Evolving Personal Finance » cars

Frugal Practices I’ve Grown to Love

It’s wonderful when a positive, self-beneficial act becomes automatic and even better when you enjoy or look forward to doing it! Being frugal doesn’t come naturally to me; I had to learn many of my current practices over time and fight against my upbringing. My husband will attest that I’m certainly not frugal in all aspects of my spending! But I’m so glad I started doing the activities that I list below because they have … Read entire article »

Filed under: cars, checking, found money, frugality, insurance

How Sharing a Car Has Helped Our Joint Finances

Kyle and I have completely joint finances – no allowances or “blow money” or anything similar – because 1) we agree on most everything anyway, 2) I don’t think we have a high enough income to spend on things we can’t both agree to, and 3) we don’t know how to halt the creep of separate finances that starts with designating any money as “mine” and “yours” instead of “ours.” Not only do we have joint … Read entire article »

One-Car Lifestyle Update

Kyle and I have been sharing one car for about four months now and I think it’s high time to give you an update in how that decision has impacted us. Financially, we’re not not-spending nearly as much money as we projected. Relationally, sharing a car has enhanced our marriage. Logistically, going down to one car hasn’t been much of a challenge, but at times it has caused stress. Financially I projected that we would not-spend a little less than … Read entire article »

Filed under: cars

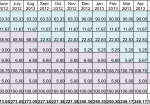

Targeted Savings Account Calculation: Cars through Aug2013

This weekend I re-projected the amount of money we need to save monthly into our Cars targeted savings account. I’d like to share my method with you so that you can see as an example how we decide how much to save into each savings account. The Cars account is a good one for this exercise because the payments we make out of it are very well-defined (unlike Travel or Appearance) but they’re shifting a … Read entire article »

Filed under: budgeting, cars, targeted savings

The Financial Implications of Dropping One Car

We have decided to become a one-car family! If you remember, three weeks ago my car wouldn’t start and we found out it needed $1,600 in repairs. We paid $400 to get it running and evaluated the possibility of relying completely on Kyle’s car until we start working at different places. (We don’t want to sell the car because it still has a lot of miles left in it. Kyle will graduate in a year-ish … Read entire article »

Why I Took Out a Car Loan for More Than the Purchase Price of the Car

When I bought my car (the one that is currently not being driven) in 2008, I needed to borrow $3,500 on top of the $1,000 I had saved to pay the private seller. However, I ended up taking out a loan for $5,000. Why in the world would I take on more debt than was necessary? First, I need to explain that I was in a little different mindset in 2008 than I am now. I … Read entire article »

Spend $1600 or Become a One-Car Family?

Irony: My car breaking down the day after writing about our disagreement over carpooling to work! When I published that post on Monday becoming a one-car family seemed a remote possibility, but as of this writing on Tuesday evening we are giving it serious consideration. So much can change in 36 hours! For the last few months, my car has been shaking considerably when its speed exceeds 65 mph. I knew I would eventually need to get … Read entire article »

Filed under: budgeting, cars, choices, emergency fund, targeted savings