Does Your Class Match Your Income?

My thoughts today might turn out to be offensive to some of my readers. I don’t intend them that way and I don’t have any specific people in mind. I’m just reflecting on my own experiences, observations, stereotypes, and biases. And I haven’t done much research for this either, so it’s certainly possible that you’ll disagree with my assertions.

In the process of looking for apartments, Kyle and I toured one complex that isn’t as nice (or as expensive) as where we currently live, in terms of how new the buildings were, how recently the appliances were updated, the quality of the construction, the available amenities, and that sort of thing. I also noticed more families walking around, whereas my perception is that most of our current neighbors are grad students. Of course, it was a much better price than what we’re paying now and in a similar location. I tried to picture myself living in one of those apartments and came to ask myself the question, “Do I want to view myself as the type of person who lives here, or in our current ‘luxury apartment?’”

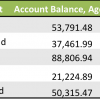

The fact is that our rent has gotten a little steep – if the increase goes through, about 25% of our gross pay – so income-wise I am the type of person who should live in the less-nice apartment complex, as much as I would prefer to believe I am the type of person to live in our current apartment.

I was raised in what appeared to be an upper-middle-class household and that is my self-identity. Since my parents paid for a lot of their lifestyle with debt (or debt-to-selves), like many other Americans, I question whether or not their income is really in that class bracket. Kyle, in contrast, was raised in what appeared to be a lower-middle-class household, while I believe his parents’ income was high enough that they could have been upper-middle-class. One of the other indicators of class that Kyle learned about from one of his college courses is what children do after school. Middle class children tend to have a full schedule of activities – in my case, Girl Scouts, soccer, and tennis – while lower-class children tend to be watched by relatives – in Kyle’s case, his grandfather, his cousin, or his mother.

We are a couple of young adults with self-images and future hopes of being upper-middle-class (once we finish our degrees we will be in “the one percent” education-wise), yet our income is probably more in the lower-middle-class/working-class range. I think we try to keep certain aspects of our lifestyle upper-middle (our apartment, frequent travel, saving for the future) while sacrificing other (our cars, rarely eating out, rarely buying clothes) so that we can make it all balance without going into debt. And yet even through practicing all this frugality I don’t like to admit to myself that I’m closer to lower class than upper, if you judge by income.

What is more important in identifying class – lifestyle, self-image, or income? Does your self-identified class match your income?

photo from Time

Filed under: housing, personal, psychology

Can a Net Income Boost Compensate for Not Having Earned Income?

Can a Net Income Boost Compensate for Not Having Earned Income? Side Income

Side Income How to Save When You Don’t Have Earned Income

How to Save When You Don’t Have Earned Income What’s the Deal? Are We Poor?

What’s the Deal? Are We Poor?

Growing up, we were firmly middle class (middle middle class – not upper or lower).We probably should have been lower. Now, we COULD afford an upper middle class lifestyle but chose to live a lower class lifestyle.

I firmly believe that it’s pointless (and a huge waste of money) to care what you live in (as long as it’s safe and accessible) if you are renting. But that’s just me.

Daisy recently posted..Celebrity Tax Avoidance

I disagree about the renting, though I definitely think the considerations are more important when buying. I mean, even if you rent, that place is your home, so I think you should enjoy it – at a reasonable price. I lived in a not-quite-as-nice apartment before Kyle and I got married and while it was okay I was pretty miserable during the winter because of the terrible insulation, so I was happy for the upgrade. There are certain other aspects that are important to me, too – a decently-sized kitchen so we can cook, a medium-sized living area so we can have our basketball group over to watch games.

I definitely grew up upper middle class, though I think that was more prevalent as we got older and not as much when we were younger. I had a wide range of activities, like you. I’m somewhat confident though that my parents financed our lifestyle with cash. They’re a tad anti-debt, unless it’s a mortgage and even then, you have to be careful.

I don’t think that any of those are surefire indicators of class.

It feels weird to try to define class when we’re in our twenties! I guess I’m probably middle class? I actually don’t really think about it that much.

Leigh recently posted..I bought a condo!

It’s definitely more difficult to pin down class at a young age, but that’s why I threw out a few ways to try to determine it. I was thinking about all those hypothetical young adults who try to achieve their parents’ middle-aged standard-of-living with their first jobs out of college – their income wouldn’t match their desired class.

Interesting topic, Emily. It’s been eye-opening to observe M’s dental school classmates this year. I’ve noticed that a lot of these students live pretty lavish lifestyles, despite the fact that they are basically financing those lifestyles with debt. I understand that many graduate/professional students have the expectation of higher incomes after they finish school, but it’s just not their current reality. I am a firm believer in living within your means, even if it requires sacrificing a sense of “class.” On the flip side, however, I realize it’s not fair to judge others’ financial decisions unless you know the full picture. What we’re willing to sacrifice (e.g. cable, shopping, eating out, cars, etc.) to afford other “luxuries” (e.g. travel – albeit on the cheap), might not hold the same value for our counterparts.

I see the same thing with my husband’s dental school classmates. They are all so careless with their money even after taking out $50-70K in loans/yr. I know right now they assume that they will make enough money to pay them back, but in my opinion, there is no guarentees for future income. I also recently talked to a third year ER resident who admitted that he was living a “doctor’s” lifestyle and that he had $20K in credit card debt on top of his undergrad and med school loans

Jessica recently posted..Tips for Selling Your Wedding Dress

How does a resident even find the time to spend all that money??

I agree about accepting your current reality, not your hopes for the future! That’s why I save for retirement now…

I wrestle with this all the time. When we go to a really upscale restaurant I think “I’d love to do this all the time.” Then I’m at an outdoor “potluck” barbeque with relatives and I think “this is what it’s all about.” I’m not sure what impresses me more: people content to spend next to nothing (or doing so because they have next to nothing) or people who enjoy their wealth.

I try to bridge “classes” as much as possible because I like to have a feel for what a range of diverse people are feeling/thinking. I also don’t like having people’s money thrown in my face. So, I’m not sure where this comment is going, but I’m glad you wrote the piece…contemplative fun, as always!

AverageJoeMoney recently posted..Blog Post of the Week! By Frugal Portland

It sounds like what you admire is satisfaction at whatever income level or in whatever class you find yourself – and I don’t think you can beat that!

We just had a post on class and how it affects how children view money (and education and so on). My parents had income that varied from lower class (there were some years I was eligible for school lunch but did not take it) to middle-middle-class, but we always had food on the table and a roof over our heads because my father was a depression baby and knew how to save and how to stretch a dollar. We viewed education, however, from an upper-middle-class standpoint… coming of age, an investment in our futures. There was a lot of sacrificing so we could have books and after school programs and classes and college.

We lived in falling down apartments, the woman living below us would sometimes trade government cheese with us for other things (she didn’t need a huge rectangular block of cheese just for herself), clothes from Sears then KMart then Walmart. Eventually we had a house in a middle class neighborhood. Today we live in a house on the middle-middle-class side of an upper-middle-class HOA. We could afford something nicer, but already have 3000 sq ft which is too much.

So a very odd mix for me growing up. Depends on the area of our life which class I was in. I love being upper middle class and do not want to return ever.

nicoleandmaggie recently posted..Kids and money and class and ramblings about allowances

Sounds like you’ve had a real progression though your adulthood and have now “arrived.” I appreciate this period of lower-income-ness in our life, though we try to keep up with our self-images in a few areas we definitely sacrifice in others.

No, that progression was through my childhood (my parents still live in the middle-class neighborhood). As an adult we lived mostly in student housing and then bought our really nice house.

nicoleandmaggie recently posted..Ask the grumpies: Retirement vs. debt

When I lived in LA, I really couldn’t afford the “middle” class, unless I wanted all of my income to go to rent. So, I moved, to a neighborhood that was probably considered lower middle class. The demographics of this neighborhood was about 47% Black, 47% Hispanic, and 6% white. I’m white………..:)

Some white people would have been uncomfortable with those ratios, but I looked at it as a new experience.

And I loved it!!

IdaBaker recently posted..Friday Flavor of the Week – 4th of July Edition

Geographic region affects what your income really means so much! My husband grew up in a majority-minority neighborhood in L.A., too.

Class is funny because we all want to say we’re the middle class. In my neighborhood, there are a bunch of fancy homes with BMWs in the driveway and grand pianos visible when the curtains are up, with signs that say “We are the 99%!” in them. This prompts the question, “99% of what? BMW owners?”

Kathleen @ Frugal Portland recently posted..Being Patient Seems Impossible Sometimes

It’s true, everyone thinks of themselves as in the middle. If you just divide your area into thirds by income I’m sure your neighbors would be upper-class, though I guess politically they want to self-identify another way.

I have some extended family on both sides who have (or are getting) their graduate degrees in music (either theory, or performance). I know their incomes (current, and perhaps future) are low, and and sometimes undependable. Most live in rented housing, don’t have smart phones, have <1 car/person. Yet when it comes to education, children's activities, saving for the future, they fit into the upper-middle class category. (Some have grand pianos–and use them!) This is another example of what you mention, where people sacrifice some things in order to afford others. By looking at their education levels, lifestyle (attending the symphony, shopping at whole foods, reading list), and self-image they appear to be upper-middle class, but by their income and overall spending, they're certainly lower-, or just plain middle class. I think this is where many graduate students may find themselves (myself included): tugged both into the upper- and lower- middle class arenas.

Good point that educational values may have tendencies with class as well, but there are exceptions to all of these trends. “Tugged” is a good term for our position!

Emily, I really don’t think anyone else would ever judge you so harshly. Even in your disclaimer, you seem to be overly concerned with how people perceive you, your status, and even your opinions. I honestly don’t even know if we are upper middle class or lower, and I don’t care. Of course I want to have more money, be able to go on more vacations, not have to worry about bills, not because of status, but because I want a better life for my family. If I told you how much money Jeff makes, you would assume we couldn’t possibly have issues with bills, but that’s because we chose to live in a nice neighborhood in a good school district, and chose to enroll our children in activities. It was also a big sacrifice for me to stay home and be their first teacher. Do those things coupled with the fact that we are climbing our way out of credit card debt negate our educations, my husband’s salary, or the fact that we are involved parents? There are way too many variables to make things so black and white, at least for me.

Michelle recently posted..What to Do When You Get a Traffic Ticket

Part of the point that I was trying to make is that how we determine our class (if we so choose) isn’t black-and-white at all but there can be many different determiners. I agree with you that the deeper impacts of money on our lives and the decisions we are able to make with it are more important that our class labels.

That’s a tough call. I always thought of us as lower-middle class, but the reality was probably that we were poor. While we never received welfare or food stamps or anything like that, we always qualified for free scout camp and there were a couple years of free school lunch that I remember.

My parents haven’t had any formal debt since my dad’s business went bust and he filed for bankruptcy.After that, it was always a shuffling of late payments on utilities, so their credit was too bad to be able to borrow.

Edward Antrobus recently posted..How to Trade Forex

I think it’s difficult to recognize when you’re poor, especially if you’re not wallowing and feeling sorry for yourself. My dad grew up poor, too, but didn’t realize it until he got to college.

I would say that I grew up middle class based on the “benefits” that I enjoyed. But I’ve realised that being right in the middle is hard – you’re always getting squeezed.

Dannielle @ Odd Cents recently posted..Comment on Weekly Report – 17 June 2012 by Dannielle

How do you mean?

[…] {Emily} discussed class (perceived and real) in her hunt for new apartments. I see this even in my family, as the disposable income of my parents went up even in the time between my high school years and my sister’s, seven years later. Definitely the difference between middle and upper-middle class. […]

Class is something I struggle with on a near-daily basis. I grew up lower middle class, and now things are just wild. My hubby comes from major money, and it’s hard to handle the change. The kicker is we have our own separate finances, so it’s like we live on two different class levels in on home. It’s so warped.

Nell @ Housewife Empire recently posted..How to Succeed Online When You Feel Like Giving Up

I’d like to hear more about how you handle that and why you chose separate finances. Do you have a blog post on it?

My buddy and his wife are a little like that. His father works in manufacturing; her father owns a radio station and gave them a house as a wedding present. At first, they had some problems because she grew up with an expectation of expensive gifts.

Edward Antrobus recently posted..My Best Tips for Making Extra Money

Is a financial status label really necessary? I feel like if you’re doing what you feel is right, working toward the goals that you’ve set for yourselves, then that is all that matters financially. To be viewed as one class or another might be a goal that is out of your reach, like when “new money” tries to break into the old money circles.

Wayne @ Young Family Finance recently posted..How to Save Money when Traveling

I don’t think about class all the time, but it was prompted by this housing search. And it’s reflexive – I don’t care how others view me but I care about how I’m doing against my own desires and standards.

[…] on other blogs until we get back. I have enjoyed reading all your comments, particularly on my thoughts on my “class,” and I’ll respond to them as soon as I find some […]

Interesting article. I am curious how my neighbours are doing. I am living in a lower upper class neighbourhood now. Big homes and nice cars. The “Millionaire next door” (Book) comments that if you live in an expensive neighbourhood, chances are people around you are spending for show and they may be struggling under debt to keep things going. My parents lived in a middle class home and had to live frugally to make ends meet. Money was scarce (after my Dad died when I was 12), but through dogged determination we were able to live in a good neighbourhood and have a simple cottage we could escape to. I was taught the value of money and I had my first job by the time I was 9 years old.

My growing up taught me to be very careful with money. I was not careful with the house we bought, but I am with all the smaller things.

Do you see a time in the near future that the house won’t be such a stretch? I’m learning my own lesson that having such a high-percentage-of-the-budget item be even a bit over-expensive can really tie up the rest of the budget.

I have learnt over the years that roughly after five years you start to really feel like the house is not a burden. I have continued to increase my mortgage payments each year and after eight years now I am about a year and a half away from being mortgage free. I am really enjoying seeing my debt melt away. I am living very frugally in order to get it paid off! it is not for everyone though.

The house we bought was quite a bit bigger than planned (It took my breath away). I have no regrets though. I am hoping to live in it until I am about 65 or 70, and then we’ll see.

interesting topic! I always have thought of myself as middle class, though I went to a private high school and we probably were one of the least well-off families there… so compared to them, lower middle class. And really, possibly even “upper working class”, if there is such thing. My mom is a nurse and my dad is an electrician – skilled jobs that pay decent, but not straight up professionals. I went to a state school for college, but ended up working at a company that hires a lot from elite schools, so it isn’t uncommon for people ask where i went to school and (at least in my imagination) judge me for not have going to somewhere prestigious. Part of the motivation for getting an M.S. was to brand myself better!

I have a reltively high paying job, but live in an expensive city (L.A.) and my husband is a grad student… so we’re all over the place as far as “class” goes, really! We do live in a really great area, but we share a care, have a small place, try not to go out to eat too much, and aren’t going to be able to buy a house anytime soon.

[…] a little late to the party on this one, but Evolving Personal Finance posted about whether your class matches your income last week. It’s an interesting […]

[…] 1) Does Your Class Match Your Income? […]

[…] guess it just struck me as a bit surprising because I associate having family provide childcare as (statistically) a lower-class arrangement, which I learned about via Kyle’s Work and Family class from college. I don’t think of any of […]