What to Do About a Large Reimbursable Expense

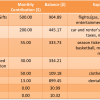

In May, I went on an interview and incurred some incidental reimbursable costs for food and transportation (my flight and hotel were paid directly by the company). Also in May, Kyle registered for a conference; in June he booked his flight to the conference; in July he paid for his lodging and food at the conference. All of his costs were reimbursable as well, but not until after he returned.

My costs were only $85, so we just floated that expense thorough our zeroing out process and didn’t fret over it. (We basically just let our checking account be $85 lower than it should have been.) However, Kyle’s conference costs totaled over $1,000! We borrowed that money from our general savings account and were eagerly anticipating the reimbursement.

Our two reimbursements arrived within a day of each other near the end of August. I had no idea that they would take so long. That was three months that we floated my $85 expense and between six and twelve weeks that we were missing $1,000 from our general savings account!

This experience made me very grateful that we have that general savings account to dip into. Going to a conference is definitely not an emergency, but it is a nice CV boost and an opportunity that should be taken when offered. We don’t always have to front or own expenses for conferences but some departments seem to work that way.

I lived paycheck to paycheck for about a year and a half right after college (in terms of not having short-term savings – I did have a Roth IRA) until I was given a small inheritance. Short-term savings and an emergency fund were just not on my radar at that point. One time I bought a flight and couldn’t pay for it in that month, so I put it on my credit card and paid it off the next month. The billing cycle was of course long enough that I wasn’t charged interest on the purchase, but looking back I really don’t like that I saw that as an option instead of building up some cash from the previous month at least.

What would I have done back then if I had to front $1,000 in conference expenses? (I actually did attend one conference during that time, but it was paid on my behalf in advance and I received a per diem, thank goodness.) I’m sorry to say I think I would have borrowed it from my parents or put it on a credit card until the reimbursement came. Over three months, I would definitely have been charged some interest. Both of those options would really hurt my pride nowadays!

Perhaps there are some other possible solutions like convincing your employer to put the expenses on a company credit card. But I’m very glad Kyle and I are now in a financial position to absorb these kinds of costs in the short term with our general savings account. This is also a reason why I prefer to not call this general savings account an emergency fund (we have a separate and tiny emergency fund), because then I would think that I could never access the money unless I was starving or dying. Doesn’t really make sense but somehow it matters to me!

What have you done in the past or present to cover large reimbursable expenses? What is your standard for using an emergency fund or line of credit?

Filed under: career, emergency fund, savings · Tags: reimbursement

The 3 to 6 Month Emergency Fund

The 3 to 6 Month Emergency Fund How to Replace Large Items on a Budget

How to Replace Large Items on a Budget If I Were My Financial Advisor, What Would I Tell Me?

If I Were My Financial Advisor, What Would I Tell Me? Our Short-Term Savings Accounts

Our Short-Term Savings Accounts

When we went to conferences, any upfront costs (such as flight) would be eligible for a cash advance. When we got back then we’d get the per diems, and the hotel cost and taxis, etc. Since the flight was usually the one that was the biggest expense, they knew it was hard for us students to float that cost. And it just required showing proof that you did go on that flight. The turnaround is pretty quick, within a month of submitting the form, so aside from the upfront expense, everything would be within a credit card billing cycle.

Alicia recently posted..Versatile Blogger Award

That sounds like a pretty good system with the fast reimbursements – almost as good as you can get without all the expenses just being fronted. It’s very considerate that the biggest and booked-most-in-advance expense was advanced. I still wouldn’t want to put it on a credit card if I didn’t have to, though, just in case!

I traveled for conferences for my old job, but I had a company credit card. I had to keep receipts but I didn’t have to pay for anything out-of-pocket. I don’t know how I would feel about letting my company borrow $1,000 for 12 weeks!

Holly@ClubThrifty recently posted..5 Unfortunate Facts About Self-Employment

Yeah they DEFINITELY don’t trust us with lab credit cards any longer, in my lab anyway, and for sure not for personal expenses like travel. We used to have access to the lab credit card for research purchases, but that privilege went away after a few unjustified Amazon purchases popped up and the card number kept getting stolen. I guess that’s one big example of how grad students are not treated like professionals! But it would sure make things easier! Keeping receipts is no big deal.

I’m waiting on $260 of transportation expenses from work, which I filed paperwork for in early July and mid-August. I worked that into my monthly budgets for those months so the reimbursements would be “bonus money” when they came, but it’s getting to the point where I think I need to check in and be like “everything OK with the paperwork?” It’s alarming when things take so long!

I think accessible savings is important for this too. I know that people put conference costs on credit cards until they get reimbursed, and that stinks in terms of having to pay interest because your employer isn’t in a rush. I can understand why people do it when jobs are at stake though.

That’s nice that you will be able to consider the reimbursement bonus money instead of just refilling savings – it’s a slight psychological shift to the positive.

About six weeks after I filed my reimbursement claim I got something in the mail from the company saying it had been processed and I could expect the check in 6 weeks… It took forever but I’m glad they updated me at that point so I didn’t have to contact them. Kyle did check on his a few weeks after he got back, but they basically just said to keep waiting.

This is one of those types of expenses that grad students might not anticipate before the first time it happens, especially if their previous department/institution handled things differently.

My department doesn’t front the hotel costs, as far as I know. Because of state rules, the flight has to be booked with a particular travel agency, where my lab will pay for it directly. I dip into my emergency fund to float any other conference expenses such as the hotel that are charged to my credit card. It actually earns me money at current interest rates, because a savings account these days only nets a little bit less than 1% APY at best, whereas my credit cards earn me at least 1.25% (and that’s basically instant, as opposed to savings account interest that has to compound for a year).

Also, the per diem distribution isn’t given until I get back from the conference – is that how it’s done at your school?

My emergency fund is a bit bigger than it needs to be, but part of the reason is so that I can front these expenses. Also, they would make for a great way to meet a signup bonus on a credit card!

I don’t mind the combo of paying for the expenses up front with a credit card to get the rewards but then using cash savings to pay the card until the reimbursement comes – I just wish it came faster!

Neither my department nor Kyle’s gives per diems, before or after. They just reimburse all the expenses incurred exactly. I thought the point of a per diem was to do it in advance, though?

ITA agree about using conference expenses to meet a sign-up bonus you wouldn’t otherwise, but it requires more forethought than we had this time around, apparently!

Thanks for answering the EF boundary question – I’m so interested in what people consider legitimate expenses! But it sounds like you built your EF high with this in mind, so it’s almost like having separate savings for each purpose.

Yea 6-12 weeks of floating an expense is quite a length of time. I think I floated about $1000 for that long, and it was annoying. But it wasn’t too bad considering I pocketed $12.50 for doing so (incidentally, I believe this is technically considered income by the IRS.)

Yea I thought the per diems are generally done in advance, but I think part of the reasoning is to make sure that you actually go on this trip before giving you money. I’m guessing they don’t want to be in the position of giving a student a per diem, the student accidentally spending it before the trip, and then not going on the trip and having to wait for the student to pay it back.

Yea, I guess it is like having a separate savings account for this purpose…I don’t delineate this explicitly and just slush it all together. It works out well for me.

I’m currently waiting on a reimbursement from a conference I attended the first week of August and submitted paperwork for the following week. It’s almost $1100! I paid for my flight upfront two or three months before the conference, and then I put the hotel for myself and my roommate (in my discipline it’s standard for conferences to fund hotel costs for grad students at two students/room) on my credit card. My funding for this conference is a bit complicated: I study at University A, the conference was held at University B, and my funding for it came from a CAREER grant awarded to one of the conference organizers, who is at University C. I’m wondering if that’s why the reimbursement has taken so long, and I’m feeling really lucky that my husband and I have enough liquid savings to be able to float this without worrying (it’s more than one whole paycheck!)

Yes, for sure it’s great that you had the cash to cover this expense. Ugh, but it’s such a huge outlay! I hope the reimbursement won’t take too much longer despite the number of players!

One of my fellow conference-attendees checked with the admin at University C and he said the checks went out last week, so hopefully I won’t have to wait too much longer!

Within three months of starting working, I needed to front about $5k because my company’s policy on work travel is that you pay for everything except for the flights and then they reimburse you when you file the report. It was a great experience, but I was a little low on cash at the time. I took that as a lesson learned that I should keep at least $5k reasonably accessible at any time. For the longest time after that, I kept the first $5k of my EF in a credit union savings account so it was immediately accessible, but now I just keep it all in Ally since there are credit cards until I get at the money. While I was house hunting, I also kept my planned earnest money in a credit union savings account because they usually wanted a cashier’s check on no notice, so that required having the money in a B&M account…

My employer is pretty quick at reimbursing my expenses though, so it’s not a concern, unless the trip is long. And at this point, I don’t really care anymore. My checking account has enough of a buffer from annual expenses now that I have a Work expenses line item that I let go negative until I get reimbursed.

Leigh recently posted..August 2014 net worth update (+21.1%)

By “pretty quick at reimbursing”, I mean that I usually have the funds in my checking account within a week or two from filing the expense report. So it’s actually a great system since then I get the credit card points 🙂

Leigh recently posted..August 2014 net worth update (+21.1%)

That really is quite fast. I wouldn’t mind at all putting a charge on a card if it’s just for a couple weeks because those rewards sure are fun!

My department admin is GREAT about putting reimbursements through quickly. When the department owes me a reimbursement, the direct deposit to my checking account usually goes through within a week of when I submit the form, sometimes faster! (and if it is a small amount, she gives out petty cash so I don’t have to wait at all!)

For that reason, I’m always happy to put dinners and stuff on my rewards card.

It’s great that they have such an efficient system. I would not trust our departments in that way, but we don’t have much opportunity to, either. Dinners out for recruiting and similar activities are paid directly by my department, for example. I hope you have a credit card with good dining rewards if it comes up frequently for you!

I use an REI card that gets 1% back on everything and 15% total back at REI (including the regular 10% dividend). I’m sure it’s not the most lucrative rewards strategy, but it’s easy and the money gets automatically added to my REI dividend every year. My husband and use the credit card to fund our backpacking habit without ever feeling like we have to pay for equipment!

Wow, that is a very high expense! It’s too bad that you have to keep as much as $5k liquid just for work purposes.

That’s a good tip about keeping the earnest money at a brick and mortar bank… We’ll have to keep that in mind even as we become more entrenched in our online-only banking lifestyle. Yikes!

I actually love booking my own travel for work. I use rewards cards to rack up the points, and my office reimburses me within two weeks of filing a claim. So I often have the reimbursement before I need to pay of the credit card.

If I don’t have a reimbursement before I need to pay off the card, it’s pretty easily coverable in with our cash float in our checking account. The one exception: when I bought $10K of TVs for a new office. That I made sure was reimbursed quickly so I didn’t need to dip into taxable investment to pay it off. 🙂

Mr. Frugalwoods recently posted..How We Manage Our Household Finances

If you reliably get the reimbursement before you need to pay the card, it’s not much risk. But this 3 months business is no good! Wow, $10k in TVs on your personal card?! That’s crazy! If you have to do it though, I hope the points were lucrative. That amount would make me very nervous no matter what assurances were made.

If I knew that I would have an expense that would be reimbursed I would take it from my emergency fund. But I would really find a way for my employer to cover this first. A company should have systems in place so the burden of funding a business trip or other expenditure doesn’t fall on the employee. But I know many don’t…mine didn’t.

Brian @ Luke1428 recently posted..The Ups and Downs of My First Month As a Stay at Home Dad

Yeah, they SHOULD… But they want to transfer the risk, I guess. Grrrrr.

My job is pretty good at reimbursing expenses, but I haven’t had to use my own money too often because I also have a corporate card for work expenses. I use the corporate card whenever the expense is low enough that I won’t get points by using my own, but if I could get points with my card, I use my own and get reimbursed. win-win

Aldo @ Million Dollar Ninja recently posted..Fun Weekend, Only $6.50 Spent!

That’s great that you have a choice! If I did I’d probably have a system similar to yours – some kind of threshold over which the points are worth the hassle of filing and waiting for the reimbursement.

Yep, we just got a reimbursement of $1,400! That’s a lot of money!

We just let our buffer in our checking account be a bit smaller.

It took B two weeks to get the forms in and another 2 weeks for the reimbursement. He was sent to talk to 3 people just to fill the forms out correctly.

Ty.pi.cal! How annoying, but at least it was only two weeks after the forms were done. We don’t like to keep a buffer in our checking account, but if we did I’m sure $1,400 would be a big hit – probably more than I would be comfortable with, but I guess it depends on your reason for keeping the buffer. Our solution of transferring it from general savings is almost the same.

Yikes, a $1,000 reimbursement would have me feeling a bit antsy. When we relocated, I factored everything into our budget, and then my boyfriend’s job finally reimbursed us about a few weeks later. Thankfully the situation doesn’t arise often for us, but it is a pain to deal with inefficient companies/departments.

Erin @ Journey to Saving recently posted..Being Grateful: Forty-Third Edition

That is great that you paid for the move yourselves first so the reimbursement was like a bonus. I think that makes sense as it was really a personal expense, even though they do choose to reimburse. I’m glad it didn’t take too long!

Most of the time our expenses go on corporate cards, but every once in a while we need to float anywhere from a few hundred to a thousand or more. Most of the time the float is due to a delay in us filing the reimbursement, not through anything that the company does. Sometimes it’s just tough to remember in a busy day to file the reimbursements right away. =)

But that’s just one of the reasons we keep a sizable cash buffer. It makes stuff like this not a big deal.

Mrs. PoP recently posted..PoP Economics of Bike Commuting, 17 Months In

I’m pretty on top of filing reimbursements right away, but Kyle has a tendency to procrastinate. 🙂 I’d just rather get the receipts or whatever off my desk! Likewise, even though we had the cash to cover this large outlay, it makes me nervous to have an “open loop” that concerns a chunk of our net worth just in limbo!

My grad program would pay per deim along with reimbursing expenses only after the conference. It usually took them at least 6 weeks after submitting the paperwork once we returned, so I alway filled it all out on my first day back in lab. Like you, the first time I experienced this, I fronted the cost on a credit card… I’m sooo happy I’m no longer living paycheck to paycheck!

Julia recently posted..Diving on Koh Phi Phi

I didn’t think living paycheck to paycheck was bad at the time, but I just didn’t know what having savings would feel like! That is a long reimbursement time but good for you for at least being on top of the submission.

I am just lucky that the company I am working give me a credit card or budget for every conference I attend to. I’ll just keep the receipts but there are time that receipts get lost. What I do is I just make a letter informing about the incident. Luckily,most of the time, my letter is accepted.

Jayson @ Monster Piggy Bank recently posted..Ways to Sell your Home Faster

As someone who has a discretionary fund from my own grant, I know the money is there; but I am always waiting on the order of 6 mo for a travel reimbursement. Lack of management and understanding at the admin level makes this problem intractable, cash advances inviable, and complaining pointless. Because I regularly travel to collaborators labs to do work for weeks at a time, I 1) can’t afford to pay for the trips before reimbursement, and 2) don’t want it to affect my (very good) credit.

My solution is to take out a new credit card each year (one with travel perks and a 0% intro offer), to use only for research purposes. I can do this because of existing good credit, and because I’ll only have to do it for three years max.

I’ve found it to a workable “last resort” option for a problem that was infuriating and unsolvable —