My Inappropriate Reaction to Being Asked, “Do You Coupon?”

Last week I was standing around with a group of friends and one of them brought up my blog and asked some critical questions about my having PF as such a huge hobby, so we were chatting about those concepts. (It’s so fun to have my IRL friends know about this blog. I love connecting with them over this unusual but revealing topic.) An acquaintance that didn’t know about EPF walked up to us and my friend started talking up my blog to him. (What an ego boost!) The acquaintance asked what I blog about and I said personal finance.

The next words out of his mouth were, “Do you coupon?”

The next words out of his mouth were, “Do you coupon?”

I laughed out loud while saying, “No, no!,” shaking my head, and waiving my hand from side to side.

Oops. Open mouth, insert foot.

I then apologized and said, “No, we don’t coupon. But it’s not necessarily a waste of time, it just depends on your shopping habits.”

Double oops. Second foot’s turn.

He didn’t say anything further to me about PF.

I try not to shut people down around the subject of money. Before I started blogging about PF I had ideas about how money should be handled, and blogging has simultaneously helped me crystallize those ideas and exposed me to communities of people who have very different ideas, much more so than what I encounter IRL. So I strive to be respectful of diverse positions on PF while getting my views across. (For example, in my post on joint finances from last week I tried to talk up joint finances while avoiding bashing other money management systems.)

The interesting thing about the coupon question specifically is that it’s one I’ve slightly shifted positions on because of the influence of the PF blogosphere. Had this acquaintance asked me if we coupon two years ago, I would still have said no but I wouldn’t have laughed.

I have tried grocery couponing in the past. Not in an extreme or particularly coordinated way, just dabbling. I subscribed to Coupon Mom and while I clipped occasionally online I never went so far as to order a Sunday paper for the coupons. Last year, I tried for several months to reduce our grocery costs by keeping a price book, paying attention to sale cycles and shopping at ALDI, which was an abject failure. For our style of eating (low-processed, generic, high-volume), coupons are fairly irrelevant and Costco offers great value. So about a year ago I gave up on complex, time-consuming strategies to reduce our grocery spending and just try to keep an eye on our budget, delay purchases when possible, shop at Costco regularly, and avoid waste.

Some people like to coupon and are very successful in reducing their spending. But I think you have to be quite careful about the value you’re getting for your time. This is the point on which the PF blogosphere has most influenced me: shifting my thinking from ‘spend less’ to ‘earn more.’

As a dual grad student household, we are kept at a low salary level without the possibility of receiving anything more than cost-of-living raises and are not allowed to hold outside jobs. In that situation, it makes sense to focus on reducing expenses, which we have done successfully.

But with the influences of all the industrious PF bloggers I read and our impending graduations, my mindset has shifted to how to earn more sometimes instead of spending less always. Cutting coupons in particular is a stereotypical example of a time-consuming activity that produces a small spending reduction in comparison with what could be earned if the coupon-cutter spent the time freelancing or working on a side business. (Whether or not that person actually has or would start a side hustle is a legitimate question, of course.) It also really came out of left field – no one I’ve told about EPF in the past has asked about couponing.

Even with all those thoughts swirling in my head when this acquaintance asked me if I coupon, I think the core reason that I laughed was that I imagined him picturing EPF to be a stereotypical couponing (mommy, though he knows I am not a mother) blog with the giveaways and the bright colors and graphics and absolute lack of interesting-to-me content. I don’t follow (you can’t even use the word ‘read,’ can you?) those types of blogs and I didn’t want him to have the idea that mine was like that. So when I laughed and denied it, I was moreover denying being a coupon blogger than I was the practice of couponing.

Of course, my acquaintance didn’t understand the furor his question provoked in my mind. He just saw me laughing at his question and dismissing the practice he inquired about. Since I don’t know him well, I’m not sure if his family coupons. Maybe it is a big hobby for them or a method by which they make their budget balance. I feel terrible that I may have shut down future conversations with him about PF by my careless reaction. In the future, I need to be more sensitive to the possible opinions and practices of people I don’t know well to keep from discouraging them.

Do the people you interact with IRL have very different attitudes about money than your or your blogger friends do? Have you ever laughed at a financial practice and did you regret it?

photo from Free Digital Photos

Filed under: blogging, frugality · Tags: coupon bloggers, couponing

How to Cut Your Food Spending – Scaling Back on Eating Out

How to Cut Your Food Spending – Scaling Back on Eating Out Using Upromise to Pay Down Student Loans

Using Upromise to Pay Down Student Loans How to Cut Your Food Spending – Reducing Grocery Costs

How to Cut Your Food Spending – Reducing Grocery Costs Blog Statistics Update December 2012 – January 2013

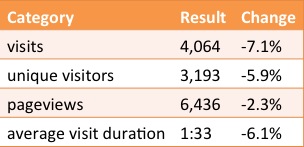

Blog Statistics Update December 2012 – January 2013

I am the same way as you. I actually do use coupons (to a limited extent) but only on household items like TP, and deodorant/lotions, etc. I will be the first to admit that I used to use them heavily, but with it only being two of us, the fact that we don’t eat a lot of processed foods, and that I was busy writing my thesis, the time spent was not worth the reward. I never really picked them up after that, except for one or two, here and there.

I’ll admit I did laugh at one of my friends because she was saying her and her fiancé couldn’t save anything in their new city when combined they make over $130k. They don’t have a car, and their student debt isn’t that severe (one of them has $30k, as of two years ago). Also, their overall taxes are much lower, BUT it’s a higher cost-of-living area. Even with taking that into account, their DINK lifestyle was eating into their budget a lot more than they thought. Yes they aren’t making a ballin’ $125k each, but it’s still a good amount of money for the two of them… they just want a certain lifestyle at the expense of saving. I had to back-pedal a bit because she wasn’t happy with my snicker… I’ll admit it wasn’t nice of me, but now that I’m so used to carefully watching my finances, I can’t imagine making that and saying “well I can’t save!”… even with a higher COL.

Alicia recently posted..Handling Criticism.

I think the laughter is really worse than whatever actual words came out of our mouths! I think in your situation – if I could have controlled my reaction – I would have questioned her conclusion and offered to either coach her on her budget/spending or give some general ides for how to prioritize savings and then cut expenses.

I’ve never been a couponer. Every now and then when I have a big purchase I want to make I’ll look quickly online for a coupon, but that’s about it. Most of it is honestly just laziness and not wanting to put all the effort in, though I do realize that part of that is simply being lucky enough to not be in a position where those dollars would really change my situation in any significant way. Still, I’m with you. I’d rather spend my time trying to earn more money.

Matt Becker recently posted..The Stock Market is Falling! In Other News, Grass is Green!

We for sure look for codes online for free shipping or a certain percentage off an order, but I think that is very different from clipping coupons for groceries and household items – both because of the frequency of the purchases and because the former types of promo codes are usually general whereas coupons are usually item-specific and therefore require a lot more organization and time commitment. Now that you have a side business I’m sure the equation swings to “earn more” for you – for me it’s not as clear!

I recently put my foot in my mouth when talking to a neighbor. I was lamenting that we had managed to save only $14 that month. I was embarrassed about even admitting that we had saved so little and had such a rough month financially. She just looked at me and said, “You ended the month in the black?!? That is amazing! How did you do that?”

On the coupons- my sister uses a lot of coupons. She really enjoys couponing- for some people, it really is an enjoyable hobby, I think you have to enjoy it for it to make sense. I do not use coupons because we buy really basic food and I make everything from scratch. I really enjoy making things from scratch, and I think you have to enjoy it for it to make sense as a way to save money, My sister and I spend about the same amount on groceries (per person- she has a bigger family.) So we get to the same place, even though our families eat differently. The time that she spends hunting down coupons is just time that I spend making bread and yogurt.

Was she amazed because she is going deeper into debt every month or because of all the challenges that were thrown your way in that specific month? I might be impressed about you ending in the black if I knew a lot of details about it, you know?

I’d rather have the homemade food too – like you said, it’s really about what you enjoy and I do enjoy cooking!

She said that she could not remember a month that they ended in the black, so that was why she was amazed. She was talking about paying off credit card debt and I was trying to be really encouraging and I said, “yeah! just wipe it all out!” And she said, no, she is just trying to “make room” on one of the cards by paying off several thousand. Then she intends to run it up again. I had never heard of anyone doing that on purpose. I guess for many people, consumer debt is just a given.

That is pretty incredible. I hope you rub off on her a bit!

I don’t coupon at all – in fact, I find that many times coupons will get me to buy things that I wouldn’t normally have purchased. That said, I know many people can get value out of coupons, especially if they have a good system going.

Well Heeled Blog recently posted..Flying… it costs big bucks to make a small world

In many instances coupons are really advertisements!

The only time I coupon is when I shop on Amazon and a “clip this for $2” coupon comes up with the item I’m purchasing (usually bath products). It seems like mostly a waste of time and effort for minimal return when I could spend that same time generating income instead of scrimping. BUT — I get your point about feeling about. I had a similar incident when I said something offhand about thinking people are idiots for not contributing to our company’s 401(k) program and a guy in the group had been there 2 years and still hadn’t opened his 401(k)… Whoops!

Hopefully the acquaintance will come check out your blog and see this post.

Broke Millennial recently posted..Being Debt Free: The Story of How I Have Minimal Credit History

Yeah that is a real slip, but I can see myself doing something similar. Maybe he was being an idiot or maybe he had a great reason (paying off debt??). I hope at least something positive came of your comment, like if he opens his 401(k).

I’ve stuck my foot in my mouth more than once, on PF. I like to think that I’m pretty open minded, but that’s kind of a lie. I think I’m right, just like a lot of folks. So kuddos for you for pushing for more open mindedness.

Done by Forty recently posted..Give Yourself Credit (Progress is PROGRESS)

Wellllll… I just want the topic to be discuss-able so I can get my opinions out and maybe help some people. Or learn – that’s happened, too. 🙂

I’m not much of a couponer either. First of all, in NYC there’s only a few places that are really accessible so I can’t just drive to the store that has the coupon. Secondly, I don’t want coupons to tempt me into buying something I don’t need, so I only look up coupons once I KNOW I’m buying something.

Stefanie @ The Broke and Beautiful Life recently posted..Four Reasons Races Make Better Investments than Gym Memberships.

I agree about only looking up coupons after the decision to make the purchase has been made – great strategy.

I use coupons for things I know I’ll use. I just got my parking for my vacation reduced from $16.95 a day to $13.95 a day by searching for a Parking Spot JFK coupon on Google. If I know I’m going to use something soon, I’ll try to search for a deal. Otherwise, like you say, it’s a waste of time. The $18 I saved on parking definitely was worth the minimal effort I used to find the coupon!

Tara @ Streets Ahead Living recently posted..I had my first “free” vacation

Using that kind of coupon is very different from grocery couponing, which is the one you really need that complex system for. We definitely search for promo codes before every time we make a purchase. That’s a great savings on the parking!

[…] @ Evolving Personal Finance writes My Inappropriate Reaction to Being Asked, “Do You Coupon?” – I made the mistake of shutting down an acquaintance for asking if I coupon when he found […]

[…] My Inappropriate Reaction to Being Asked, “Do You Coupon?” was featured in the Carnival of Financial Independence 51st Edition and the Financial Carnival for Young Adults. […]

[…] @ Evolving Personal Finance writes My Inappropriate Reaction to Being Asked, “Do You Coupon?” – I made the mistake of shutting down an acquaintance for asking if I coupon when he found […]