Living on One Income: What to Do with the Other?

With Kyle’s and my new phase of life comes a new phase of our budgeting methods. We are trying to live on Kyle’s income alone for all our expenses and save my income.

“Living on one income” (for two people) has always sounded nice to me but also a bit vague and arbitrary. Which income would you choose to budget around? What if the incomes are highly skewed? How do you account for taxes and saving for both incomes?

In our case, living on one income is not some great savings achievement but a pragmatic choice. Kyle is salaried; I have a low and irregular income. For stability and confidence, we should live on only his income, just in case I don’t get paid in a given month or quarter. (In fact, I have decided not to pay myself from my business until the end of the year.)

With our current budget, we can almost make it with Kyle’s income alone. Our irregular and/or miscellaneous expenses might be a bit high – it’s difficult to tell in advance. So I am building my irregular contractor income into our budget (a different amount every month) to give us a bit more room for error. I think that we won’t need much of it, and by default any excess will land in our short-term savings.

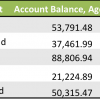

As for the business income, though, we are not going to spend it this year or probably for quite a while. We decided to, once I pay myself, apply our typical percentage-based filters: taxes (30.3%), giving (10%), and retirement savings (18%). We would like to save the remaining 41.7%.

With new jobs and new budgets come a new savings goal: a down payment on a home. We are probably still several years away from buying a home, but 5-20% of a piece of California real estate is no joke. So far our house down payment savings account consists only of gifts we received from our parents, and we’d like to start putting our own sweat into it.

So now we have two savings goals that go beyond the short term: retirement and a down payment. We have no idea how to decide what the split should be between the two, so we are just setting it to 50:50 (or 20.35% each) of the net business income. (Well, we would know if either of those goals had dollar figures associated with them, but at this point they don’t.) I also suspect that we’ll receive a decently sized tax refund between the IRS and emptying our Taxes savings account at year end (in the past we’ve withheld or mad quarterly estimated payments for within about $100 of what we owe), so we will split that 50:50 as well.

I like the idea of finally having a mid-term goal to save for! It’s been only retirement and irregular expenses/planned purchases for so long! Now to figure out how to invest it…

Do you live on one income, and if so what do you do with the other income? If you have an amount of money you can put toward your goals, how do you decide how to split it?

photo by John Hope and used under CC by 2.0

How to Make an Irregular Income as Regular as Possible

How to Make an Irregular Income as Regular as Possible How to Budget from a Lump Sum of Income

How to Budget from a Lump Sum of Income Can a Net Income Boost Compensate for Not Having Earned Income?

Can a Net Income Boost Compensate for Not Having Earned Income? A New Appreciation for Living Below Our Means

A New Appreciation for Living Below Our Means

I live solely on my wages as a GRA, and just pool my extra money from bank bonuses, credit card churning, and recently, merchandise reselling, into YNAB’s budget. It gets invested at the end of the month.

Recently I’ve been having a bit of trouble trying to decide how much money to put into merchandise reselling. It’s certainly got good returns – something like 15-20% depending on the deal – but it just feels wrong to put money into it and reduce my investments at Vanguard. Rationally, so long as those profit margins hold up, I should be putting as much money into merchandise reselling as possible, especially because it only takes about one month at most to get those 15-20% returns.

Mind you, it does come with it’s own set of risks. And requires more time than just index investing.

That’s cool you have a side hustle now! If you want to write about it for the side income series at GSF, let me know! But yeah, most pursuits are more time-consuming than index investing. 🙂 Those are great returns but what is the risk? And how much money is invested at any given time?

Risks are:

Merchandise lost or damaged during shipping. If it’s damaged from my purchase from eBay, I can get that refunded. But if it’s lost during shipping to Amazon to sell, then it’s not unless I bought shipping insurance (which I never have).

Price on Amazon falls between the time I buy merchandise and the time Amazon receives it after shipping it to them.

I sell an item through Amazon, but is later returned. It can only be sold as “like new” at that point.

Those are the major risks that come to mind, I’m sure there’s some more minor ones.

As for how much money is invested at any given time, that’s really up to me. I usually end up with up to $1000 dollars in eBay gift cards bought at ~10% discount from face value, which I sit on until a merchandise deal shows up. Ebay gift cards take about 4 hours to activate after purchase, so if I don’t have some eBay gift cards on hand when a deal goes live, I may not be able to buy eBay gift cards to use on that deal before it goes out of stock.

I’ll probably write about this on my own blog at some point. When I do, would you link to it from GSF?

Man I need to get back to that blog at some point…

One of the other benefits of doing this though is it means I have a business now, so I can sign up for business credit cards and collect those signup bonuses! =)

For this side income content, I would prefer to have a whole post on GSF in the format I’ve used for the other posts, and we could link from that post to a post on your blog with further details.

My finances work as follows (and I don’t count any of my partners). Fortnightly:

1. $1000 to our rent/food shared expenses (though this needs to increase cause we’re short often :()

2. $690 to planned savings – this is a historic number which includes lump sum bills annually like insurances, but also the bills on my owned property like building maintenance fees.

3. $50 to church

4. $50 to ‘dream’ goal (the big one I’ll chip away at every week for 20 years)

5. $100 extra to retirement (above the 14% that happens pre tax, it’s Australian law to 9% and the rest was negotiated in lieu of pay rises)

6. $100 extra to tax (to cover any bills annually, this is above the mandatory amount my employer sets aside for tax every fortnight)

7. $240ish in cash comes out to pay incidentals (church plate money, coffees, socialising with friends without my partner, gifts etc)

8. Leftover goes to the mortgage (-$2000 per annum to shares). I also have a tenant, so rent mainly covers the mortgage, and everything else gets tipped in there too.

I’m an Australian civil servant engineer and a manager of about 50 people, in case readers find the numbers high. We have a high wage economy, comes with high costs.

Very organized! I like how high-level you have it laid out here. I guess that is similar to our system of percentage-based budgeting, regular budget, irregular budget, and miscellaneous.

What’s your 20 year-long dream? We don’t have anything we’re actively saving for on a timeline between our down payment and retirement.

My ‘dream’ fund is for a first class ticket from Sydney to New York and Paris, staying in 5 star hotels, a week each. It’s not ‘world peace’ but it’s something I’d love to do, and saving a little every week will get me there when my (yet unplanned) children are old enough not to miss me 😉

That sounds amazing!

We live on one, well, less than one really now. Mostly it’s because when we got married, Mr PoP was self employed and earning peanuts (as in sometimes he was even paid in food…) whereas I had a decent salaried position. So we lived off of my earnings. Then we just didn’t really increase our lifestyle much as our earnings went up, even though they’re now about triple what they were when we got married 6.5 years ago.

When income is variable, as Mr PoP’s has been at times with commission checks, it’s just less stressful to know that you’re fine living off just the one steady income and everything else is going towards savings and investments. For us, it actually let Mr PoP be more aggressive in his job – and he often ended up selling bigger deals because he proposed large solutions that had a slightly smaller chance of coming in than if he proposed smaller solutions that might be more likely to close. That translated to higher income for us, and more $$ for his employer, so good all around.

I hope my self-employment income grows the way Mr. Pop’s has! I’m not sure if psychologically being able to depend on Kyle’s income has enabled me to do better than I would have as Mr. Pop has or has made me feel too complacent/like I don’t really need to earn. I suppose time will tell.

You guys are obviously a great example of combatting lifestyle inflation!

When we were saving for travel we saved my salary into a cash account earning about 5% interest as we needed those funds to be safe. Now we’ll likely pour the second income into paying down loans on our rental properties as our strategy for FI is to partially fund living expenses with rental income.

Sounds like a great plan! The advantage to what you’re doing now is that you have a fixed amount left on the mortgages. How did you decide how much you were saving for travel or how long it would take you?

Since my hubs is in medical school, we are living on only my income. We don’t typically take any student loan money for living unless things are looking really tight. My business income varies quite a bit though, so we do have to plan ahead and make sure to plan for that.

Can you take out student loan money whenever or only once per year/semester? You have to plan ahead pretty far if the latter! It’s good to be forced to do that!

Well, my husband is on disability, so we sort of live on one income anyway. Unfortunately, we’re not always able to put his whole check toward saving goals. Too many miscellaneous expenses cropping up here and there.

This coming year it’ll get especially interesting because we have to put his disability payments aside. Just in case the denial appeal doesn’t go our way, since that’d mean we owe all the money we’ve received during the appeal.

Wow, that does put the pressure on. But I hope it will go your way and you will have a great nest egg after.

If you’re talking about saving for a down payment in say, San Diego, that’s probably going to take quite a bit of time (possibly more than 5 years), though maybe less if you’re thinking about a small condo.

So I would suggest making sure you’re taking care of your retirement with at least 15% of total income saved for retirement (maybe more like 20% because you’ve been in grad school), then saving the extra in the stock market either in taxable funds or, if you have room in your IRA Roths that you’re not using for retirement, then in there.

In terms of what stock market, if your DH weren’t in biotech, I would suggest Nasdaq (QQQQ as an ETF or whatever the vanguard index is) because of the potential for higher returns, but since he is, that seems too risky. All of your eggs would be in the ‘tech basket. So I’d probably just go for a total stock market fund from Vanguard. Possibly putting new money to bonds or cds as you get closer to time to purchase.

[Standard disclaimer: not a financial adviser, do research and see actual financial advisers before making any life-altering decisions.]

Thanks for your suggestions! I doubt we’d go with an all-stock investment as we are not that risk tolerant over this short time period (even 5 years). But we might consult a financial advisor for serious to clean up all the different little savings pockets we have going on.

Not sure yet what size of mortgage we’ll be going for in SD… Maybe enough for a townhouse. We don’t have a target location yet.

Emily, I think that is a good strategy, living on one income and your income goes to savings or investment. That would surely boost your savings and attain retirement goals earlier.

I think our baseline savings rate for Kyle’s income is OK but I like the idea of supercharging it. 🙂

We’ve maintained a 50% savings rate for the last three years (up until 2015), but we split savings between retirment and home purchases.

For the first six months of 2016, we will attempt to live on one salary, and the salary will be my husband’s student stipend. We’ll stuff my salary into giving, retirement accounts and our HSA. It’s a grand experiment for us, and if it works, I’ll stop working when baby #2 comes.

That is very ambitious! I think it is within striking distance, though, since you own your home. I’m looking forward to following your progress!

Emily, nice strategy! You are definitely supercharging it. For how long are you gonna stick to this set-up?

For the foreseeable future, I suppose! Until our income or expenses change dramatically.

[…] 1: We are only budgeting off of Kyle’s salary and my contractor income, not my business […]

[…] budget is based on Kyle’s income alone, so we are finally living off of one income! Well, that is if we are successful in living within our […]

[…] loss – Kyle received interview and job offers very quickly last spring and we’re definitely not falling into the two-income trap! In terms of the stuff in our life that could create emergencies, we live pretty lightly – we […]