Evolving Personal Finance » budgeting

Toeing into the E in EPF

I thought I’d take this Friday post to update you all on the random money goings-on around the EPF household. We are gearing up for our first financial transition, moving from the apartment Kyle’s lived in for 5 years (and I for 2 years) to a townhouse that’s both cheaper and closer to school and church. In addition we’ve had some other small bumps in the road and changes and are looking forward to some … Read entire article »

Filed under: budgeting, credit cards, targeted savings, transitions, travel

How to Cut Your Food Spending – Scaling Back on Eating Out

For those looking to cut back on their spending, eating out is a prime target. While there are some people for whom eating out has become a lifestyle, we all know that it is totally optional! This post will help you find ways to cut back on how much money you spend on eating out as well as get more for the money you do spend. Planning in this area will pay off big time … Read entire article »

How to Cut Your Food Spending – Reducing Grocery Costs

Very early in your spending-tracking or budgeting lifestyle, you will realize that food spending is one of the most highly variable and easily manipulated expenditure categories. If you’re looking to reduct your spending, food is often the primary target of budget slashing, and for good reason! There are lots of ways to cut back on food spending, from temporary fasts from certain products to long-term lifestyle changes like cooking. Take a moment to look up your … Read entire article »

Budgeting, Tracking, or Neither?

I’ve added a new podcast to my rotation – Ric Edelman’s The Truth About Money. I don’t know how well-known RE is nationally, but he works in the area where my parents live so I’ve heard of him a few times. He has a totally different money philosophy than Dave Ramsey (low-interest debt is great!) so I started listening to it to safeguard against becoming brainwashed by DR. During last week’s show the hosts were discussing … Read entire article »

Can a Net Income Boost Compensate for Not Having Earned Income?

Two weeks ago I got a great comment on my Roth IRAs for Graduate Students post from Joe. He asked “Why would you want fellowship income to be reported as earned income? The payroll tax (6.2%+1.45%) that must be withheld from wages … in my opinion, makes the unearned income classification better.” The payroll tax exception for 1099-MISC income wasn’t something I addressed in the Roth IRA post (although I mentioned it as a perk for some … Read entire article »

Filed under: budgeting, retirement, taxes

Proposed Series: Literature Review of Joint and Separate Accounts

During a conversation with my officemate about the diversity of comments concerning joint and separate money within marriage, she told me that during college she had read a sociology paper on the ideal number of accounts for a married couple (as she recalled, 5). It had not occurred to me that such topics would have been studied by researchers but I was immediately excited about the prospect of learning about such work. During college I … Read entire article »

Filed under: budgeting, marriage, the literature

How Do You Decide What to Spend on a Wedding Gift?

Today we’re going to discuss a point of etiquette! This post was inspired by a recent invitation we received to our first black tie wedding of our peer group. Since we’ve been married, Kyle and I have worked out a standard amount of money to spend on a wedding gift. We choose gifts from the couple’s registries that total to about $70-80 so with tax and (sometimes) shipping it’s usually around $80-90. That range is purely … Read entire article »

The Fact and Fiction Behind “Two Can Live as Cheaply as One”

Everyone’s heard the phrase “two can live as cheaply as one.” In one sense it’s absolutely true: when you live in a home by yourself and someone moves in with you – a roommate or spouse who pays his own way – your per capita expenses will go down. You have someone to split the rent and utilities with. But the way the phrase is usually applied is to married couples – as if just … Read entire article »

Filed under: budgeting, choices, frugality, goals, lifestyle creep, marriage, spending

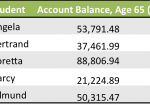

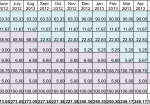

Targeted Savings Account Calculation: Cars through Aug2013

This weekend I re-projected the amount of money we need to save monthly into our Cars targeted savings account. I’d like to share my method with you so that you can see as an example how we decide how much to save into each savings account. The Cars account is a good one for this exercise because the payments we make out of it are very well-defined (unlike Travel or Appearance) but they’re shifting a … Read entire article »

Filed under: budgeting, cars, targeted savings

The Slippery Slope of Separate Money

One of the basic rules of marriage that we were introduced to in premarital counseling: Don’t keep track. Life is not 50:50, nor should it be. While both spouses should contribute to a marriage and household, it’s both fruitless and fodder for fights to try to make everything fair and even. At the moment, we keep our finances completely joint. We still have some leftover separate accounts, but all of our functioning money is joint. And … Read entire article »

Filed under: budgeting, marriage, personal, spending, targeted savings