Evolving Personal Finance » budgeting

Mini-Vacation Financials: Smoky Mountains Trip for a Wedding

This post as a case study example of how we use our Travel savings account to have a fun (and not too extravagant) weekend away for a wedding and to share some photos from our weekend! The Plan Kyle and I received a wedding invitation a few months ago from one of our very best college friends for her wedding in the Smoky Mountains. Of course we knew we would attend so we just had to decide … Read entire article »

Five Money-Saving Moves from Our Wedding

As wedding season 2012 has been heating up, I’ve seen more and more PF-blogger-brides (yet to see a groom) discuss their wedding budgets or various aspects of planning. It’s caused me to reflect on our wedding from 2010, which was not at all an inexpensive undertaking. To this day I don’t know how much money was spent on our wedding because some costs have not been disclosed to us by our parents and some small … Read entire article »

Filed under: budgeting, choices, featured, luxuries, marriage, spending, values

How Does Your Salary Compare to the Living Wage?

In my posts on saving for retirement last week I threw the term “living wage” around a few times. While I encouraged graduate students to save for retirement, I didn’t think that should apply to students being paid below a living wage. But what exactly is a living wage and how to you determine what it is for where you live? from Investopedia: “A theoretical wage level that allows the earner to afford adequate shelter, food and … Read entire article »

Filed under: budgeting

The Financial Implications of Dropping One Car

We have decided to become a one-car family! If you remember, three weeks ago my car wouldn’t start and we found out it needed $1,600 in repairs. We paid $400 to get it running and evaluated the possibility of relying completely on Kyle’s car until we start working at different places. (We don’t want to sell the car because it still has a lot of miles left in it. Kyle will graduate in a year-ish … Read entire article »

Why Do We Make Rules If We’re Just Going to Break Them?

Kyle and I have a rule: We don’t watch important basketball games (i.e. any game involving our team, or the final rounds of the NCAA tournament) with people who don’t care about basketball (apathy is bad enough – rival fans would be inconceivable!). You can imagine the situation that inspired this rule! So I was surprised when Kyle told me yesterday that he is planning to watch our team’s big rivalry game this weekend with people … Read entire article »

Filed under: budgeting, choices, credit cards, debt, giving, retirement, values

Do You Ever Just Give In and Spend?

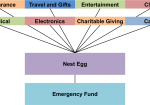

I’ve written several times about our targeted short-term savings accounts. For the most part these work very well for us in saving for our anticipated expenses. But sometimes, the system backfires – specifically, when we need (?) something that we haven’t saved for, or haven’t saved enough for. Dividing up our cash among all these accounts means we have to do some psychological tricks to get the money from elsewhere. We’ve had two instances of this … Read entire article »

Filed under: budgeting, choices, spending, targeted savings

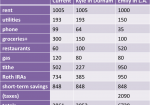

How Often Do You Adjust Your Budget?

Kyle and I have to do a massive budget overhaul for next month. We need major edits in groceries, tithe, cars, and travel and minor edits in several other categories. Of course there are always more needs/wants than take-home pay so we have to make some tough decisions. I realized this is the first big edit we’ve done in quite some time though. Every few months we’ll adjust a category or two by a small amount, … Read entire article »

Filed under: budgeting, participation

Spend $1600 or Become a One-Car Family?

Irony: My car breaking down the day after writing about our disagreement over carpooling to work! When I published that post on Monday becoming a one-car family seemed a remote possibility, but as of this writing on Tuesday evening we are giving it serious consideration. So much can change in 36 hours! For the last few months, my car has been shaking considerably when its speed exceeds 65 mph. I knew I would eventually need to get … Read entire article »

Filed under: budgeting, cars, choices, emergency fund, targeted savings

Consistent Grocery Budget Fail

Confession: We have exceeded our grocery budget every month since September. Several of our budget categories, including groceries, are supposed to be a maximum amount spent, with whatever is left over at the end of the month to be transferred into savings. Instead, for groceries we have had to take from other budget categories to cover it. How did we get into this mess and why haven’t we turned it around? Last May we lowered our … Read entire article »

Fantasy Summer Money

I’m in the process of interviewing for a summer internship in the “business world.” While I don’t want to get ahead of myself (there’s only a small possibility that I’ll even get the internship), I have given some thought to how an internship like this might change our financial situation. It would be the first of our anticipated transitions! The position pays about 4.5 to 5 times what I make now, so I’ve tried to … Read entire article »

Filed under: budgeting, personal, transitions