August 2013 Month in Review: Money

I was going to say we had another successful month of spending well below our budget, but I don’t know if spending very little money necessarily means we are successful. We’ve been underspending all summer – maybe we aren’t having enough fun. Stupid grad school.

The Everyday Budget

Top-line items

INCOME: Our paychecks from our university plus

- $162.4 from Kyle’s side hustle, divided as usual

GIVING:

- 10%+ of our stipends to our church

- $50 to the missionary we support

- 10% of Kyle’s side hustle income

SAVINGS: Our usual amount, 17%-ish.

Non-discretionary spending

Rent: $895.

Internet: $39.24. This was the last month of our promotional rate with Time Warner, so our rate will be higher next month – but we’re also moving partway through the month. We’ll switch the internet from my name into Kyle’s and hopefully get another promotional rate.

Cell phones: Kyle’s usual $69.86; due to credits to my Republic Wireless account, we didn’t pay anything for my cell this month!

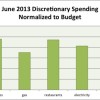

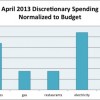

Discretionary spending

Groceries: We came in WAY under budget this month! Who the heck knows why. But this means that the amount we didn’t spend, $56.73, can go toward buying a bunch of high-quality meat! We are putting the money into our CSA savings account for the time being, and after we move we will stock up our freezer from a local farm.

Gas: We filled up more times than usual this month but still came in way under budget. I really need to convince Kyle to lower this cap by at least $20!

Restaurants: We went out to Applebee’s on a date night early in the month but used a gift card so we only paid $3 out of pocket. Kyle went out to lunch with some friends from church one Sunday and I went out to dinner with my sister when we visited my parents.

Electricity and Gas: Over this month, for once! Probably the peak of A/C usage or something.

Water: Same old, same old! Except Kyle paid two water bills this month so I had to pull the later charge forward into September (when the bill was due).

Every month we have a few transactions that do not fall under either our budget or our targeted savings.

- We spent $2.42 on a new belt for our vacuum cleaner.

- We spent $2.78 on a card and $0.92 to mail it.

- We redeemed $47.01 of credit card rewards.

Spending Out of Targeted Savings

Another month of low spending out of these accounts!

Travel and Personal Gifts

We drove up to northern Virginia to see my parents for a quick weekend and spent $58.93 on gas.

CSA

This account received the $56.73 that was left over from our grocery budget.

Cars

We had a bit of a weird situation with our car this week. The A/C has been out for months and we finally got around to getting it charged. (Just in time for the end of summer. Makes sense, right?) Anyway, we took it to a place that always tries to upsell us, determined to not give in. They told us that after evaluating the car, they couldn’t charge the A/C because there were other more pressing problems. So we walked away with a $126.51 bill for a diagnosis and an oil change and we were super mad about it. But then the A/C has been working… So we’re confused.

Entertainment

We spent $10.72 on new golf balls and $10.00 on renting golf balls at a driving range in preparation for Kyle attending a golfing bachelor party. (I talked him out of buying used clubs and into borrowing them from a friend.) The part of the bachelor party that Kyle paid for was $50.

We also bought tickets for my family to visit Mt. Vernon, which they paid us back for but we ate the online transaction fee of $2.

Appearance

I spent $84.28 on two shirts and a pair of jeans – all between 25 and 40% off. J The shirts are a little fancier material than what I normally wear so I might avoid wearing them to work.

Medical

I filled a prescription for $10.

Electronics

We spent $49.55 on a new modem (after some gift cards) because of TWC raising the rental rates.

Charitable Giving

no spending this month

Nest Egg

no spending this month

Taxes

We transferred in $37.35 for Kyle’s side hustle.

Camera

This account received the discretionary portion of Kyle’s side hustle income, $72.03.

Budget Adjustments

Next month will be a month of transitions with our move so we will have to redo our budget for October with our new lower rent. I also redid my withholdings when my pay was switched to non-comp so my net pay might change a bit.

Bottom line

We had $174.42 left over at the end of this month! Woohoo! It’s going into our Camera savings account – our biggest contribution yet! And that’s after sending the leftover grocery money to our CSA account.

Have you been over or under budget this summer, generally? Are you anticipating any budget adjustments?

Filed under: month in review · Tags: underspending

June 2013 Month in Review: Money

June 2013 Month in Review: Money May 2013 Month in Review: Money

May 2013 Month in Review: Money April 2013 Month in Review: Money

April 2013 Month in Review: Money July 2013 Month in Review: Money

July 2013 Month in Review: Money

I was way over budget this summer. A couple things attributed to that. The main one was my sister coming up here for the first time to visit. It was great getting to see her, but I spared no expense while she was here…still catching up!

Josh at CNAFinance.com recently posted..How To Make A Budget Spreadsheet That Makes Budgeting Fun!

At least you got a great time for your overspending!

Man I love using a gift card at a restaurant.

There’s just something about “free” food that gets me going.

I just can’t shake that college food mentality.

No Waste recently posted..Net WorThursday – August 2013

We haven’t done this often but it did feel pretty great! My husband is in a similar headspace as you regarding “free” food.

It’s interesting that your car’s AC started working after having it looked at. Did they charge the system with a dye-filled freon to look for leaks? That would explain it working, but it will stop after awhile if you have a leak. Did they say anything about a leak? That would be the only reason you would need to keep recharging the system. Non-leaking systems stay charged.

Bryce @ Save and Conquer recently posted..Carnival of Financial Planning B – School’s in Session

They told us that they did not add any freon, but we think they must have or it really doesn’t make sense that it would have started working again. They told us that something other than our A/C was leaking, which was very confusing. I don’t think we’ll be returning to that garage.

I’ve had Time Warner internet for 3 years. Every 6 months my promotion expires, so I call them up and say I’d like to cancel because I can no longer afford it. It’s a hassle, but they have never come close to letting me walk away. In 3 years this approach has resulted in only a $5 rate increase. If they don’t give you a lower rate by switching to Kyle’s name, you may want to try leaving. (And when I say “try,” I mean tell them you’re leaving while holding your breath that they don’t take you up on it.)

Unfortunately we have tried this strategy multiple times in the past with TWC with no luck. I don’t know why, because I hear that people have experiences like yours quite often – maybe it’s our area or maybe it’s that we suck at negotiating!

I actually live nearby (Durham) so it’s probably not the area. It might be worth another try next time. Good luck! Calling Time Warner is one of my most dreaded chores.

It’s us, then. 🙁

Great job staying under budget. Am I misremembering or weren’t you going to buy meat with leftovers from your grocery budget?

Mrs. Pop @ Planting Our Pennies recently posted..Data Driven Marketing – Cool & Convenient or Creepy?

Yep! We transferred the leftover money into our CSA savings account to buy some meat after we move!

[…] @ Evolving Personal Finance writes August 2013 Month in Review: Money – We wrapped up our amazingly under-budget summer with a record-setting amount of leftover […]

[…] August 2013 Month in Review: Money was featured in the Yakezie Carnival. […]

[…] don’t currently have a monetary buffer in our checking account. When I say we zero out our budget leftovers at the end of every month, it means that I literally look at the account balance we had on the first of the month and make […]

[…] spending this month. Eventually we will get around to spending that meat money from a couple months ago – whenever I find myself not working on a […]