Evolving Personal Finance » Entries tagged with "irregular expenses"

March 2017 Budget Report

This was a pretty bad month for us in terms of large, unexpected expenses popping up that didn’t fit into our targeted savings accounts. Our ‘Miscellaneous’ spending category was completely overwhelmed. We also incredibly overspent one of our variable expense categories. Even our targeted savings accounts didn’t fare well; one of them is now negative! But thankfully we have our buffer funds to help us smooth this out. The one success we had was a … Read entire article »

Filed under: month in review

September 2016 Budget Report

We’re still getting our feet under us in terms of our spending on DPR, but things are starting to normalize. Our large start-up costs are largely behind us, I think, and now we’ll just have some ongoing expenses to keep her fed, clothed, etc. One totally new expense for us this month was childcare! I had my first speaking engagement as a parent. I had an amazing day: my hosts put on a wonderful event and … Read entire article »

Filed under: month in review

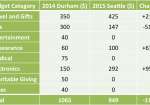

Lifestyle Inflation Analysis

One of the big purposes of me creating this blog, right from the beginning, was to keep Kyle and I from succumbing to lifestyle inflation as we transitioned out of grad school and into our careers. I knew that many people, upon experiencing a jump in salary, would mindlessly let their spending increase across various areas of their budget. I draw a strong distinction between lifestyle inflation and lifestyle increase. I see lifestyle increases as … Read entire article »

Filed under: budgeting, transitions

Irregular Expenses Are Still Kicking Our Butts!

Somehow I thought that doubling our income would solve our irregular expenses problems, but I guess I was wrong! Our targeted savings accounts were our budgetary saviors during grad school. Our income was pretty low, so irregular expenses like plane tickets and car repairs would have totally overwhelmed our available cash flow in a given month. Our targeted savings account converted large irregular expenses to small regular expenses and helped us plan, save, and make spending … Read entire article »

Filed under: targeted savings

How Do You Decide If You Can Afford a Purchase?

Lately I have been thinking about how to determine whether to make a purchase of a “want” and I’d love some feedback from you all about how you make that decision. One of the purposes of a budget, in my mind, is to help you make that decision. A budget gives you guidelines for what you want your spending to be, and then all you have to do when contemplating a purchase is ask yourself … Read entire article »

Filed under: budgeting, spending, targeted savings

When Did We Acquire All This Cash?

When Kyle and I arrived home from our honeymoon in June 2010, our non-property net worth consisted of: our Roth IRAs around $16,500 in savings accounts/CDs a bit in checking the money we received as wedding gifts $16,000 in student loans We had just spent between $10,000 and $20,000 on our rings, our honeymoon, and our portion of the wedding expenses. We felt like we were starting from zero, in cash anyway. That summer we put in CDs the amount of … Read entire article »

Filed under: personal, targeted savings

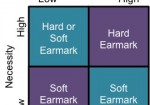

Hard and Soft Earmarks in Targeted Savings

I have come to another stage of reflection regarding our targeted savings accounts. When we first set them up right after we got married, they were a great way to plan for irregular expenses and to motivate us to defer spending. More recently, I’ve realized that as our next year is so uncertain, the role of our targeted savings accounts may become diminished. As I’ve thought through what money we might be willing to shift … Read entire article »

Filed under: targeted savings

The Benefits of Targeted Savings Accounts – and Their Uncertain Future

Boy, am I grateful for our targeted savings accounts this month! We have spent a crazy amount of money this month, some of it unexpectedly. This month we have used our targeted savings accounts to purchase our Christmas flights ($625.20), six months of car insurance ($405.47), and other miscellaneous items ($149.85). All of that was planned and budgeted for so even though it was a lot of money it wasn’t stressful at all. Actually, we have … Read entire article »

Filed under: targeted savings