The US Airways® Premier World MasterCard® – A Tempting Sign-Up Bonus Offer

I know we really need to stop signing up for credit cards for the bonuses, but I think The US Airways® Premier World MasterCard® may be next on our list. I’m really exercising restraint in not signing up for it right now! This post is my review of the card based on the Terms and Conditions.

What I find really attractive about this card is that there is no minimum spend to get the sign-up bonus – you just have to make one purchase and pay the annual fee. We can’t consider most credit cards with high sign-up bonuses because we don’t put enough on our credit cards each month to meet the minimum spends.

The sign-up bonus comes in the form of 40,000 miles that you can use on US Airways. Even though we aren’t loyal to any one airline, US Airways does offer tons of domestic flights (especially after their merger with American Airlines) so I don’t anticipate much trouble finding flights to use the bonus on. All the benefits I list below apply to US Airways-operated flights.

The Sign-Up Bonus

The sign-up bonus is 40,000 miles, which you receive after you make your first purchase (or balance transfer) and pay the $89 annual fee. The annual fee is a bummer for this card – I definitely prefer not to pay one – but I think it’s an acceptable trade-off for not having a minimum spend requirement.

You will receive a companion certificate. When you pay for a flight of at least $250 in the contiguous US or Canada, you can bring along up to two other people for $99 plus taxes and fees each. This travel must be booked within 9 months of signing up for the card and take place within 12 months.

You will also get a day pass to the US Airways Club good for a one-time visit with up to two guests.

The Ongoing Rewards

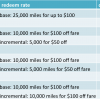

You earn two miles for every dollar spent on US Airways purchases and one mile for every dollar spent elsewhere.

For every flight you pay for with Dividend Miles, you get a 5,000 mile discount e.g. a flight that costs 25,000 miles you will be able to buy for 20,000 miles.

Other Random Benefits

Your first checked bag is free, plus the first checked bags of up to four people traveling with you.

Zone 2 boarding.

Remaining Terms

Miles do not expire as long as you make one purchase on the card every six months and if there is activity on your Dividend Miles account (earnings or redemptions) within the last 18 months.

The APR on this card is between 16 and 25%. But this is irrelevant as you should never carry a balance on a credit card!

Are We Getting This Card?

As I said above, I’m so tempted to get this card. I even looked up how many points it would take to buy my flight to FinCon14, and it would be covered by just the sign-up bonus (the cash costs are upwards of $400, not limiting the airline). That means that I would be able to get the flight for only $89 out of pocket for the annual fee, plus we’d get all the other benefits like the companion pass. I think it’s a pretty safe bet! The only reason I’m not signing up yet is that I want to be sure we’ll use the bonus we received on Kyle’s Barclaycard Arrival™ World MasterCard® – Earn 2x on All Purchases before the first year of having the card is up. If we haven’t used the bonus for some reason, I’ll use that $440+ signup bonus toward my flight.

This posts contains affiliate links. I would appreciate you going through them to sign up for The US Airways Premier World MasterCard®if you want it because EPF will get a commission! Thanks! Oh, and if you want to read all the fine print (you should!), here are the Terms and Conditions.

Do you have any airline credit cards and how do you find the ease of redemption? Would you pay an annual fee for a high sign-up bonus?

Filed under: credit cards · Tags: credit card, US Airways

Barclaycard Arrival Plus World Elite Mastercard Sign-Up Bonus Redemption

Barclaycard Arrival Plus World Elite Mastercard Sign-Up Bonus Redemption Awesome Sign-Up Bonus Ratio with Barclaycard Arrival World MasterCard

Awesome Sign-Up Bonus Ratio with Barclaycard Arrival World MasterCard Easy Travel Redemption with the Barclaycard World Arrival MasterCard

Easy Travel Redemption with the Barclaycard World Arrival MasterCard Frequent Flyer Programs: Have We Been Missing Out?

Frequent Flyer Programs: Have We Been Missing Out?

Just curious, have you considered how signing up for additional cards may impact your credit score? A free flight might sound nice now, but what if it results in a slightly higher interest rate when you buy a home?

Yes, we have considered this and it’s an important point. I’d say that signing up for a new credit card is about a wash for your credit score (it’s hard to know exactly since the bureaus don’t reveal how they calculate the score) – you get a slight ding for the hard pull and a slight increase for the increase to your overall available credit. The ding for signing up is probably pretty temporary. When you close a card, your score may dip slightly because of the decreased available credit.

As you point out, getting a great interest rate on your home mortgage is going to be more valuable in the long term than getting a free flight here or there. I don’t think that it’s for sure that churning credit cards actually hurts scores (I’ve seen people who track their scores closely and churn say their scores have increased), but personally I would err on the side of caution. For 1-2 years before applying for a loan, we wouldn’t churn (that is, open and close) any cards and probably limit the new signups. For us, a mortgage is at least a couple years if not more than 5 years away so we haven’t entered that period of caution yet so I’m fine with signing up for a new card now and then. But YMMV.

Great question!

[…] presents The US Airways® Premier World MasterCard® – A Tempting Sign-Up Bonus Offer posted at Evolving Personal Finance. I want to sign up for the US Airways card to get a free flight […]

[…] The US Airways® Premier World MasterCard® – A Tempting Sign-Up Bonus Offer was featured in the Festival of Frugality #432. […]

[…] @ Evolving Personal Finance writes The US Airways® Premier World MasterCard® – A Tempting Sign-Up Bonus Offer – I want to sign up for the US Airways card to get a free flight to FinCon14 because there is […]