A New Appreciation for Living Below Our Means

Kyle and I are coming up on our first big financial transitions – something I’ve anticipated since the founding of this blog. I always thought that our post-PhD lives would offer an opportunity for lifestyle inflation, but instead I’m grateful that we live sufficiently below our means to absorb an income cut. This week, I have a new appreciation for our budgeting system and how clearly it delineates between wants and needs. On top of that, I am realizing that we live far enough below our means, even on our low income, that my impending unemployment is not going to be much of a blow.

We have what I call our everyday budget, which is our recurring monthly transfers (saving, giving) and expenses (rent, utilities, food). Then we have our targeted savings system in which we transfer a set amount of money every month to each of many savings accounts designated for specific purposes.

Our everyday budget is largely made up of needs and our percentage-based budgeting line items – only our restaurant eating (and maybe a bit of the grocery allocation) and the missionary we support are fully optional.

Our targeted savings, on the other hand, is largely discretionary “wants.” The only needs that we’re locked into that come out of those accounts are our auto and renter’s insurances. The other non-emergency needs like clothing can be deferred if we are tight on funds. Most of the overall targeted savings rate is really just pure “wants” like travel, entertainment, a DSLR, and our CSA. Plus, we have a lot of money built up in these various targeted savings accounts, so we could probably spend as normal without saving anything into them for quite a while.

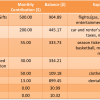

So with those observations about our current budgeting system, it was easy to divide up the wants from the needs to create budgets for three scenarios come summer/fall, for after Kyle starts his new position:

- Scenario 1: Kyle and I are both employed by our university (me as a grad student, him as a postdoc)

- Scenario 2: Kyle is the only one bringing in an income

- Scenario 3: Kyle has his income plus I have some side hustle income

(These scenarios assume I don’t have a full-time job in Durham because I’m not applying for full-time jobs in Durham. If I’m employed I will be living in another city and that will be a completely different money management scenario and not really worth speculating about at this time.)

In the first scenario, which will last only 1-2 months, we will have a very nice income boost, which obviously will all go straight to savings to shore up for the subsequent months. No changes are necessary to our spending, only to our giving, saving, and taxes to keep the proper percentages for those.

In the scenarios 2 and 3, we’ll be dealing with an income drop and the extra expense of adding me to Kyle’s health insurance plan. Essentially, we’ll keep our everyday budget the same and stop saving to our targeted savings accounts individually (except for the rates for our insurance and estimated medical expenses) and just put whatever is left over each month into general savings. If we are truly in scenario 2 and not 3 (i.e. I can’t make any side income), we would consider dropping the missionary support and taking on a roommate. But I hope that I will be able to hustle up at least the difference between Kyle’s new income and our old combined income – or even more!

My estimate is that we’ll be able to cover our percentage-based giving and saving, all of our everyday budget, and the non-deferrable needs in our targeted savings rate on Kyle’s income alone, with a few hundred left over each month to go toward general savings. That’s because 1) Kyle’s raise is about 40% of my income, 2) we don’t spend anywhere near what we make on a monthly basis, and 3) our budget guides us to easily differentiate between wants and needs. We have the added security of what I consider to be plenty of money in our emergency fund, general savings account, and various targeted savings accounts. That really takes the pressure off of me to have to earn any self-employment income, though I certainly aspire to through freelancing or website income.

I could easily be freaking out about being removed from my advisor’s payroll so suddenly without sufficient free time to look for a job. Instead, thanks to our budgeting principles and Kyle’s new job offer, I am calm and confident.

How would your budget handle an income drop? Is it easy for you to tell wants from needs in your spending?

photo from Free Digital Photos

Filed under: budgeting, career, savings, targeted savings, transitions · Tags: living below our means

How to Tell If Your Means Are Just Not Enough

How to Tell If Your Means Are Just Not Enough Our Short-Term Savings Accounts

Our Short-Term Savings Accounts How Does Your Salary Compare to the Living Wage?

How Does Your Salary Compare to the Living Wage? How Do You Decide If You Can Afford a Purchase?

How Do You Decide If You Can Afford a Purchase?

That sounds like a good system and you’ll be OK no matter what!

We’re looking at a financial transition that’s somewhat similar, but our situation doesn’t look nearly as good, and I am afraid we may just have to deal with that and hope it’s temporary. We are probably going to have an income drop AND seriously increased costs of living. My husband’s postdoc involves a raise, but it also involves higher taxes, monthly health insurance premiums, and either commuting costs or higher rent in a more expensive city (2 hrs by public transit). Those increased costs will actually eat up his entire raise, which isn’t that big. It’ll be OK when I am teaching in the fall, but I’m probably going to be out of work for at least a few months come January, and that’s when I mapped it out and our basic needs (rent on a much smaller apartment, utilities, transportation to work, health insurance, groceries, and minimum student loan payments) will cost his entire after-tax income. We may have no choice but to stop saving and charitable donations entirely, and likely take money OUT of savings for any unanticipated bills beyond those basics. I know we can survive that way temporarily, but I also can’t predict how long it will take me to find work, or whether that work will pay enough to make a difference, so it’s kind of scary to be looking at a period of LESS financial health than graduate school.

This is the kind of situation when it’s ok to draw on savings, right? Or is it NEVER ok when you do have one income?

I absolutely think there are situations when you’ll have to draw money out of savings even with one income. It’s just the reality when you had a two-income household and the incomes are similar. If our numbers had worked out a bit differently, that’s what we would do after my defense. Although I’m such a weirdo that I would probably insist on keeping our giving and long-term saving rates going from the one income while pulling money from short-term savings to cover necessities. What is the savings there for, if not to use?

It sounds like things will be tight while you’re not working but you won’t be hemorrhaging money. You will get through it! Hopefully it will be one of those “remember when” experiences you can shake your head about later on. You’re making a conscious sacrifice for your husband to have this great career opportunity.

Income drops aren’t much fun even when you do spend less than you earn. It’s hard to get out of the habit of saving! It is easier when you know they’re temporary though.

Re: the previous question: We spent out of savings when we went on sabbatical. We saved up targeted savings just so we could do that. Heck, any kind of targeted savings eventually gets spent, if it’s for a house downpayment or a car or even a vacation. Very few people can buy such things out of cashflow. If you have an emergency fund and you’re in an emergency, then it makes sense to spend out of savings. Of course, it can’t be a regular thing if it’s long term– it never hurts to take a hard look at your budget and your future prospects to see what’s sustainable and what kinds of cuts you can make.

nicoleandmaggie recently posted..How do you mentor junior faculty?

It’s a rough situation but better to go in knowing that you didn’t need all your previous income just to get by!

Thanks for sharing your experience of supplementing income from savings. That was the purpose of that savings!

Just an FYI: when I defended, I worked in the lab until August 26 or so and Duke notified me that my health insurance would expire on August 31 — very quick turn around! This might have been due to my technically having a summer graduation date because of when I defended; maybe if you defend at the very start of the fall graduation cycle (probably any time after the last Friday in July) you can hold on to your insurance for the entire semester because you’re still a student? I’m not sure!

In relation to this post, we had to do a lot of adjusting to our budget when I moved here: we no longer had two rents and two sets of utilities, but rent where we live together now is actually slightly more than what we paid for two rents combined (knew we wanted a baby – opted for a larger place). Keegan’s salary covers all of our expenses thankfully, but there is almost no money left over. To adjust in the time before I had a job, we got rid of cable which was eating away a lot of money for not much benefit and I used some of my “free time” while not applying for jobs to devote more time to couponing with groceries and making a lot of meals in bulk so that we could also cut down on our groceries. I also took him to and from the Bart station so he didn’t have to pay to park (it’s $2/day now! obscene considering you also have to pay almost $12 round trip just to get into the city). We also borrowed a several pieces of furniture from one of his coworkers so we didn’t have to spend money to have a bed to sleep in or a television to watch Netflix on 🙂

We had assumed I would have to transition to Kyle’s insurance as soon as I stopped working, but maybe it would last through the semester if I technically am graduating in the fall… Hmmm, something to look into. I found out that tuition has to be pro-rated i.e. a grant will only pay my tuition for the time that I’m actually working and the remainder of the semester would have to come from my advisor’s discretionary money. Maybe health insurance is the same since it’s paid at the start of the semester. That would be a great reason to try to defend after that last Friday in July if we can avoid paying those premiums for a few months. I’ll figure that out after I set a date, I guess.

You should check out the post I wrote this week for Budget Blonde as you recently went through the situation I was imagining. Those little ways you traded time for money while you were unemployed are good tips. Maybe we won’t even need a parking permit in the fall if I drive Kyle to work every day. 🙂 Do you still have the borrowed furniture now that you are both employed?

Ours income has been weird since we got back to NZ. T was only working for about one month out of the past six and I’ve just gotten a new job earning more, but it’s a bit of a bitter pill until HE starts earning again.

That’s great news, though! It’s a time of transition.

My HB and I experienced this when we moved cities and didn’t have any employment. It was cool to see how little we really needed to live off of, though freelance income did help a lot too.

Jessica Moorhouse recently posted..My Wedding Budget – One Year and $16 ,000 Later

What you guys did was very brave. I don’t think we’ll move until Kyle has a job unless things really change with the search.

You two will be awesome no matter what!! I hope you don’t have to take on a roommate though!

The roommate would really be a last ditch effort as it’s a big lifestyle sacrifice. But I might take on a roommate before giving up the idea of going on a nice vacation.

[…] A New Appreciation for Living Below Our Means by Evolving Personal Finance […]

[…] @ Evolving Personal Finance writes A New Appreciation for Living Below Our Means – While budgeting to live solely off my husband’s income, I came to a new appreciation […]

Income drops can be hard to navigate. In general, I also try to live below my means. I don’t go super intense on the frugality, but I strive to keep my costs reasonably low compared to my income. That way when things get harder in terms of income, its not nearly as difficult.

What you articulated really speaks “balance” to me and I love it!

[…] Evolving PF writes about living below their means […]

[…] all the planned spending we would like to (big vacation, camera, car repairs) in the fall and I am un/underemployed for a while, we might dip back below $100k for a bit. So things would still be a bit shaky on […]

[…] from Mo’ Money Mo’ Houses listed A New Appreciation for Living Below Our Means in her blog […]

[…] tallied up the paychecks that we can anticipate receiving through the end of the year (assuming Kyle stays at his current position that long). For each […]

[…] defense, so I don’t have too much to report this month. Our spending is still pretty loose. We’ll definitely have to tighten things up in a couple months when I’m without an […]

[…] I have the opportunity to be funemployed this fall. I’d like to bring in some side income, but we can get by on Kyle’s salary alone, perhaps pulling a bit from savings. I don’t feel one bit of guilt about relying on my […]

[…] income on the side through my contract job and also whatever may come from my websites. Because we were living below our means while we had two incomes, between my husband’s income (he recently got a raise) and our cash […]

[…] Apparently I’m doing a whole series about surprising or confusing things that happen when you get a real job! I mean, Kyle’s job is only like half-real (postdoc so he’s still in training and isn’t paid what he’s worth, but he gets a W-2 so he’s a real employee). I’ve already covered why we chose not to enroll him in his 403(b) and how we muddled through our new health insurance choices. Today’s topic is payroll deductions, which at the moment are super annoying to me! I’ve not really seen this addressed in my corner of the PF blogosphere so I decided to vent my frustrations in a post. I assume this is not annoying to y’all because either you haven’t transitioned jobs in a while or money is not as tight for you as it is for us right now! […]

[…] We had two other big purchases that would have come from targeted savings accounts if they still existed. It was really just a perfect storm! These are the types of purchases that we don’t mind drawing from savings, but the problem is that we’re no longer saving every month for these purchases. […]