Hobbies vs. Values in Targeted Savings

Kyle and I had an argument recently about one of those nooks and crannies of our financial life that you could never predict would come up. When we were in premarital counseling, we agreed almost totally on how to (theoretically) manage our finances, but of course when it comes to implementation thing never go as smoothly as planned. You can agree on 95% of topics but still argue over the remaining 5%!

Kyle and I had an argument recently about one of those nooks and crannies of our financial life that you could never predict would come up. When we were in premarital counseling, we agreed almost totally on how to (theoretically) manage our finances, but of course when it comes to implementation thing never go as smoothly as planned. You can agree on 95% of topics but still argue over the remaining 5%!

A few months ago I identified my top 5 values (God, marriage, security, health, community). Delineating these areas is supposed to help you make decisions about what to spend money on and what to skip. The idea is that you will get the best value for your money by spending in the areas that really matter to you.

I actually haven’t made many opportunities to spend money in any of these areas, with one exception. A couple months ago I had my annual physical exam and I elected to get a lipid panel so that I could see how my cholesterol has changed over the previous half-year. I agonized a little over the decision because I wasn’t sure if our insurance would cover it, but in the end I decided that our Medical targeted savings account could cover the copay.

Kyle disagreed that our Medical savings account should cover the copay. He called my interest in my health a hobby and argued that an elective test shouldn’t count as a medical expense. He was fine with me choosing to get the test done, but just thought we should try to cover it out of our monthly cash flow. I gave him my values argument but he has different values so it was difficult for him to understand. In general I would agree that an optional expense shouldn’t count toward the Medical account, but I thought that identifying health as a top value validated its importance.

We argued for a while and then dropped it because we weren’t getting anywhere. It turned out to only be a small copay that we could have covered out of either account. The issue remains unresolved. I’ve been encouraging Kyle to make his own list of top 5 values so that perhaps we can understand each other and make this a two-way street, but he has deferred so far.

What do you think about this situation – do elective medical procedures “count” as medical expenses? How willing are you to spend money on your top values?

photo from RambergMedialImages

Filed under: marriage, personal, targeted savings, values

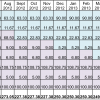

Targeted Savings Account Calculation: Cars through Aug2013

Targeted Savings Account Calculation: Cars through Aug2013 First Values and Goals, Then Strategies

First Values and Goals, Then Strategies Hard and Soft Earmarks in Targeted Savings

Hard and Soft Earmarks in Targeted Savings The Benefits of Targeted Savings Accounts – and Their Uncertain Future

The Benefits of Targeted Savings Accounts – and Their Uncertain Future

I think preventative care and precaution is likely to be far less expensive than reactive treatment. To that extent, we would take it out of our medical account. As you point out, it’s difficult to classify individual procedures – but I’d say relevance to one’s history and relative expense would be a start. In our case, I think an EKG would be too expensive and irrelevant to consider “preventative care”. For J, who has a history of chronic heartburn, I could imagine supporting some tests (who knows what they’d be) that would indicate whether Paleo has really improved his gut or not (as we suspect). Of course, if it were a significant chunk of the account, we’d have to reassess the necessity.

(Given our grocery budget, I’d say we’re VERY willing to spend money on our top values. haha.)

Given your rationale, checking my lipids is definitely relevant to my health history! The argument Kyle and I had really was quite minor given that he didn’t object to the test and it was only a little money. But I would like to get the larger principle worked out between us. I’ll bring up your thoughts with him – thanks!

[ Should birth control be considered “household”, “medical”, or “hobby”? ] 😉

lol… actually it just got transferred to “Medical” but it’s definitely “Entertainment” as well!

… or even “Charitable Giving!” (Too far??)

No, I jest, I jest.

I would say that you should only use your targeted medical savings account for the co-pay if you’re in an emergency situation.

For example, I have a sum of money in an account to cover my health insurance out-of-pocket maximum beyond what I put into the FSA each year. If I have room in my cash flow, then I will take the money out of what I would have saved out of my paycheck at the end of the month, but if I’m in a crazy situation where I’m moving (like right now), I will take it out of the targeted medical savings account.

In general, we funded that account to cover co-pays and prescriptions as well as bigger out-of-pocket expenses like vision and dental (not covered by our health insurance). This is because we usually have very little wiggle room in our budget/cash flow each month (by design). We have separate accounts that we would draw on in case of an emergency. But I agree that if there is room we should cover it out of the cash flow, because even if we do take it out of that account we have to refund it up to our max level at some point out of cash flow.

[…] best comment I received this week was from Renee, who in response to Hobbies vs. Values in Targeted Savings wrote “[ Should birth control be considered "household", "medical", or "hobby"? […]

You handled it better than I would have – if my fiance told me that I should consider a medical test a hobby (unless I am a hypochondriac, which I’m not), I would have been very peeved. I try to take small medical expenses out of cash-flow, not my copayment account. But the word “hobby” refers to something unnecessary, and while a lipid panel isn’t immediately critical, it’s important for your health.

Haha, I think Kyle just doesn’t understand because he’s a stereotypical man who never goes to the doctor. I agree with your assessment that tests like this are for some people necessary although rarely critical in the time-sensitive meaning of the word. We had this discussion before we knew that the copayment was going to be small – I was afraid it might be up to $200 if our insurance decided not to cover it because it was elective, but thankfully that wasn’t the case. If it had been that much we definitely would have needed to take the money out of our Medical account.

[…] health/dental/eyecare (remember our differential dental costs? and my elective lipid panel?) […]