Oops, We Need to File an Estimated Tax Payment This Month

When I wrote about how to have a financially successful first month of graduate school back in August, I added to my editorial calendar for this January a post on how to file estimated tax payments. I thought that would be perfect timing for those first-year grad students to consider filing estimated taxes on the fellowship money they’d received in their first semester, if they didn’t set up withholding. I never considered at that time that Kyle and I would need to take out own advice and file an estimated tax payment in January! I haven’t had to file estimated taxes since 2008.

When I wrote about how to have a financially successful first month of graduate school back in August, I added to my editorial calendar for this January a post on how to file estimated tax payments. I thought that would be perfect timing for those first-year grad students to consider filing estimated taxes on the fellowship money they’d received in their first semester, if they didn’t set up withholding. I never considered at that time that Kyle and I would need to take out own advice and file an estimated tax payment in January! I haven’t had to file estimated taxes since 2008.

There were several small pieces that added up to requiring us to file an estimated tax payment, without any one of which we probably wouldn’t have to.

1) We always keep our withholdings on the light side.

We’d rather keep more of our pay in our month-to-month budget than get a big refund every spring. Since we’ve been married, our withholdings have been such that we get very close to nothing owed nothing due every April 15. We usually owe less than $100 to the federal government (over our withholdings) and get a couple hundred dollars back from North Carolina.

2) My withholdings are even lighter after switching payroll systems.

Last August I was switched from my university’s compensatory payroll system to the non-compensatory payroll system. Apparently when I redid my W-4, I reduced my withholdings (why are those forms so hard to fill out the way you want?) and I noticed in my next paycheck that even though my gross pay increased slightly, my withholdings went way down. We decided to start transferring $40 monthly to our Taxes savings account to make up for the withholding deficit.

3) Kyle doesn’t have income tax withheld from his side income.

Kyle’s been running the sound board at church approximately every third weekend this year, which brings in around a hundred dollars per month. This is the first full year he’s had this little job. He isn’t having any income tax withheld, so with every paycheck he receives we transfer 23% to our taxes savings account.

4) We made a small amount of money from EPF in the fourth quarter that we need to pay taxes on.

People have been signing up for the travel credit card we both churned through our affiliate links, so we had a bit of income from EPF in December 2013. It’s enough that we have to pay income and self-employment taxes on it.

If I hadn’t just recently looked up the requirements for who needs to file estimated tax, I wouldn’t have even thought that we would qualify. Without any one of the above situations, we probably wouldn’t need to, and the EPF income is the most recent sort of surprise income. We owe more than $1,000 in taxes every year (please see update 2 below for clarification on this), so we definitely met that requirement. But to determine if we had already had withheld 90% of the tax we owe this year or 100% of the tax we owed last year, I had to sit down and draft our taxes.

It really wasn’t too complicated or difficult because for EPF we just need to file the short/easy forms since we’re not trying to take crazy deductions. I just looked over this year’s 1040, the Schedule C EZ, and the short Schedule SE and made a quick Excel spreadsheet to draft the relevant lines.

I actually underestimated the amount of tax we will owe when I drafted our 1040; I didn’t include our interest and dividend income since I haven’t received those forms yet, but that won’t shift the picture much and is more conservative. We haven’t received our W-2s and 1099 yet, but I just looked at our latest pay stubs to see our gross income and withholdings.

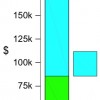

In my quick calculation, we owe $4,964.30 in federal taxes (this will actually come out slightly higher in the final version). We’ve had $4,337.08 withheld (this I know for sure). That means that we only have had withheld 87% of our taxes due, not meeting the 90% threshold. Glancing at our return from last year, I see we paid $4,442 in taxes, so we are just shy of having had 100% of last year’s tax due withheld this year. So yes, we do need to file an estimated tax payment to avoid a fine.

I think we could just pay $105 to get above 100% of what we owed last year, but we’ll pay a bit more in estimated tax to be in a safe range. I think we’ll owe a bit over $600 in additional federal tax this year, so anywhere between $105 and $600 is reasonable and we’ll shoot for the middle of that range, making up the rest by April 15.

I think we’ll be okay on our NC taxes as we usually get a refund, but I’ll check up on their requirements to see if we need to file estimated tax with the state as well.

When we do our 2013 taxes for real, we’ll follow the same protocol we did last year. 1) We’ll draft everything just in Excel based off the 1040 and other relevant forms to make sure we have all the numbers and documents we need and to come up with taxes owed. 2) We’ll use some free tax software (TurboTax, TaxAct, etc.) to do all the same calculations to make sure that we didn’t miss any relevant credits or anything (like we have in the past). We’ll reconcile these numbers with our own drafts. 3) We’ll use the IRS’s free fillable forms to create the PDFs that we will actually file.

This may seem like too much work, and certainly we could get away with only using tax software. However, I like to understand how our taxes are calculated, which I think I can best do by doing them myself, and tax software doesn’t always automatically understand the nuances of the grad student’s situation and I don’t want to let it make any mistakes. But I want to have something else checking my calculations because we aren’t always up on the latest changes to the tax code and what we might be eligible for, and the cheapest way to do that is with tax software.

Now that I’ve written two posts about estimated tax, I need to do the actual filing! Update: Done! Filed! Off my mind!

Update 2: In rereading this page, I realize now that I misinterpreted the $1,000 owed issue. I interpreted it in the post above as being if you owed less than $1,000 in total tax for the year you do not have to file estimated tax. However, I now see that the $1,000 is in additional tax owed, above the withholdings. “Generally, most taxpayers will avoid this penalty if they owe less than $1,000 in tax after subtracting their withholdings and credits, or if they paid at least 90% of the tax for the current year, or 100% of the tax shown on the return for the prior year, whichever is smaller.” So since I calculated that we only owed approximately an additional $600, we wouldn’t have been fined (probably). But we’re okay that we filed the estimated tax payment anyway. I’ve also edited my post last week on estimated tax to make this more clear. Sorry for misleading y’all! I’m not a tax professional and I’m always learning!

Do you draft your taxes before January 15 to see if you need to make any adjustments? Have you ever realized after the fact that you need to take your own advice?

photo from Free Digital Photos

Filed under: taxes · Tags: estimated tax, withholding

How to Calculate and File Estimated Tax Payments

How to Calculate and File Estimated Tax Payments Tax Lies Told to Graduate Students

Tax Lies Told to Graduate Students Our Experiences Using Tax Software

Our Experiences Using Tax Software Marginal Tax Brackets, Deductions, and Credits Explained Graphically

Marginal Tax Brackets, Deductions, and Credits Explained Graphically

Wow, that’s an interesting situation. I believe I don’t have to worry about it because I withhold more than I need to typically. I always get a refund at the end of the year.

But now you’ve got me worried about self employment tax. I honestly didn’t know I had to file a separate form if I earned money from my blog. I only earned about $100 in 2013, but I guess that’s enough that I’ll have to look into it. Do you have any posts, or know of any posts that explain this?

Cash Rebel recently posted..2013, a year for progress

There probably are posts, but I prefer to go straight to the source (I assume you are a sole proprietorship): http://www.irs.gov/Businesses/Small-Businesses-%26-Self-Employed/Sole-Proprietorships

At the level we’re working at, I actually find the IRS website very readable.

If you made around $100 you won’t have to pay any SE tax (though I guess you should fill out and perhaps file Schedule SE?) so it will just be the normal income tax, and you calculate that on the Schedule C (-EZ, in our case).

Everyone else: Did I miss anything? Should I write a post about this??

While I didn’t earn anything from my blog unless you count the few dollars from google adsense, I’d like to know how to do this if I actually earn money in the future. So yes, please write a post! =)

I am intrigued about taxes and try to understand them rather than just give them to an accountant or tax preparer like most people I know do. But the issues do get somewhat complicated. So do you HAVE to file estimated taxes or is it just something that prevents you from getting a large tax bill at the end of the year?

Andrew@LivingRichCheaply recently posted..Shamed For My Frugality

Well, you need to pay income tax on your Google Adsense earnings (if they were paid out).

I do think it’s useful to understand taxes – to a point. Right now our taxes are not so complicated that we can’t handle it with only a bit of time invested. And every year when we add some new twist (like SE income this year, taxable investments in previous years) we learn something additional. However, once our situation gets really complicated or time-consuming, we will likely outsource the work because we don’t aim to become tax experts. However, I think we’ve already learned enough about the tax code to be functional in life (marginal tax brackets, credits vs. deductions, etc.).

So generally, the IRS wants to receive the money you will owe it as you earn it throughout the year. If you fail to pay it in a timely manner enough of what you will eventually calculate that you will owe, it can fine you. But if you get pretty close it’s OK – pretty close being if you owe less than $1,000 you’re off the hook, or if you withheld more than you paid in the previous year you won’t be fined, or if you withheld 90% of what you owe in the current year you won’t be fined. Our 87% withheld didn’t meet the IRS’s standard so we have to pay at least that additional 3% to avoid a fine.

Update: Your comment made me look back at the $1,000 language and I realized I misinterpreted it! I updated the post above (update 2), but no we actually didn’t need to make the additional payment because we only owe around $600 (<$1,000) this year above our withholdings.

I just did a draft of my taxes too! I mostly just do it now because I find it fun 🙂 I have a spreadsheet that estimates my tax liability throughout the year and where I should set my withholdings. It looks like I should get a $200 refund this year.

Next year, however, I’m worried I won’t have enough withheld even with my allowances set to 0, especially since my tax liability will most likely go down since my income most likely will (less stock vesting). My itemized deductions will most likely balance those out, but I don’t like to count those until I’ve actually paid enough to itemize more than the standard deduction. I’m just going to leave the allowances at 0 for now and re-evaluate after each stock vest. If anything, I’ll just file a new W-4 with my employer, which I can do online, and ask them to withhold more taxes from my paychecks, rather than paying estimated taxes.

Leigh recently posted..Reflections on Home Ownership: 18 Months In

Note: the problem with the stock vests is that they have 25% federal tax withheld, but they should be having 28% federal tax withheld. That’s over $1,00 in taxes not withheld on that income.

Leigh recently posted..Reflections on Home Ownership: 18 Months In

I found it to be fun, too! How long do you think you’ll keep doing them yourself (or do you pay for a final version)?

I think I’d rather file the estimated taxes than mess with W-4s – like I said above, I can’t really tell how to fill them out correctly! I have more control with estimated taxes, but would have to remember to do it.

I actually paid someone to do my taxes the first couple years I was working. For 2011, it cost me about $500 due to some complicated tax situation that will probably never go away. So, it seems better to do it myself. I did use TaxAct last year because I had some issues with free file fillable forms. I might do that again this year or I may try free file fillable forms first.

You’re right – paying estimated taxes might be easier. I’ll see how things go in 2014 and I may just do that.

Leigh recently posted..2013 In Review

I’m sorry you had to do this, but good catch! I hate that there’s a penalty for underpaying throughout the year, but no benefit to the taxpayer if they get a huge refund at the end of the year. Seems a little one sided, to me, but not entirely surprising.

Done by Forty recently posted..What’s it Like in America?

Very one-sided!

Like you, we try to adjust our withholdings on our pay to come out with just little bit still owed in federal taxes and a little back from the state. That being said, we typically get enough in dividend payments in our taxable investment account that we need to file January estimated tax payments.

Bryce @ Save and Conquer recently posted..DIY Home Inspection

That’s cool, and at least it only happens once per year. We got some sweet dividend payouts this year, too, but inside our IRAs.

No, I just pay whatever they say to pay regarding estimated taxes, unless we have a bigger untaxed income shock (which would be like a thousand dollars or more). I also withhold more than we need to as a cushion– we always have taxable dividend income and I don’t really keep track of it since it mostly drips.

Our taxes are pretty complicated so even our AGI comes out as a surprise each year.

nicoleandmaggie recently posted..Recommendation for a women’s briefcase?

Sounds like you have a system that works for you, even if it’s unsettled until tax-time!

[…] @ Evolving Personal Finance writes Oops, We Need to File an Estimated Tax Payment This Month – I never thought when I wrote a post explaining estimated tax that I would need to take my […]

[…] Oops, We Need to File an Estimated Tax Payment This Month was featured in the Yakezie Carnival. […]

[…] made our month kind of wacky! We paid the rest of the federal tax we owed (after our estimated tax payment from January) and finally brought “home” our EPF income from 2013. We were waiting on […]