Evolving Personal Finance » Archive

Current Credit Cards Rewards Strategy

When I weighted the advantages and disadvantages of adding another credit card, I decided that the chief disadvantage for us is that we might lose track of how to optimally use the cards for maximum rewards. After all, we use Mint to aggregate all our accounts so we don’t ever lose track of which card needs to be paid off and whatnot. I decided to comb through our current credit cards to make sure we are … Read entire article »

Filed under: credit cards

November 2012 Month in Review: Money

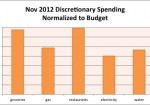

We did a terrible job staying under budget this month – check the bottom to see if it was a pass or fail (it was close!). Our lack of control in the grocery store was to blame again. Our targeted savings accounts saved our behinds, too, as our car failed its yearly safety inspection and we had to make some unexpected repairs, but our Cars account was up to the task. Kyle is, I swear, … Read entire article »

Filed under: month in review

Weekly Update 41

I can’t put my finger on exactly why, but I just feel like I had a great week! I took some confusing data from my projects that are making me think deeply about my system. I completed my certification to use a tunneling electron microscope. Kyle and I attended an AMAZING home basketball game (a bit unexpectedly – last minute tickets). I couldn’t see worth anything but I love the atmosphere. We went to a great party last night – lots of time hanging out with our friends and the best round of telephone pictionary I’ve ever been part of. I got back in the gym for a heavy weights workout. I went shopping yesterday for the first week of our reduced-grocery-spending month. I went to 5 stores in 2.5 hours and spend over half our … Read entire article »

Filed under: weekly update

How to Tell If Your Means Are Just Not Enough

I write quite often on this blog about the virtue – nay, requirement – of living within your means. Even though I am earning a salary that many would consider laughable for my education and experience, I am determined not only to live within my means but give and save as well. I think everyone else should strive for this too – whatever your income, you shouldn’t be running up debt for your living expenses. However, … Read entire article »

Filed under: budgeting, choices, debt, frugality, grad school

How to Be an Exemplary Boomerang Kid

Last week I wrote about thoughtless boomerang kids, but not every young adult who lives with her parents post-college takes that not-so-grateful attitude. It is possible for the boomerang experience to be a positive one for both children and parents, but it takes preparation, intentionality, and consistent follow-through. (Of course, there are pockets within our society that have a social contract wherein it is expected that young adults will live with their parents until they get … Read entire article »

Weekly Update 40

Um… Thanksgiving happened. We drove to my parents’ house on Wednesday night and came back to Durham Saturday night. I had a lot of nice time with family but not as much as I would have liked with friends. :/ I also gave lab meeting last week, which went fine. I have several ideas of things to try out in the immediate future so I should be keeping busy. Posts I Liked Tie the Money Knot explores the spender-saver dynamic in marriage through two example couples. J. Money from Budgets Are Sexy asks his readers eight in-dept questions about how they are doing now in comparison with four years ago. Jordann from My Alternate Life squares her consumerist tendencies with her minimalist lifestyle. Daisy from When Life Gives You Lemons reveals how she accomplishes so … Read entire article »

Filed under: weekly update

What’s In My Wallet

Happy Thanksgiving weekend, everyone! I hope that you are enjoying your loved ones and not struggling with strangers at big box retailers. I hope to be doing the former but might be forced into a bit of the latter. Just a quick post from me today – I want to show you what’s in my wallet! I love my wallet. It’s tiny so it keeps me honest about what I’m using and what I’m not. It’s a … Read entire article »

Filed under: personal

The Benefits of Targeted Savings Accounts – and Their Uncertain Future

Boy, am I grateful for our targeted savings accounts this month! We have spent a crazy amount of money this month, some of it unexpectedly. This month we have used our targeted savings accounts to purchase our Christmas flights ($625.20), six months of car insurance ($405.47), and other miscellaneous items ($149.85). All of that was planned and budgeted for so even though it was a lot of money it wasn’t stressful at all. Actually, we have … Read entire article »

Filed under: targeted savings

Boomerang Kids, Listen Up: It’s Not All about You

I run into a variation of this statement quite often around the PF blogosphere: “I chose to live at home* to save money while I paid off debt/saved for the future.” I don’t want to link to specific articles, though there are many, because I don’t want to call out the authors individually. But I want to say that this type of statement drives me up the wall! My request to you boomerang kids is this: Please don’t … Read entire article »