Evolving Personal Finance » Archive

Frequent Flyer Programs: Have We Been Missing Out?

While I have been flying several times per year for the last nine years, I never considered myself loyal to any one airline. We are almost always flying for weddings or other events so our dates are inflexible and we choose flights strictly based on timing and price, not what airline is operating the flight. (Although I do love when a direct flight on Jet Blue or Virgin is the cheapest!) Because I never practiced … Read entire article »

Weekly Update 6

This week was spring break at our university and while we didn’t take off work, we did take things a bit easy and tried to catch as much of the ACC tournament as we could. Unfortunately, our team is not going to the finals of the tournament, but I’m still planning to watch tomorrow. Several top-ranked teams lost over the last few days so I don’t feel toooooo bad. We had friends over to watch the semifinals so that’s always fun. I started doing research for a post on the “earned income” aspect of Roth IRA contributions for an upcoming Roth IRA blitz posting that Jeff Rose at Good Financial Cents is organizing. I tried to track down the sources of my funding for my four years in grad school by … Read entire article »

Filed under: weekly update

I Will Not Accept Your “Exciting” Rewards

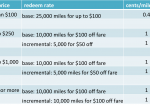

When I started graduate school and was on my own for the first time I decided it would be useful to have a credit card. I searched around and chose the BP Chase Visa rewards card because 1) there are BP gas stations everywhere in Durham, 2) the card was very positively reviewed, and 3) the cash back rewards were the best I could find for my needs. The card offered 5% back on gas, … Read entire article »

Filed under: credit cards

The Financial Implications of Dropping One Car

We have decided to become a one-car family! If you remember, three weeks ago my car wouldn’t start and we found out it needed $1,600 in repairs. We paid $400 to get it running and evaluated the possibility of relying completely on Kyle’s car until we start working at different places. (We don’t want to sell the car because it still has a lot of miles left in it. Kyle will graduate in a year-ish … Read entire article »

Why I Took Out a Car Loan for More Than the Purchase Price of the Car

When I bought my car (the one that is currently not being driven) in 2008, I needed to borrow $3,500 on top of the $1,000 I had saved to pay the private seller. However, I ended up taking out a loan for $5,000. Why in the world would I take on more debt than was necessary? First, I need to explain that I was in a little different mindset in 2008 than I am now. I … Read entire article »

Why Do We Make Rules If We’re Just Going to Break Them?

Kyle and I have a rule: We don’t watch important basketball games (i.e. any game involving our team, or the final rounds of the NCAA tournament) with people who don’t care about basketball (apathy is bad enough – rival fans would be inconceivable!). You can imagine the situation that inspired this rule! So I was surprised when Kyle told me yesterday that he is planning to watch our team’s big rivalry game this weekend with people … Read entire article »

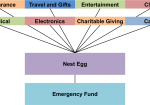

Filed under: budgeting, choices, credit cards, debt, giving, retirement, values

Private School Angst

Kyle and I received an excellent undergraduate education a private college – a very, very expensive private college (it’s on this list). Our college was an absolutely perfect choice for me. There are only around three institutions in the country that offer a similar educational setting and none are in nearly as desirable a location. For my personality, my academic interests, and my career aspirations – and my love of warm weather – it was very … Read entire article »

Do You Ever Just Give In and Spend?

I’ve written several times about our targeted short-term savings accounts. For the most part these work very well for us in saving for our anticipated expenses. But sometimes, the system backfires – specifically, when we need (?) something that we haven’t saved for, or haven’t saved enough for. Dividing up our cash among all these accounts means we have to do some psychological tricks to get the money from elsewhere. We’ve had two instances of this … Read entire article »

Filed under: budgeting, choices, spending, targeted savings

Weekly Update 4

We had a rather busy week in terms of after-work activities. In addition to our usual ones, we attended a lecture on science and faith by a mathematics professor from Oxford and watched a basketball game with friends. On Friday night we went to a wine and cheese party with some friends – delicious! Kyle also has been working super hard on a software release for his research so he’s been putting in lots of hours on that. Using only one car has been going pretty well! I had to catch a ride from a friend once this week and we had a morning or two of getting-out-of-the-house tension but we’re managing. Posts I Liked SB at One Cent at a Time shared how devoting increased time to his blog caused his … Read entire article »

Filed under: weekly update

Weekly Update 5

March 4th, 2012 | 7 Comments

Kyle and I each had something great happen at work this week – he got a paper accepted and I took a major leap forward in my project! We’ve come to the end of our two-week carpooling trial and overall driving together has definitely enhanced our marriage. I’ll write a post soon on our final decision and expected financial implications. The BIG EVENT this week is of course our university’s men’s basketball team’s end-of-season rivalry game. I attended the game and Kyle watched it on TV with some friends. We suffered a crushing defeat – it sucks to lose, especially at home! I was present for all of our home losses this season. This one actually hurt the least because it was against the best team, and it wasn’t a deciding end-of-game … Read entire article »

Filed under: weekly update