When Did We Acquire All This Cash?

When Kyle and I arrived home from our honeymoon in June 2010, our non-property net worth consisted of:

- our Roth IRAs

- around $16,500 in savings accounts/CDs

- a bit in checking

- the money we received as wedding gifts

- $16,000 in student loans

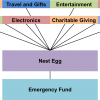

We had just spent between $10,000 and $20,000 on our rings, our honeymoon, and our portion of the wedding expenses. We felt like we were starting from zero, in cash anyway. That summer we put in CDs the amount of money we needed to pay my student loans (later invested part of it), and the rest of our cash became our emergency fund (about $1,200) and our “nest egg” savings account (the gift money).

We didn’t know it at the time, but 2010 was the busiest year for weddings we’d ever experience (to date, anyway). Within a four-month period, we were trying to buy: several pairs of plane tickets, wedding presents, 6 months of car insurance, two season tickets to Broadway musicals, a season ticket to our university’s men’s basketball games… And we just couldn’t do it all. It broke our hearts, but we had to turn down a few wedding invitations. That was when we opened the first few of our targeted savings accounts so that we would be prepared for all these huge (to our budget) irregular expenses the following year.

I say all of this to explain my mindset regarding our cash position and targeted savings accounts: I have been thinking of us as still caught in the summer of 2010, when we were trying to fund a lot of necessary or important-to-us purchases on very little cash flow and no available savings. (The retirement accounts, student loan money, and nest egg were all hard-earmarked for other purposes and next to untouchable.)

Despite my at-least-once-per-day glances at Mint, I only recently awakened to the fact that it is 2013 and our savings has really advanced. The combination of our low spending out of targeted savings this winter and that we haven’t experienced another high-volume wedding season means that we actually have a decent amount of cash on hand. I had chosen for years to selectively forget that we have any money aside from what’s present in our checking account (which is zeroed out every month) and our tiny tiny emergency fund – but that’s just not the case!

Despite my at-least-once-per-day glances at Mint, I only recently awakened to the fact that it is 2013 and our savings has really advanced. The combination of our low spending out of targeted savings this winter and that we haven’t experienced another high-volume wedding season means that we actually have a decent amount of cash on hand. I had chosen for years to selectively forget that we have any money aside from what’s present in our checking account (which is zeroed out every month) and our tiny tiny emergency fund – but that’s just not the case!

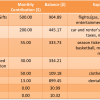

Aside from our emergency fund ($1,300), our student loan payoff money (grown to $17,500!), and whatever is in our checking account (between $0 and $4,000), we now have about $9,000 across our targeted savings accounts. $9,000 is a big mass of money to sort of sneak up on us (1/6 of our gross income), and of course that was only possible because we have it so distributed. Keeping it distributed and earmarked also helps us from using it all on a giant vacation or something. 🙂

What are our various accounts and balances as of early March 2013, are they hard or soft earmarked, and for what purpose is the money?

I think this explains why we have all the hard-earmark type of money present – we know for sure that we’ll need it in the future because of already-scheduled payments. As for the soft-earmark cash that may be repurposed, it’s not fully clear why we have so much in cash when we could have increased our savings rate to our retirement accounts or started saving for some mid-term goals. We will probably shift up a lot of this money when we undergo our financial overhaul once Kyle gets set up in his new city.

Since all this money has been saved to be spent, I wouldn’t be terribly upset or surprised if the balances are back down near zero in the near future. I guess that’s an advantage of staying in that 2010 mindset – these aren’t permanent savings, after all.

Have you ever been surprised by the high or low amount of accessible money you have? Do you trick yourself into thinking your have less money than you actually do? Did you go through a time in your financial life that still impacts your mindset?

photo from Free Digital Photos

Filed under: personal, targeted savings · Tags: debt, irregular expenses, short-term savings, wants, weddings

Hard and Soft Earmarks in Targeted Savings

Hard and Soft Earmarks in Targeted Savings Our Short-Term Savings Accounts

Our Short-Term Savings Accounts What’s the Point of Calculating Net Worth?

What’s the Point of Calculating Net Worth? Do You Ever Just Give In and Spend?

Do You Ever Just Give In and Spend?

This is the trick I use. I have another bank account that I house my savings account. It is automated, so I don’t check it often. I logged in the other day and found over $7k in there. That was a great feeling.

Grayson @ Debt Roundup recently posted..America In Debt – Broken Down Per Person

That’s awesome! What is the savings for?

We do the same basic thing and have quite a few of our targeted accounts automated. It’s always nice to log into the main account and see the nice stash there knowing (hopefully) what it’ll be going towards. I hate seeing it creep down, but that just means we had to do some of the spending we had allocated for.

John S @ Frugal Rules recently posted..Frugal Friday: Blog Posts That Ruled This Week, More Snow Edition

When you use short-term targeted savings, you really have to hold it loosely, knowing that it will be spent. I haven’t had the experience, but I’m sure when you use a big pile of money for a mid-term goal (down payment, car) it can be difficult to part with.

I started putting $250 per paycheck as a direct deposit to an online account. I did this because the bank was doing a bonus, maybe you got $100 if you did a minimum of $250 a month for 3 months? I don’t remember, but I didn’t miss the money, and kept on with the deposits even after I got the bonus. I have almost $5K in that account now, and it will most likely go toward the few expenses we pay annually, like HOA dues, garbage service, and life insurance. I believe they all come due in April or May and we have always struggled even though we know they’re coming. Not this year! Whatever is left will likely go into the rental house fund for any repairs that pop up.

Kim@Eyesonthedollar recently posted..6 Money Tips for College Graduates

Sweet! That’s so funny that you started the account on a whim and now can use the money at a rough time of the year. I guess those incentive programs work well on all sides!

While my wife looks at all of the finances, I pretty much ignore our main savings account balance. All of our short-term savings goals go in there, and we use some of that money to help us through the winter months when I’m not working. So the balance fluctuates quite a bit. In 2010, the balance reached a high in July (at which point I was laid off) and by December has dropped $10,000.

Edward Antrobus recently posted..The Case Against Minimalism

That’s a nice cushion, even at the low!

Sorry, that should have been dropped by $10,000

Edward Antrobus recently posted..The Case Against Minimalism

Congratulations! It never hurts to wake up, roll over, and find that all your hard work is accumulating into something significant!!! Keep up the hard work and good luck in the transition!

writing2reality recently posted..Savings Accounts – Why DON’T You Have One?

It does feel nice, even though our Cars account in particular will take a bit hit soon.

When I was preparing to move to NYC and go to grad school, I started saving $600 a month on a 38k year salary living in LA. I didn’t really look at my savings, then found myself with 14k to move to NYC and get settled. It ultimately helped me take out less loans and not suffer too badly in NYC. When I moved to Portland, I had about 9k in savings, which I felt comfortable with as I didn’t have permanent work. I still don’t have permanent work, but I realized I was just holding on to that number because it felt “safe” to me, but it was better suited to pay off some more debt. My savings is now half that, which should help with my non-permanent job situation and any possible moves that might occur.

Do or Debt recently posted..Love, Career and Geography

That is a crazy savings rate for that salary in LA! Great job! I’m sure it helped a ton to make that move to an even higher COL city.

That must have been a tough decision to pay off debt with your savings. Do you find having less of a safety net motivates you to earn more?

I try to keep my checking account under $3,500. Everytime it goes above that level ill invest the difference. That way, I never feel like I have a ton of cash just sitting in the checking account that needs to be burned.

cashrebel recently posted..Consumed By An Idea

Are those investments in retirement accounts or accessible taxable accounts? If the former, how are you confident you won’t need the money? 🙂

I don’t like having too much cash because it means the money is not working for me. I would rather pay debt or invest than keep it on a 1% savings account. I think I have about $3K cash but that is it and every time it reaches $5K I look for ways to be more productive with the money.

pauline recently posted..Carnival of Financial Independence, second edition

I’d like to be able to more with it but we don’t want to lose principal since we do have short-term uses in mind. :/ Once we start saving for our mid-terms goals we might take on a bit more risk.

I really like the graphics you have made in this post. There is nothing better than looking at my balance and seeing something higher than expected!

Korwil recently posted..How to Improve Web Traffic

Thanks! I keep track of these accounts both in Mint and Excel but I don’t often add them all up.

[…] @ Evolving Personal Finance writes When Did We Acquire All This Cash? – I woke up to the fact that we have a decent amount of cash in our short-term savings […]

[…] When Did We Acquire All This Cash? was featured in the Financial Carnival for Young Adults and the Yakezie Carnival. […]

That is awesome. That is the result of hard work, right investment and proper distribution of your money. The best part is, you get to enjoy the fruits of your labor.

Eventually we will enjoy it! It’s difficult to decide the timing, though.

[…] The video this week made me realize that I’ve never even calculated what 3 or 6 months of expenses is for us! Obviously, I know our incomes for that amount of time and I’ve even calculated what an emergency budget would be for us if we lost one of our stipends. But I don’t actually know what we spend in an average month because the targeted savings accounts obfuscate our spending somewhat and Mint gets confused by all our transactions. If the TS accounts were perfectly set up and the net flow averaged to zero it would be easy to calculate our spending, but we have been over-saving into those accounts recently and built up quite a bit of cash. […]

[…] (i.e. getting low in our checking account in advance of our next paycheck)! Over the last year we’ve built up a ton of cash without meaning to. We’ve been keeping our noses to the grindstones so hard trying to finish up that we have […]

[…] if it would be so easy for us to live on his salary alone during my break. Then again, we do have kind of a ridiculous amount of cash on hand and could repurpose part or all of it to go toward living expenses for a limited period of […]

[…] have been applying to 2014) and top up the extra $218.04 from extra paychecks or savings (we have too much cash lying around, anyway!), going in evenly with the 8 scheduled payments. We’ll use savings from […]

[…] we have a bunch of cash accumulated in our savings accounts – not intentionally, but because we haven’t let ourselves have much of a life recently. As of […]

[…] is really just pure “wants” like travel, entertainment, a DSLR, and our CSA. Plus, we have a lot of money built up in these various targeted savings accounts, so we could probably spend as normal without saving […]

[…] given to us. In addition, we save every month into our targeted savings accounts and have accumulated a lot of money there because we overestimated our spending […]

[…] August and won’t be working full-time again until January. I’m glad that Kyle and I made hay by saving into our short-term accounts while we were both working because that has helped sustain us during my funemployment. The income […]

[…] salary in our Roth IRAs by age 28. Including our short-term savings, which we amassed almost without awareness through automatic transfers to our targeted savings accounts, we surpassed a net worth of $100,000 […]