Evolving Personal Finance » Entries tagged with "credit cards"

“I Want a Credit Card, But I’m Scared”

I got this question from a coaching client recently. He is a recent college graduate who has never had a credit card but has been told that he should get one for his credit score. He said he was afraid because he knows how damaging misusing credit cards can be. I told him that I closely identified with this conundrum because I felt exactly the same way after I graduated from college. I read that I … Read entire article »

Filed under: credit cards

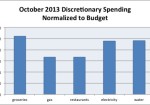

October 2013 Month in Review: Money

Our finances are almost settled after our move – we’re just waiting on a refund from TWC (isn’t it always TWC that screws you up?). We spent a loooooot of money though – I’ll post about it once everything gets shaken out – so we’re going to devote our budget leftovers toward repaying ourselves until that’s done. This has been a pretty quiet month for us in the regular budget but a big one in targeted … Read entire article »

Filed under: month in review

Talking to People Who Are Different from You about PF

Last week, I promoted one of my blog posts on my personal Facebook profile. (I know that’s crazy to anonymous PF bloggers, but I’m completely open about my blog IRL!) It was the review of the Barclaycard Arrival World MasterCard, and you can see I was pushing it a bit. (We just signed up for our second one last night! Woohoo!) I knew that some of my FB friends would see that and consider signing … Read entire article »

Filed under: credit cards, debt, family

Don’t Buy into the Pro- or Anti-Credit Card Hype

Last week’s FPU lesson was “Dumping Debt,” which was rather different from what I expected. Dave spent a lot of time talking about the disadvantages of various kinds of debt and not as much as I thought he would on the mechanics of the debt snowball. Of course, credit cards were pointed out as a particular evil, not just in the video but also reinforced by the class exercises. One exercise was to stand up … Read entire article »

Filed under: credit cards, debt

Perfect Articulation of Plastic as Real Money for Young People

In episode of Freakonomics from 10/3/2013, Steve Levitt and Steve Dubner discussed a listener question that I thought was a perfect articulation of my opinion concerning the studies that show that people tend to spend more when using credit cards in comparison with cash. Steve Reta wrote: “This morning I was reading an article on how credit card spending is making us ‘irresponsible’ because it removes the ‘pain’ of paying with cold hard cash. I found … Read entire article »

Filed under: credit cards, psychology, spending

Our Experiences with Paying Off Debt

This post is a personal story about how debt has intersected our lives and not intended to be any big lessons. You’ll see that how we paid off our debt doesn’t necessarily apply to others as I’ve been rescued a couple times! We also still go back and forth over whether or not we are officially debt-free. Between me and Kyle, I have more experience with debt so I’ll start with mine. Student Loans I took out some … Read entire article »

Filed under: cars, credit cards, debt

Current Credit Cards Rewards Strategy

When I weighted the advantages and disadvantages of adding another credit card, I decided that the chief disadvantage for us is that we might lose track of how to optimally use the cards for maximum rewards. After all, we use Mint to aggregate all our accounts so we don’t ever lose track of which card needs to be paid off and whatnot. I decided to comb through our current credit cards to make sure we are … Read entire article »

Filed under: credit cards

Toeing into the E in EPF

I thought I’d take this Friday post to update you all on the random money goings-on around the EPF household. We are gearing up for our first financial transition, moving from the apartment Kyle’s lived in for 5 years (and I for 2 years) to a townhouse that’s both cheaper and closer to school and church. In addition we’ve had some other small bumps in the road and changes and are looking forward to some … Read entire article »

Filed under: budgeting, credit cards, targeted savings, transitions, travel

Why Do Stay-at-Home Parents Need Their Own Credit Cards?

I read an article last week on CNN Money with a premise that I found absolutely ridiculous. The article covered a group of stay-at-home moms (parents?) who were protesting a portion of the Card Act that requires that credit issuers evaluate a credit applicant based on his/her individual income instead of household income. The result was that some stay-at-home parents with good credit scores have been denied credit cards when they applied for them in … Read entire article »

Filed under: credit cards, income, marriage