July 2013 Month in Review: Money

I think this is a fairly representative summer month, spending-wise. We had a bit of travel (mostly paid in advance) and grills for groups of people twice. Spent way too much on groceries, not terribly a lot on anything else!

This was one of those months when I’m so glad for our general savings “nest egg” account – we dipped into it for the security deposit at our new place. If we didn’t have that account I guess we would have used our emergency fund…? But security deposits aren’t exactly an emergency. We agreed to pay our full September rent at our current place and we’ll have to pay half a month’s rent at the new place, so later in September we should be getting a big refund of rent and our current security deposit. The security deposit at our current place is $895 and the new is only $300 so we’re going to free up $595 (assuming we aren’t charged for anything)! Sweet!

This was also our birthday month so we got some nice presents from our parents. We need to decide what to do with our birthday money – our parents said “something fun!”

The Everyday Budget

Top-line items

INCOME: Our paychecks from our university plus

- $83.33 from Kyle’s side hustle, divided as usual

GIVING:

- 10%+ of our stipends to our church

- $50 to the missionary we support

- 10% of Kyle’s side hustle income

RETIREMENT SAVINGS: Our usual amount, 17%-ish.

Non-discretionary spending

Rent: $895.

Internet: $39.24. One note here that TWC is upping our modem rental fee so we are buying our own. I need to decide if we should route the savings to our Electronics account to repay ourselves for the modem.

Cell phones: Kyle’s usual $69.59; due to credits to my Republic Wireless account, we didn’t pay anything for my cell this month!

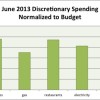

Discretionary spending

Groceries: Can’t get under budget two months in a row, even when I want to do it to buy some nice grass-fed beef! We were way over budget this month, especially with buying meat. We hosted two potlucks (providing the meat and some sides) so this is one of those months where our hypothesized hospitality targeted savings account would have come in handy!

Gas: Two fillups this month. We really should reduce this budget category, but we’ll probably repair my car soon.

Restaurants: Kyle bought a beer when we were out in celebration of a friend’s defense. After a long day at work, Kyle treated himself to a fast-food meal at a local chain known for its milkshakes. We went out to dinner for my birthday and to see a friend’s band.

Electricity and Gas: Under, yay! 79°F and off for four days FTW!

Water: Under, NBD.

Every month we have a few transactions that do not fall under either our budget or our targeted savings.

- We paid a $1.95 fee for sending the security deposit for our new place online.

Spending Out of Targeted Savings

Not a whole lot of traffic in these accounts this month except for the costs associated with moving.

Travel and Personal Gifts

We transferred $237.95 from this account to pay for the incidentals for our Madison trip.

CSA

We made five $12 transfers into this account, one for each week we picked up our box.

Cars

no spending this month

Entertainment

We paid $14 in cover charges to see a friend’s band.

Appearance

no spending this month

Medical

no spending this month

Electronics

Kyle spent $7.98 (after a coupon) on a new mouse. We also used $75 from this account to reimburse ourselves for the drum kit Kyle bought a few months ago.

Charitable Giving

no spending this month

Nest Egg

We used this account for our moving expenses – so far, $70 for the application and $300 for the security deposit. This account received the $75 reimbursement from the Electronics account. (Man, that account is always running a deficit!) We also added some cash birthday gifts to this account – we’re trying to decide whether to put them toward the camera or an iPad or some other toy.

Taxes

We added $19.17 to this account from Kyle’s side hustle paycheck.

Camera

We added $36.93 to this account from Kyle’s side hustle paycheck.

Budget Adjustments

None this month but I’m feeling like we should update several of these categories. Maybe after we move.

Bottom line: We had $91.88 left over this month! Not sure how as we were so over with our groceries!

Are you hosting people more often this summer and how is that affecting your budget? How are you responding to TWC’s modem charge increase? How much do you have out in security deposits?

Filed under: month in review · Tags: hosting, moving

July 2012 Month in Review: Money

July 2012 Month in Review: Money June 2013 Month in Review: Money

June 2013 Month in Review: Money August 2013 Month in Review: Money

August 2013 Month in Review: Money May 2013 Month in Review: Money

May 2013 Month in Review: Money

I think you meant 79°F not C :-0

Keep up the good job 🙂

Fixed! I only use Fahrenheit when talking about the temperature outside or in my house so I guess my default has truly switched to Celsius!

Actually maybe you should switch to Celsius 🙂 We desperately need to get consistent with the rest of the world, and Metric units are so much easier to use and convert!!

I’m 100% metric at work and almost 100% standard in my personal life. It’s silly!

I’m loving the referral credits! I shouldn’t have to pay a Ting bill until December at the moment. Pretty sweet!

I’m still waiting on my electricity bill for June/July. Normally it’s here for the end of the month. I feel like I’m waiting for my period and it’s late, haha.

Hosting people definitely affected my groceries spending this month! It was fun though and the real culprit was shopping for the BBQ while hungry… Oops. I don’t remember the last time I spent over $90 at the grocery store, let alone more than $40.

I bought my own modem early last year. Well, actually I got it from a coworker’s friend and he never really asked me for money and when I offered, he didn’t want it. So I got a free modem and didn’t have to pay the $7/month anymore. Sweet!

Wait, if you use Fahrenheit for talking about the temperature outside or in your house, what else do you talk about temperature for? Swimming pools? Stove? What else?

Leigh recently posted..2013 Half-Year Review: Spending

Yeah I love having the credits roll in! I don’t know exactly how many unused months I have, but it might very well take me to the end of my phone’s life/upgrade time.

Oh my gosh we spend over $100 almost every time we go to Costco! We call it the $100 store. We only go about twice per month, thankfully. We usually spend $30-40 at the grocery store as well. Shopping while hungry is definitely a huge downfall. It deserves its place in the “reduce your grocery bill by doing X” list.

I love getting other people’s perfectly functional cast-offs! That’s nice that he let you take it for free.

I talk/write about temperature fairly often at work – body temperature, water baths, process parameters. Always in Celsius. My international labmates speak about the weather in Celsius so I’m getting used to that as well.

Oh, I regularly spend between $0.20 and $10 at the grocery store 🙂 I do a lot of walking trips to grab one or two things. So > $90 was absolute insanity. I probably haven’t spent that much in over three years.

Ah, makes sense if you use them at work. One of the thermostats in my place is in Celsius and the other ones are in Fahrenheit, so I’m not sure where the Celsius one came from…

Leigh recently posted..2013 Half-Year Review: Spending

Birthday fun money = camera fund? That would definitely be fun!

The modem rental fees are pretty ridiculous in our area, so you’re pretty much always better off buying one online. We got our current one used and have been using it for the last 4 years, if we had rented it at $8 per month we would have paid $384 for the privilege. On a $55-$60 modem, break even is so short

Definitely the birthday money could go toward the camera. Or a vacation. Still not decided on that one!

We were on the fence about buying one a year ago and probably should have at the time, but the price increase definitely tipped us. Our fear was moving to a market that wouldn’t be compatible but we think it’s fairly unlikely.

Nice work on your spending. I’m intrigued by the cell phone credits. That’s great to have the cost covered by passive income!

Done by Forty recently posted..July Net Worth Update (In August…)

I guess I just put my review of RW out at a good time! I got a lot of referrals right then and they’ve been trickling in since through searches. The crazy thing is that we totally don’t need to have this cost covered because it’s so low to begin with. 🙂

I hate those online service fees for the “convienence” of paying for something online. They have since done away with it, but my local DMV used to charge a fee to pay with your credit/debit card even at their office!

Edward Antrobus recently posted..You Might Be Wasting Your Money on Organics If…

We don’t encounter fees like that very often, thankfully! We m

Normally would have run a check over to avoid it but it seemed time-sensitive.

I wish I could only spend $90 on groceries. I fairly routinely spend that much on my trips to the store a couple of times a week. I use some coupons where I can, but I have a soft spot (literally) for some of the fine meats and cheeses that they sell. Hard to turn those down when they are giving away such tasty samples.

Pension Retirement recently posted..Which is better? Defined Contribution vs. Defined Benefit Pensions

If you have the funds, why not indulge in the food you like?

You guys are really practicing some restraint with the restaurant budget. Way to go. Congrats on the new place, even if it wasn’t exactly your decision to move out of the old one.

CashRebel recently posted..Physics, Baseball, and Apple Pie

It seems our friends have really shifted from wanting to eat out at restaurants to doing big group things in homes, which I really like. But that does mean we’re spending more on groceries when we have people over.

Thanks! I’m glad we settled it quickly!

[…] @ Evolving Personal Finance writes July 2013 Month in Review: Money – This was a fairly representative summer month for us – too much spending on food and […]