Evolving Personal Finance » Archive

Marginal Tax Brackets, Deductions, and Credits Explained Graphically

Many US taxpayers have a difficult time understanding what marginal tax brackets are and the differences between credits and deductions. I will illustrate these three concepts for a hypothetical single taxpayer, Alex. Alex’s Gross Income Alex’s gross income is $225,000, all from his job, shown in solid red. Deductions Deductions reduce your amount of taxable income. Alex has deductions that can be found in lines 23 to 35 of his 1040 in the amount of $15,000 (patterned red). Examples of … Read entire article »

Filed under: taxes

Favorite Posts, Mentions, and Top Comments Week of 17Mar2013

This week is all about watching March Madness! My PI walked into my office when I had it streaming one time this week. :/ We also saw Anything Goes at our local theater – Kyle really liked it and I thought it was pretty good. On Friday night we went to a Grad Christian Fellowship gathering and hear from a bioethicist faculty member, which was fascinating and provoked a lot of great discussion afterwards. Finally, one of our friends in Kyle’s program defended this week – congratulations Dr. S! Posts I Liked Kraig from Young Cheap Living explains why he’s bucking the standard advice to use tax-advantaged retirement accounts and buy a house. Well Heeled Blog draws attention to the trend of freezing eggs to extend the childbearing years in favor of focusing … Read entire article »

Filed under: weekly update

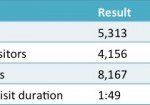

Blog Statistics Update February – March 2013

I sure am glad this month is over! I passed my prelim on March 4 and was fairly busy and stressed leading up to that date. Now I feel so much closer to graduation! Unfortunately my relative absence from the blogosphere resulted in lower traffic and comments on EPF this month, but after our great Jan/Feb it’s not been too bad. Here’s to a better next month! Guest Posts This month we had three guest posts from fellow … Read entire article »

Filed under: blogging, month in review

Our Experiences with Paying Off Debt

This post is a personal story about how debt has intersected our lives and not intended to be any big lessons. You’ll see that how we paid off our debt doesn’t necessarily apply to others as I’ve been rescued a couple times! We also still go back and forth over whether or not we are officially debt-free. Between me and Kyle, I have more experience with debt so I’ll start with mine. Student Loans I took out some … Read entire article »

Filed under: cars, credit cards, debt

How to Spend Less When Attending Out-of-Town Weddings

In a 48-hour period last week, we received two unexpected wedding invitations, heard about two more engagements, and attended a pre-wedding event – all for weddings occurring this summer! We had thought it was going to be another slow wedding season for us, but we are now planning to attend at least two out-of-town weddings – one in Boston and the other in Madison, WI. Since 2010, we have attended TEN out-of-town weddings. We want to … Read entire article »

Filed under: family, food, frugality, marriage, personal, travel

Favorite Posts, Mentions, and Top Comments Week of 10Mar2013

This week was spring break – of course that doesn’t mean anything changed schedule-wise for me and Kyle, but campus was just a bit empty. I found a really exciting paper and I want to implement the method in our lab, so I decided to give it to my undergrad to work on – Kyle said “Look at you, delegating like a PI!” I’m still trying to get comfortable in the whole mentor role thing. Our weekend plans were pretty well ruined by our team getting knocked out of our conference tournament early! We’re really bummed about that but hope it’s a wake-up call so they get it together for the big dance. Posts I Liked My Money Design lays out several wealth creation strategies. Kraig from Young Cheap Living details how to use … Read entire article »

Filed under: weekly update

When Did We Acquire All This Cash?

When Kyle and I arrived home from our honeymoon in June 2010, our non-property net worth consisted of: our Roth IRAs around $16,500 in savings accounts/CDs a bit in checking the money we received as wedding gifts $16,000 in student loans We had just spent between $10,000 and $20,000 on our rings, our honeymoon, and our portion of the wedding expenses. We felt like we were starting from zero, in cash anyway. That summer we put in CDs the amount of … Read entire article »

Filed under: personal, targeted savings

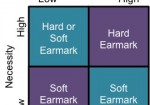

Hard and Soft Earmarks in Targeted Savings

I have come to another stage of reflection regarding our targeted savings accounts. When we first set them up right after we got married, they were a great way to plan for irregular expenses and to motivate us to defer spending. More recently, I’ve realized that as our next year is so uncertain, the role of our targeted savings accounts may become diminished. As I’ve thought through what money we might be willing to shift … Read entire article »

Filed under: targeted savings

Why We Don’t Have Life Insurance and When We’ll Buy It

Kyle and I don’t have life insurance – Kyle and I don’t believe we need life insurance right now. We view life insurance as a means to provide for dependents in the event of an early demise – specifically, to replace the income of the deceased. My mother, a former insurance agent, views life insurance as an investment vehicle, which I think she really had to believe in to be able to sell the product. But my … Read entire article »

Filed under: insurance