Evolving Personal Finance » Archive

An Adult-Sized Emergency Fund

Confession time: Until very recently, Kyle and I didn’t have a proper emergency fund. We had some cash on hand and then of course accessible investments (our house down payment and student loan payoff money), but I figured age-30-with-a-Real-Job was time enough to work on that personal finance 101 advice of having a true emergency fund. We’ve let this aspect of our financial life slide for so long because our financial life was rather small and … Read entire article »

Filed under: emergency fund

February 2016 Budget Report

This was a humdrum month for us financially, except for overspending in some of our variable budget categories. We have basically just been working our new Seattle routine. The weather is definitely changing for the better; February was much warmer than January, and there are sunny and non-rainy days from time to time. We finished filling up our 2015 Roth IRAs this month – earliest ever! From now until April 15-ish we’re putting our retirement money in my … Read entire article »

Filed under: month in review

How I Work on the Road

As a solopreneur who is also a bit of a homebody, I don’t have a typical off-site office from which I work. Most of the time, I work from my living room – at my standing desk, at our table, or on the couch. However, I also travel (fly) for work. I am a professional public speaker on the topic of personal finance for early-career PhDs, and delivering talks at universities almost always involves 2+ … Read entire article »

Filed under: self-employment, travel

A Frugal Business Trip

Last month I achieved something I’ve wanted for several months but never pulled off: a frugal trip for a speaking engagement. I minimized the costs both to me and to my host for various aspects of my travel. First, to back up to my previous speaking trips: they were surprisingly unfrugal, at least in comparison to my typical personal travel experiences. The costs I can’t do much about are the flight, which is a necessary large cost … Read entire article »

Filed under: travel

January 2016 Budget Report

We made a few adjustments to our budget this month and are gearing up for more changes this spring. First, we are going to budget off of Kyle’s salary alone instead of his salary plus my contractor income as we were last fall. This month, in addition to Kyle’s salary I did have contractor income and I paid myself part of my 2015 business earnings. (I’m going to wait until we finish our taxes and have … Read entire article »

Filed under: month in review

Picking Up the Check

Here’s one perk to being a grad student: everyone pities you. Wait, that doesn’t sound like a perk… I’ll rephrase. When you’re a PhD student, people with real jobs assume you are poor. They either think you’re taking on debt for your extended schooling or know that you’re living on a small stipend. The perk is that this pity often expresses itself in financial generosity in the form of free meals. For nearly all of … Read entire article »

The 80/20 Rule Applied to Personal Finance

I’m sure that most of you are familiar with the 80/20 rule or the Pareto principle, but in case you aren’t… The basic idea is that 80% of outcomes can be attributed to 20% of causes (Investopedia). This originated as a business principle but has been loosely applied in many other areas. This post from Money Peach on excuses for not budgeting (and counter-arguments) really got me thinking about how simple most of personal finance is. Really, … Read entire article »

How Much Is YOUR Life Worth?

Kyle and I had one of our rare money disagreements last week. The (temporary) conclusion is that we need more information before making a decision, which is where you come in! We decided that it’s high time we bought life insurance as I’m rather financially dependent on Kyle while I’m growing my business. We also want to have kids in the next couple years, at which point life insurance will go from being a good idea … Read entire article »

Filed under: insurance

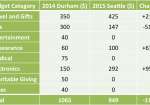

Lifestyle Inflation Analysis

One of the big purposes of me creating this blog, right from the beginning, was to keep Kyle and I from succumbing to lifestyle inflation as we transitioned out of grad school and into our careers. I knew that many people, upon experiencing a jump in salary, would mindlessly let their spending increase across various areas of their budget. I draw a strong distinction between lifestyle inflation and lifestyle increase. I see lifestyle increases as … Read entire article »

Filed under: budgeting, transitions

December 2015 Budget Report

We took an extra long Christmas break this year because we skipped out on traveling for Thanksgiving. Kyle used up all but one of his vacation days! We spent several days up through Christmas Eve with Kyle’s family in California, took a Christmas morning red-eye, then spent Christmas and several days following with my family in Virginia, and returned to Seattle for New Years Eve. The month was fairly normal spending-wise except for the 11 … Read entire article »

Filed under: month in review