Evolving Personal Finance » Archive

Living a Step Behind

This week I’m thinking about a great illustration that our pastor used a few years ago in a sermon on putting others before ourselves. He was helping our church accept that if we chose to live by the Biblical principles of money management, we should expect to see obvious differences in our lifestyles in comparison with our peers at work. By tithing 10% of our income and giving generously above that, we would be one step … Read entire article »

How Often Do You Adjust Your Budget?

Kyle and I have to do a massive budget overhaul for next month. We need major edits in groceries, tithe, cars, and travel and minor edits in several other categories. Of course there are always more needs/wants than take-home pay so we have to make some tough decisions. I realized this is the first big edit we’ve done in quite some time though. Every few months we’ll adjust a category or two by a small amount, … Read entire article »

Filed under: budgeting, participation

Weekly Update 3

Our week was fairly consumed with dealing with my car. We went to bed Tuesday night without a decision on what to do. We had discussed our options extensively (with whiteboards!) and couldn’t come to a clear resolution, so I left it up to Kyle to decide. He woke up Wednesday morning with a great proposition: commit to the one-car experiment for two weeks without making any other changes, and if that goes well we … Read entire article »

Filed under: weekly update

Wait a Second, Do I LIKE Dave Ramsey?

When I wrote about my favorite podcasts on money last week, I mentioned that I was checking out a new one (LiFE). What I didn’t say was that I had added another podcast: The Dave Ramsey Show. I figured I would only listen to an episode or two and then unsubscribe, as I do with many podcasts. After all, I knew Dave’s message, and it wasn’t for me. I had already been into personal finance for … Read entire article »

Filed under: podcasts

Spend $1600 or Become a One-Car Family?

Irony: My car breaking down the day after writing about our disagreement over carpooling to work! When I published that post on Monday becoming a one-car family seemed a remote possibility, but as of this writing on Tuesday evening we are giving it serious consideration. So much can change in 36 hours! For the last few months, my car has been shaking considerably when its speed exceeds 65 mph. I knew I would eventually need to get … Read entire article »

Filed under: budgeting, cars, choices, emergency fund, targeted savings

Frugal Tips That Go Too Far

I consider myself a frugal person. I like finding ways to cut back on our expenses so that we can put money toward our goals or fun activities/purchases. However, I often come across frugal tips that make me think “No way!” Either the trade-offs don’t make financial sense, I find the alternate activity unpalatable for some reason, or it just wouldn’t work in our family – whatever the reason, I’ve read plenty of tips that … Read entire article »

Filed under: frugality

Weekly Update 2

Hey everyone! The highlight of our week was the big game between our university’s men’s basketball team and our rival. We had a bunch of our friends over to our place to watch it. It was a nail-biter and had the most unlikely last minute (2.5, really) I’ve seen. I love watching basketball with other fans (in fact, we made it a rule). Our living room was absolutely exploding in the last minute. We also attended a home basketball game on Saturday, but since we arrived late we didn’t have much of a view of the court. This week was also recruiting week for Kyle’s program so he did a lot of social and work-related activities related to that, and I joined him at a party for the student and “recruits” on … Read entire article »

Filed under: weekly update

Consistent Grocery Budget Fail

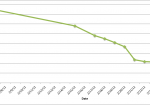

Confession: We have exceeded our grocery budget every month since September. Several of our budget categories, including groceries, are supposed to be a maximum amount spent, with whatever is left over at the end of the month to be transferred into savings. Instead, for groceries we have had to take from other budget categories to cover it. How did we get into this mess and why haven’t we turned it around? Last May we lowered our … Read entire article »