insurance – Kyle and I don’t believe we need life insurance right now. We view life insurance as a means to provide for dependents in the event of an early demise – specifically, to replace the income of the deceased. My mother, a former insurance agent, views life insurance as an investment vehicle, which I think she really had to believe in to be able to sell the product. But my … Read entire article »

Filed under: insurance

Favorite Posts, Mentions, and Top Comments Week of 3Mar2013

I am currently in the DC area to visit friends and family and attend a pre-wedding event for one of my high school friends! Kyle decided to stay home to get some serious work done. I think it’s nice to have a break from one another every so often since we do spend so much time together in our normal routine. I’m happy I live close enough to be able to drive back for these types of events and to see my parents and siblings. The BIG NEWS of the week is that I passed my preliminary exam and it was way less scary than I thought it would be! My committee really took it easy on me. I think I overprepared, which I guess is okay, and I’m glad I … Read entire article »

Filed under: weekly update

Grocery Challenge Update for February 2013

I was considering not posting about our grocery challenge this week because I don’t have a complete report, but then I decided that this blog is supposed to reflect real life and sometimes real life just doesn’t leave room for tracking receipts! I know how much money we spent on groceries last month thanks to Mint – $458.50 – but at some point in the month we lost track of our receipts for the mega pie … Read entire article »

Filed under: food

What Is a Courtesy Letter and Does It Mean I Don’t Have to Pay Taxes?

I think that one of the most confusing points regarding grad student taxes is the nature of the “courtesy letter.” I have personally never received one from my university or funding agency but I know many students in my lab, department, and university who have. You may not even be sure what you have received is a “courtesy letter” at all, but I’ll let you in on a few of it likely characteristics: It’s confusingly worded. It … Read entire article »

Filed under: grad school, taxes

Top Causes of Bad Debt

Today is the day of my preliminary exam – please send your prayers and good wishes my way! So that I can focus on my presentation, Jon from MoneySmartGuides is providing our guest post for today. Money Smart Guides is a personal finance blog that aims to teach the basics of personal finance with a focus on investing and paying off debt. After graduating college and getting into credit card debt, Jon paid the debt off … Read entire article »

Filed under: debt

Favorite Posts, Mentions, and Top Comments Week of 24Feb2013

I gave THREE practice prelim presentations this week – once for my lab, one for my peers, and one for my advisor. I wanted to work far in advance so we could go see Les Miserables on Friday night and watch a basketball game and go to a game night on Saturday without feeling too stressed. Kyle also gave two presentations this week so he was working hard as well. My prelim is TOMORROW! Oh, and in PF news, the grad student tax workshop I helped prepare was last Wednesday and it went really well! The audience was very diverse – from people who had never seen a 1040 to people who were trying to argue that grad students should be paid with W-2s instead of 1099-MISCs. I think our speaker … Read entire article »

Filed under: weekly update

February 2013 Month in Review: Money

This has been a stressful month for us. As I’ve mentioned about a hundred times on here, I’m preparing for my preliminary exam. This stress and busy-ness has translated to doing and spending less, though we still socialized with our friends in free settings quite a bit. The Everyday Budget Our non-discretionary categories aren’t changing at all now – INCOME, SAVINGS, GIVING, rent, and internet – which you can find in our last budget iteration. Kyle also … Read entire article »

Filed under: month in review