Fantasy Summer Money

I’m in the process of interviewing for a summer internship in the “business world.” While I don’t want to get ahead of myself (there’s only a small possibility that I’ll even get the internship), I have given some thought to how an internship like this might change our financial situation. It would be the first of our anticipated transitions! The position pays about 4.5 to 5 times what I make now, so I’ve tried to sketch out how our budget would work during that time, given that we would have to maintain two residences. It’s a bit difficult because I don’t yet know what city the internship might be in, but I’m loosely basing this on Los Angeles since that is my top choice office.

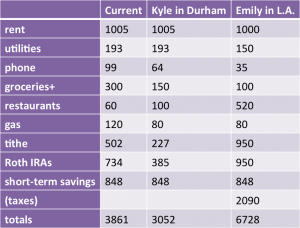

The first column is our rough current budget. The second column is our adjusted budget for Kyle’s expenses in Durham if he were alone. The third column (the most speculative) is estimates of my expenses in my temporary summer city.

The most difficult categories to estimate are how our food expenses would change. Since I would be traveling most of the time I thought my grocery expenses would be not as high (though there would be some waste) but that I would have to eat out much more than usual. I’m not sure what proportion of my meals would be expensed so I just guessed. I upped Kyle’s restaurant budget because I think he would eat more convenience foods without me around.

I am pegging my Roth contribution at 10%, but actually I would exceed the yearly limit. If I don’t have access to a 401(k) with the internship (I doubt I would get benefits like that) I suppose we can invest that money in a non-tax-advantaged account until we can add it to a better type of retirement account. We could also put it in a long-term savings account for a car or down payment. I have taxes only in one category because our current budget is set up with our take-home pay, so I had to remove taxes from what I estimate will by my gross internship pay.

The difference between my gross pay over 10 weeks and 2.5 months of estimated expenses leaves a surplus of $4800. To buy clothing appropriate for the summer I might spend $1000. If Kyle comes to visit me once that would be $400. Moving expenses/leftover rent might be another $1000. That brings us down to an extra $2400. Not too bad! We could beef up our emergency fund quite a bit or add to some of our savings. Maybe even buy the DSLR camera I’ve had on my wish list for a couple years. Or my estimates could be way off and we could net out zero.

There are some additional variations that would help us save even more money:

1) If I am in Los Angeles, I might be able to arrange to stay with family or friends instead of getting my own apartment. The internship would require travel four days out of the week so it might not be too much of an imposition, and since Kyle’s parents live nearby they would likely be the ones on whom I would impose for the weekends. This would save us around $2500.

2) I’m assuming in this calculation that I would bring my car with me for the summer. But it’s possible that I might not need a car, depending on the city. In that case, I might have additional expenses for public transport or cabs but we could also save on gas and insurance during that time.

3) Our apartment complex in Durham actually subsidizes the business students’ rent when they leave town for summer internships. Kyle’s first roommate took advantage of that. I don’t know if they would do that for me since it wasn’t part of our original lease, but if they did it would save us $1125.

I do hope I get the internship! The lotsa money would be fun but mostly I just want to do something different with my summer and advance my career.

Have you ever had to set up a temporary household, particularly a secondary one? If you travel for work, how do you estimate your expenses?

Filed under: budgeting, personal, transitions

No Summer Plans Yet

No Summer Plans Yet The Slippery Slope of Separate Money

The Slippery Slope of Separate Money Upcoming Transition and a Potential Financial Overhaul

Upcoming Transition and a Potential Financial Overhaul November 2012 Month in Review: Money

November 2012 Month in Review: Money

[…] to meet a lot of great people, both the employees and other interviewees. (Also, no chance for a big income boost this summer.) I basically did no work and less blogging-stuff than I usually do, aside from a pre-prelim […]

[…] really interested in. The guy is at UCSF so I’ve let my imagination run away with me (as I am wont to do) and have been looking up housing options in San Francisco. I’m being ridiculous because […]