How Do You Decide If You Can Afford a Purchase?

Lately I have been thinking about how to determine whether to make a purchase of a “want” and I’d love some feedback from you all about how you make that decision. One of the purposes of a budget, in my mind, is to help you make that decision. A budget gives you guidelines for what you want your spending to be, and then all you have to do when contemplating a purchase is ask yourself if it fits in the budget. When you use a budget, you don’t have to start over from the beginning and re-analyze all your available cash and upcoming expenses and so forth to decide if you can afford the purchase. But what about irregular expenses or big purchases?

Lately I have been thinking about how to determine whether to make a purchase of a “want” and I’d love some feedback from you all about how you make that decision. One of the purposes of a budget, in my mind, is to help you make that decision. A budget gives you guidelines for what you want your spending to be, and then all you have to do when contemplating a purchase is ask yourself if it fits in the budget. When you use a budget, you don’t have to start over from the beginning and re-analyze all your available cash and upcoming expenses and so forth to decide if you can afford the purchase. But what about irregular expenses or big purchases?

How We Currently Decide If We Can Afford Something

The system we have set up to help us decide whether or not we can afford a purchase is a combination of a monthly budget and our targeted savings accounts.

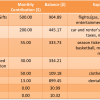

If the purchase falls within our normal monthly spending, we just check Mint to see how much of the relevant budget category we have already spent and the remaining room in that category determines whether we can make the purchase. The only categories we really do this for are groceries and eating out, since those are the only discretionary categories in our monthly budget.

If the purchase is one we have prepared for with our targeted savings accounts, we look at the balance in the account to see if we have enough cash to make the purchase. Examples of “wants” we prepare for with our targeted savings accounts are entertainment, travel, and electronics purchases. If we don’t have the money available in our savings accounts but we really want to make the purchase right then, we use some money from our general savings account and then repay the general savings account from the purchase-specific saving account over time.

This system works for us because once or twice a year we review our budget and the rate we save into each of our targeted savings accounts and make sure that the various types of spending are in balance. It’s actually quite freeing to just be able to check a balance to give a certain purchase a green or red light while having confidence that our overall spending is in balance with our other goals.

Without Targeted Savings, Are We Lost?

However, we are considering eliminating most of our targeted savings accounts in favor of having one more general savings account. The targeted savings accounts have been amazing for us over the last several years because our life and expenses were very stable. However, by the end of 2014 it’s likely that we will be living in another city with two new jobs and a 100% redone budget. It’s very difficult to predict our irregular expenses over this time period and we’ll likely have new, one-time expenses associated with job hunting and moving. We also want to make a few big purchases over the next year (a DSLR, some car repairs, and a major vacation).

But without our targeted savings accounts, we will be adrift in terms of deciding if we can afford certain purchases! We’ll just have a bulk of money and a high monthly savings rate with very little of it hard earmarked. Even with the large purchases we should set a limit of some kind but we’re not sure how to determine that limit. With the targeted savings, we can use the method of setting a savings goal for a while in the future and saving up every month for that purchase, but with all our savings pooled it will appear that we can buy anything (though not everything).

Big vs. Small Purchases

One option is to not let ourselves buy any “wants” so that we’re sure to have enough money for our big purchases, but that doesn’t sound like much fun! I don’t want to set up such a super restrictive plan. We could also set a dollar limit for all non-budget irregular expenses per month so that we will force ourselves to pick and choose which “wants” are the highest priority for that month. For the really big purchases like our vacation, perhaps we could use some kind of income or net worth guidelines to set the spending limit.

I want to come up with a reasonable method for helping us make that “can we afford it?” determination before we remove the structure of our targeted savings accounts. I don’t want to spend lots of time analyzing our finances and agonize over every “want” purchase.

How do you determine if you can afford a “want” purchase? What system do you have in place for your irregular expenses? How do you set a budget for a big expenditure like a vacation?

photo from Free Digital Photos

Filed under: budgeting, spending, targeted savings · Tags: afford, budget, irregular expenses, targeted savings, vacation, wants

Our Short-Term Savings Accounts

Our Short-Term Savings Accounts The Benefits of Targeted Savings Accounts – and Their Uncertain Future

The Benefits of Targeted Savings Accounts – and Their Uncertain Future Pulling Back the Veil on Our Daily Money Management

Pulling Back the Veil on Our Daily Money Management Do I Want a Camera or Subjects?

Do I Want a Camera or Subjects?

This is a great reminder that I need to get back to actually budgeting- right now I just track my spending and only say no to a purchase if I truly don’t need it (I just gently remind myself that I’m not making any money at the moment and that really curtails spending, haha).

For irregular expenses, I put them in their own “yearly expenses” category so that they don’t skew my monthly numbers but I can still track them throughout the year. It’s been working pretty well so far!

And as for vacations- I haven’t really taken any big trips so I’ve never had to budget for it. But I’d probably do a targeted savings account and put a certain amount of my “entertainment” money towards it every month!

I think it would be a fairly simple decision if you have no income – always a “no” to wants! But really, that can only go on for so long. Part of our problem is that we’ve been oversaving for certain goals but I’m hesitant to pull that money into the vacation fund – whereas if we’d never allocated it in the first place we would use it for vacation more readily.

I do something similar to Ashley – I calculate an estimated yearly total for irregular expenses (haircuts, new glasses or contacts, AAA membership and others) and then divide by 12 to add to my monthly budget. A good way of making room in the budget, at least for

In terms of calculating for big purchases, do you have thoughts on how to factor in “once in a lifetime” opportunities or the fact that you will likely have more freedom in terms of time and discretionary spending at this point in your life? For example, I have a large conference in South Africa next year where work would pay for travel and accomodations during the conference. It would be a huge shame not to take advantage of personal side travel after the conference, even though it might be a relatively large part of my budget or not make sense solely from a net worth/income side of things.

Yeah, that’s essentially what we do for our non-discretionary irregular expenses. But the discretionary irregular are the ones we have tried in the past to balance and don’t really know how to do that going forward. But also some of the non-discretionary ones are up in the air – for example, will our next workplace(s) require parking permits like we have saved for in the past? We don’t know!

My thought on once-in-a-lifetime opportunities is GO FOR IT. That is, if you really want to do the related travel in that area. You can find a way to make it work.

I think it’s important to rank your wants and compare them. My wife and I do this when we’re looking to make bigger purchases. Sometimes we look at it and decide it’s not really worth it. If it is then we pick a time frame and start saving for that goal. We end up making better decisions (i.e. going out to eat less or only 1 beer with dinner!) because we enjoy putting more money away.

Michael Solari recently posted..Do You Have an Investment Policy Statement?

Well, our #1 priority is not running out of money in case we are both unemployed for a while… but how do you plan for that? 😉

I’ve gotten kind of terrible at this lately. I just track every $ that is supposed to be in my checking account in a spreadsheet.

So for example, $350 of every paycheck this year is set aside for ‘Travel’. I let the budget line item be negative occasionally since there is so much buffer in my checking account and make sure to reset it to zero by the end of the year. I came up with the $350 number by calculating what trips I want to take this year and then dividing the estimate by 12.

As for want expenses, I try to evaluate whether I really need them and whether it is worth the $ amount versus sending that amount to the mortgage. For example, I finally got around to improving the master bedroom closets and that turned into a $2,500 project because I am outsourcing everything. I decided to go for it even though I hadn’t set aside any money for it because there was more than that much extra cash flow in my December paycheck. And now, I’m setting aside $100/month for home improvement just in case.

By taking many wants out of the budget (e.g. most clothing), it is forcing me to evaluate whether I would rather throw the money at the mortgage or spend it, rather than letting myself spend up to the amount set aside for the category.

Leigh recently posted..2013 In Review

I think it would make the decision easier for us if there were a good alternative for what to do with the money. For us, for now, it’s spend it or throw it into savings, where it will do no work (we hope) until after we’re settled in our next jobs.

I don’t know if you have a budget category for personal allowance, but that has helped us with wants. Each of you gets a certain amount each month to spend as you decide with no questions or discussions. Obviously, you could set it as high or low as you wanted. Regular things you could budget for, but if you found a great deal on new salad bowls or something that wasn’t planned, there you go.

For vacations, we are certainly not spontaneous. I already have ours planned out through 2015. We decide where we want to go and how much it’s going to cost to get there. I am really into credit card rewards now to pay for amazingly expensive trips that make our out of pocket very little. After you get established and purchase a home, you can take advantage as well! If we aren’t using points, you just start putting aside the amount you need every month until it’s trip time. Of course, if you don’t like to plan that far out, this does not work, but I guess you could just start setting aside an amount every month as you would with any other big expense.

Kim recently posted..Awesome, Easy Ways We Saved Over $2000 Last Year

Hey Kim, I just wanted to +1 both points you made! I know Emily and Kyle share all accounts, but I think earmarking two accounts as a ‘personal’ spending system might work on the small wants like eating out, or a new top etc.

SarahN recently posted..Waste Wednesday – a normal week

That would solve the problem of disagreements between spouses on which ‘wants’ to buy, but we’re not in disagreement. We might add a line item for general discretionary spending month-to-month for both of us, though.

We don’t do personal allowances. We just have a lot of targeted savings for our wants and some slack in our budget every month for miscellaneous things (about $40). We’ve been pretty successful in anticipating every large-ish purchase (>$30, perhaps) by keeping our targeted savings categories broad. But if we went to a general savings, perhaps we would expand our miscellaneous category to a few hundred dollars.

Wow, I would love to be able to plan out vacations so far in advance. Our flexible vacation from work cuts both ways, I guess. That certain would help for travel hacking. We just save a lot each month right now for travel without specific plans for how we’re going to spend it.

Other than our targeted savings account for vacations, everything just gets put in the context of the monthly budget. If there are items that throw our monthly savings rate off our goal, then we lean towards not purchasing them. Not a perfect system, but it works well enough for keeping us on the overall path of a specific savings rate.

Done by Forty recently posted..Should We Pay Personal Capital to Advise Us?

Do you have many significant irregular expenses? We started ours to handle season tickets, travel, and car insurance, for example, but we’re not buying season tickets for next year… but maybe we will after we move… ugh! If we didn’t save for a lot of different goals every month, though, we could handle any one of these irregular expenses with 1 month’s savings rate.

And this is one reason I don’t do a traditional budget. I set savings goals, over an annualised or quarterly period. This way, I know I need to have $x by a certain time, but one week I might add nothing as my discretionary spending is high, but the next week, I’ll need to save more.

For example, when I bought an apartment, I knew I’d have up to 6 months of unplanned expenses – furniture, homewares, DIY modifications and the like. I couldn’t accurately budget it all. So I set a savings goal for my bills (which include $1200 per quarter, so quite high), and one for my annualised health insurance premium, and then a very low savings target for ‘general’ savings (essentially an oversized emergency fund, which I take from for holidays if it’s big enough).

It worked, because I always had my eye on the longer term savings, so I didn’t spend big every single week (I get paid weekly, adjust to your pay period).

As far as big wants and little wants, I think a $ limit might work. Anything under $10 or $20 is OK, I know Emily, you are probably pretty disciplined. Things over that amount need some reflection on the need/want basis.

SarahN recently posted..Waste Wednesday – a normal week

That’s a good suggestion to get us through this transition period – thanks for sharing. We can get back to whatever system we like when we’re settled later on.

I guess what I don’t like about the low dollar limit over which to give more consideration is that a lot of small purchases add up just as fast as an infrequent larger one. I think I’d rather have a monthly limit for miscellaneous purchases than – though you are right, we are pretty disciplined about spending so we probably wouldn’t buy a bunch of small stuff anyway.

1. (Regular) Irregular expenses aren’t budgeted for and are just taken out of the budget leftovers every month or a target savings for things that come up (a set % of budget leftovers goes to this every month).

2. Vacations are paid for out of a targeted spending account (a set % of budget leftovers every month goes to this).

3. Wants are paid for out of monthly fun money budgeted for every month. I know that if I want to buy some clothes, I won’t be able to go out to eat as much or go to the movies. If a want will take out the month’s fun money, it can be divided among the next few months (eg season bball tickets), paid for out of the targeted savings account that accumulates budget left overs that we spend on things that come up (eg a new tv, gifts, or irregular expenses), or paid for out of that month’s budget extras (really only happens for wants that are almost needs, like a new bed).

Yes. This is how I do it too.

Also, I think habit is a pretty strong force. Unless your income decreases a lot, in which case you’ll obviously have to be more conscious of everything, the standard of living you are used to at this point is one you don’t necessarily need targeted savings accounts to stick to.

That’s a good point. We’ve established really strong habits here and can just keep it up without all the artificial barriers until we’re settled in a new place and have a new budget.

I think your fun money system is what we should probably shift to for the time being. If we need new clothes, we don’t get electronics. 🙂 We would then have a general savings account catches all budget leftovers and can serve as a buffer.

I think that the question you are really asking is more evaluating the value proposition than purely a budgeting question. In theory, if you have $200 a month to spend on entertainment, then yes you can buy $200 concert tickets. But that decision also comes with the choice that you will not be spending one red hot cent on any other entertainment activity this month. Say no to spontaneous invites for drinks, movies, etc. (or whatever your usual suspects in this category are) for the month. If the concert tickets are worth the sacrifice for the rest of the month, then yes you can afford it. If giving up the flexibility for the month is not worth the value you gain from the tickets, then no you cannot afford it. See, really all about the value of what you are looking at. Another example is one blogger I read who admits to eating lunch out with friends and colleagues most of the week. An expense she feels she can afford by making the choice that dinner is usually cereal or ramen. Her budget balances and she is happy with her choice, therefore yes, she can afford it.

This inherent analysis is something that we do every time we check our actual spending against our budget on an interim basis. We may not even acknowledge the full though process involved. It can be a problem in a case such as yours where you have one category for several large expenditures. The “thinky” way to solve the problem is to create a side budget for your large planned expenditures. Sit down and figure what DSLR you want and how much it should cost. Build in a little contingency if you want. Do the same for the car repairs and the vacation. It doesn’t have to be set in stone, but you need benchmarks to work with. Then, if we are being really “thinky” about this, put estimated purchase dates beside each desired item and amortize monthly.

At this point, when you ask yourself if you can afford yet another thing from your planned spending account – all you need to do is determine if you are on track to meet your purchase goals. If yes, and you can pay for something extra, you can afford it. If you are ok to move the purchase date on the camera or vacation to make the math work, you are still good. When the math stops working, you can’t afford it.

I like this method because there is nothing wrong with deciding to put 50% of your income towards something epic, if you are prepared to live with the trade offs to do it without debt. If your big vacation plans on finishing your thesis are to backpack Southeast Asia for months or stay at the Ritz in Paris for a few days, start figuring out what it will take to do it.

You are making a great point here about what we are really doing when we evaluate purchases.

Our targeted savings accounts do serve as the repository for goal-oriented saving as you have outlined, but the part we have trouble with is the estimated purchase date. For example, we saved for some car repairs that we were quoted over 1 year. Well, we’ve pushed back the repair date for an additional year (and counting) and not really reduced the saving rate because of uncertainty, so now we have way too much saved for that repair. We also save quite a bit toward travel without specific trips in mind because we do mostly obligation travel and aren’t really in control over when/where we travel (except to say yes or no). For instance, we recently bought two flights with about 1 week notice of the invitation.

This existing problem with our wishy-washyness over dates is compounded by the uncertainty of where we’ll be living and so forth toward the end of the year and specifically how long we’ll have to live off of savings during job transitions. So what we can normally afford with jobs maybe we can’t afford without a job lined up.

That sounds like a lot of excuses but I really am taking your point! We need to consider affixing hard end dates to our goal saving and budgets to our big discretionary spending like the traveling and camera.

We have a healthy amount in our budget for various “wants”, but in general don’t stress about it. We’re both good about making sure it’s something we want and will use, but don’t really even consult the other person to let them know unless it’s over $100 or so. (And those are fairly rare and usually talked up for months…)

I think for most people who aren’t in a negative cash flow situation, yourself probably included, it’s not a matter of if something can be afforded, but what you’re prioritizing it over. As long as you’re comfortable with your priorities, it seems there’s not much of a question.

Mrs. PoP recently posted..Pimp the PoP’s Garage – Part 5 – Bringing It All Together

My inclination is not to prioritize saving for possible unemployment. I think that inclination might be wrong. 🙂

I don’t have a definitive method of determining whether I can buy things not in my budget. I usually use my feelings of guilt to my advantage. If I think I will feel guilty for buying it because I could’ve paid extra on my student loans or put towards my savings, then I don’t buy it. Though, I will have to find a method soon when my boyfriend and I combine our finances. I’ll be interested to find out what will work for both of us!

Janine @ MoneySmartGuides recently posted..5 Ways To Stick To Your New Year’s Resolutions In 2014

I actually think the guilty conscience thing would work well for us because we have a good track record of living below our means in our current situation.

I love using targeted savings accounts, but we don’t have them for everything. For example, if we wanted to buy a new digital cell phone, we don’t have any thing specifically saved for “electronics” or anything like that. But since we have plenty of money saved, and we also have an “other” line item in our budget, most of our decisions aren’t made with a whole lot of precision in terms of monthly budgets. We basically just feel like our regular habits are good enough that we don’t have to worry too much about most of those kinds of purchases.

Matt Becker recently posted..5 Reasons a Roth IRA Might be Right for You

You probably don’t desire to buy electronics as often as we do. 😀 What percentage of your monthly budget is that “other” line?

For large purposes, we start saving before, so the answer on whether we can afford it is pretty simple, as we just look at how much money we have saved for the goal, and compare it to the cost.

Money Beagle recently posted..Could We Cut Cable TV This Year?

That’s what we’ve been doing for the past few years, but now with this upcoming transition we think the money we’ve saved perhaps should go toward a fund for unemployment/job searching.

Like some others have commented, we rank our wants. I currently don’t have any wants other than to save as much as possible toward our retirement. I do know that I will have to have our 4WD pickup serviced soon at 120k miles. That will probably cost around $1,000 or more. We can just cash flow that, though. We do have a vacation planned in July of this year at Lake Tahoe, but we have already prepaid for the condo rental. Other costs for the vacation should be easily cash flowed. We do some dedicated saving if we know a big-ticket item, like a new car, is in our future.

Bryce @ Save and Conquer recently posted..Fighting Consumer Fraud with the Consumer Financial Protection Bureau

That’s great that you have one big goal and then the occasional smaller goals. I have been very tempted to throw money into our long-term savings but I don’t want us to run out of cash!

[…] 2 made a very helpful observation to allay my anxiety over how to decide if we can afford a purchase: “I think habit is a pretty strong force. Unless your income decreases a lot, in which case […]

[…] @ Evolving Personal Finance writes How Do You Decide If You Can Afford a Purchase? – We currently use targeted savings accounts to save up for goals, but we are considering […]

[…] How Do You Decide If You Can Afford a Purchase? was featured in the Carnival of Financial Camaraderie. […]

[…] How Do You Decide If You Can Afford a Purchase? was featured in the Carnival of Money #15 and the Carnival of MoneyPros. […]

[…] @ Evolving Personal Finance writes How Do You Decide If You Can Afford a Purchase? – We currently use targeted savings accounts to save up for goals, but we are considering […]

[…] presents How Do You Decide If You Can Afford a Purchase? posted at Evolving Personal Finance, saying, “We currently use targeted savings accounts to […]

[…] or charge it to a credit card, you feel a need to shop and don’t factor in whether or not you can afford it. In many instances, you don’t care how much debt you accumulate. This is a clear sign that […]