February 2013 Month in Review: Money

This has been a stressful month for us. As I’ve mentioned about a hundred times on here, I’m preparing for my preliminary exam. This stress and busy-ness has translated to doing and spending less, though we still socialized with our friends in free settings quite a bit.

The Everyday Budget

Our non-discretionary categories aren’t changing at all now – INCOME, SAVINGS, GIVING, rent, and internet – which you can find in our last budget iteration. Kyle also got an additional paycheck, which we broke up according to our usual percentages/destinations.

I hope this is our last month of having a weird cell phone bill. Mine has now stabilized, but Kyle’s cell bill this month was $77.83 – we were expecting the low-$60s. I think this is because we paid for more than one month of service but I’m not certain.

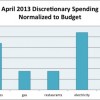

In terms of our discretionary spending:

Groceries: Over budget. But by less than the last few months… More details to follow in our grocery update next week.

Gas: We only filled up once this month – crazy! I can’t remember the last time we filled up less than twice in a month. Good thing, too, because we needed the money elsewhere.

Restaurants: We went out one evening with some friends before a dance. The restaurant was actually the relaunched version of where we had our rehearsal dinner. That was it – just the one outing!

Electricity and Gas: Slightly over this month. We haven’t remembered to turn off our heat during the day recently so we need to start doing that again.

Water: Under budget and back to paying for only one month’s usage at a time! Much easier on our budget than paying for two months at a time.

Every month we also have some random other transactions that aren’t covered in the budget but aren’t supposed to involve a targeted savings account:

- We redeemed some credit card rewards of $20.11.

- We spent $8.67 to renew a domain name.

- We spent $28.35 on snacks for my labmates and $31.79 on pizza for my classmates as a ‘thank you’ for critiquing my preliminary exam presentation.

Spending Out of Targeted Savings

We spent $269.36 from these accounts this month and added $132.23 above our normal savings rates.

Travel and Personal Gifts

We contributed the discretionary part of Kyle’s side hustle paycheck to this account, $104.96.

CSA

Our CSA account is back in the list! We paid $207 this month for an individual share for one season. We’ll repay into this account ($12/week) from our grocery budget once we actually start getting deliveries.

Cars

We paid the state property tax on Kyle’s car for $62.36.

Entertainment

no spending this month

Appearance

no spending this month

Medical

no spending this month

Electronics

We transferred $50 from this account into our Nest Egg to repay ourselves for our upfront smartphone costs.

Charitable Giving

no spending this month

Nest Egg

We transferred $50 from our Electronics account into this account to repay ourselves for our upfront smartphone costs.

Taxes

We transferred in $27.27 from Kyle’s extra paycheck

Budget Adjustments

None! Our budget is set up well now.

Bottom line:

We didn’t have quite as close a month this time around that we did last time, thankfully. We had $44.77 in surplus this month. We were well over in our grocery budget and had some extra expenses associated with preparing for my prelim, but we were well under in gas and eating out so that made up for it. The leftover money went into our Travel and Personal Gifts account.

When you’re busy and stressed, do you end up spending more or less? Have you bribed your friends with food to help you out recently or is that just for grad students? Did your wallet notice the short month?

Filed under: month in review · Tags: extra paycheck, groceries, prelim

April 2013 Month in Review: Money

April 2013 Month in Review: Money January 2013 Month in Review: Money

January 2013 Month in Review: Money May 2013 Month in Review: Money

May 2013 Month in Review: Money March 2013 Month in Review: Money

March 2013 Month in Review: Money

Way to only fill up once in February! I only filled up once too. I know it’s easier because it’s a shorter month, but I feel like it’s still a win for my goal of driving less and less.

Ross recently posted..Starting from Scratch: A frugal plan to grow wealthy

For us it was probably an accident of filling up near the end of Jan and having nearly an empty tank now. So March will definitely be a 2+ fillup month. But it helped out in the short term!

If I hadn’t burned through a tank of gas in 4 days with the move, I probably would have managed on one tank as well. That’s the best part of this new house. It’s less than 2 miles from my wife’s job. Once it warms up a bit, I’m making her walk. 🙂

We have “paid” friends to help us move with pizza or some other obscenely unhealthy food for 7 of the 8 moves we’ve had. And I’ve “paid” my brother with food for helping me with DIY chores so many times that his fiancee actually wants me to stop!

Edward Antrobus recently posted..How to Maximize the Benefit from Swagbucks Rewards: Frugal Hack

We live about 2 miles from our offices, too, but it takes me about 30 minutes or so to walk. Kyle doesn’t like it when I walk because my path goes through one of the shady residential areas near our university. But living so close is great for not spending on gas!

That is an impressive budget! We tend to have similar ebb and flows in our budget when we have events or tests. For us, when we had our baby we were surprised that we actually spent less money because we were not eating out as much and spending a little more time at home.

I like the part about only filling up once for the month. We are trying to do the same! Keep up the good post.

Simple Economist recently posted..Earn More vs. Spend Less: Attacking Financial Freedom from Both Ends

I can definitely see how a baby’s arrival would reduce your normal spending – plus your community might be bringing you meals and such!

This was not a good month for me! I had three visitors and spent too much money. I generally spend more money when I am stressed because I care less, which is bad. I still did great on my debt payoff though!

Do or Debt recently posted..What’s the strangest thing you’ve done for money?

I never know with visits whether the host or the guest is supposed to treat. Good job keeping your debt payoff goals even with a crazy month!

Bribery with food is a trick I use often. February is such a short month, you’d think spending less would be easy, but it seems no better than January at our house.

Kim@Eyesonthedollar recently posted..Money Memories-Canon Rebel T4i DSLR Giveaway

I don’t think having a 7-10% shorter month makes much of a difference, especially when some usage-based bills are delayed into March or April.

Do not dwell so much if you went over budget on your groceries. Look at the positive side. I also went over budget on my groceries last December due to the holiday vacation as we were expecting a lot of guests during Christmas and New Year. There were some cereals, canned goods, and other groceries that were left unopened so I was able to save on our grocery money for the month of February.

Cherleen @ My Personal Finance Journey recently posted..Urgency in Sports and Debt Repayment

Well, I wouldn’t care if it was an isolated month, but this is a pattern!

February was expensive, I blew my grocery budget around the 15th.. With stress I tend to buy more convenience items, so spend more.

Pauline recently posted..Reduce, reuse, recycle… or resell to make money

I might fall into that trap but it takes more time to go to the store – faster to just go home and eat peanut butter!!

February, in a nutshell: engagement, death of a family member, being on edge about Liam’s job getting cut. It was, in a word, exhausting. Although he’s been told that he’ll be one of the last to go, Liam’s job is government funded and his program is highly at risk of being slashed if we go into austerity.

Stress definitely makes me spend more often. I haven’t even checked into our spending since mid-month!

Sara recently posted..Wedding Wednesday – we’re getting hitched!

WOW! What a month. Congrats and condolences.

I am also checking up on our finances less frequently, but we have sort of become hermits so everything is just on autopilot.

You’d think with less days Februrary would be harder to “mess up”. We did OK this month, no major spending, but I did a number on my misc. budget during a girls night out. I didn’t go over budget, but pretty much spent all my extra money in one expensive night out.

KK @ Student Debt Survivor recently posted..I’m Dating a Financial Stud!

We make that choice sometimes – one big night out in a month is better than several smaller experiences. At least you made it balance!

[…] awakened to the fact that it is 2013 and our savings has really advanced. The combination of our low spending out of targeted savings this winter and that we haven’t experienced another high-volume wedding season means that we actually have a […]