The Great Debate: 15-Year vs. 30-Year Mortgages

Another way to put the question is what is the better priority – paying off debt or building wealth? Do you pay attention to interest paid or cash flow?

Another way to put the question is what is the better priority – paying off debt or building wealth? Do you pay attention to interest paid or cash flow?

This debate can be perfectly summarized by two radio personalities/podcasters I listen to: Dave Ramsey vs. Ric Edelman. I like both of them in different ways but on the question of what kind of mortgage to get they are polar opposites. Ramsey permits the idea of a mortgage – the only kind of debt he does – but encourages his listeners to pay off their mortgages quickly after starting to save for retirement. Edelman thinks that people should carry the largest mortgage (on a reasonably priced house) possible and keep refinancing into 30-year mortgages forever to maximize cash flow. Of course, there are advocates in the PF blogosphere for both of these approaches.

The Numbers

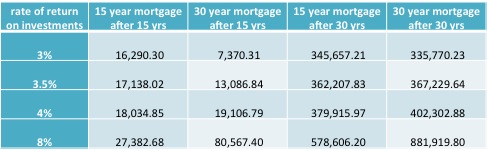

Let’s put the 15-year and 30-year mortgages head-to-head to directly compare them in terms of the net worth outcome after 30 years.

Scenario: A homeowner has the ability to take out either a 15-year or 30-year mortgage on the same property. The home value is $256,900 and she puts 20% down; the interest rate on the 15-year mortgage is 2.91% and on the 30-year mortgage is 3.62% (1). The homeowner is in the 25% tax bracket. The monthly payment on the 15-year mortgage is $1,410.40 and the payment on the 30-year mortgage is $936.70. If the homeowner goes for the 30-year mortgage, she will invest the difference between that payment and the payment for the 15-year mortgage. We will disregard inflation because it affects both scenarios proportionately.

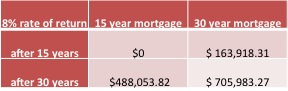

First, let’s consider the account balance at the end of 15 and 30 years of the investment account, assuming that it is growing tax-free (in a Roth IRA, for instance) at a rate of 8%. In the first 15 years, the 15-year mortgage homeowner doesn’t make any investments (related to this scenario) but in the last 15 years she is able to invest the entire amount of the previous mortgage payment (2).

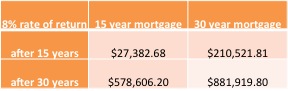

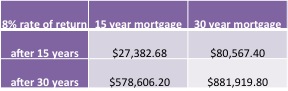

Second, we need to take into account the mortgage interest deduction. I’m not a fan of this deduction and I hope it disappears, but for now it is in place and it affects each scenario differently because the 30-year mortgage holder pays more interest. The interest deduction is also invested monthly with a return of 8% (3).

Third, we need to adjust for the fact that there is still a mortgage on the property at the end of 15 years for the 30-year mortgage.

The clear advantage is to the 30-year mortgage and the difference at the end of 15 years of these two different strategies is $53,184.72 and at the end of 30 years it is $303,313.60. That is pretty startling! And check out the time value of money! So why would anyone advocate for the 15-year mortgage over the 30-year?

1) The Assumptions Could Be Wrong

I believe the only assumption in the above scenario numbers-wise that could tip the advantage to the 15-year mortgage is the difference between the loan interest rate and the possible return elsewhere. If you have debt at a fixed interest rate that is a known quantity – if you pay it down (faster), your return is that interest rate. The return you can get elsewhere, for instance in the stock market or in a business, may be higher but it is also more uncertain and unstable.

The interest rate and investment return environment right now is pretty unique and crazy. You can get a mortgage for 3%-ish (if you have great credit) but the stock market has returned 12% over the last year. That is a striking difference and favors the 30-year mortgage coming out way ahead. But in another environment, the mortgage interest may be comparable with or even higher than the possible return elsewhere, depending on the time horizon, and then the advantage will tip to the 15-year mortgage. (Personally I am a long-term investor and don’t try to time the market, so I would prefer the historically higher average return of the market and therefore the 30-year mortgage, given these low interest rates for borrowing.)

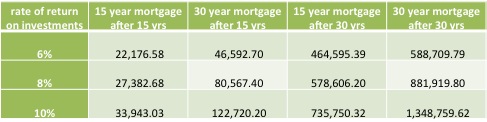

Here is the outcome of the same scenario, run with 6% and 10% returns as well as 8%.

You can see that the lower the rate of return the smaller the difference between the two outcomes becomes and the higher the rate of return the more the 30-year mortgage scenario benefits. When the rate of return dips below the 30-year mortgage interest rate, the favor starts to tip to the 15-year mortgage, as you would expect (though the time value of money still benefits the 30-year mortgage).

The mortgage interest rate is the certain part of the equation and the rate of return elsewhere is the uncertain part. I can imagine that at times it would be difficult to tell which would be the better return. However 1) interest rates are so low right now that it’s a pretty low bar for other investments to beat and 2) the historical average in the market, for instance, is higher than most interest rates most of the time.

2) People Don’t Behave Optimally

Some things could happen to the homeowner that would render the above numbers less helpful for making the decision between the 15-year and 30-year mortgages:

- Her income could change. Income decreasing is what we would be more concerned about. The 30-year mortgage provides more flexibility since she is not locked in to the higher payment and could forgo the additional investing for a time. But that just means that the she owns too much house so that’s not good.

- Her tax bracket could change. Going to a higher tax bracket will make the mortgage interest deduction a larger component of the investment and favor the 30-year mortgage (assuming she can still afford to invest the payment difference). Vice versa as well.

- She could lose the mortgage interest tax deduction if she chooses not to itemize or that loophole is closed, the tax deduction disappears as well as the investments (sort of – she could always invest a portion of her standard deduction if that still exists), favoring the 15-year mortgage.

- The homeowner could choose to move before paying off the mortgage. Selling the house wouldn’t affect the overall balance between the mortgages but just may encourage short-term thinking and these huge numbers are really due to the time value of money. She would also have to not touch the invested money for her next down payment or closing costs or whatnot.

- Her money might not grow tax-free. If the homeowner doesn’t have room available in tax-advantaged retirement accounts like a Roth IRA or a 401(k) the returns from the investments will be dampened and the 30-year mortgage has less of an advantage.

- She may choose to remove money from her investment account or decide to save less monthly. That applies for possibly cash-out mortgage refinancing as well but I think it’s a bigger danger for the 30-year mortgage.

The homeowner could have some personal characteristics that could render the above numbers less relevant.

- She could be debt-averse like DR and some of his followers. That’s just a philosophical thing so if she doesn’t want to be in debt or the interest paid bothers her all the money she could (potentially) make in the market doesn’t matter.

- She could be risk-averse and wouldn’t be able to generate better returns with her investments than she could get by paying off her mortgage faster.

- She might not have the intestinal fortitude to stay in the market through downturns (i.e. she must have the mindset of a long-term investor). She has to resist the temptation to buy high and sell low.

Let’s Get Real

What are the chances that anyone actually does this – buys a house with a mortgage that she can afford to pay off in 15 years but chooses to extend it for 30 years (or even longer) and invest the difference? That takes a lot of self-discipline. Taking out the 15-year mortgage or paying it off even faster is definitely a better use of money than taking out a 30-year mortgage and wasting the difference in payments. For many people it would be better to make the one-time decision to pay a higher monthly mortgage payment than to have to re-decide every month or every year to keep up the aggressive investment schedule. Plus, don’t most people buy a house with a payment they can barely afford on a 30-year mortgage, hoping for future raises and such?

Part of the reason I wrote this post was to settle for myself which of these two approaches is more beneficial. I think that Kyle and I would have the self-control to invest the payment difference between the 30-year and 15-year mortgages (and perhaps also the tax deduction). However, I’m not sure that we will be able to buy a house we can afford a 15-year mortgage on since we are planning to buy in southern CA. If we did start the investment strategy with the 30-year mortgage and then our income decreased (for instance if I stopped working for a while) we might be derailed from our plan. So I guess we will have to make a decision on the ground when we have a house picked out and we know our incomes a little better, but I’m glad to have laid out the advantages of each choice in this way since the PF gurus don’t really encourage balanced discussions.

Is there anything else this analysis should take into consideration? If you have ever taken out a mortgage, did you compare different mortgage lengths and how did you choose? Are you paying off your mortgage early (minimizing interest) or taking as long as possible (maximizing cash flow)? If you don’t yet have a mortgage, which camp do you think you’ll be in?

(1) source: JW’s post on 15 and 30 year mortgages

(2) I used an amortization schedule spreadsheet as a starting point and did all of my calculations off its provided interest payments and the difference between the monthly payments.

(3) I’ve set up the math so that the deduction for the interest paid each month is invested each month, which is doubtful to play out exactly in practice since the homeowner would probably make the calculation for each year instead of each month, but I think the end values will be close, especially if the homeowner invests the tax savings monthly by increasing her take-home pay instead of upon receiving a tax return.

photo from Free Digital Photos

Filed under: choices, debt, housing, investing · Tags: 15-year mortgage, 30-year mortgage

Rethinking Our Student Loan Repayment

Rethinking Our Student Loan Repayment The Thinking Person’s Guide to Dave Ramsey: Swapping Baby Step Order

The Thinking Person’s Guide to Dave Ramsey: Swapping Baby Step Order I Wish We Could Buy a House

I Wish We Could Buy a House Financial Tweaks for Our New Year

Financial Tweaks for Our New Year

I still like the 15yr mortgage. You are assuming that most people will get 8% return on the money and that they will in fact invest the money that they are saving buy getting the 30yr. Working in the banking industry I can say that most people just end up spending that money or in fact couln’t afford the home if it wasn’t for getting the 30 mortgage in the first place so they don’t even have the extra to save. I like the example and it makes a lot of sense if you have the ideal candidate for it.

Thomas S. Moore recently posted..Sneaker Fridays Part Three – Reebok Pumps

I did work through scenarios without those assumptions in place and even conservative returns make the 30-year mortgage the better option with these low interest rates. I agree that most people wouldn’t follow what I outlined above, which is why I said the 15-year mortgage is better if you’re just going to waste the difference. I think there are a lot of people who read PF blogs who may be the ideal candidate, so this post is for them!

Thanks for the mention Emily. I think one of the things that gets lost in the 15 vs. 30 year debate is that most people just look at whether or not they can afford the payment and not whether or not they can earn more in investment. Then when they compare the home they can buy on a 15 year mortgage vs a 30 year mortgage they go with the 30 year because they can buy a bigger home! Not there is anything wrong with that, but most people aren’t taking out a 30 year mortgage to invest, they are taking out a 30 year mortgage to get a bigger home.

Another thing to add to the debate is why do we stop at a 30 year mortgage? If you are going to invest the most money possible and never pay off your mortgage why not go for a 40 year mortgage and have an even lower payment? I just find it interesting that we always use the standard 30 year and 15 year mortgages in our comparison when there are other more “extreme” mortgages out there.

As for my house, we are firmly in the 15/20 year mortgage and pay it off sooner side. Just taking one look at an amortization schedule on a 30 year mortgage makes my head hurt. In addition I’m 30 so the thought of taking out a 30 year mortgage and having it until I’m 60 is not something I want to do! With that being said we are still planning on investing first before we pay extra on our mortgage. A lot of times we frame it as either paying off the mortgage or investing and you can, and really need to, do both.

But great article Emily, it is always good to look at both sides on this debate and draw your own conclusions.

I agree that most people don’t approach home-buying with an eye for maximizing investment potential! But I very well might. Choosing a home price on which we can afford the 15-year mortgage but consciously choosing the 30-year instead for this purpose is legitimately something I’d like to do (given that I don’t as of now know what our incomes will be when we finally get to San Diego).

I don’t think Ric Edelman advocates that you stop with a 30-year mortgage. As far as I can tell he wants you to keep refinancing to extend the loan and I’m not sure where that stops! I just used the 15-year and 30-year mortgages here as proxies for short and long mortgages, or paying it off early vs. keeping it forever.

I don’t think I want to have a mortgage when I go into retirement either (although owning property is never free because of taxes and HOA fees and such). I think 30 years is long enough. 🙂

We recently bought a house and went with a 30 year and are now working to pay it off early. While we could have afforded the 15 year, with rates as low as they are right now the rate difference was not that compelling.

In addition, while we plan to pay off our mortgage in less than 15 years, I like the freedom of having a lower monthly payment on the 30 year vs 15 year. This way if we run into any financial problems we can have lower payments while we get back on track.

While I’ve run the numbers on expected investment return and have thought long and hard about market return vs paying down a mortgage with a low rate for me it comes down to two things. 1) I want the security and freedom that comes with owning our house outright. And 2) the comparison is for expected returns in the market vs know return in paying down your mortgage. Right know I like the known return but mainly because of reason #1.

One more reason we are paying our mortgage- we bought our house in our 30s and I really don’t want a house payment into our 60s. It’s be one thing if we’d purchased in our 20s just out of college, but we weren’t ready at that time.

Sounds like you fall in the “risk-averse” category! Nothing wrong with your attitudes as far as I’m concerned. I don’t know how I feel about home ownership, really, since I’ve never experienced it. Even my parents are still a few years from paying off my childhood home!

I’m a huge advocate of the 15 year mortgage because I can’t imagine paying off a loan for 30 years. We haven’t bought a house but we are planning to within the next year. Granted I understand the 15 year payment is significantly higher than 30 years, which is a little scary.

I’m with you though, I want the security and freedom owning my home outright gives me.

It really is a different mindset – cash flow vs ownership/debt. You’re borrowing at a low rate to invest (ideally) at a high rate. I tend to have the latter mindset but the above numbers are compelling me to develop the former!

When we got our first mortgage, there was no difference between the 15 year rate and the 30 year rate at the time we locked in. (There usually is a difference, we just happened to get unlucky.) So there was no point in going for the 15 year mortgage rather than the 30. We could prepay as if it were a 15 year mortgage and do just as well, but with more leeway for negative shocks.

When we (no-fee) refinanced, we weren’t given a 15 year option and the 30 was the best option, when we (no-fee) refinanced again, the 20 year option was the best offered. We’re currently down to 7.25 years left on this last refinance, a little over 2 years into it. Today’s post talks about how we could lengthen that out once DH leaves his job for the lower monthly payments (or at least how that option means we don’t need to stop pre-paying and hoard cash in case we need more cash-flow in the future).

I don’t think there’s a one-size fits all answer to this question– a lot depends on the rate spread between the two mortgages and the spending habits of the folks with the house. We don’t need that extra commitment device to pay more, but some people do.

nicoleandmaggie recently posted..November Mortgage Update: under 100K and playing with amortization

I can imagine us going down a road like yours since it seems we have similar outlooks. I agree with you about some people needing the commitment device and some not. When Kyle and I talked over the post, he pointed out that with online banking and auto-withdrawals you don’t even really need to make the decision to invest over and over – you can make one decision that goes on indefinitely! Set it and forget it.

I compared the 15 and 30 year fixed mortgages, as well as 5/1 and 7/1 ARMs. The 15 year fixed mortgage and 5/1 ARM had the same interest rates. I could have afforded the 15 year fixed payment, but I opted for the 5/1 ARM since it had a bit more flexibility.

I’m paying off my mortgage aggressively (minimizing interest). I think that it will work out not too badly in the investing sense because it should take me under 5 years to pay it off in full. I’m still maxing out my 401(k) and my Roth IRA, so the only spot left to put my investments is in a taxable account, so I would rather pay off the mortgage aggressively.

Another reason I’m paying off my mortgage early is that if I decide to move to a house in say, 6 years, the rates may be significantly higher and with a paid off mortgage on my condo, I would need to take no mortgage or a pretty small one, to the point that maybe I could take out a 10 year fixed mortgage.

In your math, you assumed that the homeowner invested the income tax savings from mortgage interest. I’m actually putting that money back into the mortgage to pay it off a bit faster. By paying it off aggressively, I might not be able to itemize my deductions for very long, which is okay, because when/if I get married, we probably wouldn’t be able to itemize more than the married standard deduction.

Leigh recently posted..October 2012 net worth update (+1.0%)

I think when you run out of room in tax-advantaged accounts as you have the fast mortgage payoff becomes much more attractive. You are using your condo as a savings vehicle to avoid paying the (inevitably) higher interest rates down the road.

I think I had reason to itemize one year (barely) but that we will definitely have reason to once we have a mortgage since we’re just under the standard deduction ceiling for a married couple now.

We chose to pay off our home faster rather than investing extra because it gives us more freedom once it’s paid off. Even though our interest rate is only 3.25% and investments would likely do better, paying off the mortgage faster is like a guaranteed 3.25% (ignoring the tax deductions, which I count as a year end bonus). Always having a mortgage means always have a monthly payment.

David@SkepticFinance recently posted..A Recent Favorite (And My Wife’s Appendectomy)

Why do you think that you would have more freedom with a paid-for house? I would think the decreased liquidity would feel like less freedom. And you’d have a lot of your net worth tied up in one narrow asset. From a diversification point of view it doesn’t make much sense!

The way I look at it, not having a mortgage payment means more freedom to do what I want, whether in my career or otherwise. Pretend that our monthly expenses were $100/month and we had $10k in cash. That would mean we could go 100 months (just over 8 years) without needing a job. Right now our mortgage is roughly half of our monthly spending on lifestyle (not half of our total budget, just half of what we have to pay out each month), cutting out the mortgage would roughly double the amount of time we could survive jobless, increasing our freedom to do what we pleased.

So many people are tied down to jobs they don’t like or areas they don’t want to live in because they have homes with mortgages and feel trapped. Without that they could take a lower paying job that they enjoy more or move where they want.

I’m not saying that I think people should only be paying off their mortgage and ignore other forms of saving and investing, but for me I will feel much more free to do what I want with my life and money when I have no payments I’m required to make. If you look at percentages in our budget, the minimum mortgage amount is roughly 20% of the total and other investing is around 30%. Additional mortgage payments (principal only) usually make up another 10-15% of the budget and cut the time to pay it off roughly in half.

Hopefully that clarifies my comment a little more, if not I’m happy to keep going 🙂

I understand your point and I actually agree with your plan – it seems very balanced. If we were homeowners we would probably be doing something similar.

But in this post I’m not discussing people who feel trapped by their mortgages, I’m weighing the net worth benefits of paying off a mortgage faster vs. saving more. If your objective is to lengthen the time you can go jobless, you can either reducing expenses or increasing savings. If you could accomplish them equally with a given income and time period, it wouldn’t matter which route you chose. But I think the math I did in this post shows that (given some reasonable assumptions) you can do it better/bigger/faster by investing than paying off a low-interest-rate mortgage. So you end up with, for instance, $25k in the bank and $100/mo expenses instead of $10k in the bank and $50/mo expenses (just as an illustration).

I’m fine with you saying that you feel more free without payments. I don’t know if I would feel more free without payments or with more assets – probably the former. But in terms of functional freedom to do what you want to do I think the higher net worth and liquidity should prevail.

I don’t know how much you’ve read of our blog, but in my actual life I’m infinitely more apt to go to reducing expenses as a solution instead of increasing income. So this post is kind of trying to convince me to go against my own nature, when the time comes for us to make these decisions!

We have had the same basic argument with ourselves, should we pay off the mortgage faster or invest more. I’ve found that the lower the mortgage balance gets the more I start leaning towards the invest more option because the risk of our house value dropping below the mortgage balance and “trapping” us gets lower and lower. It’s a struggle between the rational and emotional sides of my brain.

Definitely a first world problem.

David, I am totally with you!

Screw the math. It’s based on only positive outcomes and good returns. My house will be paid off in 34 months and I will be 100% debt free.

At the same time, I am like you (we also save about 25%) so I don’t have to sacrifice saving/investing to prepay my mortgage. I just choose to do both.

Holly@ClubThrifty recently posted..The Difficulties of Shopping for My Wife

Personally, I would take the 30 year mortgage for the safety of the lower minimum payment, but pay the amount that would be required for the 15 year note. Or maybe use the difference to fund a 6 months or a years worth of minimum payments. 15 years seems like an awful long time to assume that you will be continuously employed.

Edward Antrobus recently posted..Is the Fiscal Cliff Really That Bad?

So you would pay the 15-year sized payment except during times of un/under-employment, when the 30-year payment would be part of your emergency budget? That rather makes sense to me. I don’t know if I would prefer that strategy or keeping a large enough emergency fund, though.

Quite an analysis, well thought out!

I think it depends on one’s situation. Clearly when older, you have to get a 15-year instead. When younger, I think it depends on what percentage of income you plan to spend on the home, and the variability/security of your income.

Of course, if one takes the approach of wants vs. needs, and that debt needs to be eliminated as soon as feasible, maybe it’s best to simply go with the 15 year and spend accordingly. The thing is, most people probably spend more on housing than they should anyway.

Tie the Money Knot recently posted..Saving Money for Future Needs and Financial Freedom

Why would you have to get a 15-year mortgage when older? The only math-related reason would be if you don’t want to take the risk to get better returns than your mortgage interest rate. Definitely you’ve lost most of the power of the time value of money but that applies equally to both mortgage types.

I’m not sure of you point on wants vs. needs. Wouldn’t that argue for the 30-year mortgage – get what you “need” at the lowest price?

[…] @ Evolving Personal Finance writes The Great Debate: 15-Year vs. 30-Year Mortgages – I lay out all the figures that show that a 30-year mortgage has an advantage over a 15-year […]

[…] @ Evolving Personal Finance writes The Great Debate: 15-Year vs. 30-Year Mortgages – I lay out all the figures that show that a 30-year mortgage has an advantage over a 15-year […]

Great article!

When I bought my house I did “run the numbers” of a 15 yr vs 30 yr mortgage. I think there is a key factor missing in your analysis that might be relevant to people purchasing houses while still in transition: the amount of time spent in the house. When I purchased my house I was looking at staying in the house for 5 years before selling and moving on. It made more sense financially for me to purchase instead of rent for two reasons: 1) the mortgage interest deduction on a 30 yr mortgage put me in the 15% instead of 25% tax bracket. 2) regarding a 15yr vs 30 yr mortgage: the difference in principle remaining after 5 years of ownership on a 15 yr mortgage and a 30 year mortgage was not enough to off-set the tax advantages of the mortgage interest deduction on a 30 year mortgage. It is appealing to think of owning your home in 1/2 the time, but for Chris and I, since we plan to be moving around the country every 5 years or so for the next 15 years, then the 30 year mortgage, under current tax laws, usually makes more sense than the 15 year.

The amount of time spent paying down the mortgage matters in a rent vs. buy calculation but doesn’t tip the monetary advantage from the 30 to 15 year mortgage unless the interest rate on the payment difference and rate of return are very similar.

I should write a post about rent vs. buy calculations…

[…] Whenever possible, I try to bring a scientific eye and the mathematical rigor befitting my training in the sciences to my posts, which I believe adds an academic touch. I have on several occasions read papers from the psychology and sociology literature and written posts explaining the authors’ findings (“What Happens When a Spendthrift Marries a Tightwad?”). I do a lot of math behind-the-scenes to help analyze PF questions and illustrate principles (“The Great Debate: 15-Year vs. 30-Year Mortgages”). […]

[…] The Great Debate: 15-Year vs. 30-Year Mortgages […]

[…] The Great Debate: 15-Year vs. 30-Year Mortgages was featured in the Carnival of Financial Simplicity #14. […]

[…] at Evolving PF did some excellent math comparing 15 and 30 year mortgages. I actually did very little math before deciding whether to pay off the mortgage or not. I just […]

[…] Leigh’s Financial Journey included both All I Want for Christmas Is a Giving Revolution and The Great Debate: 15-Year vs. 30-Year Mortgages in her weekend […]

[…] As far as I can tell, mortgage interest rates are the lowest in most people’s living memory! We want to own a house eventually and I know we will have to take out a mortgage for it, so I hate to fail to capitalize on the historically low rates available right now. Imagine being able to lock in 3% for 30 years! […]

Thank you for a very balanced article. If the interest rates were exactly the same, I think the 30 year would give you the best flexibility because you can always construct a 15 year out of a 30 year, but not the other way around. Also, if interest rates were to rise significantly, you would probably want to lock in that low rate for the longest possible time period. (If interest rates fall, you can always refinance either one.) But, alas, the 15 year rate is almost always materially lower, but not substantially lower, so it muddles things quite a bit.

And as it turns out, we actually have a 15 year mortgage, with 5 years to go. So if nothing else, this makes me think I’m not quite as rational as I’d like to think I am. 🙂

S. B. recently posted..Year-End Note

It’s OK to value psychology over numbers as long as you know what you’re getting into!

We have a 5/5 ARM amortized over 30 years as it gave me the interest rate of a 15 year with significantly less closing costs (and I knew I was going to pay it off very quickly). We are 1 1/2 year away from paying it off.

My plan has been –

1) Max 401k to maximize tax deductions there and shelter as much in a Tax advantaged vehicle. At least trying to keep out of the 25% bracket at the moment and avoid AMT (hits earlier if you have kids).

2) Put everything else into paying off the house as it is guaranteed investment and greatly improves my personal financial security.

3) Once house is paid off – max ROTHs, and build taxable investment fund.

You are right that you do have a chance at improving your return by investing more, but you also have more risk. I chose a mix of approaches.

Note that AMT issues look to be largely resolved due to the recent tax changes. Will keep my eye on that one though.

I like that you have a defined priority of investments and that you’ve thought it through for your income and tax levels. I think there is risk in going all-stocks and risk in going heavy-mortgage (1 house! in 1 market! your residence!) so a diversified approach is best.

[…] have already decided that if I had a mortgage at today’s rates I would want to pay it off sloooooooowly and invest money instead. Yes, that means paying interest, but we would be likely to come out with […]

[…] advice I’ve heard on his radio show and read in his books, particularly their argument to keep your mortgage forever. Therefore, it was a little surprising to me to hear them say that such a bedrock principle of my […]

For me what really tips the balance towards the 30 year option is the fact that you can withdraw your principle contributions from a Roth IRA without penalty or taxes at any time (your principle contribution was taxed before it went into the Roth IRA). If as in the scenario described above you are investing the payment difference between a 15 and 30yr mortgage in a Roth IRA you will always have the ability to take out those principle contributions and make a lump sum payment on your loan. Any interest you’ve earn stays in the Roth IRA and you get to take advantage of higher market returns and the safety of being able to pay down your mortgage if your situation calls for it.